Fill in Your Indiana Sr21 Form

Similar forms

The Indiana SR21 form is similar to the DMV Form MV-104, which is used in New York State for reporting motor vehicle accidents. Like the SR21, the MV-104 requires detailed information about the accident, including the parties involved and the circumstances surrounding the incident. Both forms aim to collect necessary data for insurance purposes and compliance with state laws. The MV-104 also emphasizes the need for accurate reporting and has a similar timeline for submission, usually within 10 days of the accident.

Another document comparable to the SR21 is the California SR-1 form. This form serves as a report of a traffic accident and must be submitted to the Department of Motor Vehicles within 10 days if there are injuries or property damage exceeding a certain threshold. Both forms require the same type of information, such as driver details, vehicle information, and specifics about the accident. The SR-1 also necessitates verification of insurance, similar to the SR21's requirement for an insurance agent's signature.

The Texas CR-2 form is also akin to the Indiana SR21. This form is used for reporting motor vehicle accidents in Texas and collects similar information, including the date, time, and location of the crash. Just like the SR21, the CR-2 requires the submission of the report within a specific timeframe, typically 10 days. Both documents serve to notify the state of accidents and ensure compliance with local traffic laws.

In Florida, the Crash Report Form (Long Form) serves a similar purpose to the Indiana SR21. This form is used to report accidents involving injuries or significant property damage. Both forms require detailed information about the drivers, vehicles, and circumstances of the accident. The Florida form also includes sections for insurance verification and must be filed within 10 days, just like the SR21.

The Illinois Traffic Crash Report is another document that mirrors the SR21. This report is used to document motor vehicle accidents in Illinois and requires similar information about the involved parties and the incident. Both forms are designed to provide law enforcement and insurance companies with essential details for processing claims and ensuring compliance with state regulations. The Illinois report must also be submitted within a specific timeframe following the accident.

The Michigan UD-10 form is comparable as well. This form is used for reporting accidents in Michigan and shares many similarities with the SR21, including the need for detailed driver and vehicle information. Both forms require submission within a set period, typically 10 days, and aim to facilitate the reporting process for law enforcement and insurance purposes.

In the realm of establishing clear operational guidelines, an essential document that many businesses consider is the Operating Agreement. This document not only delineates the responsibilities of members within a Limited Liability Company but also sets a solid framework for decision-making processes. For those looking to understand more about such legal necessities, resources like UsaLawDocs.com provide valuable insights and templates that can simplify the process of creating this crucial agreement.

Lastly, the Ohio Motor Vehicle Accident Report has similarities with the Indiana SR21. This form is used to report accidents that result in injury or significant property damage. Both forms require comprehensive details about the accident and the parties involved. The Ohio report also mandates submission within a specific timeframe and includes sections for insurance verification, aligning closely with the requirements of the SR21.

FAQ

What is the Indiana SR21 form?

The Indiana SR21 form, also known as the Operator’s Proof of Insurance/Crash Report, is a document that must be completed after a motor vehicle collision that results in injury, death, or property damage of $1,000 or more. This form serves to report the details of the crash to the Bureau of Motor Vehicles (BMV) and is essential for compliance with state laws regarding motor vehicle accidents.

When do I need to submit the SR21 form?

You are required to submit the SR21 form within 10 days of a collision that results in injury, death, or property damage exceeding $1,000. It is important to adhere to this timeline to avoid potential penalties, such as suspension or revocation of your driver's license or vehicle registration.

Who needs to fill out the SR21 form?

The driver of any motor vehicle involved in the crash must complete the form. If the driver is unable to do so due to physical incapacity, any occupant of the vehicle is responsible for filling out the report. Additionally, witnesses may also be required to report the incident if necessary.

What information do I need to provide on the SR21 form?

When completing the SR21 form, you will need to provide detailed information, including the date and time of the collision, the names and addresses of all drivers involved, their driver's license numbers, and vehicle information. You will also need to indicate if the police reported the incident and provide the name of the reporting officer.

