Fill in Your Indiana St 103Dr Form

Similar forms

The Indiana Form ST-103 is similar to the IRS Form 720, which is used to report and pay federal excise taxes. Both forms require detailed information about sales transactions, including the identification of the taxpayer and the nature of the goods sold. While the ST-103 focuses specifically on prepaid sales tax for fuel distributors, Form 720 encompasses a wider range of taxable activities, such as environmental taxes and communications taxes. Both forms must be filed periodically, ensuring compliance with tax obligations at both the state and federal levels.

Understanding the various tax forms, including the Indiana Form ST-103 and others, is critical for businesses and individuals alike. In this context, utilizing resources such as UsaLawDocs.com can provide invaluable guidance and information on necessary documentation across different states, ensuring that all legal requirements are met efficiently.

Another comparable document is the Indiana Form ST-103MP, which is a monthly sales tax return for merchants. Like the ST-103, the ST-103MP requires taxpayers to report sales and tax collected. The primary difference lies in the type of businesses that use each form; the ST-103MP is designed for general retailers, while the ST-103 is specifically tailored for fuel distributors. Both forms share a common goal: to ensure accurate reporting of tax obligations to the Indiana Department of Revenue.

The IRS Form 941 is also similar, as it reports payroll taxes withheld from employees. Though it serves a different purpose, both forms require the identification of the taxpayer and detailed reporting of financial transactions. The ST-103 focuses on sales tax for fuel, while Form 941 centers on income and FICA taxes. Each form must be filed on a regular schedule, promoting compliance with tax laws and timely reporting of financial activities.

Indiana's Form ST-1, the Sales Tax Exemption Certificate, serves as another relevant document. While the ST-103 reports on prepaid sales tax, the ST-1 allows purchasers to claim exemptions from sales tax on certain transactions. Both forms are essential for ensuring compliance with Indiana's tax regulations, but they address different aspects of the sales tax process. The ST-1 is used at the point of sale, while the ST-103 summarizes transactions over a reporting period.

Another similar document is the Indiana Form IT-20, which is the corporate income tax return. While the ST-103 is concerned with sales tax, the IT-20 focuses on income tax liabilities for corporations. Both forms require the identification of the taxpayer and detailed financial information. They must be filed periodically to maintain compliance with state tax laws, emphasizing the importance of accurate reporting for all business entities.

The IRS Form 1099-MISC is also relevant, particularly for businesses that report payments made to independent contractors. Similar to the ST-103, this form requires the reporting of financial transactions and taxpayer identification. However, while the ST-103 deals with sales tax for fuel distributors, the 1099-MISC focuses on income reporting for various types of payments. Both forms are essential for ensuring compliance with tax obligations and accurate financial reporting.

Finally, the Indiana Form ST-105, the General Sales Tax Exemption Certificate, shares similarities with the ST-103. Both forms involve sales tax, but the ST-105 is used by purchasers to claim exemptions on qualifying purchases. The ST-103, in contrast, is a reporting mechanism for distributors to account for prepaid sales tax. Both documents are crucial for understanding tax obligations and ensuring compliance with state regulations.

FAQ

What is the purpose of the Indiana ST-103DR form?

The Indiana ST-103DR form is used to report prepaid sales tax by distributors. This form must be filed monthly, even if no transactions have occurred during the reporting period. It ensures that the Indiana Department of Revenue has accurate records of sales tax collected and paid by distributors on fuel sales.

Who needs to file the ST-103DR form?

Any business operating as a gasoline distributor in Indiana is required to file the ST-103DR form. This includes both qualified and non-qualified distributors. It’s important to note that even if your business had no sales or purchases during the reporting period, you still need to submit this form.

What information is required on the ST-103DR form?

The form requires several key pieces of information, including your Taxpayer Identification Number, the tax period, your Federal Identification Number, your business name, and contact information. You also need to provide details about your suppliers and customers, including names, addresses, and the total gallons of fuel purchased and sold. Finally, you must report the amount of prepaid sales tax paid and collected.

When is the ST-103DR form due?

