Fill in Your Indiana Sf 2837 Form

Similar forms

The Indiana SF 2837 form is similar to the IRS Form SS-4, which is used to apply for an Employer Identification Number (EIN). Both forms require detailed information about the business entity, including its legal name and address. The SF 2837 specifically focuses on state unemployment tax registration, while the SS-4 is a federal requirement. However, both forms necessitate the disclosure of Social Security Numbers for verification purposes. Completing either form accurately is crucial to avoid penalties or delays in processing.

Another document that shares similarities with the Indiana SF 2837 is the IRS Form 941, the Employer's Quarterly Federal Tax Return. This form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Like the SF 2837, Form 941 requires accurate reporting of employee information and tax obligations. Both forms emphasize the importance of timely submission to avoid penalties, although they serve different tax purposes—state unemployment versus federal employment taxes.

The Indiana SF 2837 is also comparable to the Indiana Form UC-1, the Quarterly Contribution Report. This form is specifically for reporting unemployment insurance contributions owed by employers in Indiana. Both forms require the disclosure of the business's Federal Employer Identification Number (FEIN) and detailed information about the business operations. They are interrelated, as the information provided in the SF 2837 may directly impact the calculations made on the UC-1.

Another related document is the Indiana Business Entity Report (Form 49369). This form is filed with the Indiana Secretary of State to maintain the business's good standing. Similar to the SF 2837, it requires the legal name, address, and identification numbers of the business. Both forms play a role in ensuring compliance with state regulations, though the Business Entity Report focuses more on corporate status rather than tax obligations.

The Indiana SF 2837 can also be likened to the IRS Form 1099-MISC, which is used to report various types of income other than wages. Both forms require accurate identification of the business and its tax identification numbers. While the SF 2837 is focused on registering for state unemployment tax, the 1099-MISC is concerned with reporting payments made to independent contractors. Both forms emphasize the importance of accurate reporting to avoid penalties.

In addition, the Indiana SF 2837 is similar to the Indiana Employment Verification Form. This document is used to verify employment eligibility for workers in Indiana. Both forms require the disclosure of the employer's identification information and aim to ensure compliance with state regulations. They are essential for maintaining accurate records regarding employment and tax obligations, although they serve different purposes in the employment process.

To ensure a smooth transaction, consider using our streamlined Boat Bill of Sale template for Missouri which outlines the necessary details for the sale and protects both parties involved.

Lastly, the Indiana SF 2837 shares characteristics with the Indiana Sales Tax Application (Form ST-1). Both forms require the business to provide its legal name, address, and identification numbers. While the SF 2837 is focused on unemployment tax registration, the ST-1 is for sales tax collection. Both forms are critical for compliance with Indiana's tax laws and require accurate and timely submission to avoid penalties.

FAQ

What is the purpose of the Indiana SF 2837 form?

The Indiana SF 2837 form, also known as the SUTA Account Number Application and Disclosure Statement, is used by employers to register for a State Unemployment Tax Act (SUTA) account. This form collects essential information about the business, including its legal name, address, and federal employer identification number (FEIN). It ensures that the Indiana Department of Workforce Development can accurately track unemployment contributions and liabilities. Completing this form is crucial for employers who wish to comply with state regulations regarding unemployment insurance.

Who needs to fill out the SF 2837 form?

Any business entity that has employees in Indiana and is liable for unemployment insurance must complete the SF 2837 form. This includes various types of organizations, such as corporations, partnerships, and sole proprietorships. Additionally, specific entities like government agencies or 501(c)(3) organizations may also need to register, especially if they choose to voluntarily extend their unemployment coverage. If a business is unsure of its liability status, it is advisable to consult the guidelines provided by the Indiana Department of Workforce Development.

What happens if the SF 2837 form is not submitted on time?

Timely submission of the SF 2837 form is essential. If an employer fails to register their SUTA account or complete the application accurately, they may face civil penalties as outlined in state law. These penalties can be assessed not only to the employer but also to any non-employer agents involved. To avoid complications, it is recommended that employers submit the form online by the due date of their first quarterly report. If online submission is not possible, the completed form should accompany the first quarterly contribution report.

