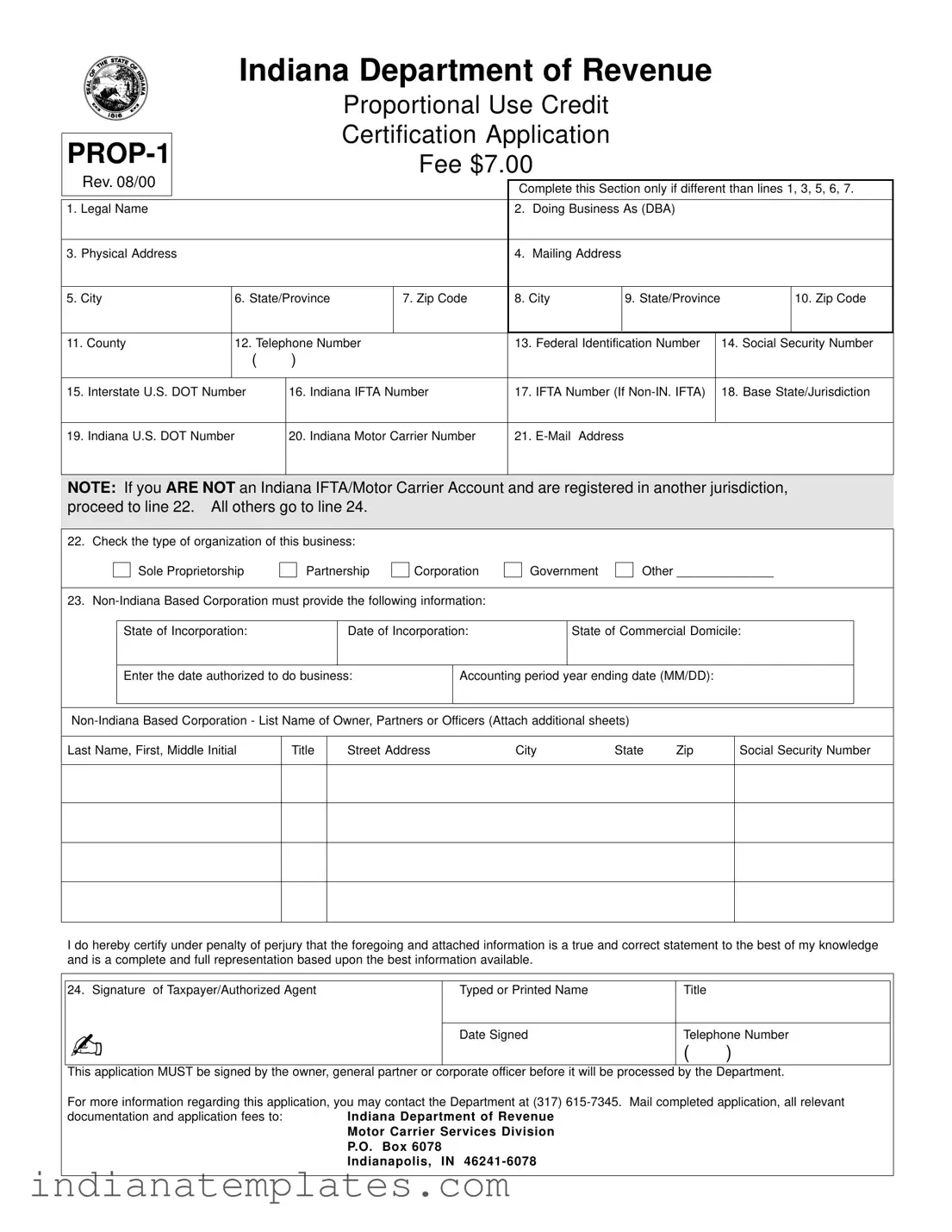

Fill in Your Indiana Prop 1 Form

Similar forms

The Indiana Prop 1 form shares similarities with the IRS Form 1065, which is used by partnerships to report income, deductions, gains, and losses. Both documents require detailed information about the business structure and ownership. Just as the Prop 1 form asks for the legal name and address of the business, Form 1065 requires the partnership's name and address. Furthermore, both forms necessitate the inclusion of identifying numbers, such as the Federal Identification Number for the Prop 1 and the Employer Identification Number (EIN) for Form 1065. This commonality helps ensure that tax authorities can accurately track and assess the tax obligations of the respective entities.

