Fill in Your Indiana State 50181 Form

Similar forms

The UCC-1 Financing Statement is closely related to the Indiana State 50181 form. Both documents serve to establish a security interest in collateral, allowing creditors to assert their rights in case of debtor default. The UCC-1 form is used nationwide, while the Indiana State 50181 is specific to Indiana. The UCC-1 requires similar information about the debtor, secured party, and collateral, ensuring consistency across states. This makes the UCC-1 a foundational document for secured transactions, just like the Indiana State 50181 form.

In the realm of rental agreements, it is essential to utilize documents such as the New York Residential Lease Agreement form, as they clarify the roles and responsibilities of landlords and tenants alike. This legally binding contract is fundamental in establishing terms like rent and lease duration, providing a clear understanding of each party's rights. For more information and access to the necessary forms, you can visit UsaLawDocs.com.

The UCC-3 Amendment form is another document that shares similarities with the Indiana State 50181. The UCC-3 is used to amend or update an existing UCC-1 filing, just as the Indiana State 50181 can be modified through its addendum. Both forms require detailed information about the original debtor and secured party, ensuring that any changes are accurately reflected. This helps maintain clear records of secured interests over time, which is crucial for both creditors and debtors.

The UCC-1Ad Addendum is also comparable to the Indiana State 50181 form. The addendum allows for additional debtors or secured parties to be included in a financing statement. Similarly, the Indiana form has provisions for adding extra information about the collateral or additional parties involved in the transaction. Both documents emphasize the importance of complete and accurate information, as any errors can lead to complications in asserting security interests.

The Notice of Lien is another document that bears resemblance to the Indiana State 50181. This document serves to inform the public of a creditor’s claim against a debtor's property. Like the Indiana form, a Notice of Lien establishes a legal right to the property in question. Both documents require accurate identification of the debtor and the secured party, ensuring that all parties are aware of the existing claims on the property.

The Security Agreement is also similar to the Indiana State 50181 form. This document outlines the terms under which a debtor grants a security interest to a lender. While the Indiana form is used for filing a financing statement, the Security Agreement serves as the foundational contract that defines the relationship between the debtor and secured party. Both documents are essential for protecting the interests of creditors in secured transactions.

The Personal Property Security Registration (PPSR) is another document that parallels the Indiana State 50181. This registration system is used in several states, including Indiana, to record security interests in personal property. Like the Indiana form, the PPSR aims to provide public notice of a creditor's claim, thereby safeguarding the rights of secured parties. Both documents require similar information about the debtor and collateral, ensuring clarity in secured transactions.

The Assignment of Security Interest is similar to the Indiana State 50181 in that it involves the transfer of a secured interest from one party to another. This document must clearly identify the original debtor, the new secured party, and the collateral involved. Like the Indiana form, it aims to maintain transparency and protect the rights of all parties involved in the transaction.

The UCC-11 Request for Information is another document related to the Indiana State 50181. This request allows a creditor to obtain information about existing financing statements filed against a debtor. Similar to the search report option in the Indiana form, the UCC-11 is crucial for creditors to assess the risk of lending to a debtor. Both documents facilitate due diligence and help creditors make informed decisions.

The Certificate of Title is also comparable to the Indiana State 50181. This document is used to establish ownership of certain types of property, such as vehicles. While the Indiana form focuses on securing interests in personal property, both documents aim to provide clear evidence of ownership and claims against the property. This helps prevent disputes and ensures that all parties are aware of existing rights.

Lastly, the Loan Agreement shares similarities with the Indiana State 50181 form. This agreement outlines the terms of a loan, including the security interest in collateral. Like the Indiana form, it requires detailed information about the debtor and the secured party. Both documents work together to protect the interests of lenders and ensure that all parties understand their rights and obligations in the transaction.

FAQ

What is the Indiana State 50181 form?

The Indiana State 50181 form, also known as the UCC Financing Statement, is a legal document used to secure interests in personal property. It allows creditors to publicly declare their rights to specific collateral in the event of a debtor's default. This form is essential for establishing a security interest under Indiana law.

