Free Indiana Real Estate Purchase Agreement Template

Similar forms

The Indiana Real Estate Purchase Agreement form is similar to the Residential Purchase Agreement. Both documents serve as a contract between a buyer and seller for the sale of residential property. They outline essential details such as the purchase price, financing terms, and contingencies. Like the Indiana form, the Residential Purchase Agreement also includes provisions for disclosures and inspections, ensuring that both parties are aware of their rights and obligations during the transaction.

Another document that shares similarities is the Commercial Purchase Agreement. While the Indiana Real Estate Purchase Agreement typically focuses on residential properties, the Commercial Purchase Agreement is tailored for commercial real estate transactions. Both documents detail the terms of the sale, including price and conditions, but the Commercial Purchase Agreement often includes additional clauses related to zoning laws and business operations, reflecting the complexities of commercial real estate deals.

In addition to the various agreements mentioned, it is important to understand the role of the North Carolina Motor Vehicle Bill of Sale form, which serves as a critical document in vehicle transactions. This form not only solidifies the change of ownership but also outlines essential details such as the purchase price and the parties involved. For those seeking more information about this important document, it can be found on UsaLawDocs.com, where resources are available to guide buyers and sellers through the necessary documentation and ensure a smooth transaction process.

The Lease Agreement is also comparable, particularly when it comes to the terms of occupancy and use of property. Both agreements establish a relationship between parties regarding property rights. However, the Lease Agreement focuses on rental terms, while the Indiana Real Estate Purchase Agreement is about the sale of property. Each document outlines responsibilities, such as maintenance and payment obligations, ensuring clarity for both landlords and tenants or buyers and sellers.

The Option to Purchase Agreement shares common ground with the Indiana Real Estate Purchase Agreement in that it grants a buyer the right to purchase a property at a later date. This document specifies the purchase price and the timeframe in which the buyer can exercise their option. Similar to the Indiana form, it protects the interests of both parties by detailing the terms and conditions surrounding the potential sale.

The Seller’s Disclosure Statement is another related document. This form is often used in conjunction with the Indiana Real Estate Purchase Agreement. It requires sellers to disclose known issues with the property, such as structural problems or environmental hazards. Both documents aim to ensure transparency in the transaction, allowing buyers to make informed decisions based on the condition of the property.

Lastly, the Closing Disclosure is similar in that it provides a detailed breakdown of the financial aspects of the transaction. This document is typically provided before closing and outlines the final costs associated with the purchase, including loan terms and closing costs. Like the Indiana Real Estate Purchase Agreement, it serves to protect both parties by ensuring that all financial obligations are clearly stated and understood before the transaction is finalized.

FAQ

What is the Indiana Real Estate Purchase Agreement?

The Indiana Real Estate Purchase Agreement is a legal document used in real estate transactions within the state of Indiana. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement serves as a binding contract once both parties sign it, ensuring that both the buyer and seller are protected during the transaction process.

What key elements are included in the agreement?

Several important components are typically included in the Indiana Real Estate Purchase Agreement. These include the purchase price, the legal description of the property, any contingencies (such as financing or inspections), and the closing date. Additionally, the agreement may specify what personal property, if any, is included in the sale, such as appliances or fixtures. Understanding these elements is crucial for both parties to ensure clarity and avoid misunderstandings.

Are there contingencies that can be included in the agreement?

Yes, contingencies are an essential part of the Indiana Real Estate Purchase Agreement. They allow buyers to set conditions that must be met before the sale can proceed. Common contingencies include financing (ensuring the buyer can secure a mortgage), home inspections (allowing the buyer to assess the property’s condition), and appraisal contingencies (confirming the property's value). These contingencies protect the buyer's interests and can provide an exit strategy if certain conditions are not met.

How does the closing process work?

The closing process is the final step in a real estate transaction. Once all terms of the Indiana Real Estate Purchase Agreement are satisfied, both parties will meet to finalize the sale. During closing, the buyer will typically pay the purchase price, and the seller will transfer ownership of the property. Various documents will be signed, including the deed, and funds will be disbursed to cover closing costs. This process can take place at a title company, attorney's office, or another agreed-upon location.

What happens if either party breaches the agreement?

