Fill in Your Indiana St 105 Form

Similar forms

The Indiana Form ST-105 is similar to the IRS Form W-9, which is used for tax purposes in the United States. Both forms require individuals or entities to provide identifying information, such as a Tax Identification Number (TIN) or Social Security Number (SSN). The W-9 form is typically used by businesses to request the correct name and TIN of a payee for tax reporting purposes. Like the ST-105, the W-9 must be completed accurately to avoid issues with tax compliance. Both forms serve as a means of confirming the tax status of the parties involved.

Another document comparable to the Indiana Form ST-105 is the IRS Form 8233. This form is used by non-resident aliens to claim a tax exemption on income earned in the United States. Similar to the ST-105, Form 8233 requires the individual to provide specific information to justify the exemption. Both forms necessitate a clear understanding of the applicable tax laws and the circumstances under which an exemption can be claimed. Each form must be completed thoroughly to ensure compliance with tax regulations.

The Indiana Form ST-105 also shares similarities with the IRS Form 8843, which is used by certain foreign students and scholars to claim exemption from the substantial presence test for tax purposes. Both forms require detailed information regarding the individual’s residency status and purpose of exemption. The ST-105 and Form 8843 both serve as documentation to support claims for tax exemptions, emphasizing the importance of accurate information in both cases.

Additionally, the Indiana Form ST-105 resembles the Certificate of Exemption used in various states. This document allows organizations, such as non-profits, to make tax-exempt purchases. Like the ST-105, these certificates require specific details about the purchaser and the nature of the exempt transaction. Both documents must be presented at the time of purchase to avoid sales tax, and they serve to verify the purchaser's eligibility for tax exemption under applicable laws.

The form is also akin to the Sales Tax Exemption Certificate used in other states, which allows buyers to claim an exemption from sales tax on qualifying purchases. These certificates typically require the buyer to provide their tax identification number and specify the reason for the exemption. Similar to the ST-105, these documents must be filled out completely to ensure they are valid and accepted by sellers.

Moreover, the Indiana Form ST-105 can be compared to the Vendor Exemption Certificate, which is used in various jurisdictions to certify that a vendor's sales are exempt from sales tax. Both forms require information about the vendor and the nature of the sales. They serve to protect the seller from liability for tax collection when the purchaser claims an exemption, reinforcing the need for accurate documentation.

Another related document is the Nonprofit Organization Exemption Certificate, which allows qualifying non-profits to make tax-exempt purchases. Similar to the ST-105, this certificate requires the organization to provide its tax identification number and details regarding the nature of the purchase. Both documents are essential for ensuring compliance with tax laws while allowing eligible entities to operate without the burden of sales tax on necessary purchases.

The North Carolina Motor Vehicle Bill of Sale form is essential for documenting the sale or purchase of a vehicle, ensuring that both the buyer and seller have a clear official record of the transaction. This form not only outlines the specifics of the vehicle being sold, such as the make, model, and VIN, but also includes important details about both parties involved. Accurate completion of this document is crucial for a smooth transfer of ownership, and for further assistance with the Bill of Sale process, one can visit UsaLawDocs.com for more information.

Furthermore, the Indiana Form ST-105 is similar to the Agricultural Exemption Certificate used by farmers in various states. This document allows farmers to purchase items exempt from sales tax that are directly related to agricultural production. Like the ST-105, this certificate must include specific information about the purchaser and the intended use of the items purchased. Both forms are crucial for facilitating tax-exempt transactions in their respective contexts.

Lastly, the Indiana Form ST-105 is comparable to the Use Tax Exemption Certificate, which is used by businesses to claim exemptions on use tax for items purchased outside of their home state. Both forms require detailed information about the purchaser and the items involved. They serve to document the claim for exemption and ensure compliance with state tax regulations, highlighting the importance of proper record-keeping in tax matters.