What if I was insured at the time of the collision?

If you had insurance at the time of the crash, it is mandatory to obtain the signature of your insurance agent on the form. This signature serves as verification that you were insured during the incident. If this signature is omitted, it will be assumed that you were not insured at the time of the collision.

Where do I send the completed SR21 form?

Once you have completed the SR21 form, it should be mailed to the Bureau of Motor Vehicles at the following address: P.O. Box 7169, Indianapolis, IN 46207. It is crucial to send the form to this address and not to the county where the crash occurred.

Is the information on the SR21 form confidential?

Yes, the information provided on the SR21 form is confidential. By law, it cannot be used as evidence in any trial. This confidentiality helps protect the privacy of those involved in the accident while still allowing for necessary data collection for safety and regulatory purposes.

Common mistakes

Filling out the Indiana SR21 form can be a straightforward process, but many people make common mistakes that can lead to delays or complications. One frequent error is not providing complete information. Each section of the form is essential, and leaving out details, such as the driver’s license number or the insurance policy number, can cause problems. Make sure to double-check that all fields are filled out accurately.

Another mistake often seen is using the wrong ink color. The instructions clearly state to complete the form in black or blue ink. Using any other color can lead to issues with legibility or processing. It's a small detail, but it matters a lot.

Many individuals also forget to print all information in capital letters. This requirement helps ensure that the information is clear and easy to read. Failing to do so might result in misunderstandings or misinterpretations of the data provided.

Some people mistakenly believe that they can submit the form without their insurance agent's signature if they had insurance at the time of the collision. This is not the case. The form must include the signature of the insurance agent to verify that the driver was insured. Without it, the form may be deemed incomplete.

Additionally, individuals often overlook the requirement to report the collision within ten days. If you wait too long, you risk penalties, including possible suspension of your driver’s license. Timeliness is crucial, so mark your calendar to ensure you meet this deadline.

Another common error is failing to list all other drivers involved in the collision. It's essential to provide the names and details of all drivers, not just your own. This information is vital for processing the report accurately and efficiently.

Some people also make the mistake of not marking “unknown” or “U” for questions they cannot answer. Leaving these sections blank can lead to confusion. It’s better to indicate that you don’t know rather than leaving it empty.

Inaccurate information can also be a problem. For instance, providing the wrong collision date or location can complicate matters significantly. Take your time to ensure that all dates and places are correct before submitting the form.

Lastly, individuals sometimes fail to follow the submission instructions correctly. The form must be sent to the Bureau of Motor Vehicles, not the county where the crash occurred. Misaddressing the form can lead to delays in processing and potential legal issues.

By avoiding these common mistakes, you can ensure that your Indiana SR21 form is filled out correctly and submitted on time. Taking a little extra care can save you a lot of hassle in the long run.

