Fill in Your Indiana State 43931 Form

Similar forms

The Indiana State 43931 form, which reports self-employment income, shares similarities with the IRS Form 1040 Schedule C. Both documents serve the purpose of detailing income and expenses related to a business. While the Schedule C is used for federal tax reporting, the Indiana State 43931 focuses on state-level reporting for self-employed individuals. Each form requires the reporting of gross income and business costs, allowing for a comprehensive overview of financial performance. This information is essential for tax assessments and benefits eligibility.

Another document akin to the Indiana State 43931 is the IRS Form 1040 Schedule SE. This form is used to calculate self-employment tax, which is a critical component for self-employed individuals. While the 43931 form emphasizes monthly income and costs, the Schedule SE focuses on the self-employment tax owed based on net earnings. Both forms are integral for self-employed individuals to ensure compliance with tax obligations and to accurately report their financial status to the relevant authorities.

The Indiana State 43931 form is also similar to the state-specific self-employment income reporting forms used in other states, such as California’s Form DE 4581. These forms are designed to capture the income and expenses of self-employed individuals within their respective states. Like the Indiana form, they require detailed reporting of monthly income and costs, which aids in determining eligibility for various state benefits and programs. Each state’s form may have unique requirements, but the fundamental purpose remains consistent.

Additionally, the Indiana State 43931 form resembles the Small Business Administration (SBA) Form 1919, which is used during the loan application process. This form collects information about the business and its income, similar to how the 43931 collects income details for reporting purposes. Both forms aim to provide a clear financial picture, which is crucial for lenders and state agencies when assessing eligibility for financial assistance or benefits.

In addition to various tax forms, understanding the legal documentation for transactions, such as the https://arizonapdfforms.com/bill-of-sale/, is vital for anyone involved in the buying and selling of personal property. This Bill of Sale form serves as proof of ownership transfer, ensuring that both parties are clear on the terms of the agreement and helping to prevent future disputes.

The Indiana State 43931 form can also be compared to the Profit and Loss Statement, often used by businesses to summarize revenues and expenses over a specific period. This document provides a broader view of financial performance, while the 43931 focuses on monthly reporting. Both documents are essential for self-employed individuals to track their financial health and make informed business decisions. They serve as important tools for understanding profitability and managing business costs effectively.

Lastly, the Indiana State 43931 form is similar to the Form 941, which is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. While the 43931 form is specific to self-employed individuals, both forms require detailed reporting of income. They also share the goal of ensuring compliance with tax regulations. Accurate reporting on both forms is necessary to avoid penalties and maintain good standing with tax authorities.

FAQ

What is the purpose of the Indiana State 43931 form?

