Fill in Your State Of Indiana 130 Short Form

Similar forms

The State of Indiana Form 130 is similar to the Indiana Form 11, which is used for property tax assessment. Form 11 serves as the official notice of assessment, informing property owners about their property’s assessed value. Just like Form 130, which allows taxpayers to contest an assessment, Form 11 provides essential information about the assessment process. Both forms emphasize the importance of timely responses, as the deadlines for appealing assessments are critical for taxpayers wishing to challenge their property valuations.

Another document that shares similarities with Form 130 is the Indiana Form 113. This form is specifically designed for personal property assessments. Like Form 130, it enables taxpayers to appeal their assessments, ensuring that they have a voice in the process. Both forms require detailed information about the property in question, and they outline the steps necessary for filing an appeal. This consistency helps property owners navigate the sometimes complex world of property taxation.

The Indiana Board of Tax Review petition form is also comparable to Form 130. This petition is used when a taxpayer wishes to appeal a decision made by the county board regarding their property assessment. Similar to Form 130, it requires the petitioner to provide specific reasons for their appeal. Both forms aim to ensure that taxpayers understand their rights and the procedures they must follow to seek a review of their property tax assessments.

Form 21513, which is a general property tax appeal form, is another document that parallels Form 130. This form is utilized for initiating a review of property assessments at the county level. Like Form 130, it requires the taxpayer to specify the property in question and the basis for their appeal. Both forms emphasize the importance of clear communication between taxpayers and assessing officials, ensuring that all parties are informed throughout the review process.

The Indiana Form 130R is also noteworthy as it relates to the appeal process for property tax exemptions. This form allows taxpayers to contest a denial of an exemption, similar to how Form 130 allows for the appeal of an assessment. Both forms require detailed information about the property and the reasons for the appeal, reinforcing the need for clarity and thoroughness in the appeal process.

The Arizona Bill of Sale form is a legal document that facilitates the transfer of ownership of personal property from one individual to another. This form serves as proof of the transaction and outlines important details such as the description of the item, purchase price, and the parties involved. Understanding how to properly complete this form is essential for ensuring a smooth transfer and protecting both the buyer's and seller's rights. For more information, you can visit arizonapdfforms.com/bill-of-sale.

Lastly, the Indiana Form 137, which is a petition for review of a property tax assessment, mirrors the purpose of Form 130. This form is specifically for taxpayers who want to appeal the county board's decision regarding their assessment. Both forms guide taxpayers through the necessary steps to initiate a review, highlighting the importance of adhering to deadlines and providing adequate justification for the appeal. The similarities in structure and requirements across these forms help create a cohesive framework for property tax appeals in Indiana.

FAQ

What is the purpose of the Indiana Form 130?

The Indiana Form 130 serves as a petition for review of property tax assessments made by local assessing officials. It allows taxpayers to formally contest their property assessments if they believe the valuation is incorrect. This process is essential for ensuring that property taxes are fair and accurately reflect the true value of the property. By filing this form, taxpayers initiate a review process that can lead to adjustments in their property tax assessments.

How long do I have to file a Form 130 after receiving a notice of assessment?

Taxpayers must file the Form 130 within a specific timeframe. If you receive a notice of assessment, you have forty-five (45) days from the date of that notice to submit your petition. For assessments in years prior to 2009, the deadline is May 10 of that year. For subsequent years, the deadline is either May 10 or forty-five days after the statement from the county auditor, whichever is later. Meeting these deadlines is crucial to ensure your appeal is considered.

What information must be included in the Form 130?

The Form 130 requires several key pieces of information to be complete. You must provide your name, the address and parcel number of the property in question, and your contact information. Additionally, you need to specify the reasons for your appeal, including any evidence that supports your claim, such as comparisons to similar properties or details about recent sales. This information helps the county board understand your position and the basis for your appeal.

What happens after I file the Form 130?