Indiana Sr21 Preview

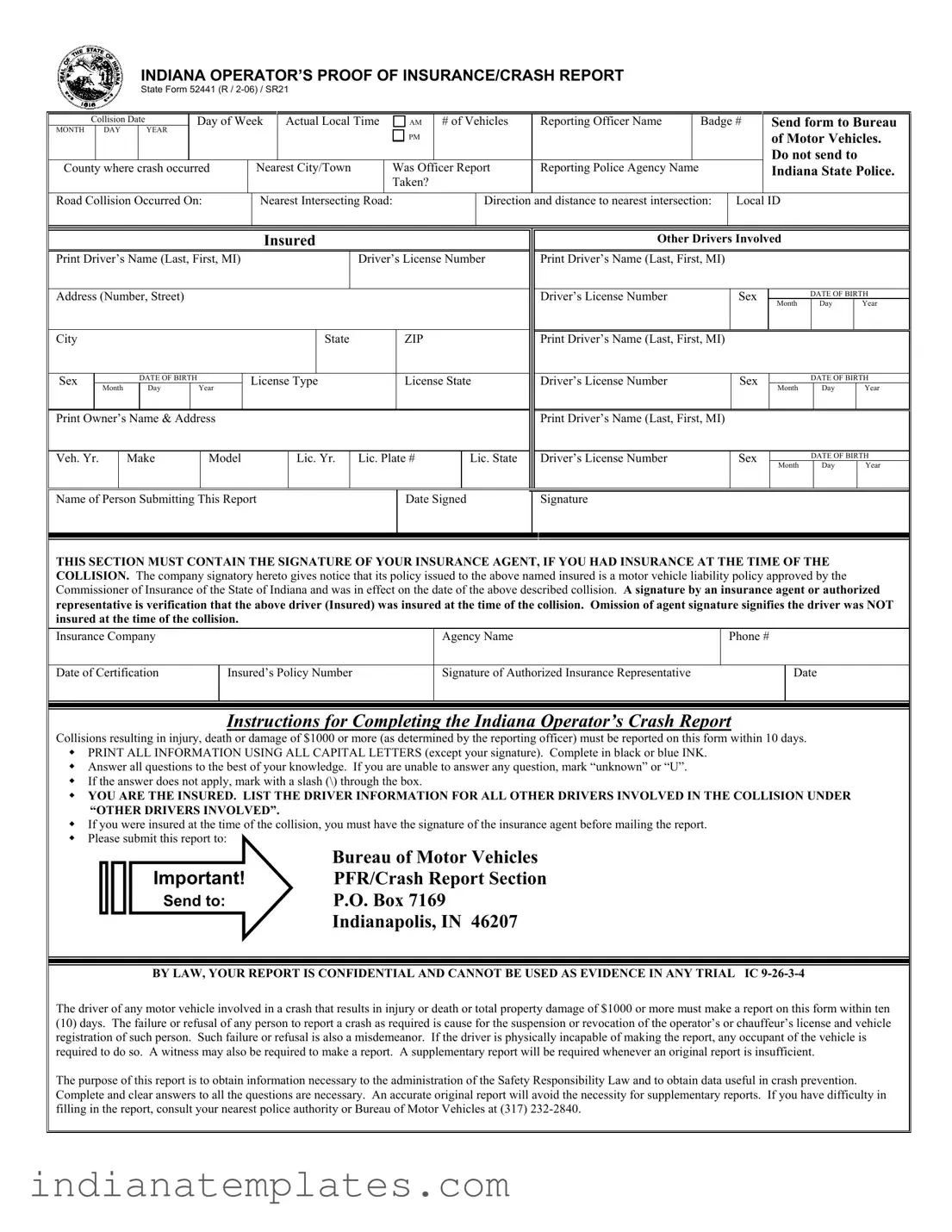

INDIANA OPERATOR’S PROOF OF INSURANCE/CRASH REPORT

STATE FORM 52441 (R /

Collision Date |

|

Day of Week |

Actual Local Time |

AM |

# of Vehicles |

Reporting Officer Name |

|

Badge # |

Send form to Bureau |

||||||

MONTH |

DAY |

|

YEAR |

|

|

|

|

PM |

|

|

|

|

|

|

of Motor Vehicles. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not send to |

County where crash occurred |

|

Nearest City/Town |

Was Officer Report |

Reporting Police Agency Name |

|

|

Indiana State Police. |

||||||||

|

|

|

|

|

|

|

|

Taken? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Road Collision Occurred On: |

|

Nearest Intersecting Road: |

|

Direction and distance to nearest intersection: |

Local ID |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Insured

Print Driver’s Name (Last, First, MI) |

|

|

|

Driver’s License Number |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Number, Street) |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

|

ZIP |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Sex |

|

|

|

DATE OF BIRTH |

|

License Type |

|

License State |

||||

|

Month |

|

Day |

|

Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Owner’s Name & Address |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|||

Veh. Yr. |

|

Make |

Model |

|

Lic. Yr. |

Lic. Plate # |

Lic. State |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Drivers Involved