FAQ

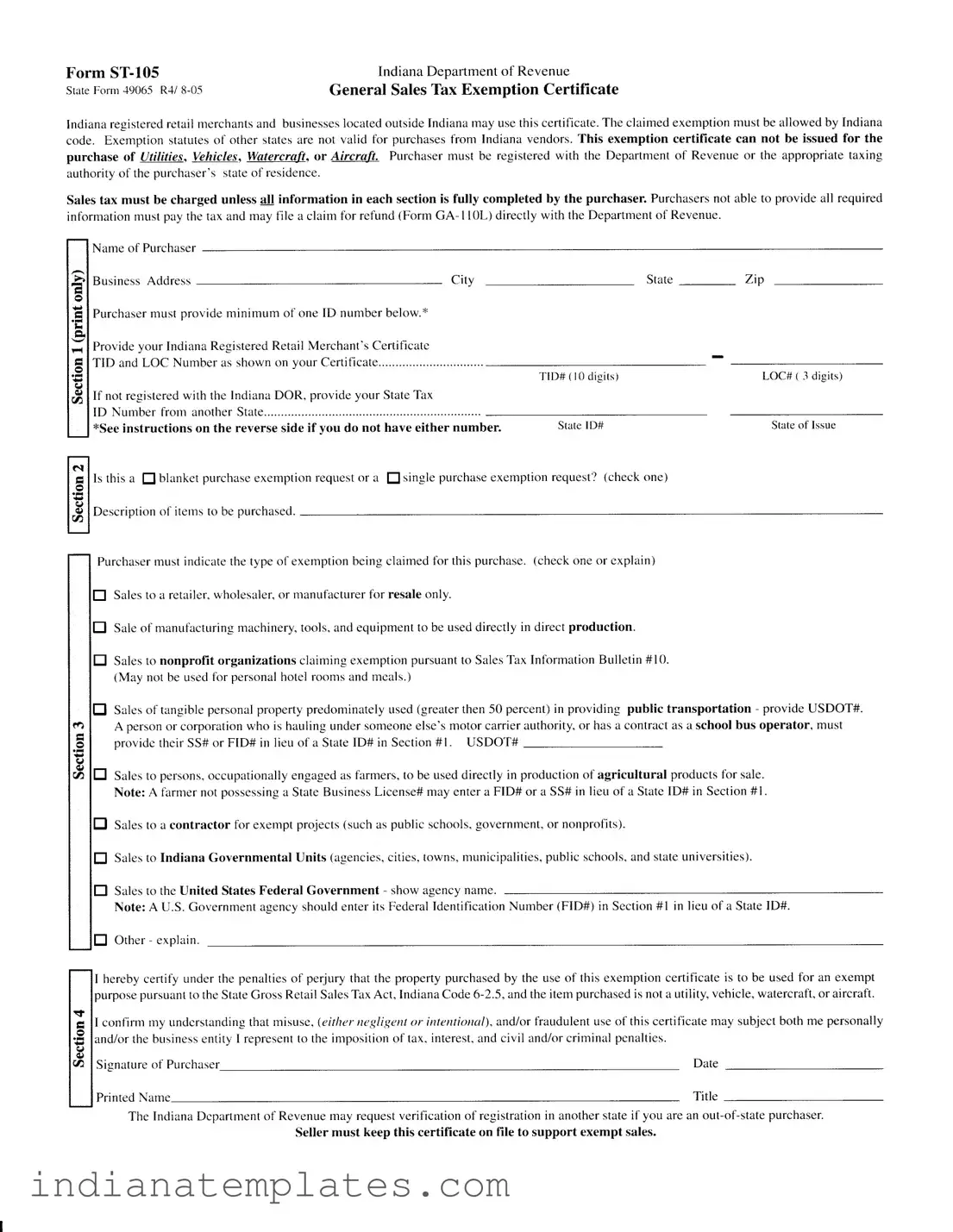

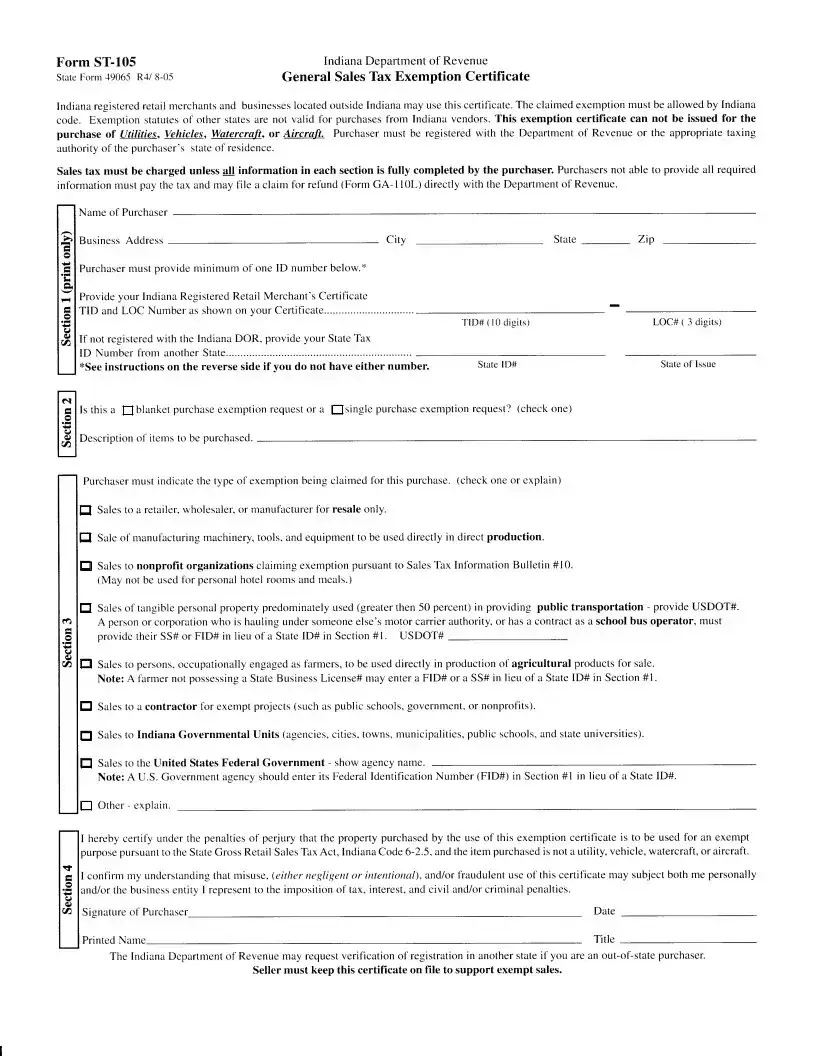

What is the Indiana ST-105 form?

The Indiana ST-105 form is a General Sales Tax Exemption Certificate. It allows Indiana-registered retail merchants and certain businesses outside of Indiana to make tax-exempt purchases. The exemption must comply with Indiana law, and exemptions from other states do not apply for purchases from Indiana vendors.

Who can use the ST-105 form?

This form can be used by Indiana-registered retail merchants and businesses located outside Indiana. However, the purchaser must be registered with the Indiana Department of Revenue or their home state’s taxing authority to qualify for the exemption.

What purchases are exempt using the ST-105 form?

The ST-105 form can be used for various exempt purchases, including sales to retailers for resale, manufacturing machinery, and sales to non-profit organizations. However, it cannot be used for purchases of utilities, vehicles, watercraft, or aircraft.

What information is required to complete the ST-105 form?

To complete the ST-105 form, the purchaser must provide their name, business address, Indiana Registered Retail Merchant's Certificate number (TID) and LOC number, or a state tax ID number from another state. Additionally, the purchaser must indicate the type of exemption being claimed and provide a description of the items to be purchased.

What happens if the form is not completed correctly?