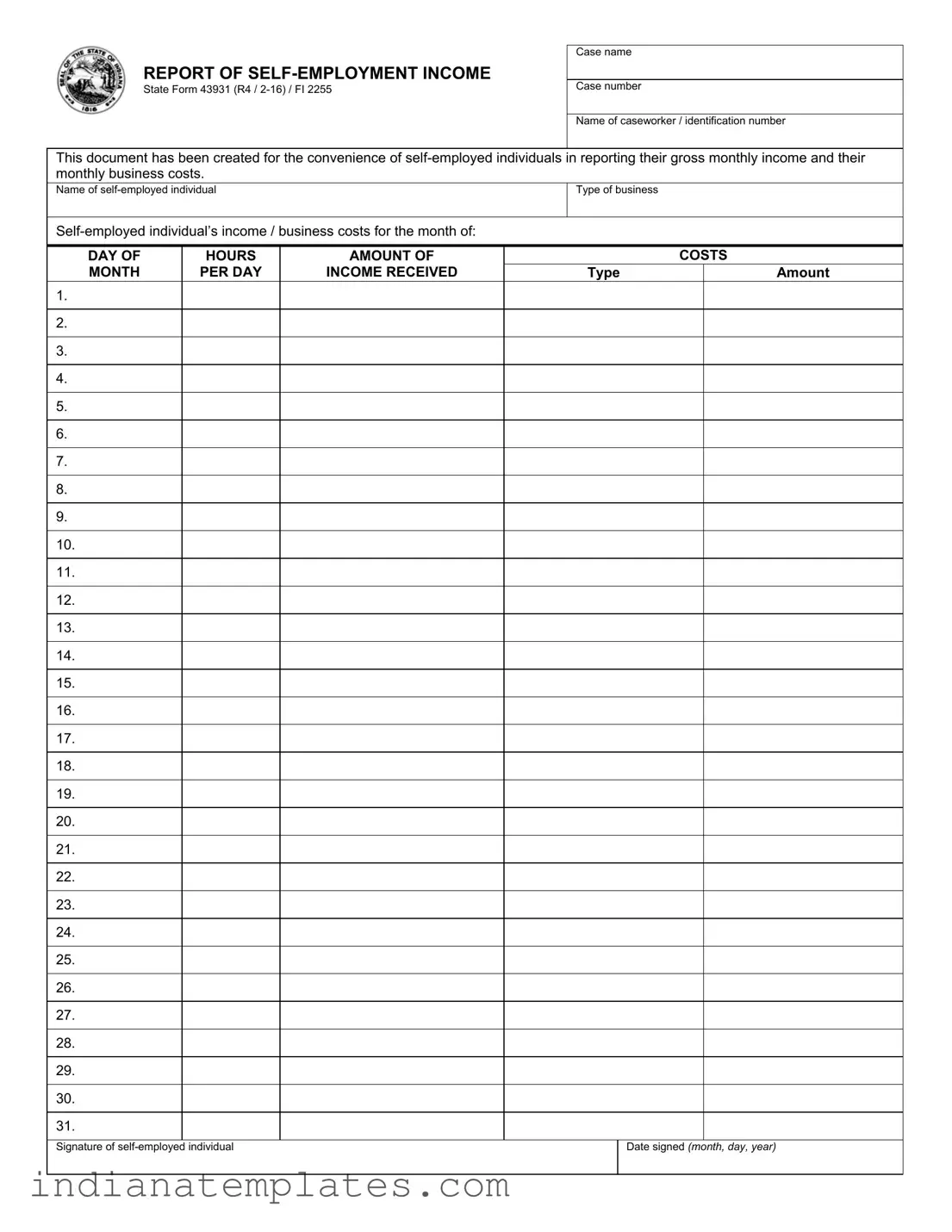

The Indiana State 43931 form, also known as the Report of Self-Employment Income, is designed to assist self-employed individuals in documenting their gross monthly income and business expenses. This form helps ensure that self-employed individuals can accurately report their financial situation, which is essential for various state assistance programs and for tax purposes. By providing a clear account of income and costs, it facilitates better understanding and management of one's business finances.

Who should fill out the Indiana State 43931 form?

This form is intended for self-employed individuals who need to report their income and business costs. If you operate your own business or work as a freelancer, you are likely required to complete this form. It is particularly relevant for those applying for state assistance or benefits that take into account self-employment income. Properly filling out the form can help ensure that your financial information is accurately represented to the appropriate authorities.

What information is required on the form?

The Indiana State 43931 form requires several key pieces of information. You will need to provide your name, the type of business you operate, and details about your income and business costs for each day of the month. Specifically, you should list the amounts received and the corresponding costs incurred. The form includes space for up to 31 days of reporting, allowing for a comprehensive monthly overview. Additionally, you must sign and date the form, confirming that the information provided is accurate to the best of your knowledge.

How do I submit the Indiana State 43931 form?

Once you have completed the Indiana State 43931 form, you should submit it to the appropriate agency or caseworker overseeing your case. This may be a local office of the Indiana Family and Social Services Administration or another relevant department. Be sure to check for any specific submission guidelines, such as deadlines or required attachments. Keeping a copy of the completed form for your records is also advisable, as it can serve as a reference for future submissions or inquiries.

Common mistakes

Filling out the Indiana State 43931 form can be a straightforward process, but several common mistakes can lead to complications. One of the most frequent errors is leaving out the case name or case number. These details are crucial for proper identification and processing of the form. Without them, the form may be rejected or delayed, causing frustration for the self-employed individual.

Another common mistake is failing to accurately report the gross monthly income. Self-employed individuals sometimes underestimate their earnings or miscalculate their income for the month. This can lead to discrepancies that might require additional documentation or clarification, wasting valuable time.

Additionally, individuals often overlook the monthly business costs. Inaccurately reporting these costs can skew the financial picture presented in the form. It’s important to include all relevant expenses to provide a clear representation of the business's financial health.

Many people also forget to include the signature and date signed at the end of the form. This simple oversight can render the form invalid. Always double-check that the form is signed and dated correctly before submission.

Another mistake is not filling out the type of business section. This detail helps clarify the nature of the self-employment, which is important for the reviewing agency. Leaving this blank can create confusion and lead to unnecessary follow-up.

Inconsistent or unclear entries in the income received section can also cause issues. Individuals should ensure that all figures are clearly written and easy to read. Ambiguities in the amounts can lead to misinterpretation and further complications.

People sometimes fail to keep their records up to date. If the form is filled out based on outdated information, it can lead to inaccuracies. Regularly updating records ensures that the information provided is current and correct.

Another common error involves the amount of costs listed. Individuals may forget to break down their costs properly or may not include all necessary expenses. A detailed breakdown is essential for a comprehensive understanding of business costs.

Finally, many self-employed individuals neglect to review the entire form before submission. Taking the time to go over each section can help catch mistakes or omissions that could delay processing. A thorough review can save time and reduce stress in the long run.

Indiana State 43931 Preview

REPORT OF

State Form 43931 (R4 /

Case name

Case number

Name of caseworker / identification number

This document has been created for the convenience of

Name of

Type of business

DAY OF |

HOURS |

AMOUNT OF |

|

COSTS |

MONTH |

PER DAY |

INCOME RECEIVED |

Type |

Amount |

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

31.

Signature of

Date signed (month, day, year)

Different PDF Forms

It6 - The E-6 form is an important aspect of corporate financial planning in Indiana.

For those entering into a rental agreement, it is essential to utilize the New York Residential Lease Agreement form, which can be conveniently accessed at UsaLawDocs.com. This document not only clarifies the terms and conditions of the lease but also protects the rights of both landlords and tenants, ensuring a smooth rental experience in New York state.

Indiana Land Contract Template - It includes stipulations for the handling of insurance proceeds that may arise from property damage.

Indiana Legal Forms Free - This form must be filed for each party involved in a civil case, ensuring proper representation is acknowledged by the court.