Free Indiana Power of Attorney Template

Similar forms

The Indiana Power of Attorney form is similar to a Health Care Proxy. A Health Care Proxy allows an individual to designate someone to make medical decisions on their behalf if they become unable to do so. Like the Power of Attorney, it is essential for ensuring that your wishes regarding health care are respected. Both documents empower a trusted person to act in your best interest, but the Health Care Proxy specifically focuses on medical matters.

Another document akin to the Power of Attorney is the Living Will. A Living Will outlines your preferences for medical treatment in situations where you cannot communicate your wishes. It serves as a guide for your Health Care Proxy and medical providers. While the Power of Attorney can grant authority for a wide range of decisions, the Living Will is strictly about end-of-life care and treatment preferences.

In addition to the various legal documents mentioned, an Operating Agreement also plays a vital role in the management of an LLC, as it defines ownership and member roles clearly. For more information on how to draft this essential document, you can visit UsaLawDocs.com, which provides valuable resources and templates for creating an effective Operating Agreement.

The Durable Power of Attorney is also closely related. This document remains effective even if you become incapacitated. It provides a broader scope of authority compared to a standard Power of Attorney, which may become invalid in such circumstances. Both documents are designed to ensure that someone you trust can manage your affairs, but the Durable Power of Attorney specifically addresses the issue of incapacity.

A Financial Power of Attorney is another similar document. This type of Power of Attorney specifically focuses on financial matters, allowing someone to handle your financial affairs, such as managing bank accounts, paying bills, and making investments. Like the general Power of Attorney, it is essential for ensuring that your financial needs are met when you cannot manage them yourself.

The Guardianship document is also relevant. A Guardianship is established by a court when an individual is deemed unable to make decisions for themselves. This can be similar to a Power of Attorney in that both involve appointing someone to make decisions on behalf of another. However, Guardianship typically requires a legal process and is more formal than a Power of Attorney, which can be created without court intervention.

Another document that shares similarities is the Revocable Living Trust. A Revocable Living Trust allows you to transfer assets into a trust while you are still alive. You can manage the trust during your lifetime, and it can provide for the distribution of your assets after your death. Like a Power of Attorney, it is a tool for managing your affairs, but it focuses more on asset management and estate planning rather than decision-making authority.

Finally, the Advance Directive is worth mentioning. An Advance Directive combines elements of both the Living Will and the Health Care Proxy. It allows you to specify your medical treatment preferences and appoint someone to make health care decisions on your behalf. This document, like the Power of Attorney, emphasizes the importance of having your wishes honored, particularly in critical medical situations.

FAQ

What is a Power of Attorney in Indiana?

A Power of Attorney (POA) in Indiana is a legal document that allows an individual, known as the principal, to appoint another person, called the agent or attorney-in-fact, to make decisions on their behalf. These decisions can pertain to financial matters, healthcare, or other personal affairs. The principal retains the right to revoke or modify the POA at any time, provided they are mentally competent to do so. This tool is particularly useful for individuals who may become incapacitated or need assistance managing their affairs.

What types of Power of Attorney are available in Indiana?

Indiana recognizes several types of Power of Attorney forms. The most common include a general Power of Attorney, which grants broad powers to the agent, and a limited Power of Attorney, which restricts the agent's authority to specific tasks or timeframes. Additionally, there is a durable Power of Attorney, which remains effective even if the principal becomes incapacitated, and a healthcare Power of Attorney, which specifically allows the agent to make medical decisions for the principal if they are unable to do so themselves.

How do I create a Power of Attorney in Indiana?

Creating a Power of Attorney in Indiana involves several steps. First, the principal must select a trusted individual to act as their agent. Next, the principal should complete the appropriate Power of Attorney form, which can be obtained from legal resources or online. After filling out the form, it must be signed by the principal in the presence of a notary public. In some cases, witnesses may also be required. Once executed, the document should be stored safely, and copies should be provided to the agent and any relevant institutions, such as banks or healthcare providers.

Can I revoke a Power of Attorney in Indiana?