If the ST-105 form is not fully completed, the seller is required to charge sales tax on the purchase. It is crucial for all sections to be accurately filled out to ensure the exemption is valid.

Can out-of-state purchasers use the ST-105 form?

Yes, out-of-state purchasers can use the ST-105 form, but they must provide their state tax ID number. The Indiana Department of Revenue may request verification of this registration if necessary.

What should a seller do with the ST-105 form?

Sellers must keep the ST-105 form on file to support any exempt sales made. This documentation is essential for compliance with Indiana tax laws.

What are the consequences of misuse of the ST-105 form?

Misuse of the ST-105 form, whether through negligence or intentional fraud, can lead to penalties. Both the individual and the business entity may face tax liabilities, interest, and potential civil or criminal penalties.

How can a purchaser claim a refund if sales tax was paid?

If a purchaser pays sales tax but believes they qualify for an exemption, they can file a claim for a refund using Form GA-110. This must be submitted directly to the Indiana Department of Revenue for consideration.

Common mistakes

Filling out the Indiana ST-105 form can seem straightforward, but many people make common mistakes that can lead to complications. One frequent error is failing to provide the correct identification numbers. The form requires either an Indiana Taxpayer Identification Number (TID#) or a State Tax ID from another state. If this crucial information is missing, the exemption cannot be processed, and the seller must collect sales tax.

Another mistake often made is not checking the appropriate box for the type of exemption being claimed. The form includes various options, and selecting the wrong one can result in denial of the exemption. Make sure to carefully read each option and choose the one that accurately reflects the nature of your purchase.

Some individuals overlook the necessity of describing the items being purchased. This description is vital as it helps clarify the purpose of the exemption. Without it, the form may be deemed incomplete, leading to unnecessary delays or complications.

Many purchasers also forget to sign and date the form. This step is essential, as an unsigned form is invalid. Ensure that your printed name and title are included as well, as they provide necessary context for the signature.

Providing insufficient information about the purchasing entity is another common pitfall. The form requires specific details such as the business address and city. Omitting any of this information can lead to issues down the line, so be thorough in your responses.

Additionally, some people mistakenly believe that exemption certificates can be used for all types of purchases. However, the ST-105 cannot be used for items like vehicles, watercraft, or aircraft. Familiarizing yourself with the limitations of the form can save you from potential headaches.

Another frequent error involves misunderstanding the concept of blanket exemptions. If you are claiming a blanket exemption, it’s crucial to indicate that clearly on the form. Otherwise, the seller may treat the transaction as a single purchase, which could complicate matters.

Lastly, individuals sometimes fail to keep a copy of the completed form for their records. Retaining a copy can be beneficial if questions arise later about the exemption or if verification is requested by the Indiana Department of Revenue. Keeping organized records can save time and effort in the future.

Indiana St 105 Preview

Form |

Indiana Department of Revenue |

StateForm :19065 |

General SalesThx Exemption Certificate |

Indianaregisteredrelail merchantsand businesseslocatedoutsideIndianamay usethis certificate.The claimedexemptionmust be allowedby Indiana code. Exemption slatutesof other statesare not valid tbr purchasesfrom Indiana vendors.This exemption certilicate can not be issued for the purchase of lLili/iqg, Vehicles, Watercraft, or Ai/crafr. Pttrcha.sermust be registered with the Depafiment of Revenue or the appropriate taxing authorityofthe purchaser'sstateof residence.

Sales tax must be charged unless a!! information in each 6ection is fully completed by the purchaser. Purchasersnot able to provide all required informationmust pay the tax and may file a ctaim for refund(Form GA- I

Name of Purchaser

B u s i n e s s A d d r e s s |

C i t y |

P u r c h a s e rm u s t p r o v i d e m i n i m u m o f o n e I D n u n i b e r b e l c l w . t '

Provide your Indiana Registered Retail Merchant's Certificatc TID and LOC Number as shown on your Certificate .

If not registered with the Indiana DOR, provide your State Tax I D N u m b e r f r o m a n o t h e r S t a t e . . . . . .