Once you file the Form 130, the county or township official will forward your notice to the county board. The board is then required to hold a hearing within one hundred eighty (180) days. You will receive a notification regarding the date and time of this hearing. During the hearing, you can present your case, and the assessing official will provide their rationale for the assessment. The county board will then make a decision, which they must communicate to you within one hundred twenty (120) days after the hearing.

Can I have a representative file the Form 130 on my behalf?

Yes, you can have an authorized representative file the Form 130 for you. If you choose to do this, your representative must attach a notarized power of attorney to the form unless they are a corporate officer or an employee of your business. It is important that your representative is well-informed about the details of your case, as they will be responsible for presenting your appeal and advocating on your behalf during the hearing.

Common mistakes

Filing the State of Indiana Form 130 can be a complex process, and mistakes can lead to delays or even denials of appeals. One common error is failing to check the appropriate type of property under appeal. The form requires taxpayers to select either "Real" or "Personal" property. Neglecting to make this selection can result in processing issues.

Another frequent mistake involves the assessment year. Taxpayers must ensure they correctly indicate the assessment year under appeal. An incorrect year can render the petition invalid, as the timeline for filing is specific to each assessment year.

Many individuals overlook the requirement to provide complete and accurate contact information. This includes the taxpayer's name, address, and phone number. Incomplete information can hinder communication and may delay the review process.

Providing vague or non-specific reasons for the appeal is another common pitfall. The form specifically requests detailed explanations for why the taxpayer believes the assessment is incorrect. General statements, such as "the assessment is too high," do not suffice and may lead to rejection.

Additionally, some taxpayers fail to attach necessary documentation. If a property was sold within the last three years, relevant documents like the purchase agreement or closing statement must be included. Without this evidence, the appeal may lack the necessary support.

Another mistake involves misunderstanding the timeline for filing the petition. Taxpayers must file their notice within 45 days of receiving the assessment notice. Missing this deadline can eliminate the right to appeal.

Some individuals do not sign the petition or fail to have it signed by an authorized representative when applicable. Signatures are crucial for validating the petition and confirming the information provided is accurate.

Taxpayers sometimes forget to submit the original petition along with a copy. The instructions specify that both must be sent to the assessing official, and failing to do so can lead to processing delays.

Another common error is not reviewing related parcels under appeal. If there are multiple properties involved, taxpayers must file separate petitions for each. Failing to do this can complicate the appeal process.

Finally, many people neglect to seek a pre-hearing meeting with the assessing official. This meeting can often resolve issues before they escalate to a formal hearing, making it a valuable step in the appeal process.

