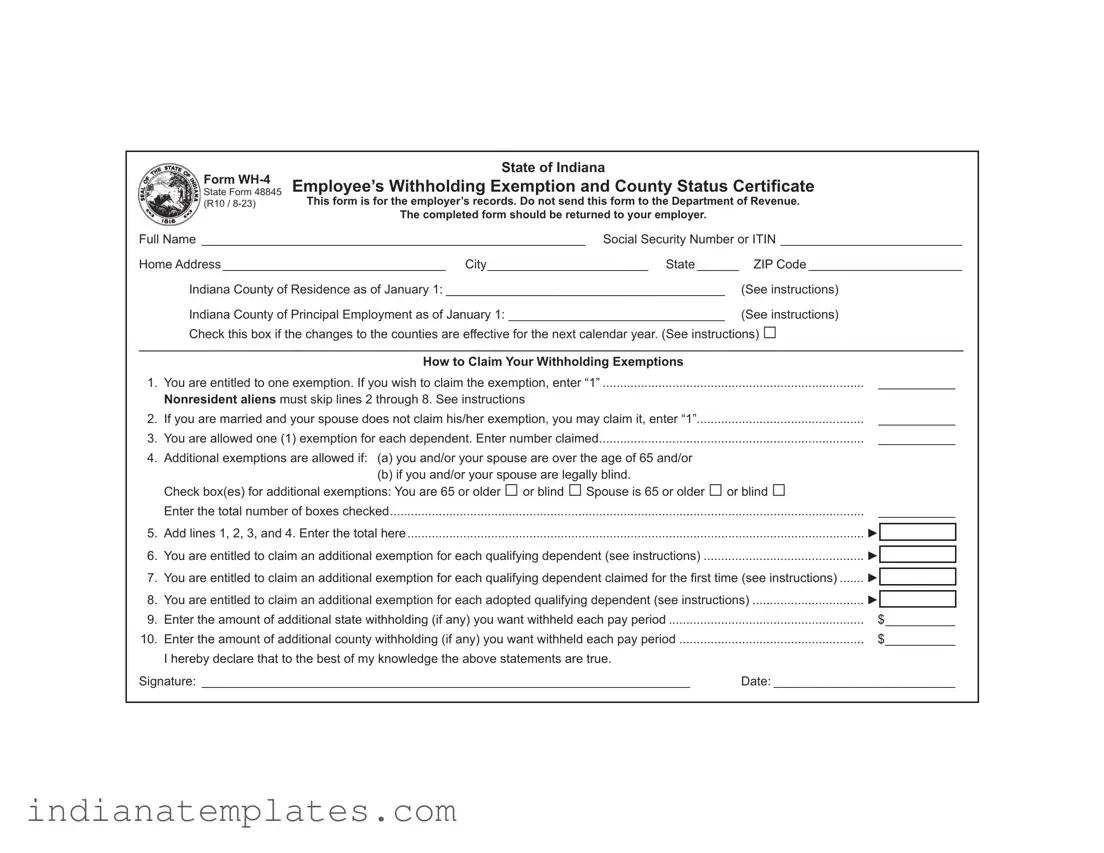

Form WH-4

State Form 48845 (R10 / 8-23)

State of Indiana

Employee’s Withholding Exemption and County Status Certificate

This form is for the employer’s records. Do not send this form to the Department of Revenue.

The completed form should be returned to your employer.

Full Name_ _______________________________________________________ Social Security Number or ITIN___________________________

Home Address_________________________________ City_______________________ State_______ |

ZIP Code_______________________ |

|

Indiana County of Residence as of January 1:_________________________________________ |

(See instructions) |

|

|

|

|

Indiana County of Principal Employment as of January 1:________________________________ |

(See instructions) |

|

|

|

|

Check this box if the changes to the counties are effective for the next calendar year. (See instructions) □ |

|

|

|

_____________________________________________________________________________________________________________________________________ |

|

How to Claim Your Withholding Exemptions |

|

|

|

|

1. |

You are entitled to one exemption. If you wish to claim the exemption, enter “1” |

___________ |

|

|

Nonresident aliens must skip lines 2 through 8. See instructions |

|

|

|

|

2. |

If you are married and your spouse does not claim his/her exemption, you may claim it, enter “1” |

___________ |

|

3. |

You are allowed one (1) exemption for each dependent. Enter number claimed |

___________ |

|

4. |

Additional exemptions are allowed if: (a) you and/or your spouse are over the age of 65 and/or |

|

|

|

|

|

(b) if you and/or your spouse are legally blind. |

|

|

|

|

|

Check box(es) for additional exemptions: You are 65 or older □ or blind □ Spouse is 65 or older □ or blind □ |

|

|

|

|

Enter the total number of boxes checked |

___________ |

|

|

|

|

|

|

5. |

Add lines 1, 2, 3, and 4. Enter the total here |

► |

|

|

|

|

|

|

6. |

You are entitled to claim an additional exemption for each qualifying dependent (see instructions) |

