Free Indiana Small Estate Affidavit Template

Similar forms

The Indiana Small Estate Affidavit is similar to the Affidavit of Heirship, which is often used in situations where a deceased person did not leave a will. This document allows heirs to declare their relationship to the deceased and establish their rights to inherit property. Both forms aim to simplify the transfer of assets without the need for lengthy probate proceedings, but the Affidavit of Heirship focuses more on proving familial connections rather than the value of the estate.

Another document that shares similarities is the Petition for Summary Administration. This petition is typically used in states that allow for a simplified probate process when the estate is small. Like the Small Estate Affidavit, it helps expedite the distribution of assets, but it usually requires court approval, while the Small Estate Affidavit can often be completed without a court appearance.

The Small Estate Affidavit also resembles the Will and Testament. While a will outlines how a person's assets should be distributed after their death, it requires probate to validate it. In contrast, the Small Estate Affidavit provides a more immediate way for heirs to claim assets without the need for formal probate, as long as the estate meets certain criteria.

In some ways, the Small Estate Affidavit is akin to the Transfer on Death Deed (TODD). This deed allows individuals to designate beneficiaries for real estate, enabling a smoother transfer upon death without probate. Both documents facilitate the transfer of assets outside of the traditional probate process, but the TODD specifically addresses real property, whereas the Small Estate Affidavit can cover a broader range of assets.

The Affidavit of Collection of Personal Property is another document that mirrors the Small Estate Affidavit. This form allows individuals to collect personal property from a deceased person’s estate without going through probate. Both documents serve to simplify the process of asset distribution, but the Affidavit of Collection is limited to personal property, while the Small Estate Affidavit can address a wider variety of estate assets.

The process of transferring ownership of a trailer in New York can be made easier by using a proper documentation method, such as utilizing a UsaLawDocs.com for the Trailer Bill of Sale form, which ensures that the transfer is legally recognized and protects both the seller's and buyer's rights throughout the transaction.

Additionally, the Declaration of Trust shares some similarities with the Small Estate Affidavit. A trust allows individuals to manage and distribute their assets during their lifetime and after death. Both documents can help avoid probate, but a trust requires more setup and ongoing management compared to the straightforward nature of the Small Estate Affidavit.

The Small Estate Affidavit can also be compared to the Living Will. While a Living Will primarily addresses healthcare decisions and end-of-life wishes, both documents serve to clarify an individual's intentions. They streamline processes—one for asset distribution and the other for medical decision-making—allowing families to navigate challenging situations more easily.

Lastly, the Durable Power of Attorney (DPOA) shares a conceptual similarity with the Small Estate Affidavit. A DPOA allows someone to make financial decisions on behalf of another individual, especially if that person becomes incapacitated. Both documents empower individuals to manage affairs without the need for court intervention, though their applications differ significantly, with the DPOA focusing on decision-making authority rather than asset distribution.

FAQ

What is the Indiana Small Estate Affidavit form?

The Indiana Small Estate Affidavit is a legal document that allows individuals to claim the assets of a deceased person without going through the lengthy and often costly probate process. This form is typically used when the total value of the deceased's estate is below a certain threshold, making it a more efficient option for settling smaller estates.

Who can use the Small Estate Affidavit in Indiana?

Any individual who is a beneficiary or heir of the deceased can use the Small Estate Affidavit. However, certain conditions must be met. The total value of the estate must be less than $50,000, and there should be no pending probate proceedings. It is important to ensure that you have a legitimate claim to the assets before proceeding.

What assets can be claimed using the Small Estate Affidavit?

The Small Estate Affidavit can be used to claim various types of assets, including bank accounts, personal property, and real estate. However, the estate's total value must remain under the specified limit. Additionally, certain assets, such as life insurance proceeds or retirement accounts, may not be included in this calculation.

How do I complete the Indiana Small Estate Affidavit form?

To complete the form, you will need to provide information about the deceased, including their name, date of death, and the estimated value of the estate. You will also need to list the names of all heirs and beneficiaries. Be sure to sign the affidavit in front of a notary public to ensure its validity.

Is there a filing fee for the Small Estate Affidavit?

