Fill in Your Indiana St 103 Form

Similar forms

The Indiana Form ST-104 is similar to the ST-103 in that both are used for reporting sales tax. Form ST-104 is specifically for businesses that are filing their sales tax return. Like the ST-103, it requires businesses to report total sales, exemptions, and taxable sales. The calculations for tax due and any penalties or interest for late payments are also comparable. However, ST-104 is intended for a broader audience, including those who may not be using electronic funds transfer (EFT) for payments.

Form ST-105 is another document that aligns closely with the ST-103. This form is used for claiming a sales tax exemption on specific purchases. Both forms require detailed reporting of sales figures, but the ST-105 focuses on purchases that qualify for exemption rather than general sales tax reporting. This means that while the ST-103 calculates tax due, the ST-105 is about proving that no tax is owed on certain transactions.

The Indiana Form ST-108 is also related to the ST-103. This form is used for reporting sales tax for out-of-state sellers who have a physical presence in Indiana. Like the ST-103, it requires the reporting of total sales and taxable sales. The main difference is that ST-108 specifically addresses the nuances of out-of-state transactions, making it essential for businesses that operate across state lines.

Form ST-109 serves a similar purpose to the ST-103 but is designed for use by governmental entities. Both forms require reporting of sales and tax calculations, but the ST-109 is tailored to meet the specific needs of tax-exempt organizations. This form ensures that governmental entities are properly accounting for their sales tax obligations without incurring unnecessary charges.

The Indiana Form ST-110 is another comparable document. It is used for reporting the sale of tangible personal property and services. Both the ST-103 and ST-110 require the reporting of total sales and taxable sales. However, the ST-110 provides more detailed instructions for specific types of transactions, ensuring that businesses comply with Indiana's tax laws for tangible goods.

Form ST-111 is similar to the ST-103 in that it is used for reporting sales tax, but it focuses specifically on the sale of food and beverages. Both forms require businesses to report total sales and calculate tax due. However, the ST-111 includes unique provisions for food and beverage sales, which may be subject to different tax rates or exemptions, making it essential for businesses in the food service industry.

The Indiana Bill of Sale is crucial for individuals looking to transfer ownership of personal property, ensuring that all necessary details are clear and legally binding. This form acts as a vital record of the transaction, encompassing information such as the description of the item, purchase price, and the involved parties. For those looking to understand the intricacies of this process, resources can be found at https://arizonapdfforms.com/bill-of-sale, providing guidance to ensure both buyers and sellers are well-informed throughout the transaction.

Lastly, Form ST-112 is another document that parallels the ST-103. This form is specifically for reporting sales tax for agricultural products. While both forms require detailed sales reporting, the ST-112 is tailored to the agricultural sector and includes specific exemptions and deductions applicable to farmers and agricultural businesses. This ensures that those in the agricultural industry are accurately reporting their sales tax obligations while taking advantage of available exemptions.

FAQ

What is the Indiana St 103 form used for?

The Indiana St 103 form is primarily a sales tax recap form. It is used by businesses to report their total sales, taxable sales, and the amount of sales tax due for a specific period. This form helps ensure that businesses comply with Indiana's sales tax regulations and provides a clear record for their financial activities. Importantly, this form is for your records only and should not be sent to the Indiana Department of Revenue.

How do I calculate the total tax due on the Indiana St 103 form?

To calculate the total tax due, you first need to determine your taxable sales. This is done by subtracting any exemptions or deductions from your total sales. Once you have your taxable sales amount, multiply it by the current sales tax rate. The sales tax rate can be found on the voucher included with the form. This calculation will give you the total tax due for the reporting period.

What if I made a late payment? Are there penalties?

Yes, if you make a late payment, you will incur both interest and a penalty. Interest is calculated from the tax due date to the date you make your payment, based on the total of your tax due and any use tax due. Additionally, a 10 percent penalty applies to late payments, calculated on the total tax due plus any use tax. It's important to note that if you pay electronically (EFT), different rules apply, and you will receive an assessment notice for any late payment interest and penalties automatically.

Can I claim a discount on my sales tax payment?

A discount, known as a collection allowance, is available if your payment is postmarked or made electronically on or before the due date. The discount rate is .0083, applicable only to your total sales tax liability accrued during the specified period. However, utilities do not qualify for this discount. Ensure you check your voucher for the current tax rate and eligibility for the discount.

What is use tax, and when do I need to pay it?

Use tax applies to purchases where no sales tax was paid, and the items were not held for resale or exempt purposes. You owe use tax if you remove an item from inventory for personal use, use it as a giveaway, or display it without selling it. To calculate the use tax due, multiply your cost by the current use tax rate, which can also be found on your voucher.

How do I report payments made through electronic funds transfer (EFT)?

If you have made payments via EFT, you should enter the total amount paid for all months within the quarter on the Indiana St 103 form. If you are submitting the recap before initiating your final EFT payment for the quarter, include the amount you plan to pay. However, do not enter the final EFT payment for the quarter on the form. It's crucial to keep track of your payments to ensure accurate reporting.