Where can I find more information about the SF 2837 form?

For additional details regarding the SF 2837 form and the registration process, employers can visit the Indiana Department of Workforce Development’s website. The site provides comprehensive resources, including FAQs, guidelines, and contact information for assistance. Employers are encouraged to review these materials to ensure compliance with all relevant unemployment insurance regulations and to clarify any uncertainties related to their obligations.

Common mistakes

Filling out the Indiana SF 2837 form can be a daunting task, and mistakes can lead to delays or penalties. One common error is failing to provide the correct Social Security Number (SSN). Since the form explicitly states that disclosure of SSNs is mandatory, omitting this information will result in the form being processed incorrectly. It is crucial to ensure that the SSN entered is accurate and matches the registrant's records.

Another frequent mistake involves not registering the business with the Indiana Secretary of State before filling out the form. The form requires the complete, legal name of the business as registered. If this name does not match the official records, it can lead to complications. Employers should verify their registration status to avoid unnecessary issues.

Many individuals also overlook the importance of providing a valid physical address where work will be performed. The instructions specify that a PO Box is not acceptable. This address is vital for determining the business's SUTA liability. Inaccurate or incomplete address information can result in miscommunications and delays in processing.

Additionally, people often misinterpret the qualification questions in Section Two. Each question is designed to capture specific types of employment situations. Selecting multiple qualifications or answering incorrectly can lead to incorrect assessments of liability. It is essential to read each question carefully and respond accurately to avoid confusion.

Another common oversight is failing to provide the date of the first payroll payment. This date is critical for determining the business's eligibility and compliance with state regulations. Without this information, the form may be deemed incomplete, leading to potential penalties.

Moreover, individuals frequently neglect to include the name and contact information of the person responsible for the business. This section is crucial for communication during audits or investigations. Incomplete contact information can hinder the state's ability to reach out when necessary, complicating matters further.

People sometimes also forget to sign the form, which is a critical step in the submission process. A missing signature can delay processing and may require resubmission of the entire form. It is advisable to double-check that all required signatures are present before submitting.

Lastly, failing to attach necessary documentation when indicating a transfer of assets can lead to severe consequences. The form explicitly requires supporting documents for any claims of asset transfer. Not providing this information can be considered a material misrepresentation, resulting in penalties.

By being aware of these common mistakes, individuals can better navigate the completion of the Indiana SF 2837 form, ensuring a smoother registration process and compliance with state requirements.