To ensure your financial decisions align with your wishes, consider utilizing a comprehensive Durable Power of Attorney document. This legal instrument empowers a chosen individual to manage your affairs, particularly in situations where you may be incapacitated. Having this document in place provides peace of mind, knowing that your preferences will be upheld when you cannot voice them yourself.

Another document akin to the Indiana Prop 1 form is the Indiana Business Entity Report. This report is mandatory for businesses operating in Indiana and provides essential details about the entity, including its legal name, address, and the names of its officers or members. Similar to the Prop 1 form, the Business Entity Report aims to keep the state informed about the business's current status and structure. Both documents require signatures from authorized representatives, affirming the accuracy of the information provided. This requirement underscores the importance of transparency in business operations.

The IRS Form 990 is also comparable to the Indiana Prop 1 form, particularly for nonprofit organizations. Form 990 serves as an annual information return that provides the IRS and the public with financial information about a nonprofit. Like the Prop 1, it requires detailed information about the organization’s activities, governance, and finances. Both forms aim to promote accountability and transparency, ensuring that the entities are operating within legal parameters. Just as the Prop 1 form requires a signature to validate the information, Form 990 must also be signed by an authorized individual, reinforcing the integrity of the submission.

Lastly, the Indiana Sales Tax Exemption Certificate bears resemblance to the Indiana Prop 1 form in that both documents are essential for specific tax-related purposes. The Sales Tax Exemption Certificate allows eligible organizations to purchase goods without paying sales tax, similar to how the Prop 1 form allows motor carriers to claim proportional use credits. Each document requires detailed information about the organization, including its legal name and address, and both serve to facilitate compliance with Indiana tax regulations. The necessity for accurate information and signatures in both forms highlights the importance of proper documentation in tax matters.

FAQ

What is the Indiana Prop 1 form used for?

The Indiana Prop 1 form, officially known as the Proportional Use Credit Certification Application, is used by motor carriers to apply for a proportional use credit. This credit is available for vehicles that operate both within and outside Indiana. By completing this form, carriers can certify their eligibility for the credit, which can help reduce their tax burden based on the proportion of miles driven in Indiana compared to total miles driven.

What information is required on the Prop 1 form?

The form requires various pieces of information, including the legal name of the business, physical and mailing addresses, contact details, and identification numbers such as the Federal Identification Number and Indiana IFTA Number. Additionally, if applicable, non-Indiana based corporations must provide their state of incorporation and date of incorporation. Vehicle information, including identification numbers and vehicle types, must also be detailed. Ensure all sections are completed accurately to avoid processing delays.

How much does it cost to submit the Prop 1 form?

There is a fee of $7.00 associated with the submission of the Indiana Prop 1 form. This fee must be included with the completed application when it is sent to the Indiana Department of Revenue. Failure to include the fee may result in delays or rejection of the application.

When should I submit the Prop 1 form?

The Prop 1 form must be submitted to the Indiana Department of Revenue before April 1 of the first calendar year for which you intend to claim the proportional use credit. Once certified, the approval remains valid for subsequent calendar years, so timely submission is crucial for maintaining eligibility.

Common mistakes

Filling out the Indiana Prop 1 form can be straightforward, but many make common mistakes that can delay processing. One frequent error is failing to provide the correct legal name of the business. This name must match official documents. If there is a discrepancy, the application may be rejected.

Another common mistake is neglecting to include the Federal Identification Number or Social Security Number. This information is crucial for identification purposes. If a business does not have a Federal ID, the Social Security Number must be provided instead. Omitting this information can lead to processing delays.

Many applicants also forget to complete the vehicle information section. This section is mandatory for all applicants. If the vehicle information is missing or incorrect, it can result in the entire application being held up.

Providing an incorrect mailing address is another mistake that can cause issues. Ensure that the mailing address matches where correspondence should be sent. If the address is wrong, important communications may not reach the applicant.

Some individuals check the wrong type of organization in line 22. It's essential to select the appropriate category, such as Sole Proprietorship or Corporation. Choosing incorrectly can lead to complications in processing the application.

Another oversight is failing to sign the application. The form must be signed by the owner, general partner, or corporate officer. Without a signature, the Department will not process the application.

Additionally, applicants often forget to attach required documentation. If the business is a non-Indiana based corporation, additional information is needed. Not including these documents can lead to a delay or rejection of the application.

Finally, many fail to submit the application by the April 1 deadline. It is crucial to apply for certification before this date to qualify for proportional use credit. Missing this deadline means the applicant will not be eligible for the credit in that calendar year.

