Fill in Your Indiana Otp 901 Form

Similar forms

The Indiana OTP 901 form is similar to the Indiana Sales Tax Application, which is used by businesses to register for a sales tax permit. Both forms require detailed information about the business entity, including ownership structure and identification numbers. Just like the OTP 901, the Sales Tax Application must be submitted prior to commencing business operations. Both documents also emphasize the importance of compliance with state regulations, ensuring that businesses operate legally within Indiana.

The New York Residential Lease Agreement form is a critical document for renters and landlords alike, establishing clear guidelines for their rental relationship in accordance with state law. When entering into such agreements, it's vital for both parties to understand their rights and responsibilities, which is why consulting resources like UsaLawDocs.com can be highly beneficial to ensure all terms are appropriately addressed and legally binding.

Another comparable document is the Indiana Business Entity Report. This report provides essential information about a business, such as its legal name, address, and ownership structure. Similar to the OTP 901, it requires accurate details about the business's operations and its registered agents. Both documents serve to keep the state informed about business activities and ensure proper licensing, which is crucial for legal operation within the state.

The Indiana Certificate of Good Standing is also akin to the OTP 901 form. This certificate verifies that a business is compliant with state regulations and has fulfilled all necessary filing requirements. Like the OTP 901, obtaining a Certificate of Good Standing is often a prerequisite for conducting certain business activities, such as applying for loans or entering into contracts. Both documents reinforce the importance of maintaining good standing with state authorities.

Finally, the Indiana Business License Application shares similarities with the OTP 901 form. This application is essential for businesses seeking to obtain the necessary licenses to operate legally. Both forms require information about the business structure, ownership, and operational details. Additionally, they both must be submitted within specific time frames to ensure compliance with state laws, emphasizing the importance of timely submissions in maintaining a valid business license.