No, there is typically no filing fee associated with the Small Estate Affidavit itself. However, if you need to file additional documents or if there are specific requirements from the court, there may be fees involved. It’s wise to check with your local court for any potential costs.

How long does it take to process a Small Estate Affidavit?

The processing time can vary based on the specific circumstances of the estate and the local court's workload. Generally, once you submit the Small Estate Affidavit, you can expect to have access to the assets relatively quickly, often within a few weeks, provided there are no complications.

Can I use the Small Estate Affidavit if there is a will?

Yes, you can use the Small Estate Affidavit even if the deceased left a will. However, the will must not name an executor or the estate must not exceed the small estate limit. If there are complications, such as disputes among heirs, it may be necessary to go through the probate process instead.

Common mistakes

Filling out the Indiana Small Estate Affidavit form can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One frequent error is failing to include all necessary information. Each section of the form must be completed accurately, and missing details can result in rejection.

Another common mistake is not providing the correct identification of the decedent. It is crucial to ensure that the name matches exactly with the official documents. Discrepancies can cause confusion and may require additional documentation to resolve.

People often overlook the requirement for signatures. The affidavit must be signed by all heirs or beneficiaries. Neglecting to gather these signatures can invalidate the document, leading to further legal challenges.

Many individuals mistakenly believe that the form can be filed without notarization. However, the Indiana Small Estate Affidavit must be notarized to be legally binding. Failing to have the document notarized can result in the affidavit being deemed ineffective.

Another error involves incorrectly estimating the total value of the estate. The affidavit must accurately reflect the value of the estate, including all assets and debts. Underestimating or overestimating can lead to complications with probate courts.

Some people do not understand the timeframe for filing the affidavit. It is essential to file within a specific period after the decedent's death. Missing this deadline can complicate the process and may even require a full probate proceeding.

Inaccurate descriptions of property can also pose problems. The affidavit requires detailed descriptions of all assets. Vague or incomplete descriptions can lead to disputes among heirs and may delay the distribution of assets.

Another mistake is failing to include all relevant heirs. It is important to identify all individuals who have a claim to the estate. Omitting an heir can lead to legal challenges and potential claims against the estate later on.

People sometimes misunderstand the role of the Small Estate Affidavit. This form is not a substitute for a will. Using it incorrectly can create confusion about the decedent's wishes and complicate the legal process.

Finally, individuals may not seek legal advice when needed. Consulting with a legal professional can help ensure that the form is filled out correctly and that all legal requirements are met. Taking this step can save time and prevent costly mistakes.

