Free Indiana Motor Vehicle Bill of Sale Template

Similar forms

The Indiana Motor Vehicle Bill of Sale form shares similarities with a standard Bill of Sale used for personal property transactions. Both documents serve as proof of a transfer of ownership from one party to another. They typically include details such as the names and addresses of the buyer and seller, a description of the item being sold, and the sale price. This basic structure ensures that both parties have a clear record of the transaction, which can be useful for future reference or in case of disputes.

Another document similar to the Indiana Motor Vehicle Bill of Sale is the Vehicle Title. While the Bill of Sale serves as a receipt for the transaction, the Vehicle Title is an official document issued by the state that indicates ownership of the vehicle. When a vehicle is sold, the title must be transferred to the new owner, often requiring the seller to sign it over. Both documents are essential for establishing legal ownership and can be used together to facilitate the registration of the vehicle with the state.

In the realm of business operations, having a well-drafted Operating Agreement can significantly enhance the clarity and effectiveness of management practices for LLCs, similar to how respective documents function in vehicle transactions. These foundational documents, including the UsaLawDocs.com operating agreement form, serve to define roles and responsibilities, ensuring that every member is on the same page, thus preventing potential disputes and fostering smooth operational flow.

A third document that resembles the Indiana Motor Vehicle Bill of Sale is the Purchase Agreement. This document outlines the terms and conditions of the sale, including payment methods, delivery details, and any warranties or guarantees. Like the Bill of Sale, it provides a written record of the transaction. However, the Purchase Agreement may cover a broader range of items beyond vehicles and often includes more detailed terms to protect both parties involved in the sale.

Lastly, the Affidavit of Title is another document that can be compared to the Indiana Motor Vehicle Bill of Sale. This affidavit is used when there is a dispute regarding the ownership of a vehicle or when the title is lost. It typically requires the seller to affirm their ownership under oath. While the Bill of Sale documents the sale itself, the Affidavit of Title serves to clarify ownership and resolve issues that may arise during the transfer process.

FAQ

What is a Motor Vehicle Bill of Sale in Indiana?

A Motor Vehicle Bill of Sale is a legal document that serves as proof of the transfer of ownership of a vehicle from one party to another in the state of Indiana. This document includes essential details such as the vehicle’s make, model, year, Vehicle Identification Number (VIN), and the purchase price. It helps protect both the buyer and the seller by providing a written record of the transaction.

Is a Bill of Sale required in Indiana for vehicle sales?

While a Bill of Sale is not legally required for all vehicle transactions in Indiana, it is highly recommended. Having a Bill of Sale can help facilitate the registration process with the Indiana Bureau of Motor Vehicles (BMV) and can serve as evidence in case of disputes regarding ownership or the terms of the sale.

What information should be included in the Indiana Motor Vehicle Bill of Sale?

The Bill of Sale should include several key pieces of information. This includes the names and addresses of both the buyer and the seller, the vehicle’s make, model, year, and VIN, the sale price, and the date of the transaction. Additionally, both parties should sign the document to validate the sale. If applicable, it may also be beneficial to include any warranties or representations made by the seller regarding the vehicle.

Can I create my own Bill of Sale for a vehicle in Indiana?

Yes, you can create your own Bill of Sale for a vehicle in Indiana. While there are templates available online, it is crucial to ensure that the document contains all necessary information to be legally binding. It is advisable to keep the language clear and straightforward to avoid any misunderstandings between the parties involved.

Do I need to have the Bill of Sale notarized?

In Indiana, notarization of a Bill of Sale is not a requirement. However, having the document notarized can add an extra layer of authenticity and may be beneficial if there are any disputes in the future. It can also help in situations where the buyer needs to register the vehicle in a different state.

What should I do with the Bill of Sale after the sale is complete?

After the sale is complete, both the buyer and the seller should keep a copy of the Bill of Sale for their records. The buyer will need it when registering the vehicle with the Indiana BMV, while the seller may want to retain it as proof of the transaction. It is important to store these documents in a safe place, as they may be needed for future reference.

How does the Bill of Sale affect vehicle registration in Indiana?