Where can I find more information about filing electronically?

For those interested in filing electronically, Indiana offers an online filing program called INtax. You can visit www.INtax.in.gov to learn more about registering to file returns and make tax payments electronically. This platform supports filing for Indiana sales tax, withholding tax, and tire fees. Additional electronic payment options can be found at www.in.gov/dor under the Electronic Services section.

Common mistakes

Filling out the Indiana ST 103 form can be straightforward, but many make common mistakes that can lead to complications. One prevalent error is failing to accurately report total sales. Individuals often include sales from periods outside the specified timeframe. It is crucial to only enter sales from the period indicated on the form. Remember, this figure should not include sales tax.

Another frequent mistake involves exemptions and deductions. Some filers mistakenly omit this section or miscalculate the total amount. This can lead to an incorrect taxable sales figure. Always double-check your calculations to ensure that you are reporting the correct deductions.

When calculating total tax due, some people neglect to multiply the taxable sales by the current sales tax rate. This step is essential to determine the correct amount owed. Be sure to refer to the voucher for the current rate, as it may change periodically.

Timeliness is also critical. Many individuals overlook the discount for early payment. If your payment is postmarked on or before the due date, you are eligible for a collection allowance. However, remember that utilities do not qualify for this discount.

Additionally, errors in reporting use tax can occur. Some taxpayers forget to include use tax on purchases where no sales tax was paid. If you’ve used an item for personal purposes or as a promotional giveaway, ensure you calculate and report the use tax due accurately.

Interest and penalties for late payments are another area where mistakes can happen. Filers often miscalculate interest by failing to include all applicable lines. Interest is based on the total tax due and use tax, not on penalties. Likewise, the penalty for late payment must be calculated correctly, considering the greater of 10 percent of the total tax due or $5.00.

Another common oversight is in reporting previous payments made via Electronic Funds Transfer (EFT). Some individuals mistakenly enter the final EFT payment on the recap form, which should not be done. Only include payments made for the months within the quarter.

Finally, when determining the amount due, some people fail to add and subtract the correct lines. It’s essential to ensure that all calculations are accurate to avoid any discrepancies. Remember, cash should not be sent with the form, and EFT taxpayers must adhere to their specific payment schedules.

