Fill in Your W2 Bob Evans Indianapolis Form

Similar forms

The W-2 form is commonly compared to the 1099 form, which is used for reporting income received by independent contractors and freelancers. While the W-2 details wages paid to employees and the taxes withheld, the 1099 form provides information on non-employee compensation. Both documents serve the purpose of reporting income to the IRS, but they cater to different employment relationships. Understanding the distinction between these forms is crucial for accurate tax reporting and compliance.

The Arizona Bill of Sale form is a legal document that facilitates the transfer of ownership of personal property from one individual to another. This form serves as proof of the transaction and outlines important details such as the description of the item, purchase price, and the parties involved. Understanding how to properly complete this form is essential for ensuring a smooth transfer and protecting both the buyer's and seller's rights. For more information, you can visit https://arizonapdfforms.com/bill-of-sale.

Another similar document is the 1040 form, which is the individual income tax return form used by taxpayers to report their annual income. While the W-2 provides details on the income earned from an employer, the 1040 form aggregates all income sources, including wages, dividends, and capital gains. Taxpayers use the information from their W-2 forms to complete their 1040 forms, making the W-2 an essential component of the tax filing process.

The 1098 form also shares similarities with the W-2. This form is used to report mortgage interest paid by a borrower to a lender. Just as the W-2 provides a summary of income and taxes withheld, the 1098 summarizes interest payments that may be deductible on a taxpayer's return. Both forms play a role in tax preparation, helping individuals maximize their deductions and ensure compliance with tax laws.

The Pay Stub is another document that resembles the W-2 in its function. A pay stub, or paycheck stub, provides a detailed breakdown of an employee's earnings for a specific pay period, including gross pay, deductions, and net pay. While the W-2 summarizes annual earnings and tax withholdings, the pay stub offers a more immediate view of an employee's financial situation. Both documents are vital for understanding compensation and tax obligations.

Form 941 is a quarterly tax return that employers file to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Similar to the W-2, it reflects tax obligations related to employee earnings. However, the W-2 is an annual summary, while Form 941 is filed quarterly. Both forms ensure that the IRS receives accurate information about employment taxes, helping to maintain compliance with tax regulations.

The 1095-C form is another document that relates to employee reporting, particularly concerning health insurance coverage. Employers use this form to report information about health coverage offered to employees, similar to how the W-2 reports income. Both forms are essential for employees when filing their taxes, especially under the Affordable Care Act, as they provide necessary information for compliance with health insurance mandates.

The Schedule C form is utilized by sole proprietors to report income and expenses from their business activities. While the W-2 reports wages for employees, the Schedule C serves a similar purpose for self-employed individuals. Both documents are essential for accurately reporting income to the IRS, but they cater to different types of earners within the economy.

The 1099-R form is used to report distributions from retirement accounts, such as pensions and IRAs. Similar to the W-2, it provides information about income that is taxable. While the W-2 focuses on wages earned from employment, the 1099-R highlights income received from retirement plans. Both forms are critical for individuals when preparing their tax returns, ensuring they report all taxable income accurately.

The Form 4506-T is a request for a transcript of tax return information, which can be similar to the W-2 in that it helps individuals obtain necessary documentation for tax purposes. While the W-2 provides a summary of earnings and withholdings, the Form 4506-T allows taxpayers to request a summary of their entire tax return history. Both documents serve important roles in tax filing and verification processes.

Lastly, the Form W-4 is a document that employees complete to indicate their tax withholding preferences to their employer. While the W-2 reports the taxes that have been withheld based on the information provided on the W-4, the W-4 itself is a proactive measure taken by employees to manage their tax liabilities. Both forms are interconnected in the process of ensuring accurate tax withholding and compliance.