Who needs to file the Indiana State 50181 form?

Any individual or organization that is a creditor and wishes to secure a loan or credit with collateral should file this form. It is particularly important for businesses and lenders to protect their interests when extending credit or loans to debtors.

What information is required on the form?

The form requires the exact legal names of the debtor(s) and secured party, their addresses, and details about the collateral being secured. Additionally, if there are multiple debtors or secured parties, their information must also be included. It is crucial that names are entered exactly as they appear in legal documents.

How much does it cost to file the Indiana State 50181 form?

The filing fee for the first two pages of the form is $4.00. If the form exceeds two pages, an additional fee may apply. Special transactions, such as public finance or mobile home transactions, may incur higher fees. Always check the latest fee schedule before filing.

Where should the completed form be submitted?

The completed Indiana State 50181 form should be submitted to the appropriate filing office in Indiana. This is typically the county recorder’s office or the Secretary of State's office, depending on the nature of the collateral and the jurisdiction.

What happens after filing the form?

After the form is filed, the filing office will process it and provide an acknowledgment of receipt if requested. This acknowledgment serves as proof that the financing statement has been officially recorded. The secured party should keep this acknowledgment for their records.

Can the form be amended or canceled?

Yes, the Indiana State 50181 form can be amended or canceled by filing a UCC Amendment form (UCC3) or a UCC Termination form. This is necessary if there are changes to the debtor's information, the secured party, or if the security interest has been satisfied.

What is the importance of the collateral description?

The collateral description is critical because it defines what property is secured under the financing statement. A clear and accurate description helps to protect the creditor's interests and ensures that the collateral can be identified in case of default. If space is insufficient on the form, additional pages can be attached.

What should be done if mistakes are found on the form?

If mistakes are discovered after filing, it is important to correct them as soon as possible. Errors in the debtor's name or collateral description can have significant legal consequences. An amendment can be filed to rectify any inaccuracies in the original financing statement.

Common mistakes

Filling out the Indiana State 50181 form can be tricky. Many people make mistakes that can lead to delays or issues with their filings. One common mistake is not using the exact legal name of the debtor. It's crucial to enter the full name without abbreviations. For organizations, this means checking official documents to ensure accuracy. For individuals, it’s important to avoid using titles like Mr. or Mrs. in the name field.

Another frequent error is failing to provide a complete mailing address. Every debtor listed must have a valid address. This is important for communication and record-keeping. Skipping this step can result in the form being rejected or delayed.

People often overlook the requirement to include additional information about the organization. Items such as the type of organization and jurisdiction are essential. If this information is missing, it can create complications in the filing process. Additionally, some filers forget to include the organizational ID number, which is necessary if one exists.

Many individuals also neglect to check the appropriate boxes related to the type of filing. For example, if the financing statement involves a lease or a lien, it’s important to indicate this clearly. Not doing so can lead to misunderstandings about the nature of the filing.

Another common mistake is not providing a description of the collateral. This section is critical, as it outlines what is being secured. If there isn’t enough space on the form, filers should use an addendum. Leaving this section blank or vague can cause problems later on.

People sometimes forget to detach the copies meant for the debtor and secured party. It’s important to ensure that all parties have their copies for their records. Failing to do this could lead to disputes about the terms of the agreement.

Additionally, some filers make the mistake of not following the instructions carefully. Ignoring the front and back instructions can result in errors that may have serious legal implications. Each section of the form has specific requirements that must be met.

Another issue arises when individuals try to combine names or abbreviate titles. Each name should be entered as it appears legally. This means no shortcuts or combinations, as this can lead to confusion and potential legal issues.

Lastly, people sometimes forget to include payment for the filing fee. The form requires a specific fee based on the number of pages. Not including the correct amount can delay the filing process, as the form will not be processed until payment is received.

By being aware of these common mistakes, filers can improve their chances of successfully completing the Indiana State 50181 form without complications. Attention to detail is key in this process.

