Free Indiana Tractor Bill of Sale Template

Similar forms

The Indiana Vehicle Bill of Sale is similar to the Tractor Bill of Sale in that both documents serve as proof of a transaction involving a vehicle. Each form typically includes details about the buyer, seller, and the vehicle itself, such as make, model, year, and VIN. Both documents are essential for transferring ownership and may be required for registration purposes in Indiana.

The Indiana Boat Bill of Sale shares similarities with the Tractor Bill of Sale, particularly in the context of transferring ownership. Both documents outline the buyer and seller's information, along with details about the boat or tractor being sold. Just like the Tractor Bill of Sale, the Boat Bill of Sale can be used to register the boat with the state, ensuring that ownership is officially recognized.

When it comes to the intricacies of vehicle transactions, it's essential to have the proper documentation in place, such as the Indiana Vehicle Bill of Sale, which shares similarities with various other forms. For example, the New York Trailer Bill of Sale form, available at UsaLawDocs.com, plays a vital role in ensuring that ownership transfer is documented correctly. Each of these forms not only guarantees legal compliance but also protects the rights of both buyers and sellers by detailing necessary information about the vehicle being sold.

The Indiana Motorcycle Bill of Sale is another document akin to the Tractor Bill of Sale. Both forms detail the transaction between a buyer and seller, including pertinent information about the motorcycle or tractor. These documents are essential for establishing ownership and may be required when registering the vehicle with the Indiana Bureau of Motor Vehicles.

The Indiana RV Bill of Sale is comparable to the Tractor Bill of Sale in that both involve the sale of a vehicle. Each document captures critical information about the parties involved and the vehicle being sold. This form is particularly important for RVs, as it helps facilitate the registration process and ensures that ownership is properly transferred.

The Indiana Mobile Home Bill of Sale resembles the Tractor Bill of Sale in its function of documenting a sale. Both forms include details about the buyer, seller, and the item being sold. While the Tractor Bill of Sale pertains to agricultural machinery, the Mobile Home Bill of Sale is specifically designed for real property transactions, making it essential for legal ownership transfers.

The Indiana Aircraft Bill of Sale is another document that serves a similar purpose to the Tractor Bill of Sale. Both documents formalize the transfer of ownership between a buyer and seller. They include important details about the aircraft or tractor, ensuring that ownership is clearly established and recognized by relevant authorities.

The Indiana Firearm Bill of Sale shares characteristics with the Tractor Bill of Sale, as both documents record the sale of personal property. Each form requires information about the buyer and seller, along with specifics about the firearm or tractor. This documentation is crucial for legal compliance and helps protect the rights of both parties involved in the transaction.

The Indiana Equipment Bill of Sale is akin to the Tractor Bill of Sale in that both are used to document the sale of equipment. Each form captures the necessary details about the buyer, seller, and the equipment being sold. This documentation is vital for establishing ownership and may be necessary for tax purposes or financing arrangements.

The Indiana Pet Bill of Sale is similar to the Tractor Bill of Sale in that it serves to document the transfer of ownership of a personal property item. Both documents require information about the buyer and seller, as well as specifics about the pet or tractor. While the nature of the items differs, the underlying purpose of establishing ownership remains consistent.

The Indiana Business Bill of Sale parallels the Tractor Bill of Sale in its function of documenting a sale. Both forms provide a record of the transaction, including details about the buyer, seller, and the business or tractor being sold. This documentation is essential for legal purposes and helps ensure that ownership is clearly defined and recognized.

FAQ

What is a Tractor Bill of Sale in Indiana?

A Tractor Bill of Sale is a legal document that records the sale of a tractor between a buyer and a seller in the state of Indiana. This document serves as proof of the transaction and includes essential details such as the names of both parties, the tractor's identification information, and the sale price. By having this document, both the buyer and seller can protect their interests and clarify the terms of the sale. It is particularly useful for transferring ownership and can be required for registration purposes with the Indiana Bureau of Motor Vehicles (BMV).

What information is typically included in the Indiana Tractor Bill of Sale?