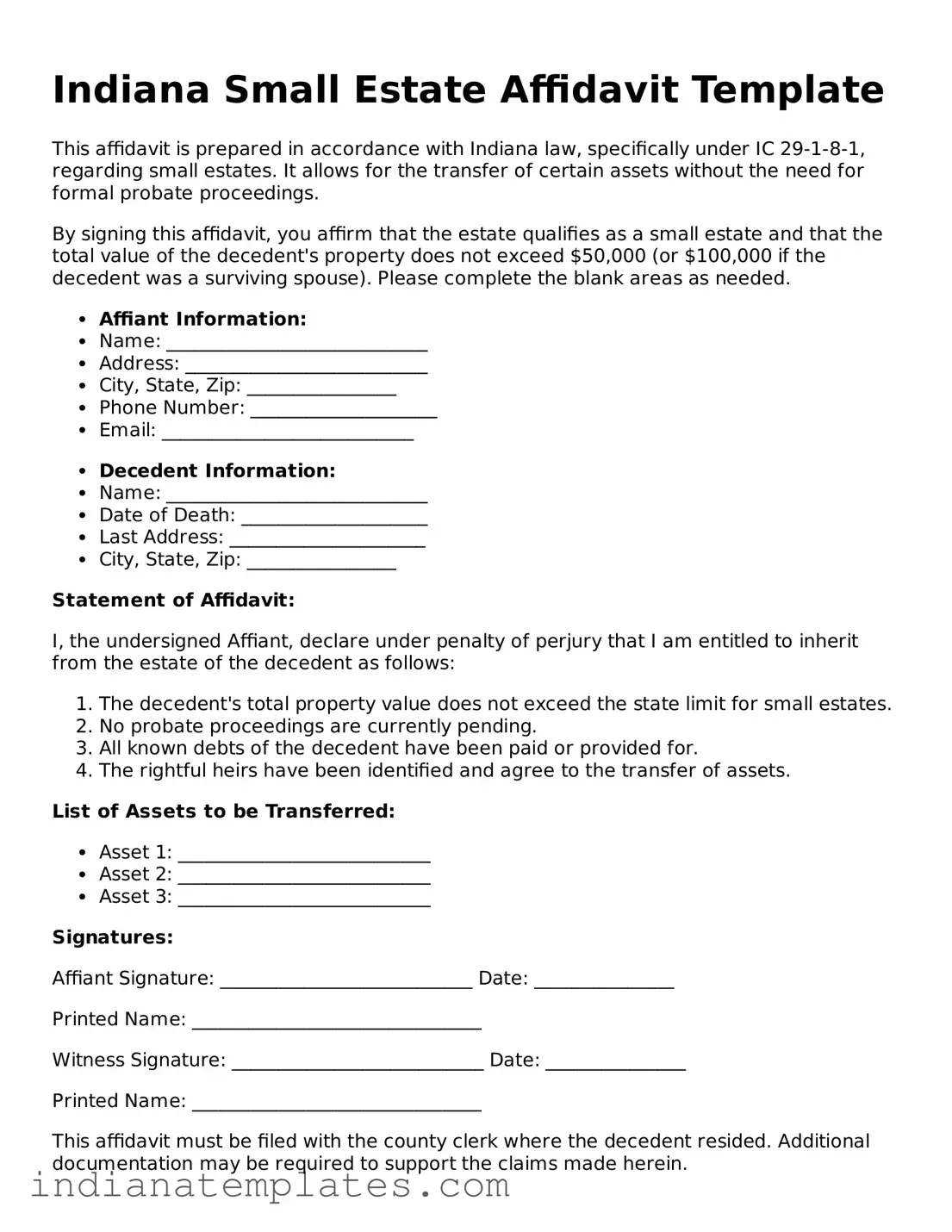

Indiana Small Estate Affidavit Preview

Indiana Small Estate Affidavit Template

This affidavit is prepared in accordance with Indiana law, specifically under IC 29-1-8-1, regarding small estates. It allows for the transfer of certain assets without the need for formal probate proceedings.

By signing this affidavit, you affirm that the estate qualifies as a small estate and that the total value of the decedent's property does not exceed $50,000 (or $100,000 if the decedent was a surviving spouse). Please complete the blank areas as needed.

- Affiant Information:

- Name: ____________________________

- Address: __________________________

- City, State, Zip: ________________

- Phone Number: ____________________

- Email: ___________________________

- Decedent Information:

- Name: ____________________________

- Date of Death: ____________________

- Last Address: _____________________

- City, State, Zip: ________________

Statement of Affidavit:

I, the undersigned Affiant, declare under penalty of perjury that I am entitled to inherit from the estate of the decedent as follows:

- The decedent's total property value does not exceed the state limit for small estates.

- No probate proceedings are currently pending.

- All known debts of the decedent have been paid or provided for.

- The rightful heirs have been identified and agree to the transfer of assets.

List of Assets to be Transferred:

- Asset 1: ___________________________

- Asset 2: ___________________________

- Asset 3: ___________________________

Signatures:

Affiant Signature: ___________________________ Date: _______________

Printed Name: _______________________________

Witness Signature: ___________________________ Date: _______________

Printed Name: _______________________________

This affidavit must be filed with the county clerk where the decedent resided. Additional documentation may be required to support the claims made herein.

Other Popular Indiana Forms

Indiana Car Title - A straightforward approach to formalizing a vehicle sale for both parties.

When engaging in the sale of personal property, it is crucial to include a Bill of Sale form in order to document the transaction legally. The Arizona Bill of Sale form not only ensures that both parties have a clear understanding of the terms of the sale, but it also protects their rights. For more information on how to properly complete this important document, you can visit arizonapdfforms.com/bill-of-sale/.

Vehicle Bill of Sale Indiana - Some states may have specific formats or requirements for how a Bill of Sale must be filled out.

Real Estate Purchase Agreement Pdf - The agreement can help in managing expectations around repairs and warranties.