Indiana State 50181 Preview

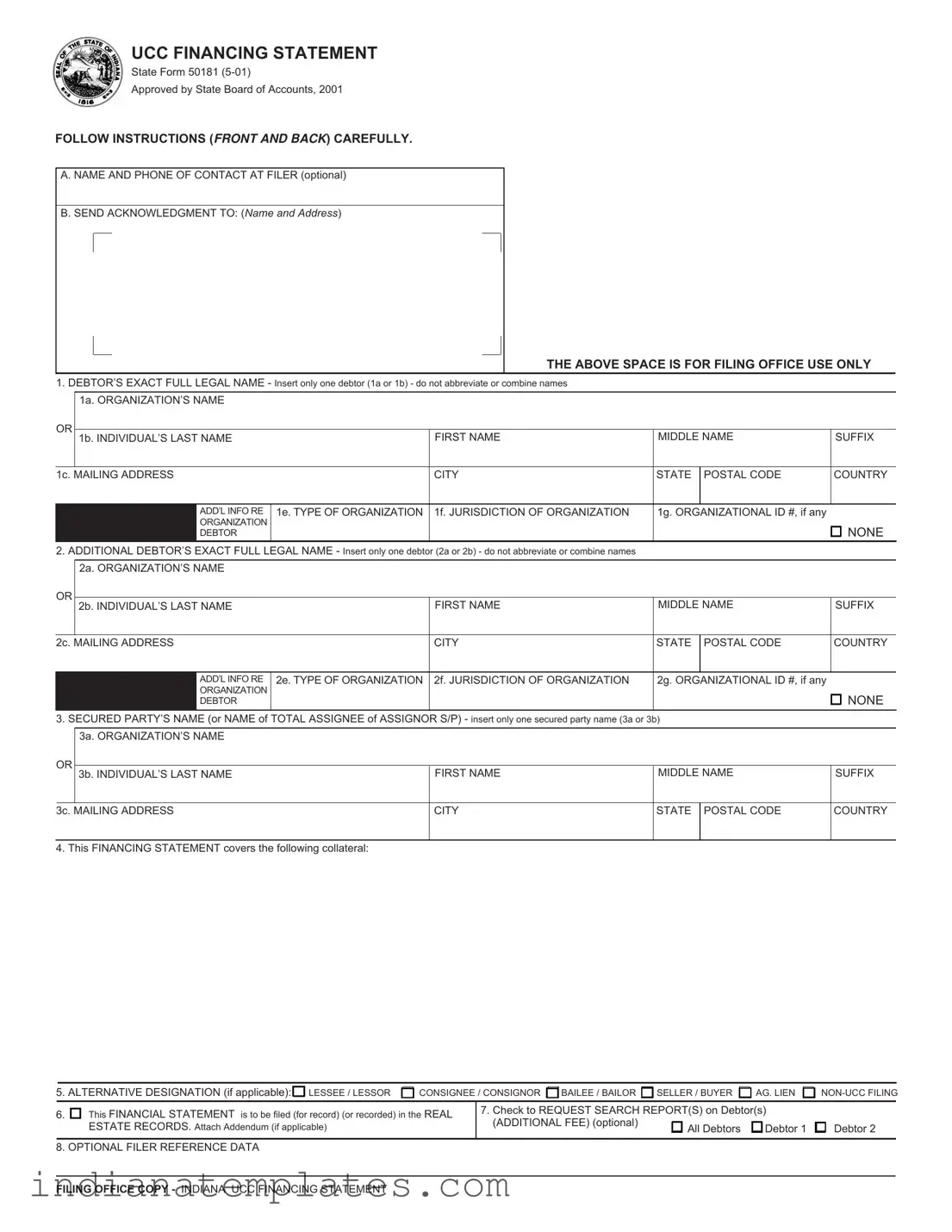

UCC FINANCING STATEMENT

State Form 50181

Approved by State Board of Accounts, 2001

FOLLOW INSTRUCTIONS (FRONT AND BACK) CAREFULLY.