The Indiana Tractor Bill of Sale generally includes several key pieces of information. First, it identifies the seller and buyer by name and address. Next, it provides details about the tractor, such as the make, model, year, and Vehicle Identification Number (VIN). The document also specifies the sale price and the date of the transaction. Additionally, both parties may need to sign the document to validate the sale. Including accurate and complete information is crucial to ensure that the bill of sale is legally binding.

Do I need to have the Tractor Bill of Sale notarized?

In Indiana, notarization is not typically required for a Tractor Bill of Sale. However, having the document notarized can add an extra layer of protection for both parties involved in the transaction. Notarization verifies the identities of the signers and confirms that they willingly entered into the agreement. This can be particularly helpful in case of disputes or if you need to prove the authenticity of the document in the future. It is always a good practice to check with local regulations or consult with a legal professional for specific requirements.

How do I use the Tractor Bill of Sale after the sale is completed?

Once the sale is completed and both parties have signed the Tractor Bill of Sale, the buyer should keep the document for their records. This document acts as proof of ownership and may be necessary for registering the tractor with the Indiana BMV. The seller should also retain a copy for their records, as it confirms the transfer of ownership. If the buyer plans to register the tractor, they may need to present the bill of sale along with other required documents, such as proof of identity and any applicable taxes or fees.

Common mistakes

When completing the Indiana Tractor Bill of Sale form, individuals often encounter several common mistakes that can lead to complications. One frequent error is failing to provide accurate identification information for both the buyer and the seller. This includes names, addresses, and contact numbers. Incomplete or incorrect details can create confusion and potentially affect the validity of the sale.

Another common mistake is neglecting to include the tractor's Vehicle Identification Number (VIN). The VIN is crucial for identifying the specific tractor being sold. Omitting this information can lead to disputes about ownership and may hinder future registration processes.

Many individuals also overlook the importance of documenting the sale price. The form should clearly state the agreed-upon amount for the tractor. Without this information, it may be difficult to prove the transaction occurred, and it can also impact tax obligations.

Additionally, some people forget to sign the document. Both the buyer and the seller must provide their signatures to validate the transaction. A lack of signatures can render the bill of sale ineffective, leading to potential legal issues down the line.

Another mistake is not including the date of the transaction. The date is essential for establishing when the sale took place, which can be important for tax purposes and for determining the timeline of ownership transfer.

Lastly, individuals may fail to keep a copy of the completed bill of sale. Retaining a copy is important for both parties as it serves as proof of the transaction. Without a copy, either party may face difficulties if disputes arise in the future.