The Bill of Sale plays a crucial role in the vehicle registration process. When the buyer goes to register the vehicle with the Indiana BMV, they will need to present the Bill of Sale along with other required documents, such as proof of identity and proof of insurance. This document serves as evidence that the buyer has legally purchased the vehicle and is entitled to register it in their name.

What if there are issues after the sale?

If issues arise after the sale, such as disputes over the vehicle’s condition or ownership, the Bill of Sale can serve as an important piece of evidence. It outlines the terms of the sale and the details of the transaction. If the seller made any representations about the vehicle that were not honored, the buyer may have grounds for a claim based on the information documented in the Bill of Sale.

Common mistakes

When individuals fill out the Indiana Motor Vehicle Bill of Sale form, they often overlook critical details that can lead to complications later. One common mistake is failing to provide complete and accurate vehicle information. This includes not only the make, model, and year but also the Vehicle Identification Number (VIN). Omitting or incorrectly entering any of this information can create confusion and may complicate future ownership transfers.

Another frequent error is neglecting to include the purchase price. While it may seem straightforward, some people either leave this field blank or write an amount that doesn’t reflect the actual transaction. This can lead to issues with tax assessments and may even raise suspicions of fraud if the sale price appears significantly lower than the vehicle's market value.

Many individuals also forget to include the date of sale. This detail is crucial for establishing the timeline of ownership and can affect the registration process. If the date is missing, it may lead to disputes about when the transaction occurred, complicating matters for both the buyer and seller.

In addition, signatures are often a point of contention. Both the buyer and seller must sign the form to validate the sale. Some individuals mistakenly believe that only one signature is necessary, or they may forget to sign altogether. Without the appropriate signatures, the document lacks legal validity, which can create problems when registering the vehicle.

Another common oversight is not having a witness or notarization when required. While Indiana does not mandate notarization for the Bill of Sale, having a witness can provide an extra layer of security. Some individuals skip this step, thinking it is unnecessary, only to find themselves in a dispute later on.

People also frequently misinterpret the purpose of the Bill of Sale. It is not just a receipt; it serves as proof of the transfer of ownership. Therefore, treating it as a mere formality can lead to incomplete documentation. Buyers should ensure that all relevant details are thoroughly filled out to avoid any future legal issues.

Finally, many individuals fail to keep a copy of the completed Bill of Sale. After the transaction, it is essential for both parties to retain a copy for their records. This document may be needed for future reference, whether for tax purposes or in the event of a dispute. Without a copy, individuals may find themselves at a disadvantage should any questions arise about the sale.