Indiana Sf 2837 Preview

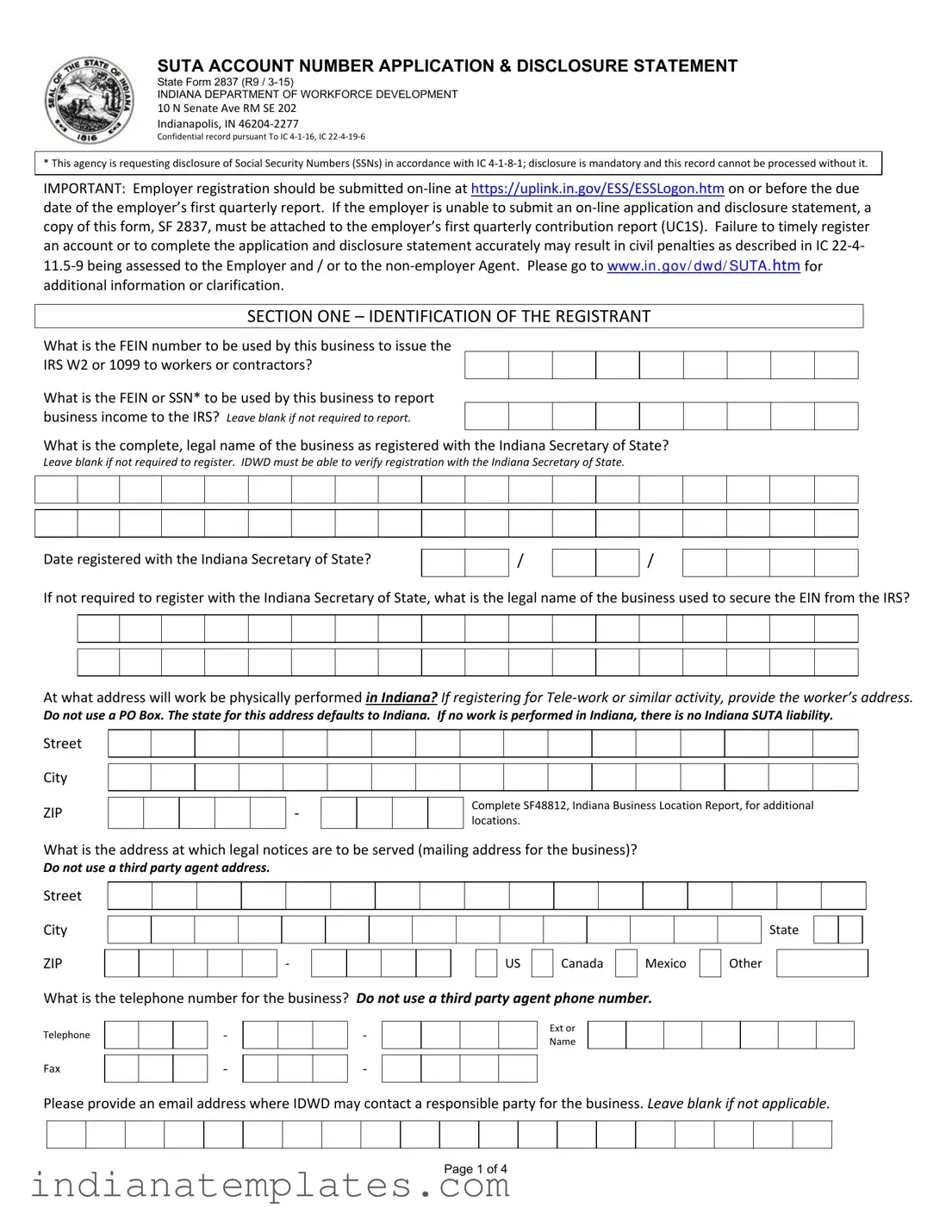

SUTA ACCOUNT NUMBER APPLICATION & DISCLOSURE STATEMENT

State Form 2837 (R9 /

INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT

10 N Senate Ave RM SE 202

Indianapolis, IN 46204‐2277

Confidential record pursuant To IC 4‐1‐16, IC 22‐4‐19‐6

* This agency is requesting disclosure of Social Security Numbers (SSNs) in accordance with IC 4‐1‐8‐1; disclosure is mandatory and this record cannot be processed without it.

IMPORTANT: Employer registration should be submitted on‐line at https://uplink.in.gov/ESS/ESSLogon.htm on or before the due date of the employer’s first quarterly report. If the employer is unable to submit an on‐line application and disclosure statement, a copy of this form, SF 2837, must be attached to the employer’s first quarterly contribution report (UC1S). Failure to timely register an account or to complete the application and disclosure statement accurately may result in civil penalties as described in IC 22‐4‐ 11.5‐9 being assessed to the Employer and / or to the non‐employer Agent. Please go to www.in . g ov / d w d / SUTA. htm for additional information or clarification.

SECTION ONE – IDENTIFICATION OF THE REGISTRANT

What is the FEIN number to be used by this business to issue the

IRS W2 or 1099 to workers or contractors?

What is the FEIN or SSN* to be used by this business to report business income to the IRS?

What is the complete, legal name of the business as registered with the Indiana Secretary of State?

Leave blank if not required to register. IDWD must be able to verify registration with the Indiana Secretary of State.

Date registered with the Indiana Secretary of State?

/

/

If not required to register with the Indiana Secretary of State, what is the legal name of the business used to secure the EIN from the IRS?

At what address will work be physically performed in Indiana? If registering for Tele‐work or similar activity, provide the worker’s address.

Do not use a PO Box. The state for this address defaults to Indiana. If no work is performed in Indiana, there is no Indiana SUTA liability.

Street

City

ZIP

‐

Complete SF48812, Indiana Business Location Report, for additional locations.

