Fill in Your St 105 Indiana Form

Similar forms

The ST-105 Indiana form serves as a General Sales Tax Exemption Certificate, allowing qualified purchasers to buy goods without paying sales tax. A similar document is the IRS Form W-9, which is used by individuals and businesses to provide their Taxpayer Identification Number (TIN) to another party. Both forms require the disclosure of an identification number and are used to validate tax-exempt status. While the ST-105 focuses on sales tax exemptions in Indiana, the W-9 is more general and is often used for various tax reporting purposes, such as when a business hires a contractor or freelancer.

Another document comparable to the ST-105 is the Form ST-4, also known as the Sales Tax Exemption Certificate used in Massachusetts. Like the ST-105, the ST-4 allows certain purchasers to claim exemptions from sales tax. Both forms require the purchaser to provide specific information regarding their tax-exempt status and the nature of the items being purchased. However, the ST-4 is specific to Massachusetts, whereas the ST-105 is tailored for Indiana, reflecting the unique tax laws of each state.

For individuals interested in securing their healthcare preferences, the Durable Power of Attorney document is vital in ensuring that your choices are respected. By utilizing a Durable Power of Attorney for essential decisions, you can designate someone to act on your behalf if you become incapacitated, safeguarding your interests during critical moments.

The Texas Sales and Use Tax Resale Certificate is another document that shares similarities with the ST-105. This certificate allows retailers in Texas to purchase items tax-free if those items are intended for resale. Both documents require the purchaser to indicate whether the purchase is for resale or for an exempt purpose. However, the Texas certificate also includes specific provisions for different types of purchases, which may not be present in the Indiana form.

The Form ST-120, used in New York, is also akin to the ST-105. This form serves as a sales tax exemption certificate for New York purchasers. Both documents aim to validate the tax-exempt status of the purchaser and require completion of specific sections to ensure compliance. While the ST-120 is designed for use in New York, it follows similar principles of identifying the purchaser and the nature of the exemption being claimed.

The California Resale Certificate is another document that parallels the ST-105. This certificate allows California businesses to purchase goods intended for resale without paying sales tax. Both the California Resale Certificate and the ST-105 require the purchaser to provide their seller’s permit number, which serves as proof of their eligibility for tax exemption. The key difference lies in the specific state regulations that govern each form.

The Exempt Use Certificate in Florida also resembles the ST-105. This certificate allows buyers to claim exemption from sales tax for certain purchases that will be used in an exempt manner. Both documents necessitate detailed information about the purchaser and the intended use of the items. However, the Exempt Use Certificate is tailored specifically for Florida's tax laws, whereas the ST-105 is specific to Indiana.

Another similar document is the Form ST-3 in New Jersey, which is used for sales tax exemption purposes. Like the ST-105, the ST-3 allows qualified purchasers to buy goods without paying sales tax. Both forms require the completion of sections that identify the purchaser and the reason for the exemption. However, the ST-3 is specific to New Jersey and has its own set of rules and regulations governing its use.

Finally, the Form ST-101 in New York, which is a sales tax exemption certificate, also shares similarities with the ST-105. This form is used by exempt organizations to purchase items without incurring sales tax. Both the ST-101 and the ST-105 require the purchaser to provide relevant information about their tax-exempt status and the nature of the purchases. However, the ST-101 is specifically designed for New York, reflecting the state's unique tax regulations.

FAQ

What is the ST-105 Indiana form?

The ST-105 Indiana form is a General Sales Tax Exemption Certificate issued by the Indiana Department of Revenue. It allows Indiana registered retail merchants and businesses located outside Indiana to claim exemptions from sales tax on certain purchases. The exemption must comply with Indiana law, and it is important to note that exemptions from other states do not apply to purchases made from Indiana vendors.

Who can use the ST-105 form?

The ST-105 form can be used by Indiana registered retail merchants as well as businesses located outside of Indiana. However, to qualify for the exemption, the purchaser must be registered with the Indiana Department of Revenue or the appropriate taxing authority in their state of residence.

What types of purchases are exempt using the ST-105 form?

The ST-105 form can be used for various exempt purchases, including sales to retailers, wholesalers, or manufacturers for resale. It also covers sales of manufacturing machinery, tools, and equipment used directly in production, as well as sales to nonprofit organizations. However, it cannot be used for utilities, vehicles, watercraft, or aircraft.

What happens if the ST-105 form is incomplete?

