Fill in Your Indiana State 104 Form

Similar forms

The Indiana State Form 102 is a property tax return for residential real estate. Similar to Form 104, it requires taxpayers to report the assessed value of their property. Both forms have filing deadlines and penalties for late submissions. The Form 102 specifically focuses on real property, while Form 104 addresses business tangible personal property. Taxpayers must provide accurate information to ensure compliance with state regulations, highlighting the importance of transparency in property valuation.

Understanding the various property tax forms can be complex, but resources are available to help navigate these requirements. For instance, the fastpdftemplates.com website provides templates and forms that can simplify the filing process, ensuring that taxpayers have the necessary tools to comply with state regulations effectively.

Form 103, also known as the Business Personal Property Tax Return, is closely related to Form 104. It is used by businesses to report personal property used in their operations. Like Form 104, it includes sections for reporting assessed values and requires submission to the appropriate local authority. Both forms emphasize the need for accurate reporting and may impose penalties for undervaluation or late filing. However, Form 103 is typically used for larger businesses or those with more complex property holdings.

The Indiana Form 105 serves as a summary form for taxpayers with properties in multiple taxing districts. This form is required for those who must file separate returns in different districts, similar to the requirements outlined in Form 104. Both forms require detailed reporting of property locations and values. Form 105 streamlines the process for taxpayers who operate across various jurisdictions, ensuring compliance with local tax laws while maintaining clarity in reporting obligations.

Lastly, Form 101 is used for reporting recreational personal property not subject to excise tax. While it differs from Form 104 in that it focuses on non-business assets, both forms require taxpayers to accurately disclose property details. Each form has specific instructions and deadlines, reinforcing the importance of timely reporting. The distinction lies in the type of property being reported, yet both contribute to the overall assessment and taxation process within Indiana.

FAQ

What is the Indiana State 104 form and who needs to file it?

The Indiana State 104 form is a property return form specifically designed for reporting business tangible personal property. It must be filed by any taxpayer who owns, holds, possesses, or controls tangible personal property used for business purposes within the state of Indiana. This form is required to be submitted to the Township Assessor by May 15 of each year, unless a written extension has been granted. Taxpayers with property in multiple taxing districts must file separate returns for each district, as tax rates may vary.

What are the penalties for failing to file the Indiana State 104 form on time?

Failure to file the Indiana State 104 form by the deadline can result in significant penalties. A taxpayer who does not file by the due date will incur a penalty of $25. If the return is not submitted within 30 days after the deadline, an additional penalty of 20% of the taxes due may be assessed. Furthermore, if a taxpayer undervalues their property by more than 5%, a penalty of 20% on the additional taxes due may also be imposed. These penalties are applied to the property tax installment next due, regardless of any appeals filed with the Indiana Tax Court.

What information is required to complete the Indiana State 104 form?

To complete the Indiana State 104 form, taxpayers must provide comprehensive information about their tangible personal property. This includes the name of the taxpayer, the nature of the business, the address of the property, and the assessed value of the property. Taxpayers must also disclose any improvements made to real estate since the last assessment date. It is crucial to provide accurate and complete information, as incomplete returns may lead to additional penalties and the requirement to submit further documentation.

What should a taxpayer do if they have property in more than one taxing district?

If a taxpayer has tangible personal property in more than one taxing district, they must file separate returns for each district. Each return should only cover property located within that specific district. Additionally, taxpayers who need to file in multiple townships are required to submit a summary form, known as Form 105, to the Department of Local Government Finance by July 15 of the assessment year. This ensures that all property is accurately reported and assessed according to the appropriate local tax regulations.

Common mistakes

Filling out the Indiana State 104 form can be straightforward, but many people make common mistakes that can lead to penalties or delays. One significant error is missing the filing deadline. The form must be submitted to the Township Assessor by May 15. If you miss this date, a penalty of $25 may be imposed. It’s essential to mark your calendar and ensure that your form is submitted on time.

Another frequent mistake involves not filing separate returns for properties located in multiple taxing districts. If you own property in more than one district within the same township, you must file separate returns for each district. Failing to do so can complicate your tax situation and may result in additional penalties.

People also often overlook the requirement to file in duplicate if their total assessed value of business personal property is $150,000 or more. Not providing the necessary duplicate returns can lead to issues with compliance and may result in penalties. Be sure to check your total assessed value and submit the correct number of forms.

Inadequate disclosure of property details is another common pitfall. Taxpayers must provide complete information regarding the value, nature, and location of their personal property. If you fail to include all required information, you may be contacted for clarification, which could delay your assessment.

Many individuals forget to report improvements made to real estate since the last assessment date. If you made any enhancements, you need to attach a statement detailing the nature, cost, and completion status of those improvements. Omitting this information can lead to penalties for undervaluation.