Indiana Prop 1 Preview

|

|

|

|

Indiana Department of Revenue |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

Proportional Use Credit |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

Certification Application |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

Fee $7.00 |

|

|

|

|

|

|

|

|

||||||

Rev. 08/00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Complete this Section only if different than lines 1, 3, 5, 6, 7. |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1. Legal Name |

|

|

|

|

|

|

|

2. |

Doing Business As (DBA) |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. Physical Address |

|

|

|

|

|

|

|

4. |

Mailing Address |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

5. City |

|

6. State/Province |

|

7. Zip Code |

8. City |

|

9. State/Province |

|

|

10. Zip Code |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

11. County |

|

12. Telephone Number |

|

|

13. Federal Identification Number |

|

14. Social Security Number |

||||||||||||||

|

|

|

|

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

15. Interstate U.S. DOT Number |

16. Indiana IFTA Number |

17. IFTA Number (If |

|

18. Base State/Jurisdiction |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

19. Indiana U.S. DOT Number |

|

|

20. Indiana Motor Carrier Number |

21. |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

NOTE: If you ARE NOT an Indiana IFTA/Motor Carrier Account and are registered in another jurisdiction, |

|||||||||||||||||||||

proceed to line 22. All others go to line 24. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22. Check the type of organization of this business: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Sole Proprietorship |

Partnership |

Corporation |

|

Government |

|

Other ______________ |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

23. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

State of Incorporation: |

|

|

Date of Incorporation: |

|

|

State of Commercial Domicile: |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Enter the date authorized to do business: |

|

Accounting period year ending date (MM/DD): |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Last Name, First, Middle Initial |

|

Title |

|

Street Address |

City |

State |

Zip |

|

Social Security Number |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I do hereby certify under penalty of perjury that the foregoing and attached information is a true and correct statement to the best of my knowledge and is a complete and full representation based upon the best information available.

24. Signature of Taxpayer/Authorized Agent |

Typed or Printed Name |

Title |

|

|

|

|

|

- |

Date Signed |

Telephone Number |

|

|

( |

) |

|

|

|

||

|

|

|

|

This application MUST be signed by the owner, general partner or corporate officer before it will be processed by the Department.

For more information regarding this application, you may contact the Department at (317)

documentation and application fees to: |

Indiana Department of Revenue |

|

Motor Carrier Services Division |

|

P.O. Box 6078 |

|

Indianapolis, IN |

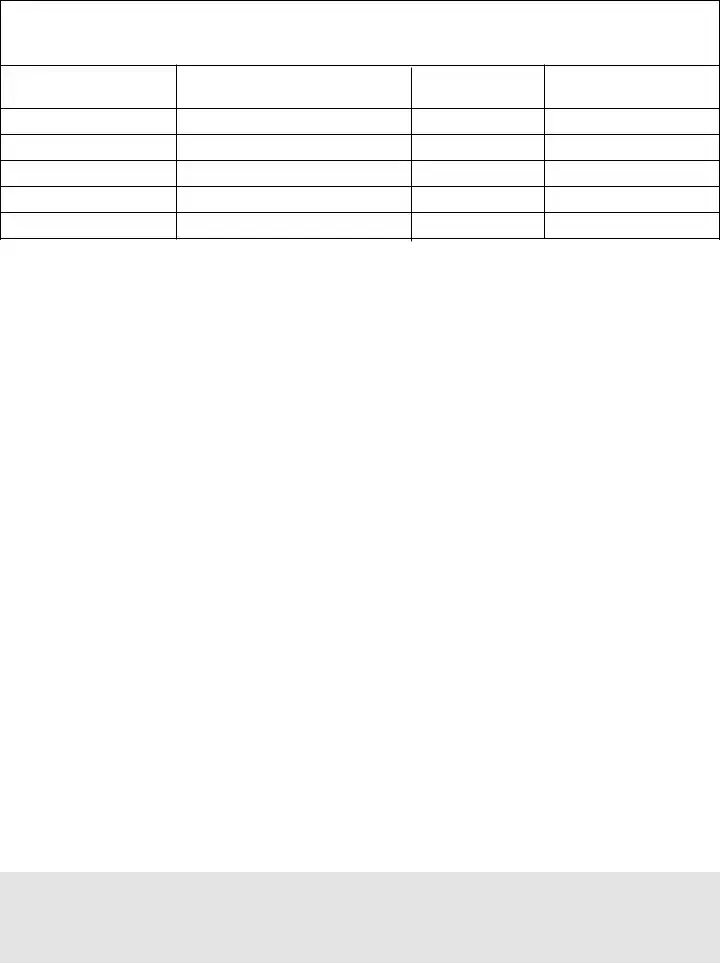

Vehicle Information

(This section must be completed by all applicants)