If the ST-105 form is not fully completed, the seller is required to charge sales tax on the purchase. Incomplete forms can lead to tax liability for the seller. Purchasers who fail to provide all necessary information must pay the sales tax and can file a claim for a refund using Form GA-110L with the Indiana Department of Revenue.

What identification is required on the ST-105 form?

The form requires at least one identification number. For Indiana purchasers, this is typically the Indiana Taxpayer Identification Number (TID) and the associated Location (LOC) number. Out-of-state purchasers must provide their State Tax ID Number. In some cases, alternative identification numbers such as a Federal Identification Number (FID) or Social Security Number (SSN) may be used.

Can the ST-105 form be used for blanket exemptions?

Yes, the ST-105 form allows the purchaser to indicate whether the exemption is for a single purchase or a blanket exemption. A blanket exemption applies to multiple purchases over a specified period, while a single purchase exemption is for a one-time transaction.

What is required in Section 3 of the ST-105 form?

In Section 3, the purchaser must check the reason for claiming the exemption. They may need to provide additional information if requested. This section ensures that the purchaser understands the specific grounds for the exemption being claimed.

What penalties exist for misuse of the ST-105 form?

Misuse of the ST-105 form, whether negligent or intentional, can lead to serious consequences. Both the individual and the business entity may face tax liabilities, interest, and civil or criminal penalties. It is crucial for purchasers to use the exemption certificate correctly and in accordance with Indiana law.

How long should sellers keep the ST-105 form on file?

Sellers are required to keep the ST-105 form on file to support any exempt sales made using the certificate. This documentation is essential for compliance and may be requested during audits or reviews by the Indiana Department of Revenue.

Where can I find instructions for completing the ST-105 form?

Instructions for completing the ST-105 form are provided on the back of the certificate itself. It is important for purchasers to carefully follow these instructions to ensure that all required information is included, as incomplete forms will not be valid for claiming exemptions.

Common mistakes

Filling out the ST-105 Indiana form can be straightforward, but many people make common mistakes that can lead to complications. One frequent error is failing to complete all four sections of the form. Each section is essential for validating the exemption. If any section is left blank, the seller is obligated to collect sales tax, which defeats the purpose of using the exemption certificate.

Another mistake is not providing the correct identification number. Purchasers must include either an Indiana Taxpayer Identification Number (TID) or a valid State ID Number from another state. Some individuals mistakenly think that providing just any number will suffice. It’s crucial to ensure that the number entered is accurate and corresponds to the correct category of exemption being claimed.

Many people also overlook the requirement to indicate whether the exemption is for a single purchase or a blanket exemption. This selection must be clearly marked. Failing to check the appropriate box can create confusion and may result in the exemption being invalidated.

In Section 3, purchasers need to select the reason for the exemption. Some individuals forget to check a box or provide an explanation. This omission can lead to unnecessary delays or complications in processing the exemption.

Signature and date are critical components in Section 4. Some individuals neglect to sign the form or forget to date it. Without a signature, the form lacks validity, and the seller may still be required to collect sales tax.

Another common issue arises when purchasers do not provide a detailed description of the items being purchased. A vague description can lead to misunderstandings about the nature of the purchase. Clearly stating what items are being bought helps ensure that the exemption is correctly applied.

Some purchasers fail to understand the limitations of the exemption. For instance, this certificate cannot be used for utilities, vehicles, watercraft, or aircraft. Ignoring these restrictions can lead to serious consequences, including penalties for misuse.

Additionally, out-of-state purchasers often forget to verify their registration status in their home state. The Indiana Department of Revenue may request this verification, and not having it ready can complicate the process.

Lastly, not keeping a copy of the completed ST-105 form can be detrimental. Sellers must retain this certificate on file to support exempt sales. If the form is misplaced, it can create issues later on when trying to prove the validity of the exemption.