Another mistake is not providing accurate contact information. Ensure that the name and address for mailing tax notices are correct. If you provide incorrect details, you may miss important communications regarding your tax assessment.

Some taxpayers neglect to sign the form. The signature certifies that the information provided is accurate and complete. Without a signature, the return may be considered invalid, leading to further complications.

Finally, failing to double-check for errors before submission can be detrimental. Simple mistakes in calculations or missing information can result in penalties or delays. Take the time to review your form thoroughly to ensure accuracy and completeness.

Indiana State 104 Preview

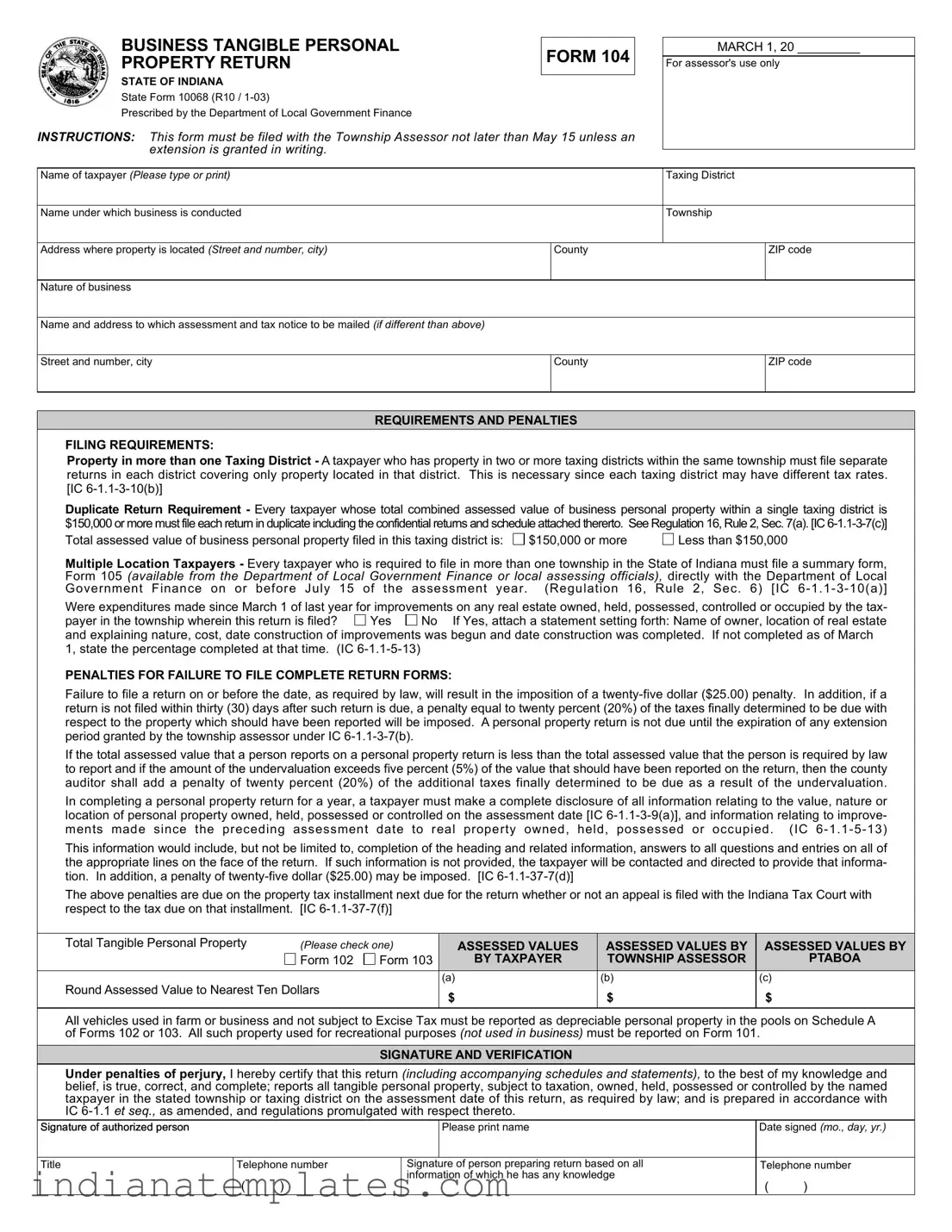

BUSINESS TANGIBLE PERSONAL |

FORM 104 |

|

PROPERTY RETURN |

||

|

||

|

|

STATE OF INDIANA

State Form 10068 (R10 /

Prescribed by the Department of Local Government Finance

INSTRUCTIONS: This form must be filed with the Township Assessor not later than May 15 unless an extension is granted in writing.