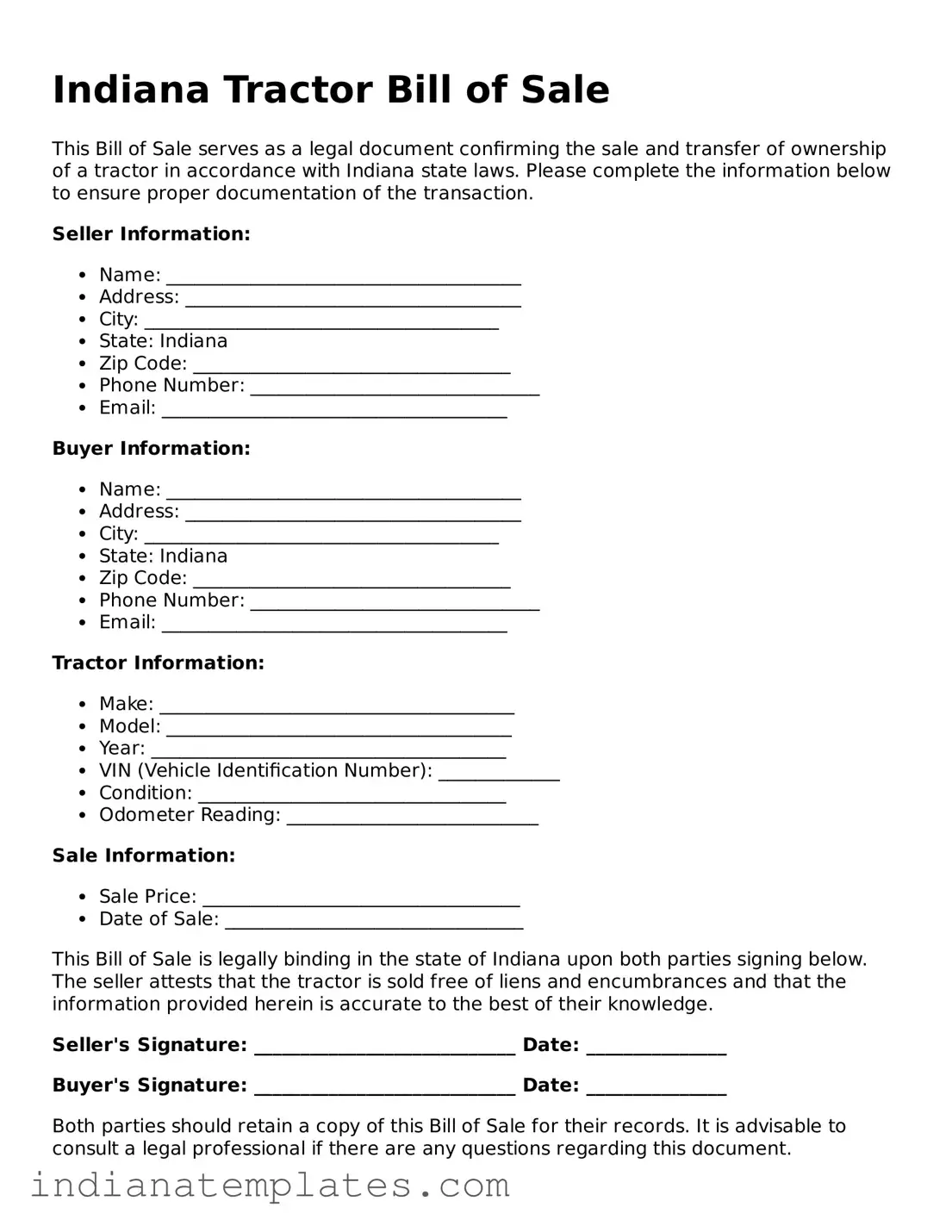

Indiana Tractor Bill of Sale Preview

Indiana Tractor Bill of Sale

This Bill of Sale serves as a legal document confirming the sale and transfer of ownership of a tractor in accordance with Indiana state laws. Please complete the information below to ensure proper documentation of the transaction.

Seller Information:

- Name: ______________________________________

- Address: ____________________________________

- City: ______________________________________

- State: Indiana

- Zip Code: __________________________________

- Phone Number: _______________________________

- Email: _____________________________________

Buyer Information:

- Name: ______________________________________

- Address: ____________________________________

- City: ______________________________________

- State: Indiana

- Zip Code: __________________________________

- Phone Number: _______________________________

- Email: _____________________________________

Tractor Information:

- Make: ______________________________________

- Model: _____________________________________

- Year: ______________________________________

- VIN (Vehicle Identification Number): _____________

- Condition: _________________________________

- Odometer Reading: ___________________________

Sale Information:

- Sale Price: __________________________________

- Date of Sale: ________________________________

This Bill of Sale is legally binding in the state of Indiana upon both parties signing below. The seller attests that the tractor is sold free of liens and encumbrances and that the information provided herein is accurate to the best of their knowledge.

Seller's Signature: ____________________________ Date: _______________

Buyer's Signature: ____________________________ Date: _______________

Both parties should retain a copy of this Bill of Sale for their records. It is advisable to consult a legal professional if there are any questions regarding this document.

Other Popular Indiana Forms

Free Living Will Form Indiana - A Living Will is an essential part of comprehensive estate planning.

When engaging in a transaction involving personal property, it's crucial to utilize a proper legal document, such as the Arizona Bill of Sale. This form not only facilitates the transfer of ownership but also acts as proof of the transaction, detailing important aspects like the description of the item and the purchase price. For those looking to draft this essential paperwork accurately, resources are available online; for example, you can find the necessary template at arizonapdfforms.com/bill-of-sale.

Indiana Title Correction Form - Use this form to certify corrections to previously filed paperwork.