State Of Indiana 130 Short Preview

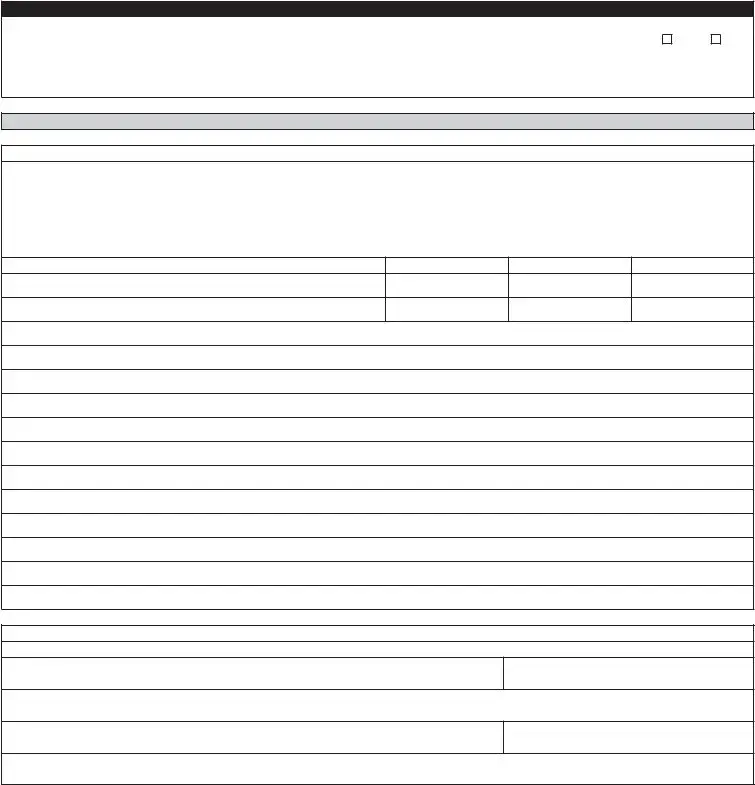

PETITION FOR REVIEW OF ASSESSMENT BY LOCAL ASSESSING OFFICIAL - PROPERTY TAX ASSESSMENT BOARD OF APPEALS

State Form 21513 (R6 /

Prescribed by the Department of Local Government Finance

Check type of property under appeal (check only one): |

Real |

Personal |

FORM 130

Assessment year under appeal

MARCH 1, ________________

READ IMPORTANT FILING INFORMATION BEFORE COMPLETING THIS FORM

IC

Review by county board; initiation by taxpayer notice; notice deadline; taxpayer meeting; hearing; appraisal not required; decision

Section 1. (a) A taxpayer may obtain a review by the county board of a county or township official’s action with respect to the assessment of the taxpayer’s tangible property if the official’s action requires the giving of notice to the taxpayer. At the time that the notice is given to the taxpayer, the taxpayer shall also be informed in writing of:

(1)the opportunity for a review under this section, including a meeting under subsection (h) with the county or township official referred to in this subsection; and

(2)the procedures the taxpayer must follow in order to obtain a review under this section.

(b)In order to obtain a review of an assessment effective for the assessment date to which the notice referred in subsection (a) applies, the taxpayer must file a notice in writing with the county or township official referred to in subsection (a) not later than

(c)A taxpayer may obtain a review by the county board of the assessment of the taxpayer’s tangible property effective for an assessment date for which a notice of assessment is not given as described in subsection (a). To obtain the review, the taxpayer must file a notice in writing with the township assessor of the township in which the property is subject to assessment. The right of a taxpayer to obtain a review under this subsection for an assessment date for which a notice of assessment is not given does not relieve an assessing official of the duty to provide the taxpayer with the notice of assessment as otherwise required by the article. For an assessment date in a year before 2009, the notice must be filed on or before May 10 of the year. For an assessment date in a year after 2008, the notice must be filed no later than the later of:

(1)May 10 of the year; or

(2) forty - five (45) days after the date of the statement mailed by the county auditor under IC 6 - 1 . 1 - 17 - 3(b) .

(d)A change in an assessment made as a result of a notice for review filed by a taxpayer under subsection (c) after the time prescribed in subsection (c) becomes effective for the next assessment date. A change in an assessment made as a result of a notice for review filed by a taxpayer under subsection (b) or (c) remains in effect from the assessment date for which the change is made until the next assessment date for which the assessment is changed under this article.

(e)The written notice filed by the taxpayer under subsection (b) or (c) must include the following:

(1)the name of the taxpayer;

(2)The address and parcel or key number of the property; and

(3)The address and telephone number of the taxpayer.

(f)A county or township official who receives a notice for review filed by a taxpayer under subsection (b) or (c) shall immediately forward the notice to the county board.

(g)The county board shall hold a hearing or a review under this subsection no later than one hundred eighty (180) days after the date of the notice for review filed by the taxpayer under subsection (b) or (c). The county board shall, by mail, give notice of the date, time, and place fixed for the hearing to the taxpayer and the county or township official with whom the taxpayer filed notice for review. The taxpayer and the county or township official with whom the taxpayer filed the notice for review are parties to the proceeding before the county board.

(h)Before the county board holds the hearing required under subsection (g), the taxpayer may request a meeting by filing a written request with the county or township official with whom the taxpayer filed the notice for review to:

(1)attempt to resolve as many issues under review as possible; and

(2)seek a joint recommendation for settlement of some or all issues under review.

