Fill in Your Indiana Np 20 Form

Similar forms

The Indiana NP-20 form is similar to the IRS Form 990, which is used by tax-exempt organizations to report their financial information. Both forms require organizations to disclose details about their operations, governance, and financial activities. They serve to ensure transparency and compliance with tax regulations. The NP-20 form specifically caters to Indiana nonprofit organizations, while Form 990 is a federal requirement. Both documents also require the signature of an authorized officer, affirming the accuracy of the information provided.

Another document that shares similarities with the NP-20 is the Indiana IT-20NP form. This form is specifically for nonprofit organizations that have unrelated business income exceeding $1,000. Like the NP-20, the IT-20NP requires detailed financial reporting and disclosure of the organization’s activities. Both forms aim to ensure that nonprofits comply with state and federal tax laws, particularly regarding income that is not related to their primary mission. Organizations must file both forms if they meet the necessary criteria.

If you are involved in a transaction, the helpful boat bill of sale guide can simplify the process and provide necessary documentation for both parties to protect their interests.

The Form 990-EZ is another document comparable to the NP-20. This form is a simplified version of the standard Form 990 and is designed for smaller tax-exempt organizations. Both forms require the organization to provide information about their finances, governance, and mission. However, the Form 990-EZ is typically used by organizations with gross receipts under a certain threshold, making it less complex than the NP-20. Despite the differences in complexity, both forms aim to maintain transparency in nonprofit operations.

Lastly, the Indiana Annual Report form serves a similar purpose to the NP-20. This form is required for all business entities in Indiana, including nonprofits, to report their current status and any changes in their structure. While the NP-20 focuses specifically on financial and operational details relevant to tax-exempt status, the Annual Report is broader and includes general information about the organization. Both forms must be filed annually, ensuring that the state has up-to-date information about the organization’s activities and structure.

FAQ

What is the Indiana NP-20 form used for?

The Indiana NP-20 form is the annual report required for nonprofit organizations operating in Indiana. It provides essential information about the organization, including its contact details, purpose, and any changes to governing documents. This form must be submitted to the Indiana Department of Revenue to ensure compliance with state regulations.

When is the NP-20 form due?

The NP-20 form is due on the 15th day of the 5th month following the end of the organization’s tax year. For example, if your organization’s tax year ends on December 31, the form must be filed by May 15 of the following year. It is important to meet this deadline to avoid potential penalties.

What should be included with the NP-20 form?

When submitting the NP-20 form, organizations must attach a completed copy of their federal return, which can be Form 990, 990EZ, or 990PF. Additionally, if the organization has unrelated business income exceeding $1,000, it must also file Form IT-20NP. A schedule listing current officers and any changes to governing instruments should also be included.

Is there a fee associated with filing the NP-20 form?

No fee is required for filing the Indiana NP-20 form. Organizations can submit the form without incurring any charges, making it accessible for nonprofits to maintain compliance with state reporting requirements.

Common mistakes

Filling out the Indiana NP-20 form can be a straightforward task, but many people make common mistakes that can lead to delays or complications. Understanding these pitfalls can help ensure a smooth filing process.

One frequent mistake is neglecting to check the appropriate box for changes in address or report status. If your organization has moved or is submitting an amended report, indicating this clearly is crucial. Failing to do so may result in confusion or miscommunication with the Indiana Department of Revenue.

Another common error involves not providing a complete and accurate Federal Employer Identification Number (FEIN). This number is essential for identifying your organization, and missing or incorrect information can lead to processing delays. Double-check this number before submitting your form.

Many organizations also forget to attach the required federal return, such as Form 990, 990EZ, or 990PF. If your organization has unrelated business income exceeding $1,000, you must file Form IT-20NP as well. Omitting these documents can lead to penalties or additional inquiries.

When it comes to the current information section, some people overlook the need to indicate the number of years the organization has been in existence. This detail helps the state understand the stability and history of your nonprofit. Leaving this blank can raise questions about your organization’s legitimacy.

Changes to governing documents, like bylaws or articles of incorporation, must be reported. If there have been any updates that haven’t been previously communicated, you must attach a detailed description of those changes. Failing to disclose this information could result in compliance issues down the line.

Another mistake involves not providing a complete list of current officers. The NP-20 form requires you to attach a schedule with names, titles, and addresses. This information is vital for transparency and accountability, so ensure that it is thorough and accurate.

When describing your organization’s mission, some individuals write vague or overly complex statements. Clarity is key. A concise and straightforward description helps the state understand your purpose and can prevent misunderstandings.

People often forget to include a daytime telephone number for the contact person listed on the form. This number is essential for any follow-up questions or clarifications the Department of Revenue may have. Make sure it’s accurate and easy to read.

Lastly, don’t overlook the declaration statement at the bottom of the form. This section requires a signature from an officer or trustee. Skipping this step can render your submission invalid, leading to unnecessary delays. Always double-check that this is signed and dated.

By being aware of these common mistakes, you can enhance the accuracy of your NP-20 form submission. Taking the time to review each section carefully will save you from potential headaches and ensure your organization remains in good standing with the state.