Indiana St 103 Preview

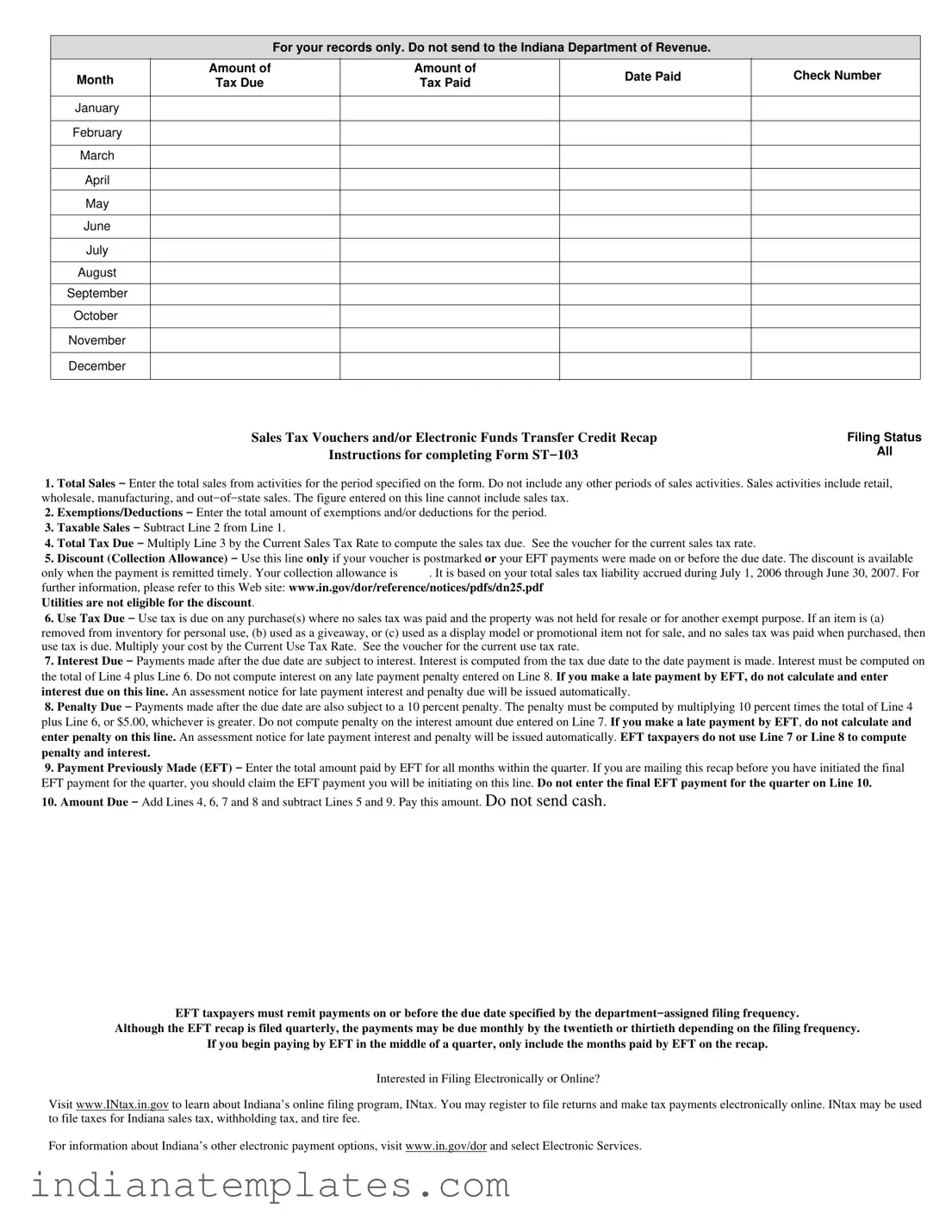

For your records only. Do not send to the Indiana Department of Revenue.

Month |

Amount of |

Amount of |

Date Paid |

Check Number |

|

Tax Due |

Tax Paid |

||||

|

|

January

February

March

April

May

June

July

August

September

October

November

December

Sales Tax Vouchers and/or Electronic Funds Transfer Credit Recap |

Filing Status |

Instructions for completing Form ST−103 |

All |

|

1.Total Sales − Enter the total sales from activities for the period specified on the form. Do not include any other periods of sales activities. Sales activities include retail, wholesale, manufacturing, and out−of−state sales. The figure entered on this line cannot include sales tax.

2.Exemptions/Deductions − Enter the total amount of exemptions and/or deductions for the period.

3.Taxable Sales − Subtract Line 2 from Line 1.

4.Total Tax Due − Multiply Line 3 by the Current Sales Tax Rate to compute the sales tax due. See the voucher for the current sales tax rate.

5.Discount (Collection Allowance) − Use this line only if your voucher is postmarked or your EFT payments were made on or before the due date. The discount is available only when the payment is remitted timely. Your collection allowance is .0083. It is based on your total sales tax liability accrued during July 1, 2006 through June 30, 2007. For further information, please refer to this Web site: www.in.gov/dor/reference/notices/pdfs/dn25.pdf

Utilities are not eligible for the discount.

6.Use Tax Due − Use tax is due on any purchase(s) where no sales tax was paid and the property was not held for resale or for another exempt purpose. If an item is (a) removed from inventory for personal use, (b) used as a giveaway, or (c) used as a display model or promotional item not for sale, and no sales tax was paid when purchased, then use tax is due. Multiply your cost by the Current Use Tax Rate. See the voucher for the current use tax rate.

7.Interest Due − Payments made after the due date are subject to interest. Interest is computed from the tax due date to the date payment is made. Interest must be computed on the total of Line 4 plus Line 6. Do not compute interest on any late payment penalty entered on Line 8. If you make a late payment by EFT, do not calculate and enter interest due on this line. An assessment notice for late payment interest and penalty due will be issued automatically.

8.Penalty Due − Payments made after the due date are also subject to a 10 percent penalty. The penalty must be computed by multiplying 10 percent times the total of Line 4 plus Line 6, or $5.00, whichever is greater. Do not compute penalty on the interest amount due entered on Line 7. If you make a late payment by EFT, do not calculate and enter penalty on this line. An assessment notice for late payment interest and penalty will be issued automatically. EFT taxpayers do not use Line 7 or Line 8 to compute penalty and interest.

9.Payment Previously Made (EFT) − Enter the total amount paid by EFT for all months within the quarter. If you are mailing this recap before you have initiated the final EFT payment for the quarter, you should claim the EFT payment you will be initiating on this line. Do not enter the final EFT payment for the quarter on Line 10.

10. Amount Due − Add Lines 4, 6, 7 and 8 and subtract Lines 5 and 9. Pay this amount. Do not send cash.

EFT taxpayers must remit payments on or before the due date specified by the department−assigned filing frequency.

Although the EFT recap is filed quarterly, the payments may be due monthly by the twentieth or thirtieth depending on the filing frequency.

If you begin paying by EFT in the middle of a quarter, only include the months paid by EFT on the recap.

Interested in Filing Electronically or Online?

Visit www.INtax.in.gov to learn about Indiana’s online filing program, INtax. You may register to file returns and make tax payments electronically online. INtax may be used to file taxes for Indiana sales tax, withholding tax, and tire fee.

For information about Indiana’s other electronic payment options, visit www.in.gov/dor and select Electronic Services.

Different PDF Forms

Contempt of Court Indiana - This form is designed for those seeking justice in family law matters.

The New York Residential Lease Agreement form is essential for anyone entering a rental agreement, ensuring clarity and protection under the law. For more detailed information and to access the necessary documentation, you can visit UsaLawDocs.com, which provides valuable resources related to this legal requirement.

St-103 - Blank forms cannot be accepted, as they will require sales tax payment.