► |

|

|

7. |

You are entitled to claim an additional exemption for each qualifying dependent claimed for the first time (see instructions) |

► |

|

|

|

|

|

|

|

8. |

.................................You are entitled to claim an additional exemption for each adopted qualifying dependent (see instructions) |

► |

|

|

9. |

Enter the amount of additional state withholding (if any) you want withheld each pay period |

$__________ |

|

10. |

Enter the amount of additional county withholding (if any) you want withheld each pay period |

$__________ |

|

|

I hereby declare that to the best of my knowledge the above statements are true. |

|

|

|

|

Signature:_ ______________________________________________________________________ |

Date:___________________________ |

Instructions for Completing Form WH-4

This form should be completed by all resident and nonresident employees having income subject to Indiana state and/or county income tax.

Print or type your full name, Social Security number or ITIN and home address. Enter your Indiana county of residence and county of principal employment as of January 1 of the current year. If you neither lived nor worked in Indiana on January 1 of the current year, enter ‘not applicable’ on the line(s). If you move to (or work in) another county after January 1, your county status will not change until the next calendar year. Please check the box if you are requesting a change to a county of residence or work for the next calendar year.

Nonresident alien limitation. A nonresident alien is allowed to claim only one exemption for withholding tax purposes. If you are a nonresident alien, enter “1” on line 1, then skip to line 9. You are considered to be a nonresident alien if you are not a citizen of the United States and do not meet the green card test and the substantial presence test (get Publication 519 from www.irs.gov for information about these tests).

All other employees should complete lines 1 through 8.

Lines 1 & 2 - You are allowed to claim one exemption for yourself and one for your spouse (if he/she does not claim the exemption for him/herself). If a parent or legal guardian claims you on their federal tax return, you may still claim an exemption for yourself for Indiana purposes. You cannot claim more than the correct number of exemptions; however, you are permitted to claim a lesser number of exemptions if you wish additional withholding to be deducted.

Line 3 - Dependent Exemptions: You are allowed one exemption for each of your dependents based on state guidelines. To qualify as your dependent, a person must receive more than one-half of his/her support from you for the tax year and must have less than $4,400 gross income during the tax year (unless the person is your child and either (1) is under age 19 or (2) is under age 24 and a full-time student at a qualified educational institution during at least 5 months of the tax year).

Line 4 - Additional Exemptions. You are also allowed one exemption each for you and/or your spouse if either is 65 or older and/or blind. Line 5 - Add the total of exemptions claimed on lines 1, 2, 3, and 4. Enter the total in the box provided.

Line 6 - Additional Dependent Exemptions. An additional exemption is allowed for certain dependent children that are included on line 3. The dependent child must be a son, stepson, daughter, stepdaughter, foster child, and/or child for whom you are a legal guardian. The dependent must be under age 19 or must be both under age 24 and a full-time student at a qualified educational institution during at least 5 months of the taxable year.

Line 7 - First-time Claimed Additional Exemption. If an additional dependent exemption on Line 6 is being claimed for one or more children for the first time, enter the number of children for whom you are claiming. This exemption is good only for the calendar year in which the WH-4 claiming the exemption is submitted. If you claim this in multiple tax years, you MUST submit a new WH-4 each year for which this exemption is claimed. Do not claim this exemption if the child was eligible for the additional dependent exemption in any previous year, regardless of whether the exemption was claimed. This includes instances where the child was eligible for the additional dependent exemption before 2023. This also includes instances where the child was eligible to be claimed for the additional dependent exemption by another individual.

Line 8 - Additional Adopted Dependent Exemptions. An additional exemption is allowed for certain dependent children that are included on lines 3 and 6 and have been adopted by you or your spouse. The dependent child must be a son, stepson, daughter, or stepdaughter. The dependent must be under age 19 or must be both under age 24 and a full- time student at a qualified educational institution during at least 5 months of the taxable year.

Lines 9 & 10 - If you would like an additional amount to be withheld from your wages each pay period, enter the amount on the line provided. NOTE: An entry on this line does not obligate your employer to withhold the amount. You are still liable for any additional taxes due at the end of the tax year. If the employer does withhold the additional amount, it should be submitted along with the regular state and county tax withholding.

You may file a new Form WH-4 at any time if the number of exemptions increases. You must file a new Form WH-4 within 10 days if the number of exemptions previously claimed by you decreases for any of the following reasons:

(a)you divorce (or are legally separated from) your spouse for whom you have been claiming an exemption or your spouse claims him/herself on a separate Form WH-4;

(b)someone else takes over the support of a dependent you claim or you no longer provide more than one-half of the person’s support for the tax year; or

(c)a dependent no longer qualifies for an additional dependent or an adopted dependent exemption.

Penalties are imposed for willingly supplying false information or information which would reduce the withholding exemption.