Free Indiana Last Will and Testament Template

Similar forms

The Indiana Last Will and Testament form shares similarities with a Living Will. While a Last Will primarily addresses the distribution of assets after death, a Living Will focuses on healthcare decisions during a person's lifetime. Both documents allow individuals to express their wishes regarding personal matters. In a Living Will, a person can specify the type of medical treatment they wish to receive or refuse if they become incapacitated. This ensures that their preferences are honored when they cannot communicate them directly.

Another document that resembles the Indiana Last Will is the Durable Power of Attorney. This legal instrument grants someone the authority to make financial or legal decisions on behalf of another person, particularly if that person becomes unable to do so. Like a Last Will, it is essential for ensuring that an individual’s wishes are respected. However, the Durable Power of Attorney takes effect during the individual's lifetime, while the Last Will only comes into play after death.

The Indiana Last Will also aligns with a Trust, specifically a Revocable Living Trust. A Trust allows individuals to manage their assets during their lifetime and designate how those assets will be distributed after death. Unlike a Last Will, which typically goes through probate, a Trust can help avoid this lengthy process, making it a popular choice for those seeking to streamline asset transfer. Both documents serve to protect the individual’s wishes regarding their estate but operate in different capacities.

Similar to the Last Will is a Codicil, which serves as an amendment to an existing Will. This document allows individuals to make changes or updates without having to create an entirely new Last Will. For example, if someone wishes to add a beneficiary or alter an executor, they can do so through a Codicil. This flexibility ensures that the Will remains current and reflective of the individual's intentions over time.

In the realm of motor vehicle transactions, understanding the necessary documentation is essential for ensuring a smooth process. The North Carolina Motor Vehicle Bill of Sale form is one such vital document that not only facilitates the exchange of ownership but also safeguards the interests of both parties involved. For those seeking guidance and templates, resources like UsaLawDocs.com can provide valuable assistance in completing this crucial paperwork.

A Declaration of Guardian is another document that parallels the Indiana Last Will. This form allows parents to designate a guardian for their minor children in the event of their death or incapacity. While a Last Will addresses the distribution of assets, the Declaration of Guardian focuses on the care and upbringing of children. Both documents work together to ensure that an individual’s wishes regarding family and assets are clearly articulated and legally recognized.

Additionally, a Living Trust can be compared to the Last Will in terms of asset management and distribution. A Living Trust allows individuals to place their assets into a trust during their lifetime, which can then be distributed according to their wishes upon their passing. This can provide a smoother transition of assets to beneficiaries and can often bypass the probate process, similar to how a Last Will directs asset distribution but may require probate proceedings.

Finally, a Health Care Proxy is similar to the Indiana Last Will in that it allows individuals to appoint someone to make healthcare decisions on their behalf if they become unable to do so. While the Last Will focuses on asset distribution after death, the Health Care Proxy ensures that personal health care choices are respected during life. Both documents empower individuals to control their affairs and ensure that their preferences are known and honored.

FAQ

What is a Last Will and Testament in Indiana?

A Last Will and Testament is a legal document that outlines how a person’s assets and affairs should be handled after their death. In Indiana, this document allows individuals to specify who will inherit their property, name guardians for minor children, and appoint an executor to manage the estate. It serves as a crucial tool for ensuring that your wishes are honored and can help avoid disputes among heirs.

Do I need a lawyer to create a Last Will and Testament in Indiana?

While it is not legally required to have a lawyer to create a will in Indiana, consulting with one can be beneficial. A legal professional can provide guidance tailored to your specific situation, help you navigate complex issues, and ensure that your will complies with state laws. This can help prevent potential challenges to your will in the future.

What are the requirements for a valid will in Indiana?

For a will to be valid in Indiana, it must be in writing and signed by the person creating the will (the testator). Additionally, it must be witnessed by at least two individuals who are present at the same time. These witnesses should not be beneficiaries of the will to avoid conflicts of interest. If these requirements are met, the will is generally considered valid.

Can I change my will after it has been created?

Yes, you can change your will at any time while you are still alive. In Indiana, this is typically done through a process called a codicil, which is an amendment to the original will. Alternatively, you can create a new will that revokes the previous one. It’s important to follow the same legal requirements for signing and witnessing when making changes to ensure the new document is valid.

What happens if I die without a will in Indiana?