*See instructions on the reverse side if vou do not have either number .

State _ |

Zip |

T I D # ( l 0 d i g i t s ) |

LOC# ( 3 digits) |

SrarelD# |

Stateof Issue |

HI s t h i s a I b l a n k e t p u r c h a s ee x e m p t i o n r e q u e s to r a I

D e s c r i p t i o no f i l e m s t o b e p u r c h a s e d .

s i n g l e p u r c h a s ee x e m p t i o n r e q u e s t ? ( c h e c k o n e )

Purchasermust indicatethe lype oI exemptionbeing claimedfor this purchase.(checkone or explain)

E

E

E

E

Salesto a retailer,wholesaler,or manufacturerfor resaleonly.

Saleof manufactu ng machinery tools.andequipmentto be useddirectly in direct production.

Salesto nonprofft organizations claimingexemptionpursuantto SalesTax lnformationBullelin #10. (May not be usedfor personalhotel roomsand meals.)

Salesofrangible personalpropertypredominatelyused(greaterthen50 percent)in providing public transportation - provide USDOT#.

Apersonor corporalionwho is baulingundersomeoneelse'smotor carrierauthority,or hasa contractasa schoolbus operator, must providc their SS#or FID# in lieu of a StateID# in Section#1. USDOT# -

E

E

E

Salesto persons,occupationallyengagedasfamers, to be useddirectly in productionof agricultural productsfor sale. Note: A farmernot possessinga StateBusinessLicense#may entera FID# or a SS# in lieu of a StateID# in Section#1.

Salesto a contractor for exemptprojects(suchaspublic $chools,or nonprofits). Sovemment,

Salesto Indiana Governmental Units (agencies,cilies,towns.municipalities,public schools,and slateuniversities).

El

Salesto the United States Federal Government - show agency name .

Note: A U . S . Government asencv should enter its Federal Identification Number (FID#) in Section #1 in lieu of a State ID# .

E O t h e r - e x p l a i n .

Iherebycerlify underthe penaltiesof perjury that lhe propeny purchasedby the useof this exemptioncertificateis to be usedfor an exempt purposepursuanlto theStateCrossRetailSalesTaxAct,

Iconfirm my undeBtandingthat misuse,(?ifrer egligentor intentioral), and/orfraudulentuseofthis certificatemay subjectboth me personally and/orthe businessentity I represenlto the impositionoftax, interest,and civil and/orcriminal penalties.

Signature of Purchaser |

Date |

Printed Name |

Title |

The Indiana Dcpartntent of Revenue may request verification of registration in another state if you are an out - of - state purchaser .

Seller must keep this certificate on file to support exempt sales.