What is the address at which legal notices are to be served (mailing address for the business)?

Do not use a third party agent address.

Street

City

ZIP |

|

|

|

|

|

‐ |

|

|

|

|

|

|

|

|

US |

|

|

Canada |

|

|

Mexico |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

What is the telephone number for the business? Do not use a third party agent phone number. |

|||||||||||||||||||||||

Telephone |

|

|

|

‐ |

|

|

|

‐ |

|

|

|

|

|

|

|

|

Ext or |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Fax |

|

|

|

‐ |

|

|

|

‐ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State

Other

Please provide an email address where IDWD may contact a responsible party for the business. Leave blank if not applicable.

Page 1 of 4

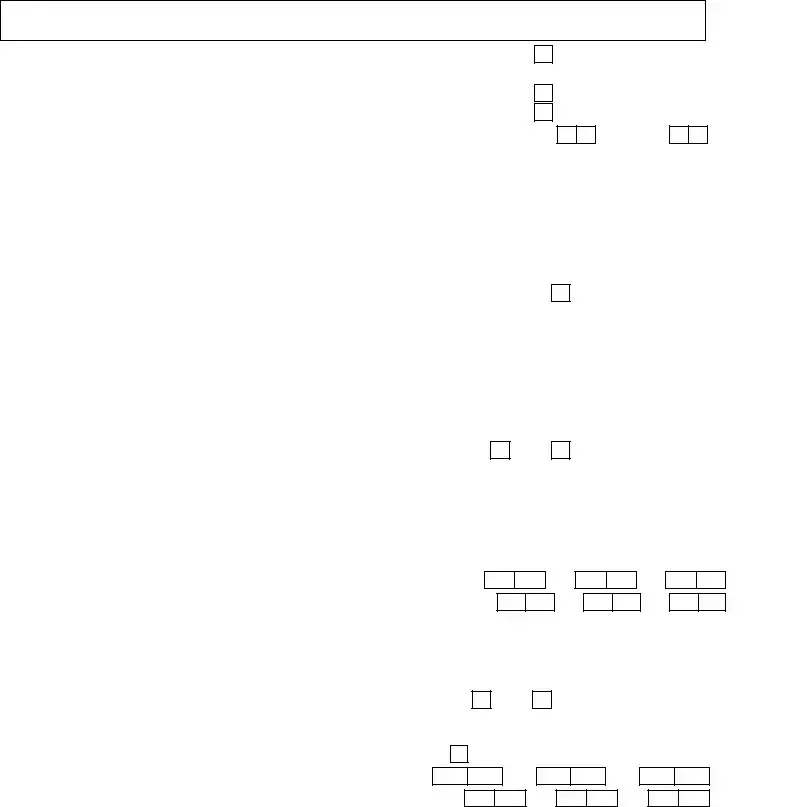

SECTION TWO – QUALIFICATION OF THE ENTITY

You can only qualify – answer yes – to one qualification type (questions 1 – 6).

1. Are you registering as a FUTA exempt organization under 26 USC 3306(c)(7) |

|

|

Yes |

||||

(government or municipality)? |

|

|

|

|

|

|

|

If Yes, select the |

|

Indiana State Agency |

|

Federal Government |

|

||

|

|

|

|||||

type of entity: |

|

Foreign/ International |

|

Other State Agency |

|

||

|

|

|

|||||

(a)On what date was the first payroll check issued to an individual not excluded under IC 22‐4‐8‐2(i)(2):

No If No, go to questions 2.

Local Government

IN Quasi‐State Agency

/ |

|

|

/ |

If you answered Yes to Question 1, have selected the type of entity, and answered 1(a), go to section 3 to complete the registration. If you are electing to make payments in lieu of contributions, you must submit this form and SF 24321 within thirty‐one (31) days of the date indicated on 1(a).

2. Are you registering as a FUTA exempt organization under 26 USC 3306(c)(8) also |

|

Yes |

|

|||||

known as 501(c)(3)? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

If Yes, are you an: |

|

Indiana Not for Profit |

|

Other State Not for Profit |

||||

(a) Are you a church or other non‐qualifying exempt organization requesting to |

|

Yes |

||||||

|

||||||||

voluntarily extend the Act? |

|

|

|

|

|

|

|

|

No If No, go to question 3.