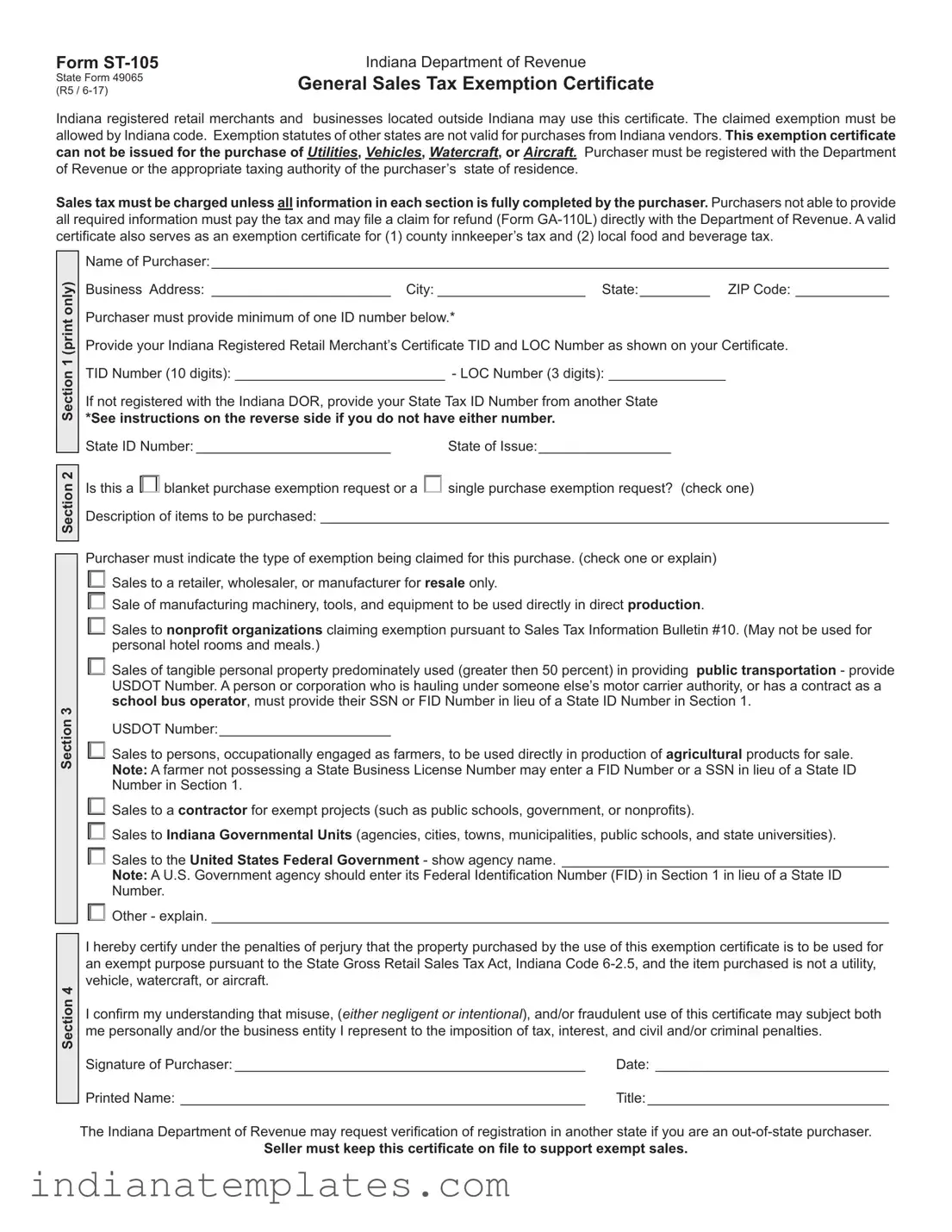

St 105 Indiana Preview

Form |

Indiana Department of Revenue |

(R5 / |

General Sales Tax Exemption Certificate |

State Form 49065 |

|

Indiana registered retail merchants and businesses located outside Indiana may use this certificate. The claimed exemption must be allowed by Indiana code. Exemption statutes of other states are not valid for purchases from Indiana vendors. This exemption certificate can not be issued for the purchase of Utilities, Vehicles, Watercraft, or Aircraft. Purchaser must be registered with the Department of Revenue or the appropriate taxing authority of the purchaser’s state of residence.

Sales tax must be charged unless all information in each section is fully completed by the purchaser. Purchasers not able to provide all required information must pay the tax and may file a claim for refund (Form

Section 2 Section 1 (print only)

Section 2 Section 1 (print only)

Section 3

Section 4

Name of Purchaser:________________________________________________________________________________________

Business Address:_ _______________________ City:____________________ State:__________ ZIP Code:_____________

Purchaser must provide minimum of one ID number below.*

Provide your Indiana Registered Retail Merchant’s Certificate TID and LOC Number as shown on your Certificate.