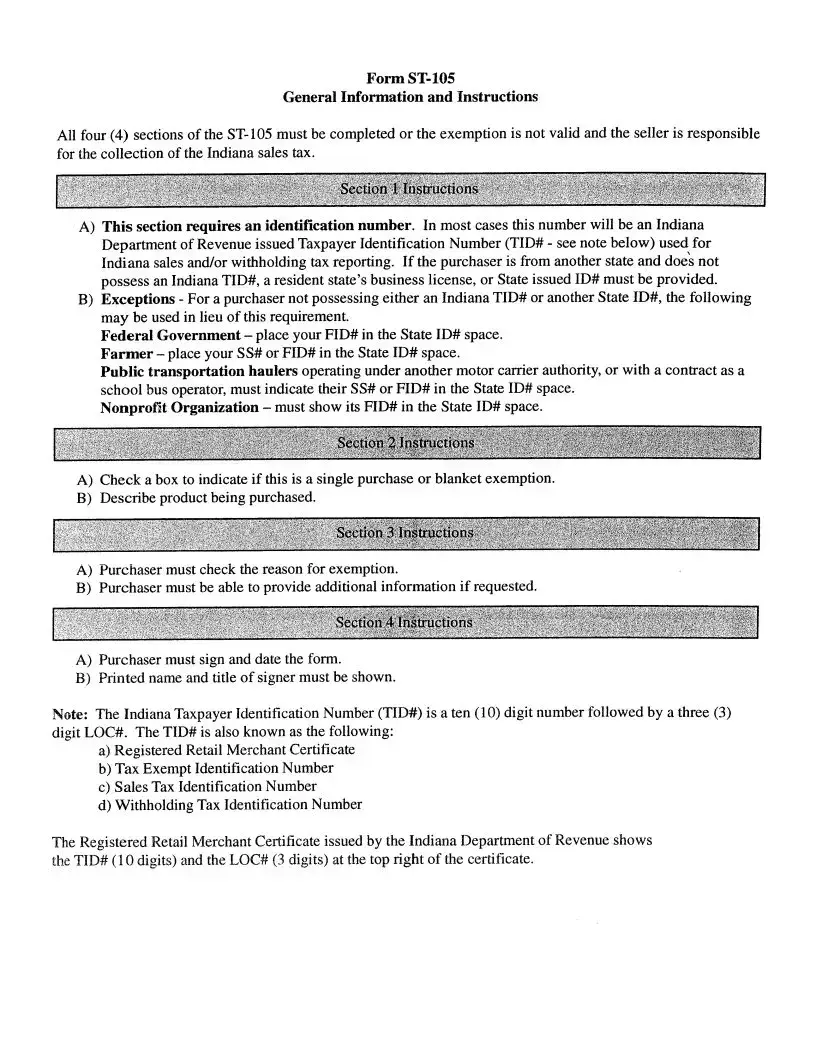

GeneralInfonnation and Instructions

All four (4) sectionsof

A)This sectionrequires an identification number. In mostcasesthis numberwill be anIndiana DeparunentofRevenueissuedTaxpayerldentificationNumber(TID# - seenotebelow) usedfor Indianasalesand/orwithholdingtax reporting. If the purchaseris from anotherstateanddoei not possessanIndianaTID#, a residentstate'sbusinesslicense,or StateissuedID# mustbeprovided.

B)Exceptions- For a purchasernot possessingeitheranIndianaTID# or anotherStateID#, thefollowing

may beusedin lieu of thisrequirement. tr'ederalGovernment- placeyourFID# in theStateID# space. Farmer - placeyour SS#or FID# in theStateID# space.

Public transportation haulersoperatingunderanothermotor carrierauthority,or witb a contractasa

schoolbusoperator,mustindicatetheir SS#or FID# in theStateID# space. Nonprolit Organization- mustshowits FID# in the StateID# space.

A)Check a box to indicateif this is a singlepurchaseor blanketexemption.

B)Describeproductbeingpurchased.

A)Purchasermustcheckthereasonfor exemption.

B)Purchasermustbe ableto provide additionalinformation if requested.

A)Purchasermust sign and date the form.

B)Printednameandtitle of signermustbe shown.

Note: The Indiana TlrxpayerIdentification Number (TID#) is a ten (10) digit number followed by a thtee (3) digit LOC#. The TID# is alsoknown asthe following:

a)RegisteredRetail Merchant Certificat€

b)Tax Exempt Identification Number

c)SalesTax Identification Number

d)Withholding Tax Identification Number

The RegisteredRetailMerchantCertificateissuedby the IndianaDepartrnentofRevenueshows the TID# ( I 0 digits) and the LOC# (3 digits) at the top right of the certificate'

Different PDF Forms

Bt-1 Indiana - Keep copies of the completed form for your records and future reference.

This vital Durable Power of Attorney document enables you to make informed decisions about your financial and medical needs, ensuring your wishes are carried out. For those interested in learning more about creating this document, check out this valuable resource: step-by-step guide for Durable Power of Attorney.

State Form 54244 640p - Employers can submit the form online for expedited processing or through traditional mail.

Contempt of Court Indiana - This motion is for parents who need to address contempt issues related to visitation.