No

IMPORTANT: Voluntary election means that you are not required to pay into the unemployment system, but that you would like to pay contributions so that your workers are insured for unemployment. Voluntary election must be made by January 31st of the year for which is it effective and is binding for a minimum of two (2) calendar years. The election remains in effect unless terminated in writing after two (2) calendar years and by January 31st of the year of revocation. Checking Yes and signing this form is an election to extend the Act per IC 22‐4‐7 and IC 22‐4‐9. If you are making a voluntary election, please go to section 3 to complete the registration. An entity voluntarily electing to extend the act under IC 22‐4‐7‐2(d) is not eligible to make payments in lieu of contributions per IC 22‐4‐10‐1.

(b)Has your 501(c)(3) had four (4) or more workers in twenty (20) different calendar weeks in the same calendar year?

Yes

No

IMPORTANT: If you answered no to the above, and you are not voluntarily extending the Act, and you are not reporting a reorganization, spin‐off, or restructuring; you are not currently liable under IC 22‐4‐7‐2. Please submit this form only once you are liable. If you become liable at any time during a calendar year, you are liable for all payroll for the entire calendar year. A qualifying 501(c)(3) will always have a minimum of two (2) quarters to report at the time they become liable. If you are registering due to a reorganization, spin‐off, or restructuring of the organization, please go to question 5.

(c)Please provide the date on which you made your first payment to any worker:

(d)Please provide the date of the 20th calendar week when you had four (4) or more workers in the same year:

/

/

/

/

If you answered Yes to Question 2(b), have selected the type of entity, and have answered questions 2(c) and 2(d) please go to section 3 to complete the registration. If you are electing to make payments in lieu of contribution, you must submit this form and SF 24321 within thirty‐one (31) days of the date indicated on 2(d).

3.Are you registering to report domestic employment in a private home, local college club or local chapter of a college fraternity or sorority with wages of $1000 or more in a single calendar quarter?

Yes

No If No, go to question 4.

If Yes, select type of entity: |

|

Home |

|

LLC |

|

Corporation |

|

|

|

|

|

|

|

(a)On what date was the first payment made to a domestic worker:

(b)On what date did total payments to domestic workers for a quarter meet or exceed $1000:

Association

/

/

/

/

If you answered Yes to Question 3, have selected the type of entity, and have answered questions 3(a) and 3(b) please go to section 3 to complete the registration.

Page 2 of 4

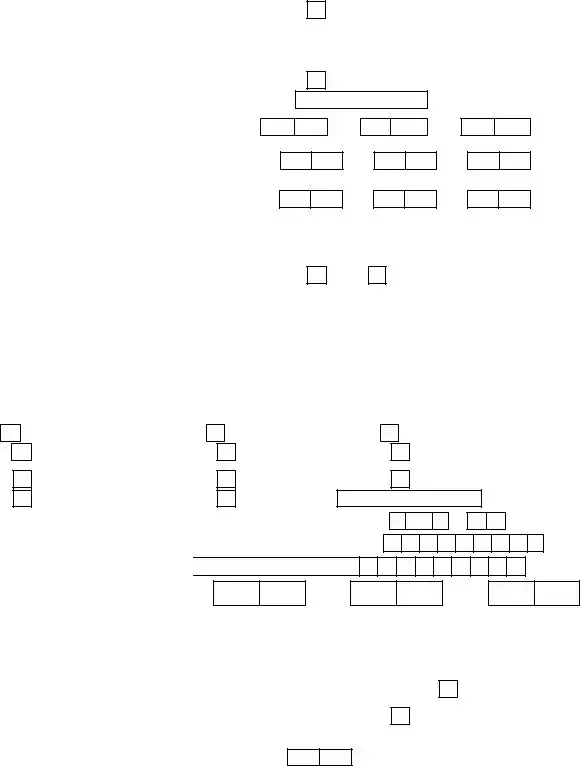

4.Are you registering to report agricultural employment of $20,000 or more in a

single calendar quarter or of ten (10) workers in twenty (20) different weeks in the same calendar year? If you are reporting the reorganization, transfer or spin‐off of an agricultural operation, please go to question 5.