A. NAME AND PHONE OF CONTACT AT FILER (optional)

B. SEND ACKNOWLEDGMENT TO: (Name and Address)

THE ABOVE SPACE IS FOR FILING OFFICE USE ONLY

1.DEBTOR’S EXACT FULL LEGAL NAME - Insert only one debtor (1a or 1b) - do not abbreviate or combine names

1a. ORGANIZATION’S NAME

OR |

|

|

|

|

|

|

|

|

1b. INDIVIDUAL’S LAST NAME |

|

FIRST NAME |

MIDDLE NAME |

SUFFIX |

||

|

|

|

|

|

|

|

|

1c. MAILING ADDRESS |

|

CITY |

STATE |

POSTAL CODE |

COUNTRY |

||

|

|

|

|

|

|

|

|

|

|

ADD’L INFO RE |

1e. TYPE OF ORGANIZATION |

1f. JURISDICTION OF ORGANIZATION |

1g. ORGANIZATIONAL ID #, if any |

|

|

|

|

ORGANIZATION |

|

|

|

|

|

|

|

DEBTOR |

|

|

|

|

NONE |

2.ADDITIONAL DEBTOR’S EXACT FULL LEGAL NAME - Insert only one debtor (2a or 2b) - do not abbreviate or combine names

2a. ORGANIZATION’S NAME

OR |

|

|

|

|

|

|

|

|

2b. INDIVIDUAL’S LAST NAME |

|

FIRST NAME |

MIDDLE NAME |

SUFFIX |

||

|

|

|

|

|

|

|

|

2c. MAILING ADDRESS |

|

CITY |

STATE |

POSTAL CODE |

COUNTRY |

||

|

|

|

|

|

|

|

|

|

|

ADD’L INFO RE |

2e. TYPE OF ORGANIZATION |

2f. JURISDICTION OF ORGANIZATION |

2g. ORGANIZATIONAL ID #, if any |

|

|

|

|

ORGANIZATION |

|

|

|

|

|

|

|

DEBTOR |

|

|

|

|

NONE |

|

|

|

|

|

|

|

|

3.SECURED PARTY’S NAME (or NAME of TOTAL ASSIGNEE of ASSIGNOR S/P) - insert only one secured party name (3a or 3b) 3a. ORGANIZATION’S NAME

OR |

FIRST NAME |

MIDDLE NAME |

SUFFIX |

3b. INDIVIDUAL’S LAST NAME |

3c. MAILING ADDRESS

CITY

STATE

POSTAL CODE

COUNTRY

4. This FINANCING STATEMENT covers the following collateral:

5. ALTERNATIVE DESIGNATION (if applicable): |

|

LESSEE / LESSOR |

CONSIGNEE / CONSIGNOR BAILEE / BAILOR SELLER / BUYER |

AG. LIEN |

||||||

|

|

|

|

|

|

|

|

|

|

|

6. |

This FINANCIAL STATEMENT is to be filed (for record) (or recorded) in the REAL |

7. Check to REQUEST SEARCH REPORT(S) on Debtor(s) |

|

|

||||||

(ADDITIONAL FEE) (optional) |

|

|

|

|

|

|||||

|

ESTATE RECORDS. Attach Addendum (if applicable) |

|

All Debtors |

|

Debtor 1 |

Debtor 2 |

||||

|

|

|

|

|||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

8. OPTIONAL FILER REFERENCE DATA

FILING OFFICE COPY - INDIANA UCC FINANCING STATEMENT

Instructions for National UCC Financing Statement (Form UCC1)