MARCH 1, 20 _________

For assessor's use only

Name of taxpayer (Please type or print) |

|

Taxing District |

|

|

|

|

|

Name under which business is conducted |

|

Township |

|

|

|

|

|

Address where property is located (Street and number, city) |

County |

|

ZIP code |

|

|

|

|

Nature of business |

|

|

|

|

|

|

|

Name and address to which assessment and tax notice to be mailed (if different than above) |

|

|

|

|

|

|

|

Street and number, city |

County |

|

ZIP code |

|

|

|

|

REQUIREMENTS AND PENALTIES

FILING REQUIREMENTS:

Property in more than one Taxing District - A taxpayer who has property in two or more taxing districts within the same township must file separate returns in each district covering only property located in that district. This is necessary since each taxing district may have different tax rates. [IC

Duplicate Return Requirement - Every taxpayer whose total combined assessed value of business personal property within a single taxing district is $150,000 or more must file each return in duplicate including the confidential returns and schedule attached thererto. See Regulation 16, Rule 2, Sec. 7(a). [IC

Total assessed value of business personal property filed in this taxing district is:

$150,000 or more

Less than $150,000

Multiple Location Taxpayers - Every taxpayer who is required to file in more than one township in the State of Indiana must file a summary form, Form 105 (available from the Department of Local Government Finance or local assessing officials), directly with the Department of Local Government Finance on or before July 15 of the assessment year. (Regulation 16, Rule 2, Sec. 6) [IC

Were expenditures made since March 1 of last year for improvements on any real estate owned, held, possessed, controlled or occupied by the tax- payer in the township wherein this return is filed?  Yes

Yes  No If Yes, attach a statement setting forth: Name of owner, location of real estate and explaining nature, cost, date construction of improvements was begun and date construction was completed. If not completed as of March 1, state the percentage completed at that time. (IC

No If Yes, attach a statement setting forth: Name of owner, location of real estate and explaining nature, cost, date construction of improvements was begun and date construction was completed. If not completed as of March 1, state the percentage completed at that time. (IC

PENALTIES FOR FAILURE TO FILE COMPLETE RETURN FORMS:

Failure to file a return on or before the date, as required by law, will result in the imposition of a

If the total assessed value that a person reports on a personal property return is less than the total assessed value that the person is required by law to report and if the amount of the undervaluation exceeds five percent (5%) of the value that should have been reported on the return, then the county auditor shall add a penalty of twenty percent (20%) of the additional taxes finally determined to be due as a result of the undervaluation.

In completing a personal property return for a year, a taxpayer must make a complete disclosure of all information relating to the value, nature or location of personal property owned, held, possessed or controlled on the assessment date [IC

This information would include, but not be limited to, completion of the heading and related information, answers to all questions and entries on all of the appropriate lines on the face of the return. If such information is not provided, the taxpayer will be contacted and directed to provide that informa- tion. In addition, a penalty of

The above penalties are due on the property tax installment next due for the return whether or not an appeal is filed with the Indiana Tax Court with respect to the tax due on that installment. [IC

Total Tangible Personal Property |

(Please check one) |

|

ASSESSED VALUES |

ASSESSED VALUES BY |

ASSESSED VALUES BY |

|

|

Form 102 |

Form 103 |

|

BY TAXPAYER |

TOWNSHIP ASSESSOR |

PTABOA |

|

|

|

(a) |

|

(b) |

(c) |

Round Assessed Value to Nearest Ten Dollars |

|

$ |

|

$ |

$ |

|

|

|

|

|

|||

|

|

|

|

|

|

|

All vehicles used in farm or business and not subject to Excise Tax must be reported as depreciable personal property in the pools on Schedule A of Forms 102 or 103. All such property used for recreational purposes (not used in business) must be reported on Form 101.

SIGNATURE AND VERIFICATION

Under penalties of perjury, I hereby certify that this return (including accompanying schedules and statements), to the best of my knowledge and belief, is true, correct, and complete; reports all tangible personal property, subject to taxation, owned, held, possessed or controlled by the named taxpayer in the stated township or taxing district on the assessment date of this return, as required by law; and is prepared in accordance with IC

Signature of authorized person |

|

|

|

Please print name |

Date signed (mo., day, yr.) |

|

|

|

|

|

|

||

Title |

Telephone number |

Signature of person preparing return based on all |

Telephone number |

|||

|

( |

) |

information of which he has any knowledge |

|

|

|

|

|

|

( |

) |

||

Different PDF Forms

How to Get Qma Certification - Identify common medication errors and strategies to prevent them in a clinical environment.

Sr16 Indiana - The SR21 form supports data collection for traffic safety improvement initiatives.

To ensure a smooth transaction, it is important to properly fill out the California ATV Bill of Sale form, which captures all necessary details about the sale process. For your convenience, you can download and submit the form to facilitate the ownership transfer of your ATV in compliance with state laws.

Indiana Entertainment Permit - Check for any updates or changes to the permit process before applying.