If Yes, select the |

|

Proprietorship |

|

Partnership |

|

|

|

|

|

|

|

|

||

type of entity: |

|

LLC |

|

Other (specify) |

Yes |

|

No If No, go to |

|

|

question 5. |

Corporation

(a)On what date was the first payment made to a worker:

(b)On what date did total payments to workers for a quarter meet or exceed $20,000? Leave 4(b) blank if not applicable:

(c)On what date did the 10th worker perform service in the 20th week of the year? Leave 4(c) blank if not applicable:

/

/

/

/

/

/

If you answered Yes to Question 4, have selected the type of entity, and have answered questions 4(a) and 4(b) or4(c) please go to section 3 to complete the registration.

5.Are you registering to report that you have acquired, through any means, all or part of the assets of an existing Indiana business entity?

Yes

No If No, go to questions 6.

IMPORTANT: Indiana requires that a business disclose the transfer of assets, including the workforce, between businesses. Answering no to this question indicates that you did not in any way assume operational control of all or part of an existing Indiana business including the workforce. Failure to disclose transfer of operational control of assets is considered a material misrepresentation under the Act. Please attach documentation which supports the type of transfer for evaluation under IC 22‐ 4‐10 and IC 22‐4‐11.5. For a bankruptcy, you must attach the specific Order approving the sale or transfer of the assets. If you disagree with the successorship determination of the Agency, you will have fifteen (15) days to protest the initial determination in writing per IC 22‐4‐32.

Select the type that best

describes this transfer:

Select the Acquirer

entity type:

Reorganization or FEIN Change Purchase/Transfer Franchise

Proprietorship

LLC

Bankruptcy

PEO/ Leasing Agreement

Partnership

Other (specify)

Sheriff’s Sale / Foreclosure Other purchase or transfer

Corporation

(a) To the best of your knowledge, what percent of the existing business transferred?

Please provide any known information regarding the identity of the Disposer: |

|

|

FEIN |

|||||||||||||

SUTA # |

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.

%

(b) What day did operational control transfer to the acquirer?

/

/

Operational control transfers on the day that the acquirer has a legal right to direct the business operations, even if they do not immediately exercise the right.

If you answered Yes to Question 5, have selected the type of transfer, the type of entity, have answered questions 5(a) and 5(b), and have identified the disposer to the best of your ability, please go to section 3 to complete the registration.

6. Are you registering as a new business with liability for $1 or more in Indiana payroll?

If Yes, select the |

|

Proprietorship |

|

Partnership |

type of entity: |

|

LLC |

|

Other (specify) |

|

|

(a) If yes, please provide the date of your first payroll payment:

|

|

|

Yes |

No |

|||

|

|

|

|

Corporation |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

/ |

|

|

|

|

|

|

|

|

||

IMPORTANT: If you answered no to all questions, you have self evaluated as not being liable for Unemployment Insurance in Indiana at this time. Please submit this registration document only once your business has liability in Indiana for SUTA reporting and contribution

