Free Indiana Operating Agreement Template

Similar forms

The Indiana Operating Agreement is similar to the LLC Operating Agreement used in other states. Both documents serve as foundational legal frameworks for Limited Liability Companies (LLCs). They outline the management structure, member responsibilities, and operational guidelines. While the specifics may vary by state, the primary purpose remains the same: to establish clear rules for how the business will operate and to protect the interests of its members.

Another comparable document is the Partnership Agreement. This agreement governs the relationship between partners in a business. It details the contributions of each partner, profit-sharing arrangements, and decision-making processes. Like the Operating Agreement, it aims to prevent disputes by clearly defining roles and responsibilities within the partnership.

The Corporate Bylaws document also shares similarities with the Indiana Operating Agreement. Bylaws provide internal rules for corporations, outlining governance, management structure, and procedures for meetings. Both documents serve to ensure that all parties understand their rights and obligations, fostering a more organized and efficient operation.

The Shareholder Agreement is another related document, particularly for corporations. This agreement outlines the rights and obligations of shareholders, including how shares can be bought or sold and what happens in the event of a dispute. Like the Operating Agreement, it protects the interests of the stakeholders involved and helps to maintain order within the company.

The EDD DE 2501 form is a crucial element for those navigating the complexities of disability benefits in California, as it allows individuals facing temporary work limitations to secure financial assistance required during their recovery phase. Documenting one's eligibility accurately is essential, and the EDD DE 2501 form serves as a vital resource in this process.

A Joint Venture Agreement can also be compared to the Indiana Operating Agreement. This document outlines the terms of a partnership between two or more parties for a specific project or business endeavor. It specifies the contributions of each party, profit distribution, and management roles. Both agreements serve to clarify expectations and responsibilities, reducing the risk of conflict.

Lastly, the Nonprofit Bylaws are similar in function to the Indiana Operating Agreement, particularly for nonprofit organizations. They establish the rules for governing the nonprofit, including board structure, membership, and operational procedures. Both documents are essential for ensuring compliance with legal requirements and for guiding the organization's activities.

FAQ

What is an Indiana Operating Agreement?

An Indiana Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Indiana. It serves as an internal guideline for the members of the LLC, detailing their rights, responsibilities, and the rules governing the business. This agreement is crucial for ensuring that all members are on the same page regarding the operation of the company.

Is an Operating Agreement required in Indiana?

No, an Operating Agreement is not legally required in Indiana. However, having one is highly recommended. It helps prevent misunderstandings among members and provides a clear framework for resolving disputes. Additionally, if your LLC ever faces legal challenges, having a well-drafted Operating Agreement can help protect the members' personal assets.

Who should create the Operating Agreement?

The members of the LLC should collaboratively create the Operating Agreement. This document should reflect the specific needs and preferences of the members. While it can be beneficial to consult with a legal professional during the drafting process, the members can also draft it themselves as long as it complies with Indiana laws and regulations.

What key elements should be included in the Operating Agreement?

Several important elements should be included in the Operating Agreement. These typically encompass the following: the LLC's name and purpose, the duration of the LLC, the rights and duties of members, the management structure, voting procedures, and how profits and losses will be distributed. Additionally, it should outline the process for adding new members or handling member departures.

Can the Operating Agreement be changed?

Yes, the Operating Agreement can be amended. Members can agree to changes as long as they follow the procedures outlined in the original agreement for making amendments. It is important to document any changes in writing and have all members sign the updated agreement to ensure clarity and enforceability.

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by Indiana's default LLC laws. This can lead to unexpected outcomes, as state laws may not reflect the specific intentions or agreements of the members. Without an Operating Agreement, members may face challenges in decision-making and profit distribution, potentially leading to conflicts among members.

Where can I find a template for an Indiana Operating Agreement?

Templates for an Indiana Operating Agreement can be found online through various legal websites and resources. Many of these templates are customizable to fit your LLC's specific needs. However, it is advisable to review the template carefully and consider consulting with a legal professional to ensure it meets all legal requirements and accurately reflects your business's intentions.

Common mistakes

Filling out the Indiana Operating Agreement form can be a straightforward process, but many people make common mistakes that can lead to complications down the road. One frequent error is not clearly defining the roles and responsibilities of each member. Without this clarity, misunderstandings may arise regarding who is in charge of what, leading to potential disputes among members.

Another mistake is failing to include all necessary members in the agreement. It's essential to list every individual or entity that has a stake in the business. Omitting a member can create legal issues later, especially if that member feels entitled to certain rights or profits. Always double-check the list of members before finalizing the document.

People often overlook the importance of specifying the management structure. Whether the business will be managed by members or designated managers should be clearly stated. This decision affects how the business operates and how decisions are made. Without this specification, the agreement may lack the necessary framework for effective management.

In addition, many individuals neglect to address the distribution of profits and losses. It's crucial to outline how profits will be shared among members and how losses will be handled. This section should be as detailed as possible to prevent confusion or disagreements in the future. Clear terms can help maintain harmony among members.

Lastly, a common oversight is not including provisions for amending the agreement. Business needs can change over time, and having a process in place for making updates is vital. Without this, members may find it challenging to adapt the agreement to reflect new circumstances or changes in the business structure.