If either the buyer or seller fails to uphold their obligations under the Indiana Real Estate Purchase Agreement, it is considered a breach of contract. The non-breaching party may have several options, including seeking damages or specific performance, which means asking the court to enforce the agreement. It’s essential for both parties to understand their rights and responsibilities to minimize the risk of a breach and the potential legal consequences that may follow.

Can the agreement be modified after it has been signed?

Yes, the Indiana Real Estate Purchase Agreement can be modified after it has been signed, but both parties must agree to any changes. Typically, modifications are made in writing and should be signed by both the buyer and seller to ensure they are legally binding. It’s important to document any changes to prevent confusion and to maintain clarity regarding the terms of the agreement.

Common mistakes

When filling out the Indiana Real Estate Purchase Agreement form, many individuals make common mistakes that can lead to complications later. One frequent error is failing to provide accurate property details. Buyers and sellers must ensure that the property address, legal description, and any relevant parcel numbers are correct. A simple typo can lead to significant issues down the line.

Another mistake is neglecting to specify the purchase price clearly. It’s essential to write the amount in both numerical and written form. This redundancy helps prevent misunderstandings about the agreed-upon price. If only one format is provided, it may lead to disputes during the transaction process.

Many people also overlook the importance of including contingencies. Contingencies protect buyers and sellers by outlining specific conditions that must be met before the sale can proceed. Common contingencies include home inspections and financing. Without these, one party may find themselves at a disadvantage.

Additionally, failing to include earnest money can be a significant oversight. This deposit shows the buyer's commitment to the purchase. Not specifying the amount or the terms related to the earnest money can create confusion and potential issues later in the transaction.

Another common mistake is not addressing the closing date. The agreement should clearly state when the closing will take place. Without a specified date, both parties may have different expectations, leading to frustration and delays.

Buyers and sellers often forget to review the terms related to repairs. The agreement should detail who is responsible for repairs and any necessary maintenance before closing. If this is left vague, misunderstandings can arise, resulting in disputes after the agreement is signed.

Some individuals fail to include the necessary disclosures required by Indiana law. Sellers must disclose known issues with the property, such as structural problems or pest infestations. Omitting these disclosures can lead to legal troubles and financial repercussions.

Another mistake is not obtaining the required signatures. All parties involved must sign the agreement for it to be legally binding. Failing to gather all necessary signatures can render the agreement invalid.

Lastly, individuals often neglect to consult with a real estate professional or attorney before submitting the agreement. This step can help identify potential issues early on and ensure that all aspects of the agreement comply with Indiana law. Relying solely on personal knowledge can lead to errors that could have been easily avoided.