FAQ

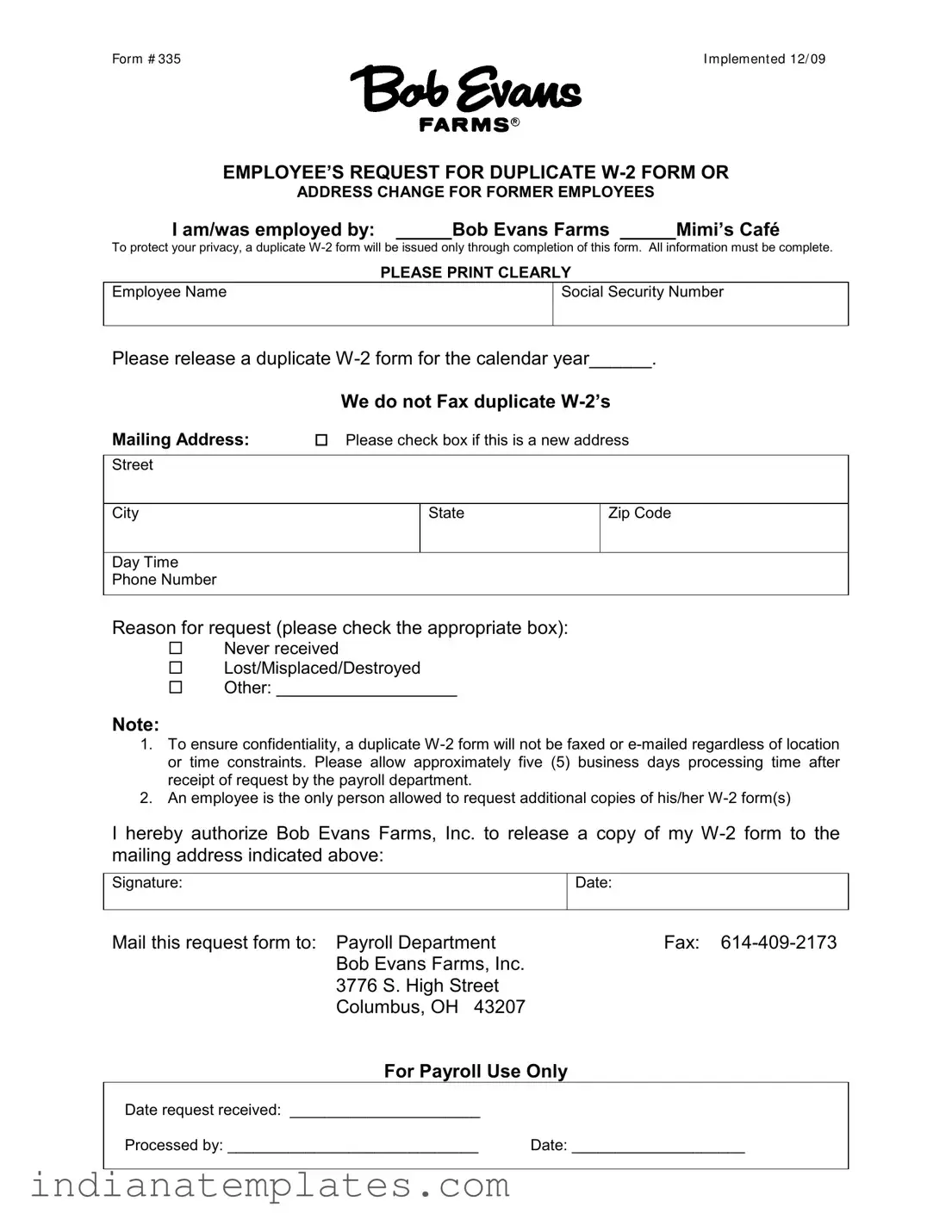

What is the W-2 Bob Evans Indianapolis form?

The W-2 Bob Evans Indianapolis form is a document that reports an employee's annual wages and the taxes withheld from their paychecks. This form is essential for employees when filing their income tax returns. It includes information such as the employee's name, Social Security number, and the total earnings for the calendar year.

How can I request a duplicate W-2 form from Bob Evans?

If you need a duplicate W-2 form, you must complete the Employee’s Request for Duplicate W-2 Form. This form requires you to provide your name, Social Security number, and the calendar year for which you are requesting the duplicate. You must also indicate the reason for your request and provide your mailing address. The completed form should be mailed to the Payroll Department at Bob Evans Farms, Inc.