A county or township official who receives a meeting request under this subsection before the county board hearing shall meet with the taxpayer. The taxpayer and the county or township official shall present a joint recommendation reached under this subsection to the county board at the hearing required under subsection (g). The county board may adopt or reject the recommendation whole or in part.

(i)At the hearing required under subsection (g):

(1)the taxpayer may present the taxpayer’s reasons for disagreement with the assessment; and

(2)the county or township official with whom the taxpayer filed the notice for review must be present:

(A)the basis for the assessment decision; and

(B)the reasons the taxpayer’s contentions should be denied.

(j)The county board may not require a taxpayer to file documentary evidence or summaries or statements of testimonial evidence before the hearing required under subsection (g). If the action for which a taxpayer seeks review under this section is the assessment of tangible property, the taxpayer is not required to have an appraisal of the property in order to:

(1)initiate the review;

(2)prosecute the review.

(k)Regardless of whether or not the county board adopts a recommendation under subsection (h), the county board shall prepare a written decision resolving all of the issues under review. The county board shall, by mail, give notice of its determination not later then one hundred twenty (120) days after the hearing under subsection (g) to the taxpayer, the assessor, and the township assessor.

(l)If the maximum time elapses:

(1)under subjection (g) for the county board to hold a hearing; or

(2)under subsection (k) for the county board to give notice of its determination;

the taxpayer may initiate a proceeding for review before the Indiana board by taking the action required by Section 3 of this chapter at any time after the minimum time elapses.

Page 1 of 4

IMPORTANT FILING INFORMATION (continued)

IC

Review by Indiana board; initiation by petition of taxpayer or county assessor; petition deadline and form; appraisal not required; decision

Section 3.(a) A taxpayer may obtain a review by the Indiana board of a county board's action with respect to the following:

(1)The assessment of that taxpayer's tangible property if the county board's action requires the giving of notice to the taxpayer.

(2)The exemption of that taxpayer's tangible property if the taxpayer receives a notice of an exemption determination by the county board under IC

(b)The county assessor is the party to the review under this section to defend the determination of the county board. At the time the notice of that determination is given to the taxpayer, the taxpayer shall also be informed in writing of:

(1)the taxpayer's opportunity for review under this section; and

(2)the procedures the taxpayer must follow in order to obtain review under this section.

(c)A county assessor who dissents from the determination of an assessment or an exemption by the county board may obtain a review of the assessment or the exemption by the Indiana board.

(d)In order to obtain a review by the Indiana board under this section, the party must, not later than

(1)file a petition for review with the Indiana board; and

(2)mail a copy of the petition to the other party.

(e)The Indiana board shall prescribe the form of the petition for review of an assessment determination or an exemption by the county board. The Indiana board shall issue instructions for completion of the form. The form and the instructions must be clear, simple, and understandable to the average individual. A petition for review of such a determination must be made on the form prescribed by the Indiana board. The form must require the petitioner to specify the reasons why the petitioner believes that the assessment determination or the exemption determination by the county board is erroneous.

(f)If the action for which a taxpayer seeks review under this section is the assessment of tangible property, the taxpayer is not required to have an appraisal of the property in order to do the following:

(1)Initiate the review.

(2)Prosecute the review.

GENERAL INSTRUCTIONS:

1.Please print or type.

2.The petitioner should complete Section I, Section II, and Section III of this form.

3.The petition must be signed by the petitioner or an authorized representative. A representative must attach a notarized power of attorney unless the representative is a duly authorized employee of corporate officer of the taxpayer.

Is a power of attorney attached? |

Yes |

No |

4.Certified tax representatives must attach a Tax Representative Disclosure statement. 50 IAC

As a result of filing this petition, the assessment may increase, may decrease, or may stay the same.