Indiana Real Estate Purchase Agreement Preview

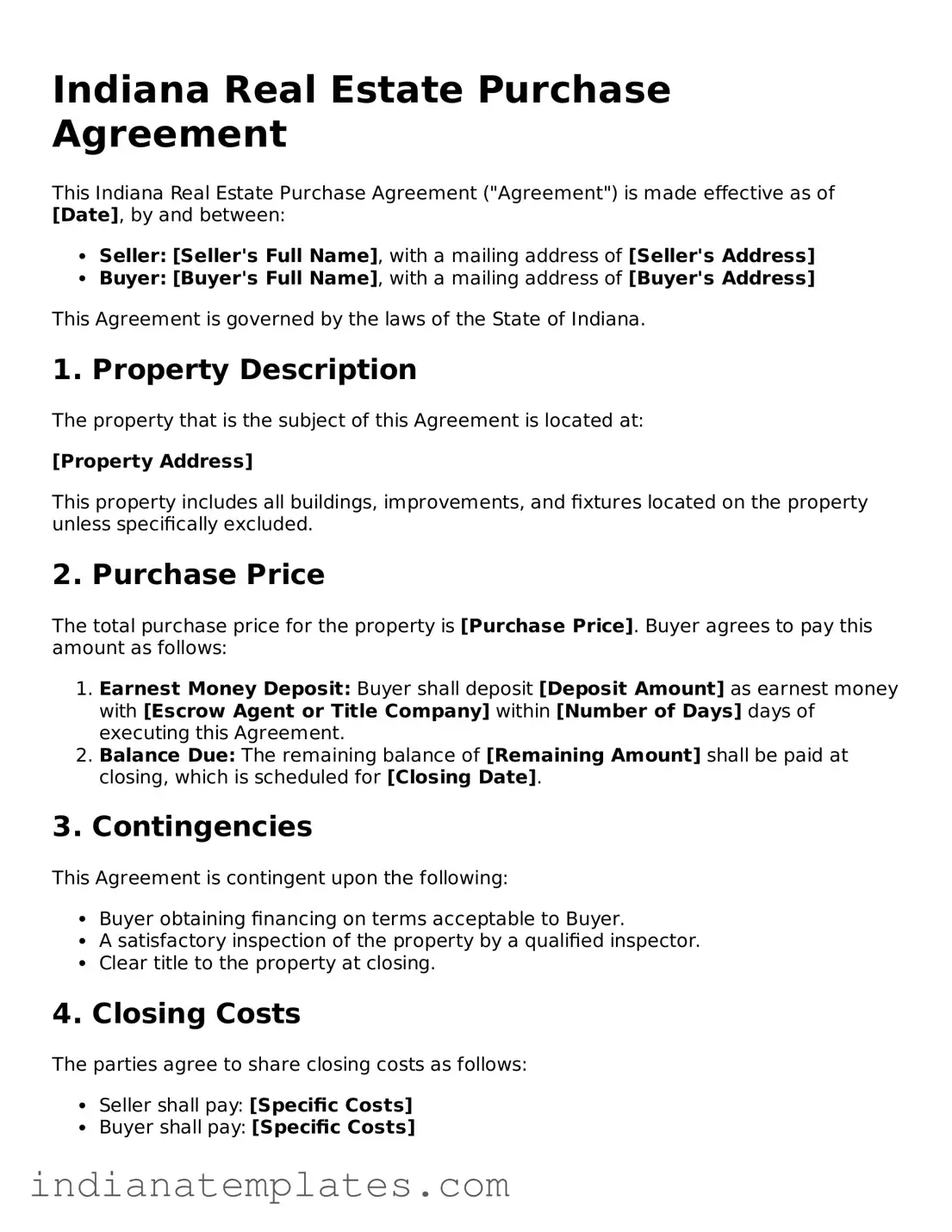

Indiana Real Estate Purchase Agreement

This Indiana Real Estate Purchase Agreement ("Agreement") is made effective as of [Date], by and between:

- Seller: [Seller's Full Name], with a mailing address of [Seller's Address]

- Buyer: [Buyer's Full Name], with a mailing address of [Buyer's Address]

This Agreement is governed by the laws of the State of Indiana.

1. Property Description

The property that is the subject of this Agreement is located at:

[Property Address]

This property includes all buildings, improvements, and fixtures located on the property unless specifically excluded.

2. Purchase Price

The total purchase price for the property is [Purchase Price]. Buyer agrees to pay this amount as follows:

- Earnest Money Deposit: Buyer shall deposit [Deposit Amount] as earnest money with [Escrow Agent or Title Company] within [Number of Days] days of executing this Agreement.

- Balance Due: The remaining balance of [Remaining Amount] shall be paid at closing, which is scheduled for [Closing Date].

3. Contingencies

This Agreement is contingent upon the following:

- Buyer obtaining financing on terms acceptable to Buyer.

- A satisfactory inspection of the property by a qualified inspector.

- Clear title to the property at closing.

4. Closing Costs

The parties agree to share closing costs as follows:

- Seller shall pay: [Specific Costs]

- Buyer shall pay: [Specific Costs]

5. Signatures

By signing below, both parties agree to the terms outlined in this Agreement:

Seller Signature: ____________________________ Date: _______________

Buyer Signature: ____________________________ Date: _______________

This Agreement constitutes the entire understanding between the parties and replaces any prior agreements or discussions regarding the purchase of the property listed above.

Other Popular Indiana Forms

Indiana Premarital Contract - A prenuptial agreement promotes honesty about money before tying the knot.

Completing a divorce can be a challenging process, but utilizing the Maryland Divorce Settlement Agreement form simplifies matters by ensuring all agreements are recorded clearly. This document covers critical aspects like property division and custody arrangements, helping both parties to avoid potential disputes in the future. For those looking to draft their agreement efficiently, you can also refer to the Divorce Contract.

Vehicle Bill of Sale Indiana - For sellers, a Trailer Bill of Sale creates proof of the sale to prevent future disputes.

Hold Harmless Waiver - The Hold Harmless Agreement is often used in contracts to allocate risk between parties.