What reasons can I provide for requesting a duplicate W-2?

When requesting a duplicate W-2, you can select from a few options. The reasons include never receiving the original W-2, losing or misplacing it, or other specific circumstances you may wish to note. It’s important to select the appropriate reason to help the payroll department process your request efficiently.

How long does it take to receive a duplicate W-2 form?

After submitting your request, please allow approximately five business days for processing. The payroll department will take this time to verify your information and send the duplicate W-2 form to your specified mailing address. Be sure to account for this timeframe when planning your tax filing.

Can someone else request my W-2 form on my behalf?

No, only the employee is authorized to request additional copies of their W-2 form. This policy is in place to protect your personal information and ensure confidentiality. If you need a duplicate, you must submit the request yourself.

Will my duplicate W-2 be sent via fax or email?

No, for confidentiality reasons, duplicate W-2 forms will not be sent via fax or email. They will only be mailed to the address you provide on the request form. This policy helps safeguard your sensitive information from unauthorized access.

Common mistakes

Filling out the W-2 Bob Evans Indianapolis form can be straightforward, but many people make common mistakes that can delay processing. One of the most frequent errors is failing to provide complete information. All fields must be filled out clearly, including your name, Social Security number, and mailing address. Incomplete forms will likely lead to delays.

Another mistake is neglecting to check the box for a new address if applicable. If you have moved recently, it’s crucial to indicate that your mailing address has changed. Failing to do so may result in your duplicate W-2 being sent to the wrong location, causing further complications.

Many individuals also overlook the reason for their request. It is important to check the appropriate box that corresponds to your situation, whether you never received your W-2, lost it, or have another reason. This helps the payroll department understand your request better and process it more efficiently.

Some people forget to sign and date the form. Your signature is essential as it authorizes Bob Evans Farms, Inc. to release your W-2. Without it, the request will not be processed, and you will have to start over.

Additionally, not allowing enough processing time can lead to frustration. The form notes that it may take approximately five business days for the payroll department to process your request after they receive it. Planning ahead can prevent unnecessary stress.

Using incorrect contact information is another common issue. Ensure that the day and time phone number you provide is accurate. This will allow the payroll department to reach you if there are any questions or issues with your request.

Lastly, some individuals mistakenly believe they can request a duplicate W-2 through fax or email. However, the form clearly states that a duplicate will not be sent via these methods. All requests must be mailed to ensure confidentiality. Adhering to these guidelines will help ensure a smooth process.

W2 Bob Evans Indianapolis Preview

Form # 335 |

I mplement ed 12/ 09 |

EMPLOYEE’S REQUEST FOR DUPLICATE

ADDRESS CHANGE FOR FORMER EMPLOYEES

I am/was employed by: |

|

Bob Evans Farms |

|

Mimi’s Café |

To protect your privacy, a duplicate

PLEASE PRINT CLEARLY

Employee Name

Social Security Number

Please release a duplicate

|

We do not Fax duplicate |

Mailing Address: |

Please check box if this is a new address |

|

|

Street |

|

City

State

Zip Code

Day Time

Phone Number

Reason for request (please check the appropriate box):

Never received

Lost/Misplaced/Destroyed

Other: ___________________

Note:

1.To ensure confidentiality, a duplicate

2.An employee is the only person allowed to request additional copies of his/her

I hereby authorize Bob Evans Farms, Inc. to release a copy of my

Signature:

Date:

Mail this request form to: Payroll Department |

Fax: |

Bob Evans Farms, Inc. |

|

3776 S. High Street |

|

Columbus, OH 43207 |

|

For Payroll Use Only |

|

Date request received: ______________________ |

|

Processed by: _____________________________ |

Date: ____________________ |

|

|

Different PDF Forms

Indiana 53421 - The application inquires about any dependents requiring care and related expenses.

Obtaining the right documentation for your boat sale is crucial, and using a well-structured Missouri Boat Bill of Sale template can simplify the process while ensuring all necessary details are captured.

Indiana Oversize Overweight Permits - The form mandates that signatures from responsible officers are necessary before submission.