The ST-103DR form is due on the last day of the month following the reporting period. For example, if you are reporting for the month of January, the form must be submitted by the last day of February. Timely filing is crucial to avoid penalties.

What happens if I fail to file the ST-103DR form?

Failing to file the ST-103DR form can result in penalties and interest charges from the Indiana Department of Revenue. Additionally, it may lead to increased scrutiny of your business operations. To avoid these consequences, ensure that you file the form on time, even if there are no transactions to report.

Where do I send the completed ST-103DR form?

Once you have completed the ST-103DR form, mail it to the Indiana Department of Revenue, Excise Tax, at P.O. Box 6114, Indianapolis, IN 46206-6114. If you have any questions or need assistance, you can contact the department at (317) 615-2552.

Common mistakes

Completing the Indiana ST-103DR form can be straightforward, but many individuals make common mistakes that can lead to delays or issues with their filing. One frequent error is failing to include the Taxpayer Identification Number. This number is crucial for the Indiana Department of Revenue to identify your business. Omitting it can result in your form being returned or rejected.

Another common mistake involves the Federal Identification Number. Some filers either leave this section blank or enter incorrect information. This number is essential for verifying your business status and ensuring that all tax obligations are met. Double-checking this number against official documents can prevent unnecessary complications.

Many people also overlook the requirement to provide the Tax Period. It is important to specify the correct month and year for the report. Not doing so can lead to confusion regarding the timing of your transactions and may affect your tax calculations.

When it comes to the Doing Business as Name (DBA), some filers forget to include it or misstate it. This name should match what is registered with the state. If there is a discrepancy, it could raise questions during processing.

Providing an accurate telephone number is also critical. Some individuals either omit this information or provide incorrect numbers. This contact detail allows the Department of Revenue to reach you if there are questions about your submission.

In Section I, many filers neglect to complete both sides of the form. This oversight can lead to incomplete submissions, which may be rejected or require additional follow-up. Ensure that all sections are filled out as instructed to avoid this issue.

Another mistake occurs when listing the name and address of the supplier. Failing to provide complete and accurate information can hinder the verification process. It is essential to ensure that the supplier's details are correct and match what is on file with the IRS.

Lastly, many people fail to total the gallons purchased and the prepaid sales tax paid accurately. This step is crucial for the final reporting and can affect the overall tax liability. Take the time to double-check all calculations to ensure accuracy.