TID Number (10 digits):____________________________ - LOC Number (3 digits):________________

If not registered with the Indiana DOR, provide your State Tax ID Number from another State

*See instructions on the reverse side if you do not have either number.

State ID Number:__________________________ |

State of Issue:_________________ |

Is this a □blanket purchase exemption request or a □single purchase exemption request? (check one)

Description of items to be purchased:__________________________________________________________________________

□must indicate the type of exemption being claimed for this purchase. (check one or explain)

□Sales to a retailer, wholesaler, or manufacturer for resale only.

□Sale of manufacturing machinery, tools, and equipment to be used directly in direct production.

Sales to nonprofit organizations claiming exemption pursuant to Sales Tax Information Bulletin #10. (May not be used for

□personal hotel rooms and meals.)

Sales of tangible personal property predominately used (greater then 50 percent) in providing public transportation - provide USDOT Number. A person or corporation who is hauling under someone else’s motor carrier authority, or has a contract as a school bus operator, must provide their SSN or FID Number in lieu of a State ID Number in Section 1.

□USDOT Number:______________________

Sales to persons, occupationally engaged as farmers, to be used directly in production of agricultural products for sale. Note: A farmer not possessing a State Business License Number may enter a FID Number or a SSN in lieu of a State ID

□Number in Section 1.

□Sales to a contractor for exempt projects (such as public schools, government, or nonprofits).

□Sales to Indiana Governmental Units (agencies, cities, towns, municipalities, public schools, and state universities).

Sales to the United States Federal Government - show agency name._ __________________________________________

Note: A U.S. Government agency should enter its Federal Identification Number (FID) in Section 1 in lieu of a State ID

□Number. Other - explain.________________________________________________________________________________________Purchaser

I hereby certify under the penalties of perjury that the property purchased by the use of this exemption certificate is to be used for an exempt purpose pursuant to the State Gross Retail Sales Tax Act, Indiana Code

I confirm my understanding that misuse, (either negligent or intentional), and/or fraudulent use of this certificate may subject both me personally and/or the business entity I represent to the imposition of tax, interest, and civil and/or criminal penalties.

Signature of Purchaser:______________________________________________ |

Date:_ ______________________________ |

Printed Name:_____________________________________________________ |

Title:________________________________ |

The Indiana Department of Revenue may request verification of registration in another state if you are an

Seller must keep this certificate on file to support exempt sales.

Instructions for Completing Form

All four sections of the

Section 1

A)This section requires an identification number. In most cases this number will be an Indiana Department of Revenue issued Taxpayer Identification Number (TID - see note below) used for Indiana sales and/or withholding tax reporting. If the purchaser is from another state and does not possess an Indiana TID Number, a resident state’s business license, or State issued ID Number must be provided.

B)Exceptions - For a purchaser not possessing either an Indiana TID Number or another State ID Number, the following may be used in lieu of this requirement.

Federal Government – place your FID Number in the State ID Number space. Farmer – place your SSN or FID Number in the State ID Number space.

Public transportation haulers operating under another motor carrier authority, or with a contract as a school bus operator, must indicate their SSN or FID Number in the State ID Number space.

Nonprofit Organization – must show its FID Number in the State ID Number space.

Section 2

A)Check a box to indicate if this is a single purchase or blanket exemption.

B)Describe product being purchased.

Section 3

A)Purchaser must check the reason for exemption.

B)Purchaser must be able to provide additional information if requested.

Section 4

A)Purchaser must sign and date the form.

B)Printed name and title of signer must be shown.

Note: The Indiana Taxpayer Identification Number (TID) is a ten digit number followed by a three digit LOC Number. The TID is also known as the following:

a)Registered Retail Merchant Certificate

b)Tax Exempt Identification Number

c)Sales Tax Identification Number

d)Withholding Tax Identification Number

The Registered Retail Merchant Certificate issued by the Indiana Department of Revenue shows the TID (10 digits) and the LOC (3 digits) at the top right of the certificate.

Different PDF Forms

Bob Evans 401k - Make sure to fill out all sections to ensure confidentiality and security.

Understanding your earnings can be significantly enhanced by reviewing the ADP Pay Stub form, which details your compensation and deductions for each pay period. For a comprehensive template that can simplify this process, you can visit https://fastpdftemplates.com, ensuring you have a clear view of your financial standing and aiding your ability to manage your finances better.

Indiana Wh 4 - It’s a good practice to review your withholding status regularly to align with your current situation.