Yes, a Power of Attorney can be revoked in Indiana at any time, as long as the principal is mentally competent. To revoke a POA, the principal should create a written revocation document that clearly states their intention to cancel the previous Power of Attorney. This revocation should be signed and dated by the principal, and it is advisable to notify the agent and any institutions that were relying on the original Power of Attorney. Additionally, if the original POA was recorded with a county office, the revocation should also be recorded to ensure clarity and prevent any potential disputes.

What happens if I do not have a Power of Attorney in place?

If an individual becomes incapacitated without a Power of Attorney in place, their loved ones may face challenges in making decisions on their behalf. In such cases, family members might need to seek guardianship through the court system, which can be a lengthy and costly process. Having a Power of Attorney in advance can help avoid these complications, ensuring that a trusted person can manage affairs without the need for court intervention.

Common mistakes

Filling out a Power of Attorney (POA) form can be a daunting task, especially for those unfamiliar with legal documents. In Indiana, there are common mistakes that individuals often make when completing this important form. Recognizing these pitfalls can help ensure that your intentions are clearly communicated and legally valid.

One frequent error is failing to specify the powers granted. A general POA can lead to confusion about what authority the agent truly has. It's crucial to clearly outline the specific powers you wish to delegate. For instance, if you want your agent to handle financial matters, explicitly state that. Vague language can lead to misunderstandings and potential legal disputes.

Another mistake involves not dating the document properly. A POA must be dated to indicate when it becomes effective. Without a date, it may be difficult to determine its validity, especially if there are changes in your circumstances or if a dispute arises. Always ensure that the date is clearly marked when you complete the form.

Additionally, many people overlook the importance of signatures. The form requires the principal’s signature, but it also needs to be signed by witnesses or a notary, depending on the type of POA. Neglecting to include these signatures can render the document invalid. Ensure that all necessary parties sign the document to avoid complications later.

Some individuals fail to consider the selection of their agent carefully. Choosing someone who is trustworthy and capable of managing your affairs is essential. Rushing this decision can lead to regret. Take the time to discuss the responsibilities with your chosen agent and ensure they are willing to accept the role.

Another common oversight is not reviewing the form thoroughly before submission. Mistakes in the details, such as incorrect names or addresses, can invalidate the document. It’s important to double-check all information for accuracy. A small error can lead to significant issues down the line.

Moreover, many people do not keep copies of their completed POA. After filling out the form, it’s wise to make copies for both yourself and your agent. This ensures that everyone involved has access to the document and can refer to it as needed. Without copies, confusion may arise about the powers granted.

Finally, individuals sometimes forget to revoke previous POAs. If you create a new Power of Attorney, it is essential to formally revoke any prior versions. This can prevent conflicting authorities and ensure that your current wishes are honored. Be proactive in managing your legal documents to reflect your current intentions.

By being aware of these common mistakes, individuals can navigate the process of completing an Indiana Power of Attorney form with greater confidence and clarity. Taking the time to ensure that every detail is correct will help protect your interests and provide peace of mind.