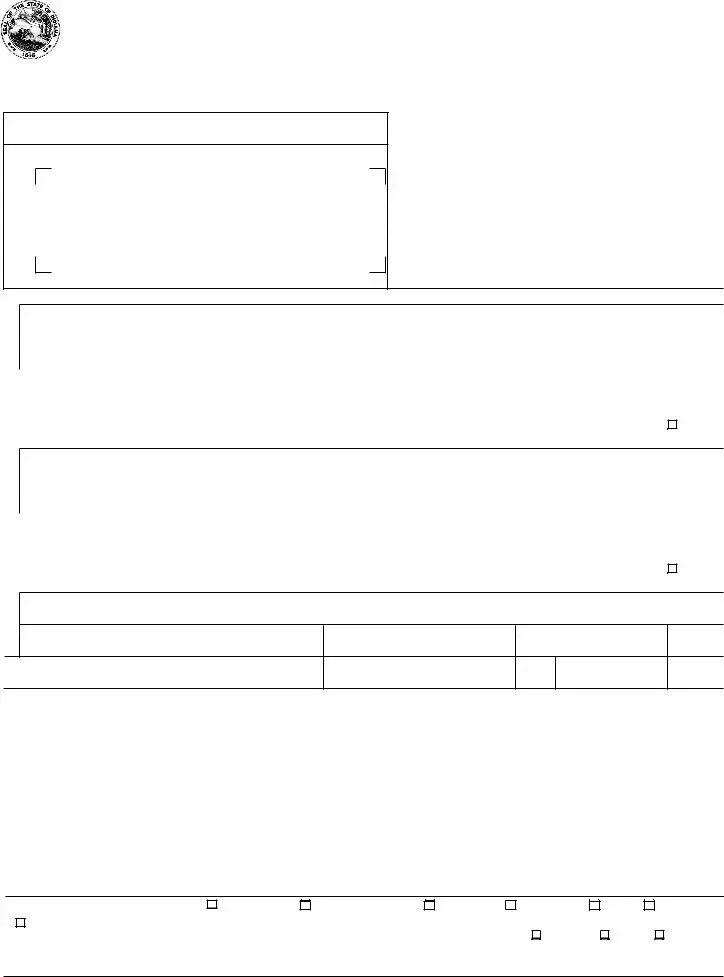

Fees Worksheet |

|

|

|

1. |

First two pages are $4.00 |

$ |

4.00 |

2. |

Enter $4.00 if there are more than 2 pages, otherwise enter $0.00 |

$ _____________ |

.00 |

|

Total (Pay this amount): |

$ _____________ |

.00 |

|

|

|

|

NOTE: A statement filed in connection with a public finance transaction or mobile home transaction is $8.00 plus the amount above.

Please type or

Fill in form very carefully; mistakes may have important legal consequences. If you have questions, consult your attorney. Filing office cannot give legal advice.

Do not insert anything in the open space in the upper portion of this form; it is reserved for filing office use.

When properly completed, send Filing Office Copy, with required fee, to filing office. If you want an acknowledgment, complete item B and, if filing in a filing office that returns an acknowledgment copy furnished by filer, you may also send Acknowledgment Copy; otherwise detach. Always detach Debtor and Secured Party Copies.

If you need to use attachments, use

A. To assist filing offices that might wish to communicate with filer, filer may provide information in item A. This item is optional B. Complete item B to have an acknowledgment sent to you.

1.Debtor name: Enter only one Debtor name in item 1, an organization’s name (1a) or an individual’s name (1b). Enter debtor’s exact full legal name. Don’t abbreviate.

1a. Organization Debtor. “Organization” means any entity having a legal identity separate from its owner. A partnership is an organization; a sole proprietorship is not an organization, even if it does business under a trade name. If Debtor is a partnership, enter exact full legal name of partnership; you need not enter names of partners as additional Debtors. If Debtor is registered organization (e.g., corporation, limited partnership, limited liability company), it is advisable to examine Debtor’s current filed charter documents to determine Debtor’s correct name, organization type, and jurisdiction of organization.

1b. Individual Debtor. “Individual” means a natural person; this includes a sole proprietorship, whether or not operating under a trade name. Don’t use prefixes (Mr., Mrs., Ms.). Use suffix box only for titles of lineage (Jr., Sr., III) and not for other suffixes or titles (e.g., M.D.). Use married woman's personal name (Mary Smith, not Mrs. John Smith). Enter individual’s Debtor’s family name (surname) in Last Name box, first given name in First Name box, and all additional given names in Middle Name box.

For both organization and individual Debtors: Don’t use Debtor’s trade name, DBA, AKA, FKA, Division name, etc. in place of or combined with Debtor’s legal name; you may add such other names as additional Debtors if you wish (but this is neither required or recommended).

1c. An address is always required for the Debtor named in 1a or 1b.

