Free Indiana Transfer-on-Death Deed Template

Similar forms

The Indiana Transfer-on-Death Deed (TOD) form shares similarities with a Last Will and Testament. Both documents are used to convey property rights upon an individual’s death. However, the key difference lies in their activation; a will requires probate, which can be a lengthy and public process, while a TOD deed allows property to pass directly to the designated beneficiary without going through probate. This feature can simplify the transfer process and maintain privacy regarding the estate's assets.

Understanding the importance of properly structured legal documents in managing assets is crucial, as seen in the various forms like the Transfer-on-Death Deed (TOD) and the Revocable Living Trust. Each serves distinct purposes in estate planning, ensuring that responsibilities are clear and beneficiaries are designated. For instance, an Operating Agreement form is essential for LLCs to delineate ownership and member duties, providing a solid groundwork for operational decisions. For those interested in creating an Operating Agreement, a useful resource can be found at UsaLawDocs.com.

Another document similar to the TOD deed is the Revocable Living Trust. Like the TOD, a revocable living trust allows for the transfer of assets upon death. However, a trust is typically more comprehensive, managing not only real estate but also other assets during the individual's lifetime and after death. The trust can also provide for incapacity, which the TOD deed does not address. This makes trusts a more versatile option for estate planning.

The TOD deed is also akin to a Beneficiary Designation form, commonly used for financial accounts like life insurance policies or retirement accounts. Both documents allow individuals to name beneficiaries who will receive assets directly upon death. However, while a beneficiary designation applies to specific financial products, the TOD deed specifically pertains to real estate. This distinction is crucial when planning how various types of assets will be distributed.

A Power of Attorney (POA) can be compared to the TOD deed in that both documents deal with the management of an individual's assets. A POA allows someone to act on behalf of another person while they are alive, particularly if they become incapacitated. In contrast, the TOD deed only comes into play after the individual’s death. While both are important in managing assets, their purposes and timelines differ significantly.

Another document that resembles the TOD deed is the Joint Tenancy with Right of Survivorship agreement. This arrangement allows co-owners of property to automatically transfer ownership to the surviving owner(s) upon the death of one owner. Both the joint tenancy and the TOD deed facilitate a seamless transfer of property, avoiding probate. However, joint tenancy requires both parties to hold the property together during their lifetimes, whereas a TOD deed allows the original owner to retain full control until death.

Lastly, the TOD deed is similar to a Transfer-on-Death Registration for vehicles. This document enables vehicle owners to designate a beneficiary who will receive the vehicle upon the owner's death, bypassing probate. Both the vehicle registration and the TOD deed streamline the transfer process, ensuring that assets are passed on quickly and efficiently. However, the vehicle registration is specific to motor vehicles, while the TOD deed is focused on real estate assets.

FAQ

What is an Indiana Transfer-on-Death Deed?

The Indiana Transfer-on-Death Deed is a legal document that allows a property owner to designate one or more beneficiaries to receive their real estate upon their death. This deed enables the transfer of property without going through probate, simplifying the process for heirs and ensuring a smoother transition of ownership.

How does a Transfer-on-Death Deed work?

When the property owner passes away, the designated beneficiaries automatically gain ownership of the property. The deed must be properly executed and recorded before the owner's death to be effective. Once recorded, the beneficiaries can claim the property without needing to go through the lengthy probate process.

Who can be named as a beneficiary in the deed?

Any individual or entity can be named as a beneficiary in an Indiana Transfer-on-Death Deed. This includes family members, friends, or even organizations. However, it is essential to ensure that the beneficiaries are clearly identified to avoid any confusion or disputes later on.

Can I change or revoke a Transfer-on-Death Deed?

Yes, property owners have the right to change or revoke a Transfer-on-Death Deed at any time before their death. This can be done by creating a new deed that explicitly revokes the previous one or by recording a formal revocation document. It is crucial to follow proper procedures to ensure that the changes are legally recognized.

Is there a cost associated with recording the Transfer-on-Death Deed?