SECTION I: PROPERTY & PETITIONER INFORMATION

County |

Township |

Parcel or key number (for real property only) |

|

|

|

|

|

Address of property being appealed (number and street, city state, and ZIP code) |

|

|

|

|

|

|

|

Legal description on Form 11 or Property Record card (for real property), or business name (for personal property) |

|

|

|

|

|

|

|

Name of property owner |

|

Telephone number of property owner |

|

|

|

( |

) |

|

|

|

|

Mailing address of property owner (number and street, city state, and ZIP code) |

|

|

|

|

|

|

|

Name of authorized representative (if different from owner) |

|

Telephone number of authorized representative |

|

|

|

( |

) |

|

|

|

|

Mailing address of authorized representative (number and street, city state, and ZIP code)

Page 2 of 4

SECTION II: REASON FOR APPEAL

Land |

Improvements |

Personal Property |

The property described in Section I is currently assessed at:

The petitioner contends that the property should be assessed at:

Present use for the property

Use for which property was designed

Classification of property (commercial, residential, etc.)

Was property sold in the last three years? |

|

If yes, date of sale (month, day, year) |

Sale price |

Yes |

No |

|

|

|

|

|

|

If the property was sold in the last three years, attach the purchase agreement, escrow statement, closing statement, or other evidence, if available. If buyer and seller were or are related or had any common business interests, attach an explanation of the relationship.

If the property was not sold but was listed for sale in the past three years, attach a copy of the listing agreement or other available evidence.

Do you intend to present the testimony or report of a professional assessor / appraiser?

Yes |

No |

Is the property valued higher than comparable properties?

Yes

No

If yes, attach the owner’s name and address of each comparable property and explain how the property is comparable to the property being appealed.

The requested change in assessed value is justified for the following reasons: (Give specific reasons. Do not give conclusions such as the assessment is too high.)

SECTION III: SIGNATURES

Petitioner, taxpayer, or duly authorized employee or corporate officer of the taxpayer

I certify that my entries in Section I and Section II are accurate to the best of my knowledge and belief. I also understand that by appealing my assessment, my assessment may increase, may decrease, or may remain the same.

Signature of petitioner, taxpayer, or duly authorized officer

Date of signature (month, day, year)

Printed or typed name of petitioner, taxpayer, or duly authorized officer

Tax representative

I certify that the entries in Section I and Section II are accurate to the best of my knowledge and belief. I certify that I have viewed this property, the property record card, and Form 11 or Form 113, and that I have the authority to file this appeal on behalf of the taxpayer. I certify that I have made all necessary disclosures to my client, pursuant to 50 IAC

Signature of tax representative

Date of signature (month, day, year)

Printed or typed name of tax representative

Attorney representative

I certify that my entries in Section I and Section II are accurate to the best of my knowledge and belief.

Signature of attorney representative

Date of signature (month, day, year)

Printed or typed name of attorney representative

CHECKLIST

I have reviewed Form 11 RA, Form 11 CI, or Form 113. I have reviewed the property record card.

If I am appealing both real and personal property assessments, I have filed separate petitions for each property. I have checked the type of property under appeal (real or personal) at the top of page one.

I have completed Section I, Section II, and Section III of this petition.

I have given specific reasons for the requested change in value in Section II of this petition.

If this petition is being filed by an authorized tax representative, a duly executed power of attorney and a Tax Representative Disclosure statement is attached. I have signed this petition.

I understand that I must submit the original and one copy of this form to the assessing official. If there are other related parcels currently under appeal, a listing of these parcels is attached.