1e,f,g. Additional information re organization Debtor” is always required. Type of organization and jurisdiction of organization as well as Debtor’s exact legal name can be determined from Debtor’s current filed charter document. Organization ID #, if any, is assigned by the agency where the charter document was filed; this is different from tax ID #; this should be entered proceeded by the

Note: If Debtor is a trust or a trustee acting with respect to properly held in trust, enter Debtor’s name in item 1 and attach Addendum (Form UCC1Ad) and check appropriate box in item 17. If Debtor is a decedent’s estate, enter name of deceased in individual in item 1b and attach Addendum (Form UCC1Ad) and check appropriate box in item 17. If Debtor is a transmitting utility or this Financing Statement is filed in connection with a Manufacture- Home Transaction or a

2.If an additional Debtor is included, complete item 2, determined and formatted per Instruction 1. To include further additional Debtors, or one or more additional Secured Parties, attach either Addendum (Form UCC1Ad) or other additional page(s), using correct name format. Follow Instruction 1 for determining and formatting additional names.

3.Enter information for Secured Party or Total Assignee, determined and formatted per Instruction 1. If there is more than one Secured Party, see Instruction 2. If there has been a total assignment of the Secured Party’s interest prior to filing this form, you may either (1) enter Assignor S/P’s name and address in item 3 and file an Amendment (Form UCC3) (see item 5 of that form); or (2) enter Total Assignee’s name and addressing item 3 and, if you wish, also attaching Addendum (Form UCC1Ad) giving Assignor S/P’s name and address in item 12.

4.Use item 4 to indicate the collateral covered by this Financing Statement. If space in item 4 is insufficient, put the entire collateral description or continuation of the collateral description on either Addendum (Form UCC1Ad) or other attached additional page(s).

5.If filer desires (at filer’s option) to use titles of lessee and lessor, or consignee and consignor, or seller and buyer (in the case of accounts or chattel paper), or bailee and bailor instead of Debtor and “Secured Party, check the appropriate box in item 5. If this is an agricultural lien (as defined in applicable Commercial Code) filing or is otherwise not a UCC security interest filing (e.g., a tax lien, judgement lien, etc.), check the appropriate box in item 5, complete items

and attach any other items required under other law.

6.If this Financing Statement is filed as a fixture filing or if the collateral consists of timber to be cut or

7.This item is optional. Check appropriate box in item 7 to request Search Report(s) on all or some of the Debtors named in this Financing Statement. The Report will list all Financing Statements on file against the designated Debtor on the date of the Report, including the Financing Statement. There is an additional fee for each Report. If you have checked a box in item 7, file Search Report Copy together with Filing Officer Copy (and Acknowledgment Copy). Note: Not all states do searches and not all states will honor a search request made via this form; some states require a separate request form.

8.This item is optional and is for filer’s use only. For filer’s convenience of reference, filer may enter in item 8 any identifying information (e.g., Secured Party’s loan number, law firm file number, Debtor’s name or other identification, state in which form is being filed, etc.) that filer may find useful.

UCC FINANCING STATEMENT ADDENDUM

State Form 50181

Approved by State Board of Accounts, 2001

FOLLOW INSTRUCTIONS (FRONT AND BACK) CAREFULLY.

9.NAME OF FIRST DEBTOR (1a or 1b) ON RELATED FINANCING STATEMENT 9a. ORGANIZATION’S NAME

OR |

|

|

|

9b. INDIVIDUAL’S LAST NAME |

FIRST NAME |

MIDDLENAME,SUFFIX |

|

|

|

|

|

10. MISCELLANEOUS |

|

|

|

THE ABOVE SPACE IS FOR FILING OFFICE USE ONLY

11.ADDITIONAL DEBTOR’S EXACT FULL LEGAL NAME - Insert only one debtor (11a or 11b) - do not abbreviate or combine names