If you have more than 5 vehicles, please attach printout

Vehicle

Code

Vehicle Identification Number

Power Units Only

Vehicle Type

TK or TR

Vehicle Make

Line By Line Instructions |

List of Eligible Vehicles |

|

CODE |

Line 1: Enter Legal Name or Sole Proprietorship, Partnership, Cor- poration, or other legal name.

Lines 3, 5, 6, 7 & 11: Enter the actual location of your business by providing the Street Address, City, State/Province, Zip Code and County* (*Indiana businesses only).

Lines 2,4,8,9,10: Enter the appropriate information ONLY if differ- ent than lines 1,3,5,6,7,11.

Line 12: Enter the area code and telephone number of your prin- ciple place of business.

Line 13: Enter your nine (9) digit Federal Identification Number.

Line 14: Enter your Social Security Number if your business does not have a Federal Identification Number.

Line 15: Enter your INTERSTATE US DOT Number (you will have an Interstate US DOT Number if your vehicle(s) operate outside the state of Indiana.)

Line 16: Enter your Indiana IFTA Tax Identification Number (if based in Indiana.)

Line 17: Enter your IFTA Account Number if based outside the state of Indiana.

Line 18: Enter your Base State/Jurisdiction in which you have your IFTA registered.

Line 19: Enter your Indiana US DOT Number (you will have an IN US DOT Number if your vehicle(s) operate in the state of Indiana only).

Line 20: Enter your Indiana Motor Carrier Account Number.

Line 21: Enter an

Line 22: To be entered by

Line 23: Enter the requested information below. This certificate will not be processed without this section completed.

Line 24: Enter the signature of Taxpayer/Authorized Agent.

10 |

Air Conditioning Unit for Buses |

10% |

11 |

Bookmobile |

35% |

12 |

Boom |

20% |

13 |

Bulk Feed Trucks |

15% |

14 |

Car Carrier with Hydraulic Winch |

10% |

15 |

Carpet Cleaning Van |

15% |

16 |

Cement Mixers |

30% |

17 |

Distribution |

10% |

18 |

Dump Trailers |

15% |

19 |

Dump Trucks |

23% |

20 |

Fire Truck |

48% |

21 |

Leaf Truck |

20% |

22 |

Lime Spreader |

15% |

23 |

Line |

20% |

24 |

Milk Tank Trucks |

30% |

25 |

Mobile Cranes |

42% |

26 |

Pneumatic Tank Truck |

15% |

27 |

Refrigeration Truck |

15% |

28 |

Salt |

15% |

29 |

Sanitation Dump Trailers |

15% |

30 |

Sanitation Truck |

41% |

31 |

Seeder Truck |

15% |

32 |

Semi Wrecker |

35% |

33 |

Service Truck with Jackhammer, Pneumatic Drill |

15% |

34 |

Sewer Cleaning Truck Sewer Jet, Sewer Vactor |

35% |

35 |

Snow Plow |

10% |

36 |

Spray Truck |

15% |

37 |

Super Sucker |

90% |

38 |

Sweeper Truck |

20% |

39 |

Tank Trucks |

24% |

40 |

Tank Transport |

15% |

41 |

Truck with Power Take Off Hydraulic Winch |

20% |

42 |

Wrecker |

10% |

Please use the code number when listing the vehicles on this Certification and all Claims for Credit forms. Also use these codes when adding/deleting vehicles quarterly.

****IMPORTANT****

A carrier must complete this application and be certified by the department in order to qualify for a proportional use credit. A carrier must apply to the Department for certification before April 1 of the first calendar year for which the proportional use will be claimed. NOTE: Once the carrier has been certified by the Department, that certification is valid for all subsequent calendar years.

Different PDF Forms

It6 - Changes in the FEIN should be reported using the appropriate forms included in the IT-6 packet.

To simplify the transaction process further, many individuals choose to utilize resources such as UsaLawDocs.com, which provides templates and guidance on filling out the North Carolina Motor Vehicle Bill of Sale form accurately.

Personal Property Tax Indiana - Knowing the assessment date is vital for reporting personal property correctly.