Indiana Power of Attorney Preview

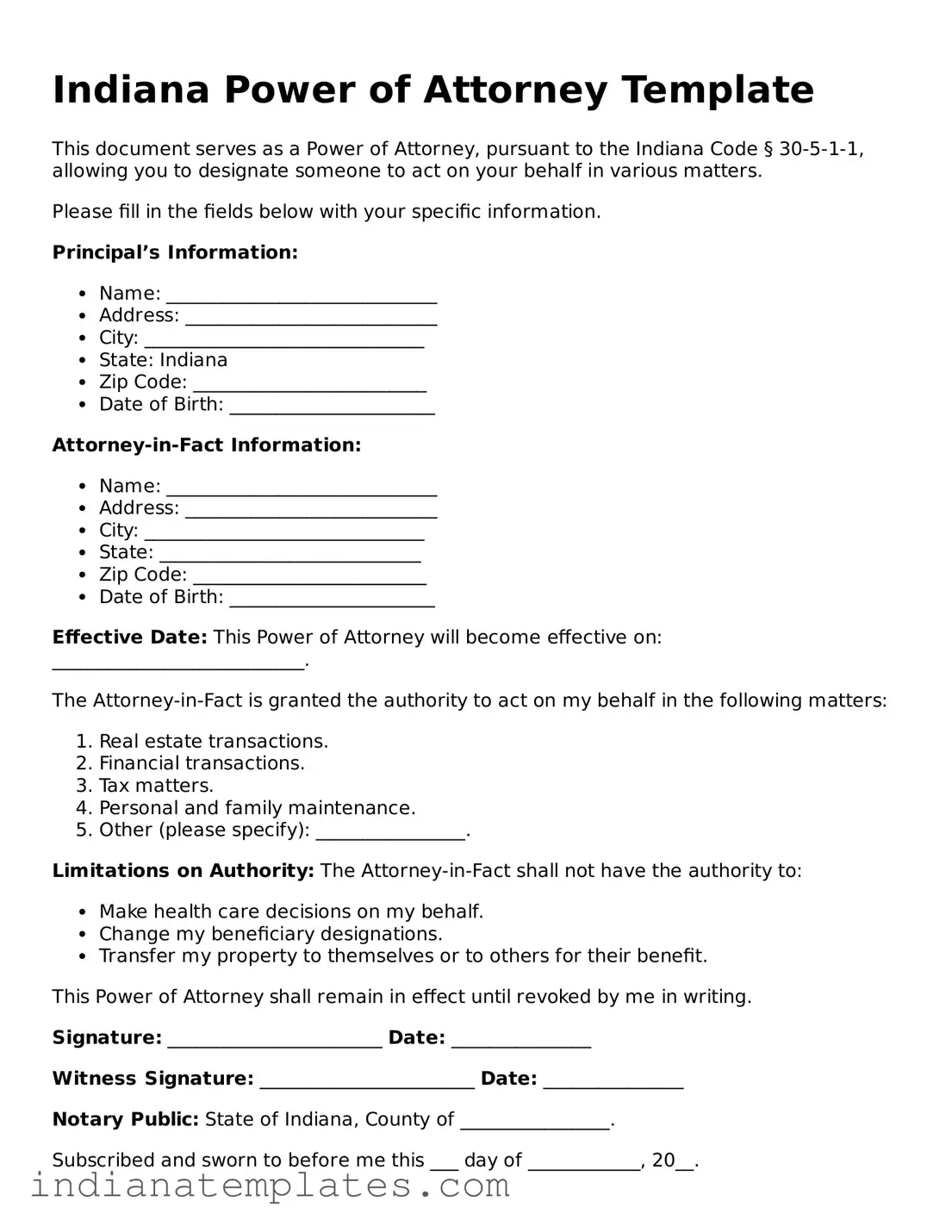

Indiana Power of Attorney Template

This document serves as a Power of Attorney, pursuant to the Indiana Code § 30-5-1-1, allowing you to designate someone to act on your behalf in various matters.

Please fill in the fields below with your specific information.

Principal’s Information:

- Name: _____________________________

- Address: ___________________________

- City: ______________________________

- State: Indiana

- Zip Code: _________________________

- Date of Birth: ______________________

Attorney-in-Fact Information:

- Name: _____________________________

- Address: ___________________________

- City: ______________________________

- State: ____________________________

- Zip Code: _________________________

- Date of Birth: ______________________

Effective Date: This Power of Attorney will become effective on: ___________________________.

The Attorney-in-Fact is granted the authority to act on my behalf in the following matters:

- Real estate transactions.

- Financial transactions.

- Tax matters.

- Personal and family maintenance.

- Other (please specify): ________________.

Limitations on Authority: The Attorney-in-Fact shall not have the authority to:

- Make health care decisions on my behalf.

- Change my beneficiary designations.

- Transfer my property to themselves or to others for their benefit.

This Power of Attorney shall remain in effect until revoked by me in writing.

Signature: _______________________ Date: _______________

Witness Signature: _______________________ Date: _______________

Notary Public: State of Indiana, County of ________________.

Subscribed and sworn to before me this ___ day of ____________, 20__.

_______________________________

Notary Public Signature

My commission expires: ____________.

Other Popular Indiana Forms

Indiana Reassignment Form - It is advisable to complete the sale in person to exchange the form and payment.

To streamline your workplace policies, consider utilizing this efficient Employee Handbook resource that outlines vital guidelines for your staff. You can enhance your organizational clarity by accessing the template necessary for creating an effective Employee Handbook today.

Indiana Non Compete Laws - A well-crafted Non-compete Agreement can enhance the overall value of the business.