Page 3 of 4

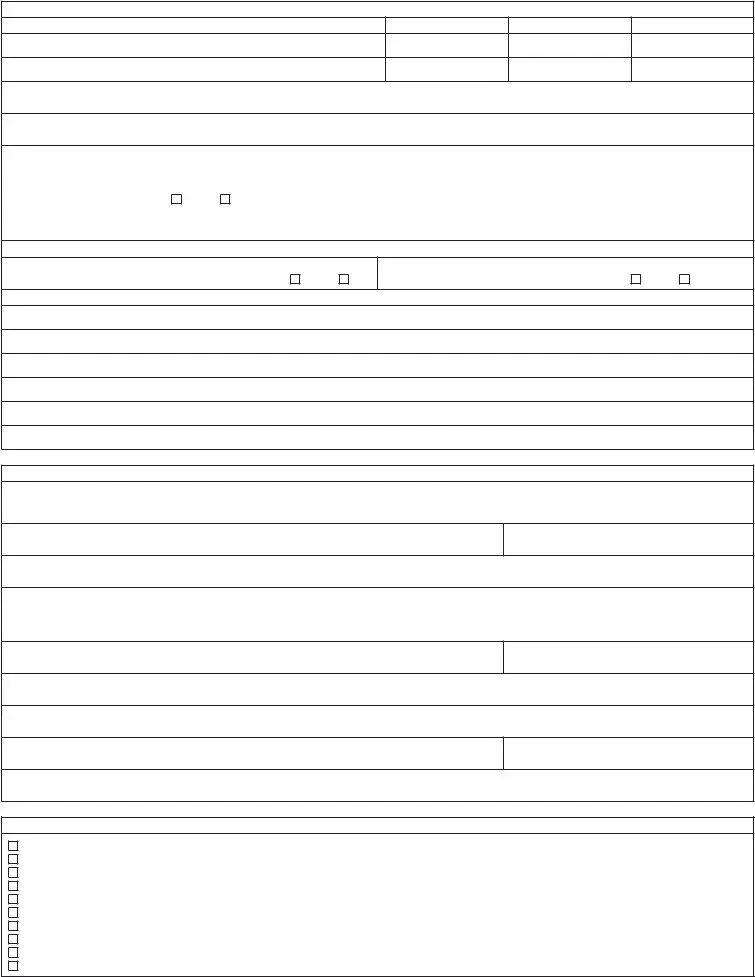

FOR ASSESSING OFFICIAL USE ONLY

1. Date notice was sent to taxpayer (month, day, year) |

2. Date petition for review was filed by petitioner (month, day, year) |

3. Petition for review timely filed? |

|

|

|

Yes |

No |

|

|

|

|

Signature of assessor |

Date of signature (month, day, year) |

|

|

|

|

|

|

If the answer to number 3 above is “No”, the assessor shall notify the petitioner that the petition was not timely filed.

THE FOLLOWING SECTION IS FOR THE ASSESSOR / PETITIONER CONFERENCE

SECTION IV: RESULTS OF ASSESSOR / PETITIONER CONFERENCE

Before the county board holds the hearing required under IC

(1)attempt to resolve as many issues under review as possible; and

(2)seek a joint recommendation for settlement of some or all of the issues under review.

A county or township official who receives a meeting request under this subsection before the county board hearing shall meet with the taxpayer. The taxpayer and the county or township official shall present a joint recommendation reached under this subsection to the county board at the hearing required under IC

Land |

Improvements |

Personal Property |

The petitioner contends that the property should be assessed at:

The assessing official contends that the property should be assessed at:

If no agreement can be reached, explain the reasons for disagreement. If a change in assessed value is being made, explain the reason for the change.

SIGNATURES

The values listed above and the explanation given accurately reflect my opinion regarding this property.

Signature of assessing official

Date of signature (month, day, year)

Printed or typed name of assessing official

Signature of taxpayer or authorized representative

Date of conference (month, day, year)

Printed or typed name of taxpayer or authorized representative

Page 4 of 4

Different PDF Forms

It 40 - Make sure any additional schedules mentioned are enclosed as required.

When completing the transfer of ownership for a trailer in New York, it is important to have a proper bill of sale, such as the one available at UsaLawDocs.com, to ensure that all necessary details are accurately documented and that both parties are protected throughout the process.

Indiana Legal Forms Free - It fosters an organized legal process by ensuring that all necessary parties are aware of the proceedings.