If you die without a will, your estate will be distributed according to Indiana's intestacy laws. This means that your assets will be divided among your surviving relatives based on a predetermined hierarchy. This process may not align with your wishes and can lead to complications or disputes among family members. Having a will helps you avoid this situation and ensures your preferences are respected.

Can I include specific bequests in my will?

Absolutely! In your Indiana will, you can include specific bequests, which are gifts of particular items or sums of money to named individuals. For example, you might specify that a family heirloom goes to a certain relative. Including these details helps clarify your intentions and reduces the likelihood of misunderstandings among heirs.

How can I ensure my will is properly executed?

To ensure your will is properly executed in Indiana, follow the legal requirements for signing and witnessing. Keep the original document in a safe place and inform your executor and loved ones about its location. It’s also a good idea to review your will periodically, especially after major life events, to ensure it still reflects your wishes.

Is it necessary to have my will notarized in Indiana?

Notarization is not a requirement for a will to be valid in Indiana. However, having your will notarized can add an extra layer of credibility. A notarized will may be easier to prove valid in court if any disputes arise. While it’s not mandatory, it can be a helpful step to consider.

What should I do if I want to contest a will in Indiana?

If you believe a will is invalid or does not reflect the true intentions of the deceased, you may contest it. This typically involves filing a petition with the probate court. Grounds for contesting a will can include lack of capacity, undue influence, or improper execution. It’s advisable to consult with a legal professional to understand your rights and the process involved.

How often should I update my will?

It’s wise to review and potentially update your will every few years or after significant life changes, such as marriage, divorce, the birth of a child, or the death of a beneficiary. Regular updates ensure that your will accurately reflects your current wishes and circumstances, helping to prevent complications after your passing.

Common mistakes

When filling out the Indiana Last Will and Testament form, one common mistake is not being specific about the beneficiaries. People often assume that their loved ones know what they will receive. However, it is crucial to clearly state who gets what. This helps avoid confusion and potential disputes among family members after your passing.

Another frequent error is failing to sign the document properly. In Indiana, a will must be signed by the person making it, known as the testator. If the testator does not sign or if the signature is not witnessed correctly, the will may not be considered valid. This can lead to the entire will being thrown out, leaving your estate to be distributed according to state law instead of your wishes.

Many individuals also overlook the importance of updating their will. Life events such as marriage, divorce, or the birth of a child can significantly change how you want your estate distributed. If you do not revise your will to reflect these changes, it may not represent your current intentions, which can lead to unintended consequences.

Lastly, some people neglect to include an executor in their will. The executor is responsible for managing the estate and ensuring that the terms of the will are carried out. Without appointing someone for this role, there may be confusion or delays in settling the estate. This can create additional stress for your loved ones during an already difficult time.