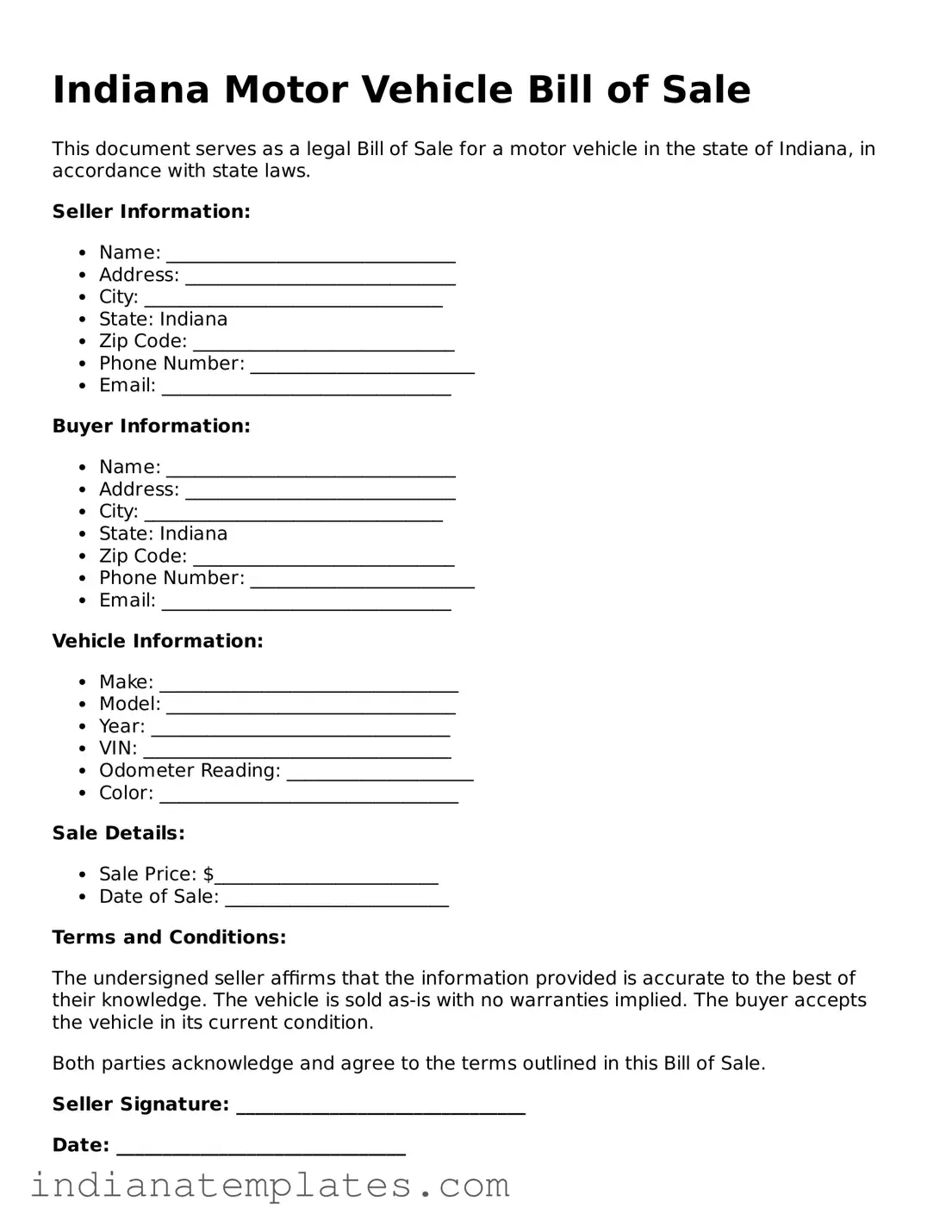

Indiana Motor Vehicle Bill of Sale Preview

Indiana Motor Vehicle Bill of Sale

This document serves as a legal Bill of Sale for a motor vehicle in the state of Indiana, in accordance with state laws.

Seller Information:

- Name: _______________________________

- Address: _____________________________

- City: ________________________________

- State: Indiana

- Zip Code: ____________________________

- Phone Number: ________________________

- Email: _______________________________

Buyer Information:

- Name: _______________________________

- Address: _____________________________

- City: ________________________________

- State: Indiana

- Zip Code: ____________________________

- Phone Number: ________________________

- Email: _______________________________

Vehicle Information:

- Make: ________________________________

- Model: _______________________________

- Year: ________________________________

- VIN: _________________________________

- Odometer Reading: ____________________

- Color: ________________________________

Sale Details:

- Sale Price: $________________________

- Date of Sale: ________________________

Terms and Conditions:

The undersigned seller affirms that the information provided is accurate to the best of their knowledge. The vehicle is sold as-is with no warranties implied. The buyer accepts the vehicle in its current condition.

Both parties acknowledge and agree to the terms outlined in this Bill of Sale.

Seller Signature: _______________________________

Date: _______________________________

Buyer Signature: _______________________________

Date: _______________________________

Other Popular Indiana Forms

Indiana Non Compete Laws - By signing, employees agree not to start a similar business in the same area after their employment ends.

Notary Paragraph - This form ensures that signatures are made voluntarily and with understanding.

Obtaining an Emotional Support Animal (ESA) Letter is crucial for those who require the comforting presence of their pets to enhance their mental well-being. This document, provided by a licensed mental health professional, confirms the necessity of an emotional support animal in a person's life. For those interested in this process, detailed guidelines can be found in the Emotional Support Animal Letter form, which outlines the steps needed to ensure that individuals can receive the support they need in various settings, such as housing and travel.

Indiana Poa - A durable Power of Attorney remains in effect even if you become incapacitated.