11a. ORGANIZATION’S NAME

OR |

|

|

|

|

|

|

|

|

|

11b. INDIVIDUAL’S LAST NAME |

|

FIRST NAME |

MIDDLE NAME |

|

SUFFIX |

||

|

|

|

|

|

|

|

|

|

11c. MAILING ADDRESS |

|

CITY |

STATE |

POSTAL CODE |

|

COUNTRY |

||

|

|

|

|

|

|

|

|

|

|

|

ADD’L INFO RE |

11e. TYPE OF ORGANIZATION |

11f. JURISDICTION OF ORGANIZATION |

11g. ORGANIZATIONAL ID #, if any |

|

||

|

|

ORGANIZATION |

|

|

|

|

|

|

|

|

DEBTOR |

|

|

|

|

|

NONE |

12. ADDITIONAL SECURED PARTY’S or |

ASSIGNOR S/P’S NAME - insert only one secured party name (12a or 12b) |

12a. ORGANIZATION’S NAME |

|

OR |

|

|

|

|

|

|

|

12b. INDIVIDUAL’S LAST NAME |

|

FIRST NAME |

MIDDLE NAME |

SUFFIX |

|

|

|

|

|

|

|

|

12c. MAILING ADDRESS |

|

CITY |

STATE |

POSTAL CODE |

COUNTRY |

|

|

|

|

|

|

|

|

13. |

This FINANCING STATEMENT covers |

timber to be cut |

16. Additional collateral description: |

|

|

|

|

|

|

|

|||

|

fixture filing. |

|

|

|

|

|

14. |

Description of real estate: |

|

|

|

|

|

15. Name and address of a RECORD OWNER of |

|

|

|

|

|

(if Debtor does not have a record interest): |

|

|

|

|

|

17. |

Check only if applicable and check only one box. |

||||

|

|||||

|

|

||||

|

Debtor is a Trust or Trustee acting with respect to property held in trust or |

|

Decedent’s Estate |

||

|

|

|

|

|

|

|

18. Check only if applicable and check only one box. |

||||

|

|

Debtor is a TRANSMITTING UTILITY |

|||

|

|

Filed in connection with a |

|||

|

|

Filed in connection with a |

|||

|

|

|

|

||

FILING OFFICE COPY - INDIANA UCC FINANCING STATEMENT ADDENDUM |

|

|

|

||

Instructions for National UCC Financing Statement Addendum (Form UCC1Ad)

9.Insert name of first Debtor shown on Financing Statement to which this Addendum is related, exactly as shown in item 1 of Financing Statement.

10.Miscellaneous: Under certain circumstances, additional information not provided on Financing Statement may be required. Also, some states have

11.If this Addendum add an additional Debtor, complete item 11 in accordance with Instruction 1 on Financing Statement. To add mor than one additional Debtor, either use an additional Addendum form for each additional Debtor or replicate for each additional Debtor the formatting of Financing Statement item 1 on an 8 1/2 X 11 inch sheet (showing at the top of the sheet the name of the first Debtor shown on the Financing Statement), and in either case give complete information for each additional Debtor in accordance with Instruction 1 on Financing Statement. All additional Debtor information, especially the name, must be presented in proper format exactly identical to the format of item 1 of Financing Statement.

12.If this Addendum adds an additional Secured Party, complete item 12 in accordance with Instruction 3 on Financing Statement. In the case of a total assignment of the Secured Party’s interest before the filing of this Financing Statement, if filer has given the name and address of the Total Assignee in item 3 of the Financing Statement, filer may give the Assignor S/P’s name and address in item 12.

16.Use this space to provide continued description of collateral, if you cannot complete description in item 4 of Financing Statement.

17.If Debtor is a trust or a trustee acting with respect to property held in trust or is a decedent’s estate, check the appropriate box.

18.If Debtor is a transmitting utility or if the Financing Statement relates to a

Different PDF Forms

Bt-1 Indiana - Familiarize yourself with tax responsibilities and regulations relevant to your business type.

For those looking to navigate the selling process smoothly, the completed documentation is critical, especially regarding the Boat Bill of Sale that ensures clarity during the transfer. To access an editable version, visit the link for the easy-to-understand boat bill of sale template.

Indiana State Tax Forms - Documentation of termination of liability must also be filed correctly to void the bond.