Yes, there are typically fees associated with recording a Transfer-on-Death Deed, which can vary by county. It is advisable to check with the local county recorder's office for the exact fees and any additional requirements that may apply.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney to create a Transfer-on-Death Deed, consulting with a legal professional can be beneficial. An attorney can provide guidance on the implications of the deed, help ensure that it is properly executed, and address any specific concerns regarding your estate planning needs.

What happens if a beneficiary predeceases the property owner?

If a beneficiary named in the Transfer-on-Death Deed dies before the property owner, the share designated for that beneficiary typically lapses. The property owner can choose to update the deed to name a new beneficiary or allow the remaining beneficiaries to inherit the property. It is essential to review and update the deed as circumstances change.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when using a Transfer-on-Death Deed. However, the property may be subject to estate taxes upon the owner's death, depending on the overall value of the estate. Beneficiaries should consult with a tax professional to understand any potential tax liabilities they may face when inheriting property.

Can I use a Transfer-on-Death Deed for all types of property?

In Indiana, a Transfer-on-Death Deed can only be used for real estate, such as residential or commercial properties. It cannot be applied to personal property, bank accounts, or other types of assets. For those assets, different estate planning tools may be more appropriate.

Common mistakes

Filling out the Indiana Transfer-on-Death Deed form can be a straightforward process, but many individuals make common mistakes that can lead to complications down the line. One frequent error is failing to properly identify the property. When listing the property, it is crucial to include a clear and accurate legal description. Simply providing an address may not suffice, as the legal description ensures that there is no ambiguity about which property is being transferred.

Another mistake often made involves not naming the beneficiaries correctly. It is essential to ensure that the names of the beneficiaries are spelled accurately and that their relationship to the property owner is clearly stated. Omissions or errors in this section can create confusion and may even result in disputes among heirs. Additionally, failing to consider alternate beneficiaries can lead to complications if the primary beneficiaries are unable to inherit the property for any reason.

People frequently overlook the importance of signing the deed in the presence of a notary. In Indiana, the law requires that the Transfer-on-Death Deed be notarized to be valid. Neglecting this step can invalidate the entire deed, leaving the property subject to probate. It is also important to remember that the deed must be recorded with the county recorder's office to take effect. Many individuals mistakenly believe that simply filling out the form is sufficient.

Another common oversight is not updating the deed after significant life events. Changes such as marriage, divorce, or the birth of a child can affect the intended distribution of the property. Failing to revise the deed to reflect these changes can lead to unintended consequences, including disputes among family members. Regularly reviewing and updating estate planning documents is a crucial step in ensuring that one’s wishes are honored.

Lastly, individuals often underestimate the implications of their decisions when filling out the form. They may not fully understand how a Transfer-on-Death Deed interacts with other estate planning tools, such as wills or trusts. It is vital to consider the broader context of one’s estate plan to avoid conflicts or unintended consequences. Engaging with a knowledgeable professional can help clarify these complexities and ensure that the deed aligns with overall estate planning goals.