FAQ

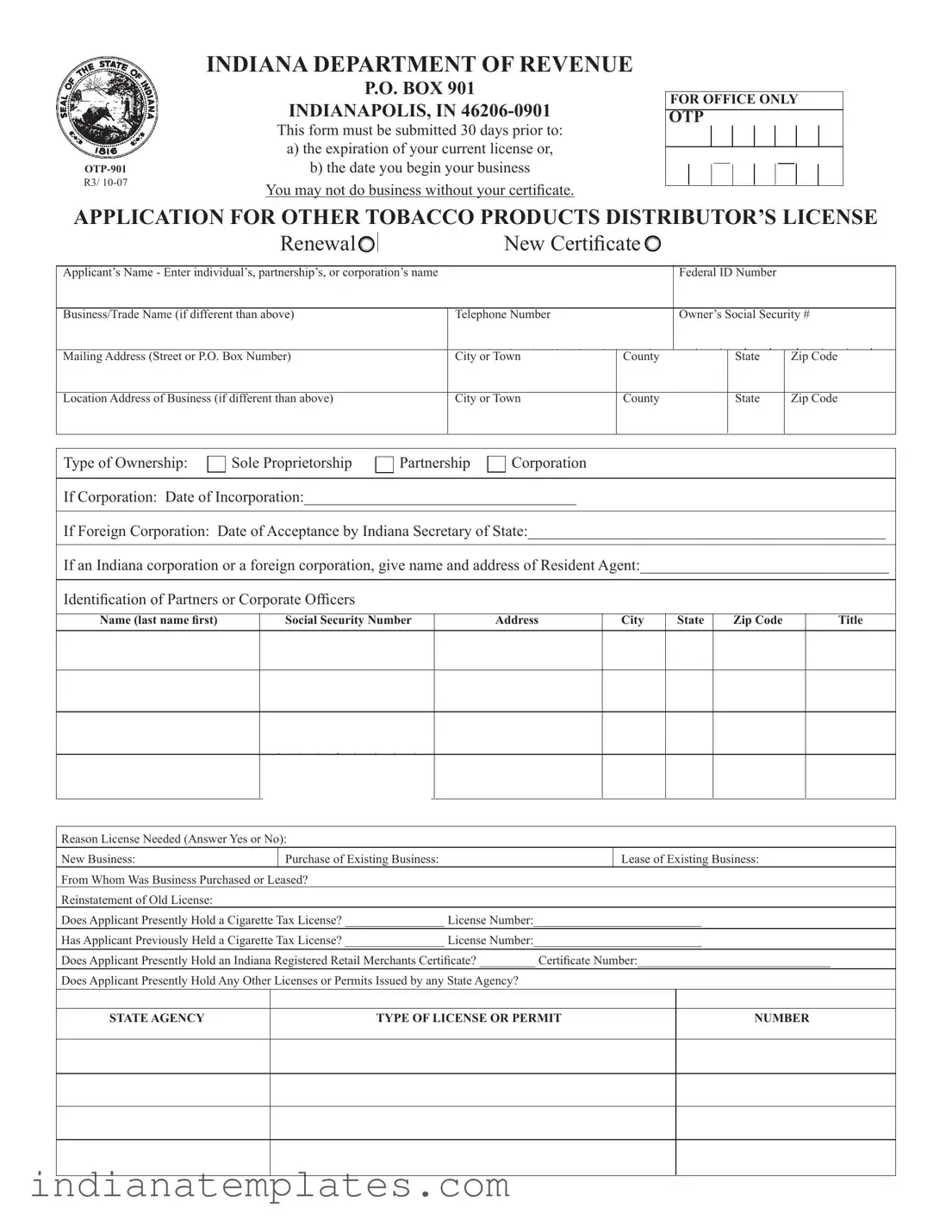

What is the Indiana OTP 901 form used for?

The Indiana OTP 901 form is an application for a distributor's license for other tobacco products. It is essential for individuals or businesses that wish to sell tobacco products in Indiana. This form must be submitted to the Indiana Department of Revenue to obtain the necessary certification to operate legally.

When should I submit the OTP 901 form?

This form must be submitted at least 30 days before either the expiration of your current license or the date you plan to begin your business. It is crucial to ensure that you have the proper certification in place before conducting any business activities involving tobacco products.

Who needs to fill out the OTP 901 form?

What information is required on the OTP 901 form?

The form requires various details, including the applicant's name, federal ID number, business name, contact information, ownership type, and the reason for the license request. Additional information about partners or corporate officers, as well as details about existing licenses or permits, is also necessary.

What happens if I do not submit the OTP 901 form on time?

Failing to submit the OTP 901 form within the required timeframe can result in the inability to legally conduct business involving tobacco products. You may face penalties or delays in obtaining your license, which could hinder your business operations.

Is there a fee associated with the OTP 901 form?

While the form itself does not specify a fee, there may be associated costs for obtaining a distributor's license. It is advisable to check with the Indiana Department of Revenue for any applicable fees and payment methods.

Can I apply for a renewal of my license using the OTP 901 form?

Yes, the OTP 901 form can be used to apply for a renewal of your existing distributor's license. Ensure that you complete the form accurately and submit it before the expiration date of your current license to avoid any interruptions in your business activities.

What should I do if I need assistance with the OTP 901 form?

If you require assistance while completing the OTP 901 form, you may consider reaching out to the Indiana Department of Revenue directly. They can provide guidance and clarify any questions you may have about the form or the application process.

Where can I find the OTP 901 form?

The OTP 901 form can be obtained from the Indiana Department of Revenue's website or by visiting their office. It is important to ensure that you are using the most current version of the form to avoid any issues during the application process.

Common mistakes

Filling out the Indiana OTP 901 form can be a straightforward process, but there are common mistakes that applicants often make. One frequent error is not submitting the form on time. The Indiana Department of Revenue requires that this form be submitted at least 30 days before the expiration of a current license or the start date of a new business. Missing this deadline can lead to delays in obtaining the necessary license, which may hinder business operations.

Another mistake is failing to provide complete and accurate information. Applicants often overlook sections such as the identification of partners or corporate officers. Each officer's name, Social Security number, and address must be included. Incomplete information can result in processing delays or even denial of the application.

Many applicants also forget to indicate the reason for needing the license. This section requires a simple "Yes" or "No" answer regarding whether the application is for a new business, purchase of an existing business, or other reasons. Neglecting to answer this question can create confusion and may delay the review process.

Additionally, applicants sometimes fail to include necessary supporting documents. For example, if the business is a corporation, it’s essential to provide the date of incorporation and the name and address of the resident agent. Without these details, the application may be considered incomplete, leading to further complications.

Lastly, many people do not double-check their application for accuracy before submission. Simple mistakes, such as typos in the business name or incorrect phone numbers, can cause significant issues. It is crucial to review the form thoroughly to ensure that all information is correct and up to date. Taking the time to avoid these common pitfalls can save applicants from unnecessary headaches and delays in obtaining their tobacco products distributor’s license.

Indiana Otp 901 Preview

INDIANA DEPARTMENT OF REVENUE

R3/

P.O. BOX 901

INDIANAPOLIS, IN

This form must be submitted 30 days prior to:

a)the expiration of your current license or,

b)the date you begin your business

You may not do business without your certificate.