Page 3 of 4

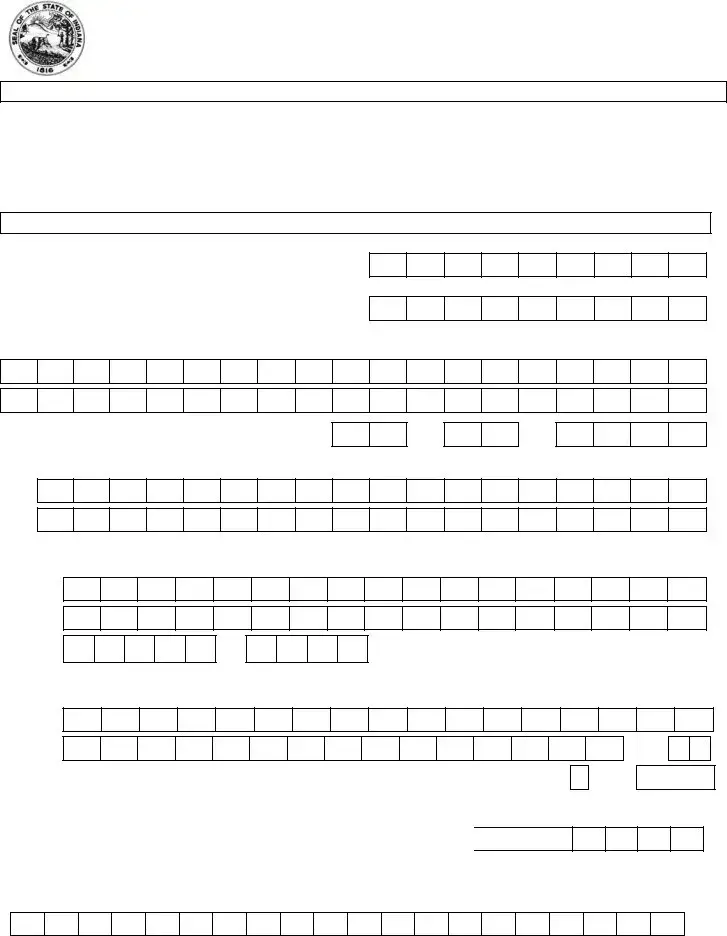

SECTION THREE – DISCLOSURES AND CERTIFICATION OF INFORMATION

Provide the name of the person in this organization that should be notified in the event of an audit or investigation. Not a third party provider

First |

|

|

|

|

|

|

|

|

Last |

Name |

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

What is this person’s Social Security Number?* Mandatory disclosure

Does this business share ownership, management, or control with any current or former Indiana Business?

Yes

No

Please identify the related business: |

SUTA # |

FEIN

Name

IMPORTANT: If you have additional business relationships to disclose, please complete the related business disclosure form SF 28804.

What is the NAICS that best describes this entity? NAICS codes can be found at http://www.census.gov/eos/www/naics/

Code

Additional Keywords

Key Word(s) / Description

Provide the name and contact information for the person who prepared this form for signature.

First

Name

Telephone

‐

Last

Name

‐

Agent

Employee

Preparer’s Signature: |

|

Date |

|

|

|

/

/

Provide the name of the person who is the responsible party for registration of this entity. Do not identify a third party Agent.

First

Name

Telephone

‐

Last

Name

‐

Title

Responsible Party’s Signature: |

|

Date |

|

|

|

/

/

IMPORTANT: By signing this form, you are certifying that the information contained herein is true and accurate to the best of your knowledge and belief. You further affirm that you are a person of sufficient authority with regard to the named entity to file this document and to bind the business by the information provided including all required attachments and disclosures as indicated.

Third party providers: This form should not contain third party provider information for any required response except the preparer signature, if applicable. Employers can designate correspondence agents or external authorized users for Indiana SUTA purposes only via ESS as described in 646 IAC 5‐2‐15. Third party providers are hereby notified that submitting this form or any ESS registration where the agent self identifies as the responsible party for the employer is specifically prohibited and is a violation of the Act as described in IC 22‐4‐11.5‐9.

Mail completed forms to: |

IDWD – Employer Status Reports |

Fax: 317‐233‐2706 |

|

10 N Senate Ave Rm SE 202 |

Questions: 800‐437‐9136 (2) |

|

Indianapolis, IN 46204‐2277 |

Handbook: www.in.gov/dwd |

Page 4 of 4

Different PDF Forms

Financial Declaration Form Indiana - Respondents must disclose all sources of income, including child support and unemployment.

Indiana State Tax Return - Attach all relevant documentation and the application fee when submitting the form.

For those looking to understand the intricacies of trailer ownership transfer, utilizing a reliable resource can be beneficial. Exploring the UsaLawDocs.com provides valuable insights and templates that facilitate the drafting of a New York Trailer Bill of Sale, ensuring all necessary details are captured accurately to support a seamless transaction.

Indiana Department of Revenue Forms - The form asks whether the MEWA operates as a non-profit organization.