Indiana Last Will and Testament Preview

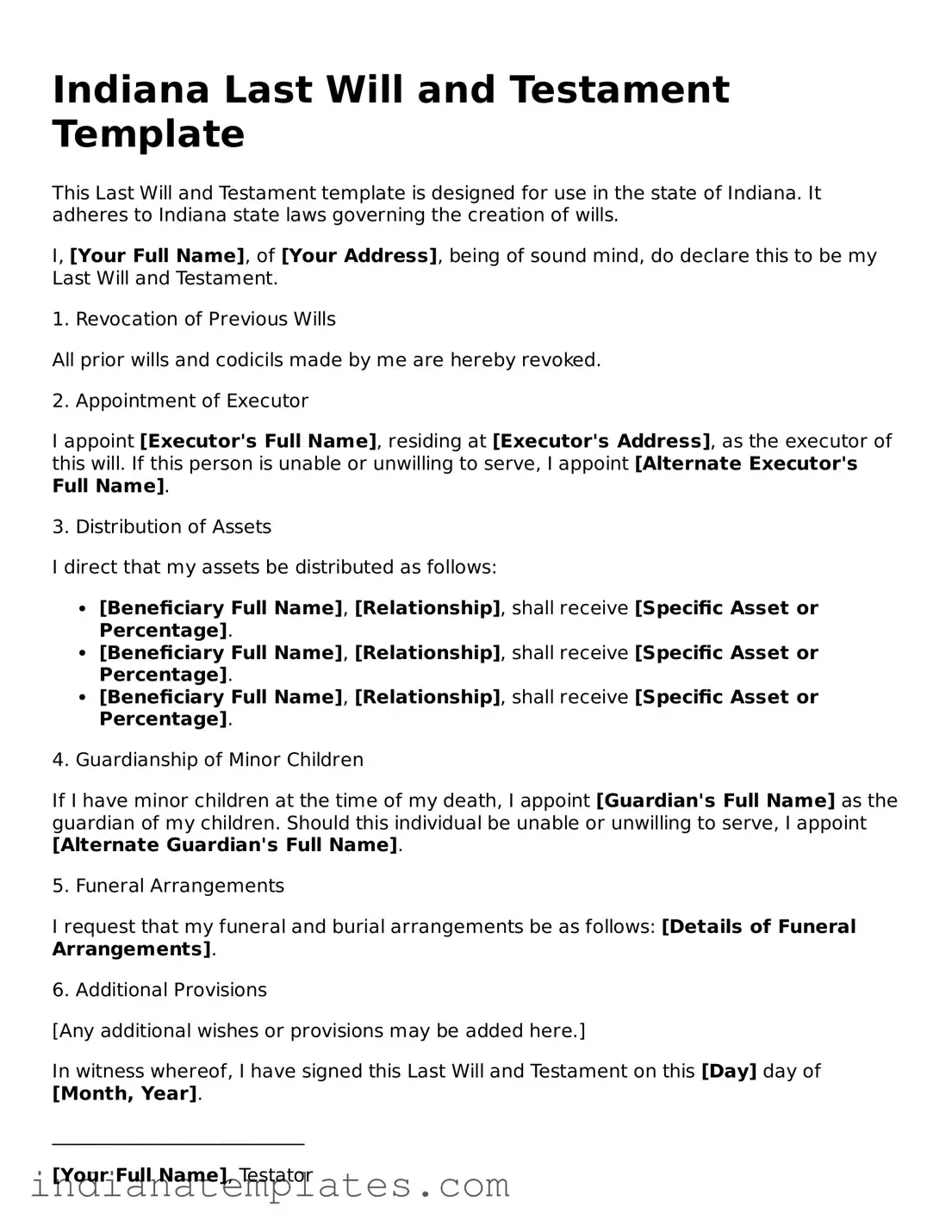

Indiana Last Will and Testament Template

This Last Will and Testament template is designed for use in the state of Indiana. It adheres to Indiana state laws governing the creation of wills.

I, [Your Full Name], of [Your Address], being of sound mind, do declare this to be my Last Will and Testament.

1. Revocation of Previous Wills

All prior wills and codicils made by me are hereby revoked.

2. Appointment of Executor

I appoint [Executor's Full Name], residing at [Executor's Address], as the executor of this will. If this person is unable or unwilling to serve, I appoint [Alternate Executor's Full Name].

3. Distribution of Assets

I direct that my assets be distributed as follows:

- [Beneficiary Full Name], [Relationship], shall receive [Specific Asset or Percentage].

- [Beneficiary Full Name], [Relationship], shall receive [Specific Asset or Percentage].

- [Beneficiary Full Name], [Relationship], shall receive [Specific Asset or Percentage].

4. Guardianship of Minor Children

If I have minor children at the time of my death, I appoint [Guardian's Full Name] as the guardian of my children. Should this individual be unable or unwilling to serve, I appoint [Alternate Guardian's Full Name].

5. Funeral Arrangements

I request that my funeral and burial arrangements be as follows: [Details of Funeral Arrangements].

6. Additional Provisions

[Any additional wishes or provisions may be added here.]

In witness whereof, I have signed this Last Will and Testament on this [Day] day of [Month, Year].

___________________________

[Your Full Name], Testator

Witnesses:

We, the undersigned witnesses, do hereby declare that we witnessed the signing of this Last Will and Testament by the above-named Testator, who is known to us and who appears to be of sound mind. We are not beneficiaries of this will.

___________________________

[Witness 1 Full Name], residing at [Witness 1 Address]

___________________________

[Witness 2 Full Name], residing at [Witness 2 Address]

Other Popular Indiana Forms

Tractor Bill of Sale Word Template - Can outline any specific terms agreed upon by both parties.

For businesses seeking to enhance workplace clarity, our guide on creating an effective Employee Handbook template is invaluable. This resource provides a solid foundation for developing a document that aligns with your organization's culture and compliance needs. You can access the template by following this helpful link.

Indiana Non Compete Laws - This document provides a mutual understanding between both parties regarding future employment opportunities.

Hold Harmless Waiver - A Hold Harmless Agreement may also include time limitations on indemnity claims.