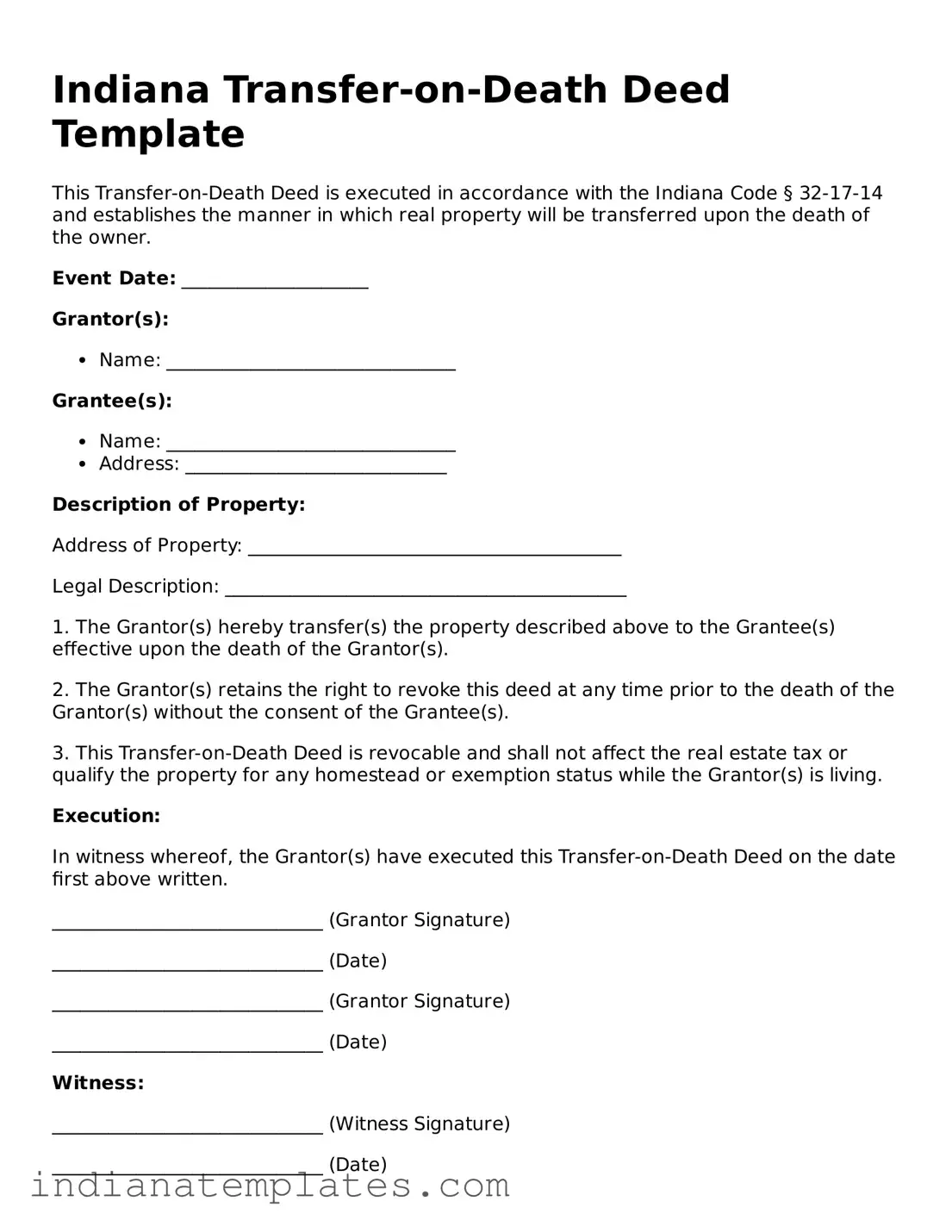

Indiana Transfer-on-Death Deed Preview

Indiana Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the Indiana Code § 32-17-14 and establishes the manner in which real property will be transferred upon the death of the owner.

Event Date: ____________________

Grantor(s):

- Name: _______________________________

Grantee(s):

- Name: _______________________________

- Address: ____________________________

Description of Property:

Address of Property: ________________________________________

Legal Description: ___________________________________________

1. The Grantor(s) hereby transfer(s) the property described above to the Grantee(s) effective upon the death of the Grantor(s).

2. The Grantor(s) retains the right to revoke this deed at any time prior to the death of the Grantor(s) without the consent of the Grantee(s).

3. This Transfer-on-Death Deed is revocable and shall not affect the real estate tax or qualify the property for any homestead or exemption status while the Grantor(s) is living.

Execution:

In witness whereof, the Grantor(s) have executed this Transfer-on-Death Deed on the date first above written.

_____________________________ (Grantor Signature)

_____________________________ (Date)

_____________________________ (Grantor Signature)

_____________________________ (Date)

Witness:

_____________________________ (Witness Signature)

_____________________________ (Date)

Notary Public:

State of Indiana

County of ___________________________

Subscribed and sworn to before me on this _____ day of ____________, 20__.

_____________________________ (Notary Public Signature)

My Commission Expires: _______________

Other Popular Indiana Forms

Notary Paragraph - The process can involve confirming that the signer is not under duress.

To enhance your workplace operations, consider utilizing our well-structured Employee Handbook template for better organizational clarity and compliance.Employee Handbook solutions provide a solid foundation for setting clear expectations.

How to Evict Someone in Indiana - Receiving a Notice to Quit does not automatically mean immediate eviction; it’s a chance to rectify the issue.