FOR OFFICE ONLY

OTP

APPLICATION FOR OTHER TOBACCO PRODUCTS DISTRIBUTOR’S LICENSE

|

|

Renewal |

|

|

|

|

New Certificate |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Applicant’s Name - Enter individual’s, partnership’s, or corporation’s name |

|

|

|

|

|

|

Federal ID Number |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business/Trade Name (if different than above) |

|

|

|

Telephone Number |

|

|

|

Owner’s Social Security # |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address (Street or P.O. Box Number) |

|

|

|

City or Town |

County |

|

|

State |

Zip Code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location Address of Business (if different than above) |

|

|

|

City or Town |

County |

|

|

State |

Zip Code |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Ownership: |

|

Sole Proprietorship |

|

|

Partnership |

|

Corporation |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

If Corporation: Date of Incorporation:___________________________________

If Foreign Corporation: Date of Acceptance by Indiana Secretary of State:______________________________________________

If an Indiana corporation or a foreign corporation, give name and address of Resident Agent:________________________________

Identifi cation of Partners or Corporate Officers

Name (last name fi rst)

Social Security Number

Address

City

State |

Zip Code |

|

|

Title

Reason License Needed (Answer Yes or No):

New Business: |

Purchase of Existing Business: |

Lease of Existing Business: |

From Whom Was Business Purchased or Leased?

Reinstatement of Old License:

Does Applicant Presently Hold a Cigarette Tax License? ________________ License Number:___________________________

Has Applicant Previously Held a Cigarette Tax License? ________________ License Number:___________________________

Does Applicant Presently Hold an Indiana Registered Retail Merchants Certifi cate? _________ Certificate Number:_______________________________

Does Applicant Presently Hold Any Other Licenses or Permits Issued by any State Agency?

STATE AGENCY

TYPE OF LICENSE OR PERMIT

NUMBER

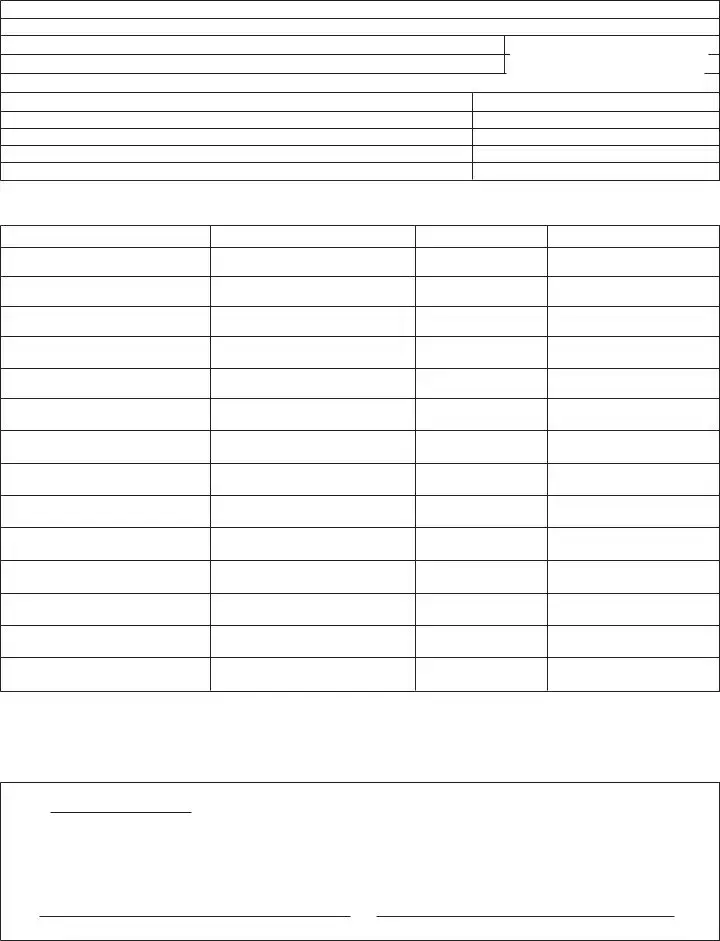

Audit Information:

Location Where Records Will Be Available For Audit:

Phone Number of Location Of Audit Records:

Phone Number of Business Location:

Indicate Address of Each Location In Which You Have Other Tobacco Products in Storage

Location

OTP License Number

Indicate Name, Address, Phone Number and Estimated Annual Purchases from Whom You Currently Purchase and/or Expect to Purchase Other Tobacco Products: (A Computer Generated List Which Includes All Requested Information Will Be Accepted)

Supplier’s Name

Address

Phone Number

Estimated Annual Purchases

TOTAL:

If Necessary Attach Additional List.

Does Your Company Expect to Sell Other Tobacco Products Into Another State?___________________________________________________________________

List States: _________________________________________________________________________________________________________________________

Today’s Date

I declare under penalties of perjury that the information contained in this application and any attachments is true, correct and complete to the best of my knowledge and belief.

Signature of Taxpayer or Authorized Agent, Title |

Telephone Number |

Different PDF Forms

Indiana Oversize Permits Online - Companies must maintain records of all permits issued under the M203 form for accountability.

For those looking to simplify their transactions, an important resource is the Missouri Boat Bill of Sale document, which serves as a vital tool for ensuring a smooth transfer of boat ownership.

Bob Evans 401k - W-2 forms are essential for filing your annual income tax return.