Print Driver’s Name (Last, First, MI)

Driver’s License Number |

Sex |

|

DATE OF BIRTH |

|

|

|

Month |

Day |

Year |

|

|

|

|

|

Print Driver’s Name (Last, First, MI) |

|

|

|

|

|

|

|

|

|

Driver’s License Number |

Sex |

|

DATE OF BIRTH |

|

|

|

Month |

Day |

Year |

|

|

|

|

|

Print Driver’s Name (Last, First, MI) |

|

|

|

|

|

|

|

|

|

Driver’s License Number |

Sex |

|

DATE OF BIRTH |

|

|

|

Month |

Day |

Year |

|

|

|

|

|

Name of Person Submitting This Report

Date Signed

Signature

THIS SECTION MUST CONTAIN THE SIGNATURE OF YOUR INSURANCE AGENT, IF YOU HAD INSURANCE AT THE TIME OF THE COLLISION. The company signatory hereto gives notice that its policy issued to the above named insured is a motor vehicle liability policy approved by the Commissioner of Insurance of the State of Indiana and was in effect on the date of the above described collision. A signature by an insurance agent or authorized representative is verification that the above driver (Insured) was insured at the time of the collision. Omission of agent signature signifies the driver was NOT insured at the time of the collision.

Insurance Company

Agency Name

Phone #

Date of Certification

Insured’s Policy Number

Signature of Authorized Insurance Representative

Date

Instructions for Completing the Indiana Operator’s Crash Report

Collisions resulting in injury, death or damage of $1000 or more (as determined by the reporting officer) must be reported on this form within 10 days. PRINT ALL INFORMATION USING ALL CAPITAL LETTERS (except your signature). Complete in black or blue INK.

Answer all questions to the best of your knowledge. If you are unable to answer any question, mark “unknown” or “U”. If the answer does not apply, mark with a slash (\) through the box.

YOU ARE THE INSURED. LIST THE DRIVER INFORMATION FOR ALL OTHER DRIVERS INVOLVED IN THE COLLISION UNDER “OTHER DRIVERS INVOLVED”.

If you were insured at the time of the collision, you must have the signature of the insurance agent before mailing the report.

Please submit this report to:

Bureau of Motor Vehicles

Important! PFR/Crash Report Section

Send to: P.O. Box 7169

Indianapolis, IN 46207

BY LAW, YOUR REPORT IS CONFIDENTIAL AND CANNOT BE USED AS EVIDENCE IN ANY TRIAL IC

The driver of any motor vehicle involved in a crash that results in injury or death or total property damage of $1000 or more must make a report on this form within ten

(10)days. The failure or refusal of any person to report a crash as required is cause for the suspension or revocation of the operator’s or chauffeur’s license and vehicle registration of such person. Such failure or refusal is also a misdemeanor. If the driver is physically incapable of making the report, any occupant of the vehicle is required to do so. A witness may also be required to make a report. A supplementary report will be required whenever an original report is insufficient.

The purpose of this report is to obtain information necessary to the administration of the Safety Responsibility Law and to obtain data useful in crash prevention. Complete and clear answers to all the questions are necessary. An accurate original report will avoid the necessity for supplementary reports. If you have difficulty in filling in the report, consult your nearest police authority or Bureau of Motor Vehicles at (317)

Different PDF Forms

Indiana Eviction Laws 2023 - At the bottom of the form, the plaintiff signs, affirming the claims made are true under penalty of perjury.

Guardianship Forms Indiana - Legal advice should be sought if there is confusion regarding the application or court requirements.

When considering end-of-life care, it is essential to be aware of the Maryland Do Not Resuscitate (DNR) Order, as it clearly articulates your medical preferences during emergencies. For detailed instructions and to access the necessary paperwork, including the important DNR Order, you can streamline this critical process and ensure your wishes are honored.

Indiana Sales Tax Return - Timely submission of the ST-103Dr is important for maintaining good standing with tax authorities.