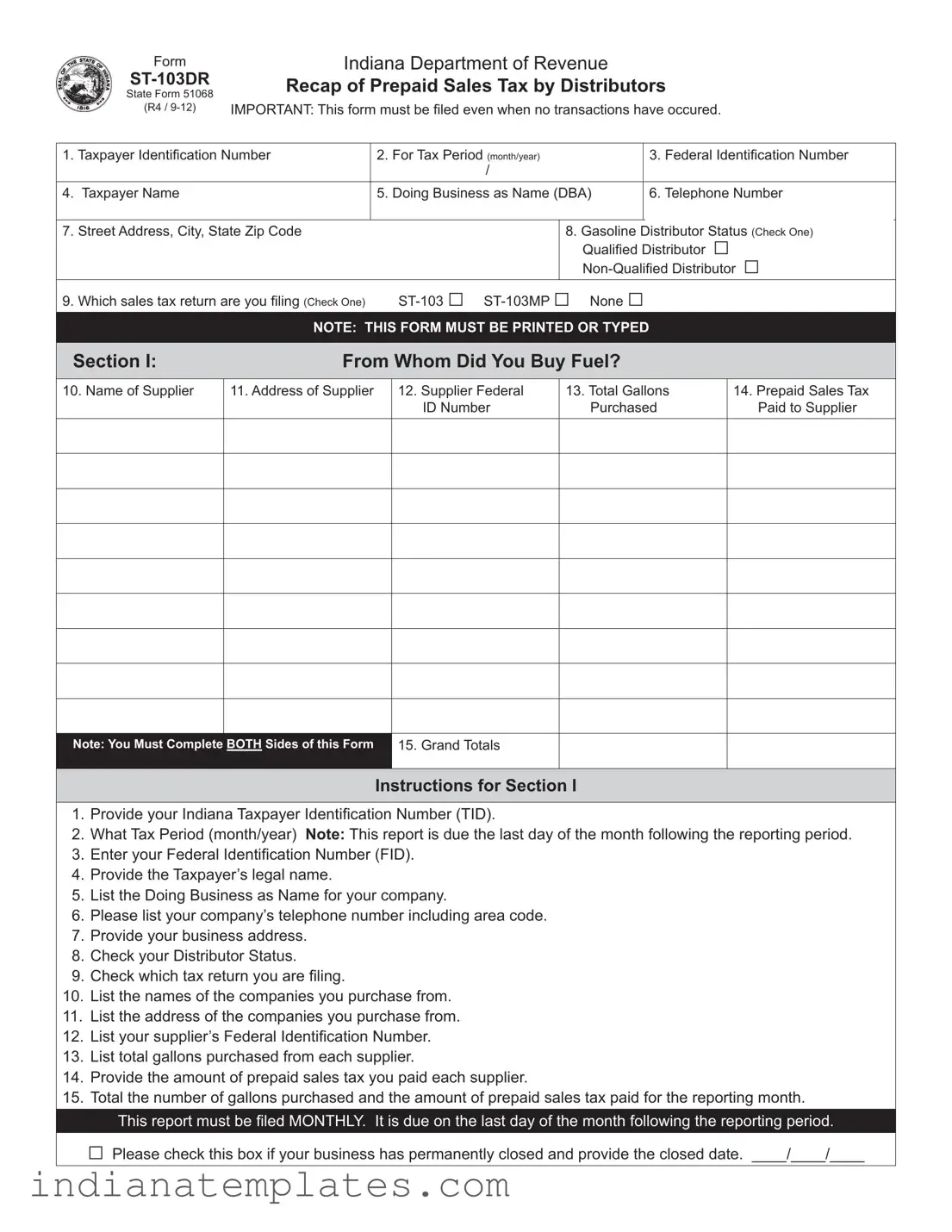

Indiana St 103Dr Preview

|

Form |

|

Indiana Department of Revenue |

|

|||

|

Recap of Prepaid Sales Tax by Distributors |

||||||

|

State Form 51068 |

||||||

|

|

|

|

|

|

|

|

|

(R4 / |

IMPORTANT: This form must be fi led even when no transactions have occured. |

|||||

|

|

|

|

|

|

||

1. Taxpayer Identifi cation Number |

|

2. For Tax Period (month/year) |

|

3. Federal Identification Number |

|||

|

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

4. |

Taxpayer Name |

|

|

5. Doing Business as Name (DBA) |

|

6. Telephone Number |

|

|

|

|

|

|

|

||

7. |

Street Address, City, State Zip Code |

|

|

8. Gasoline Distributor Status (Check One) |

|||

|

|

|

|

|

Qualifi ed Distributor □ |

||

|

|

|

|

|

|||

9. |

Which sales tax return are you filing (Check One) |

|

|||||

|

|

|

NOTE: THIS FORM MUST BE PRINTED OR TYPED |

|

|||

|

|

|

|

||||

Section I: |

|

From Whom Did You Buy Fuel? |

|

||||

10. Name of Supplier

11. Address of Supplier

12.Supplier Federal ID Number

13.Total Gallons Purchased

14.Prepaid Sales Tax Paid to Supplier

Note: You Must Complete BOTH Sides of this Form

15. Grand Totals

Instructions for Section I

1.Provide your Indiana Taxpayer Identifi cation Number (TID).

2.What Tax Period (month/year) Note: This report is due the last day of the month following the reporting period.

3.Enter your Federal Identifi cation Number (FID).

4.Provide the Taxpayer’s legal name.

5.List the Doing Business as Name for your company.

6.Please list your company’s telephone number including area code.

7.Provide your business address.

8.Check your Distributor Status.

9.Check which tax return you are filing.

10.List the names of the companies you purchase from.

11.List the address of the companies you purchase from.

12.List your supplier’s Federal Identification Number.

13.List total gallons purchased from each supplier.