Indiana Operating Agreement Preview

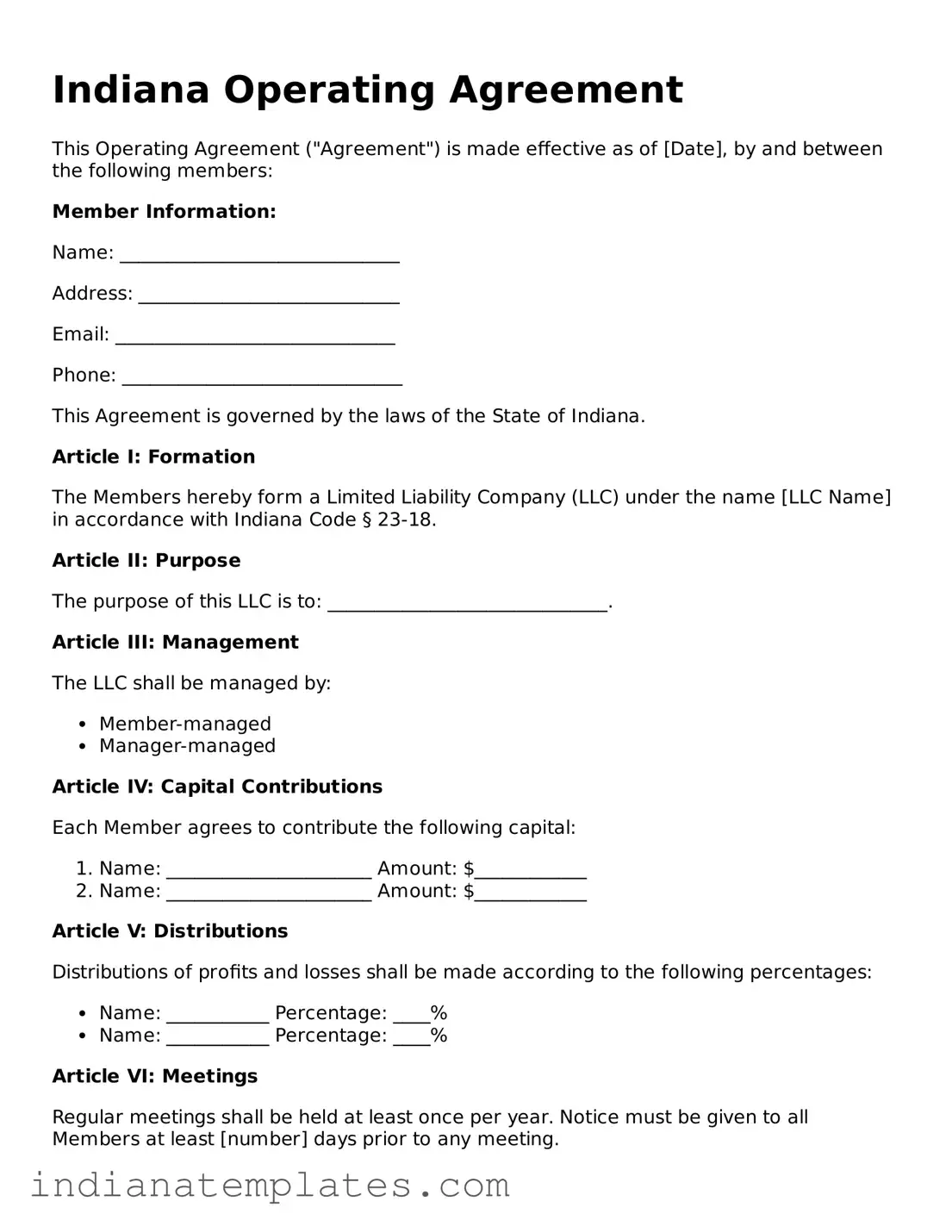

Indiana Operating Agreement

This Operating Agreement ("Agreement") is made effective as of [Date], by and between the following members:

Member Information:

Name: ______________________________

Address: ____________________________

Email: ______________________________

Phone: ______________________________

This Agreement is governed by the laws of the State of Indiana.

Article I: Formation

The Members hereby form a Limited Liability Company (LLC) under the name [LLC Name] in accordance with Indiana Code § 23-18.

Article II: Purpose

The purpose of this LLC is to: ______________________________.

Article III: Management

The LLC shall be managed by:

- Member-managed

- Manager-managed

Article IV: Capital Contributions

Each Member agrees to contribute the following capital:

- Name: ______________________ Amount: $____________

- Name: ______________________ Amount: $____________

Article V: Distributions

Distributions of profits and losses shall be made according to the following percentages:

- Name: ___________ Percentage: ____%

- Name: ___________ Percentage: ____%

Article VI: Meetings

Regular meetings shall be held at least once per year. Notice must be given to all Members at least [number] days prior to any meeting.

Article VII: Amendments

This Agreement can be amended only by a written agreement signed by all Members.

Article VIII: Miscellaneous

This Agreement constitutes the entire understanding among the Members regarding the LLC. It shall be binding on all members and their successors.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

Member Signatures:

- __________________________ (Name)

- __________________________ (Name)

Date Signed: __________________________

Other Popular Indiana Forms

Vehicle Bill of Sale Indiana - Serves as proof of purchase for the buyer.

When engaging in the buying or selling of a vehicle in North Carolina, having the appropriate documentation is essential. The North Carolina Motor Vehicle Bill of Sale form not only records the vital details of the transaction but also aids in ensuring a smooth transfer of ownership. For additional resources and to obtain the form, you can visit UsaLawDocs.com.

Indiana Warranty Deed Form - Life estates and trust property can involve unique deed considerations.