14.Provide the amount of prepaid sales tax you paid each supplier.

15.Total the number of gallons purchased and the amount of prepaid sales tax paid for the reporting month.

This report must be fi led MONTHLY. It is due on the last day of the month following the reporting period.

□Please check this box if your business has permanently closed and provide the closed date. ____/____/____

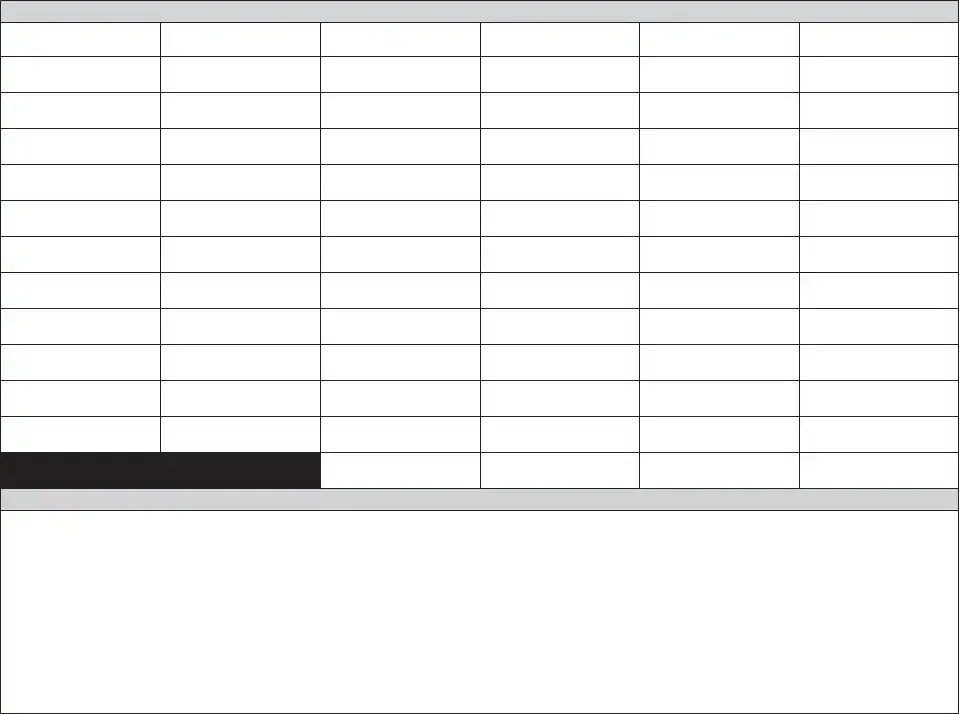

SECTION II |

To Whom Did You Sell Fuel? |

16. Customer’s Name

17. Customer’s Address

18.Customer’s Federal ID Number

19. Total Gallons Sold

20. Exempt Gallons Sold

21. Prepaid RST Collected

All Gallons EXEMPTED and TAXED must be shown

22. Total

Instructions for Section II

16.List your Customer’s Name. (Attach additional sheets if necessary).

17.List your Customer’s Address.

18.List your Customer’s Federal ID Number.

19.List the total gallons of gasoline sold for this month to each customer.

20.List the total tax exempt gallons sold to each customer.

21.List the total amount of Prepaid Sales Tax collected for this month from each customer.

22.Total the amounts of all columns and give the total gallonage and amount collected here.

I declare, under penalties of perjury that this is a true, correct and complete report.

Mail to: Indiana Department of Revenue Excise Tax

P.O. Box 6114 Indianapolis, IN

______________________________________________ |

_____________________________________________ |

__________________________ |

________________ |

Printed Name |

Authorized Signature |

Title |

Date |

Different PDF Forms

Personal Property Tax Indiana - The Indiana State 104 form is used to report business tangible personal property for tax purposes.

For those looking to establish a strong workplace framework, the robust guidance on the critical Employee Handbook essentials can prove invaluable in defining organizational policies and expectations.

Resale Certificate Indiana - Taxpayers must include their Indiana Registered Retail Merchant's Certificate TID and LOC numbers.