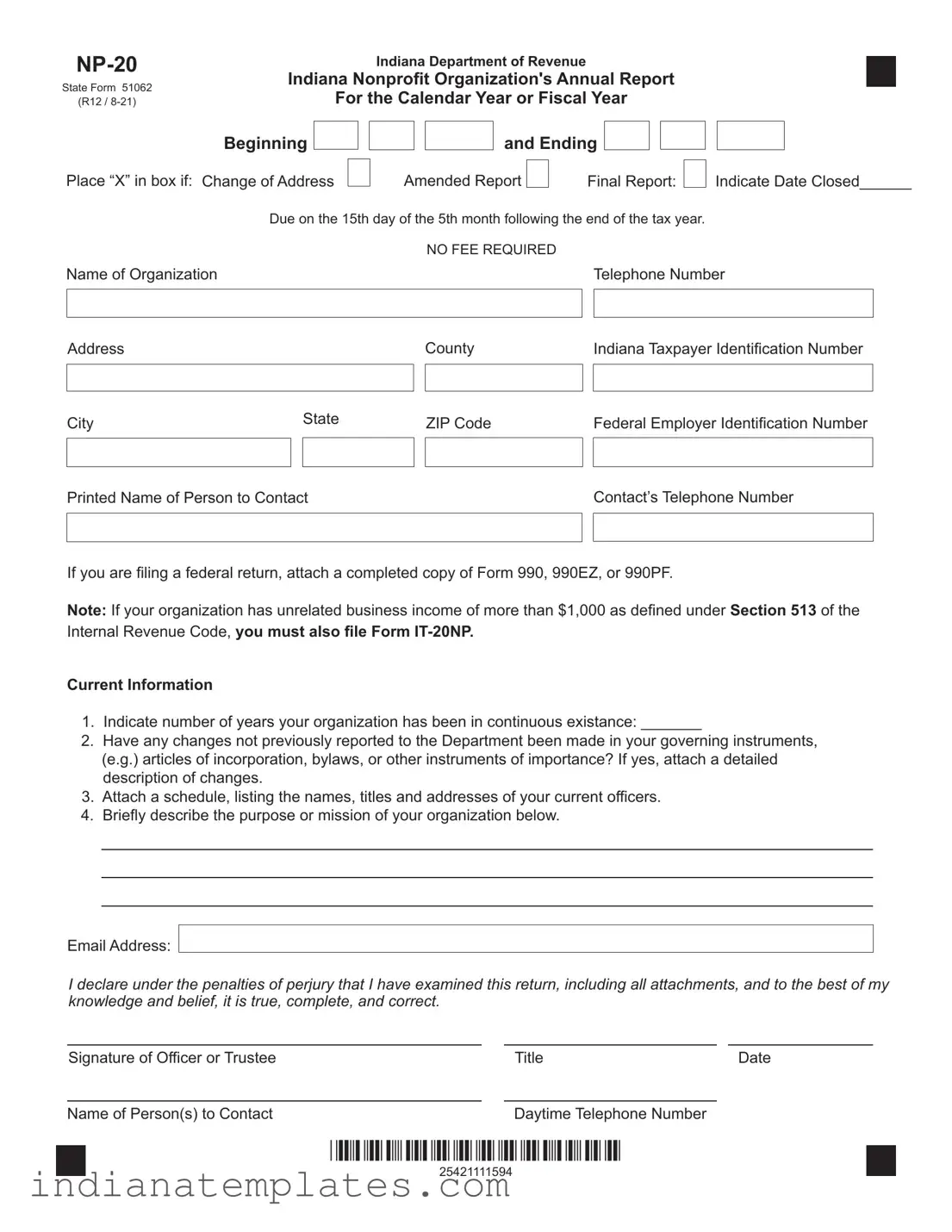

Indiana Np 20 Preview

|

|

|

|

|

Indiana Department of Revenue |

|

|

|

|

|

||||||

State Form 51062 |

Indiana Nonprofit Organization's Annual Report |

|||||||||||||||

(R12 / |

|

|

For the Calendar Year or Fiscal Year |

|||||||||||||

|

Beginning |

|

|

|

|

|

|

|

and Ending |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Place “X” in box if: Change of Address |

|

|

|

|

|

|

|

|

||||||||

|

|

|

Amended Report |

|

|

Final Report: |

|

|||||||||

Indicate Date Closed______

Due on the 15th day of the 5th month following the end of the tax year.

|

|

|

|

NO FEE REQUIRED |

|

|

Name of Organization |

|

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

County |

|

Indiana Taxpayer Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

ZIP Code |

|

Federal Employer Identification Number |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed Name of Person to Contact |

|

|

Contact’s Telephone Number |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you are filing a federal return, attach a completed copy of Form 990, 990EZ, or 990PF.

Note: If your organization has unrelated business income of more than $1,000 as defined under Section 513 of the

Internal Revenue Code, you must also file Form

Current Information

1.Indicate number of years your organization has been in continuous existance: _______

2.Have any changes not previously reported to the Department been made in your governing instruments, (e.g.) articles of incorporation, bylaws, or other instruments of importance? If yes, attach a detailed description of changes.

3.Attach a schedule, listing the names, titles and addresses of your current officers.

4.Briefly describe the purpose or mission of your organization below.

Email Address:

I declare under the penalties of perjury that I have examined this return, including all attachments, and to the best of my knowledge and belief, it is true, complete, and correct.

Signature of Officer or Trustee |

Title |

Date |

|

|

|

|

|

Name of Person(s) to Contact |

Daytime Telephone Number |

|

|

*25421111594*

25421111594

Different PDF Forms

Snap Self Employment Form - Costs are to be recorded for each corresponding day in the month.

The New York Residential Lease Agreement form is essential for any rental arrangement, as it clearly outlines the rights and obligations of both the landlord and the tenant. By defining key terms such as rent, duration, and conditions of the living space, this legal document protects the interests of both parties under New York law. For more information on obtaining this form, visit UsaLawDocs.com.

It 40 - Be mindful to round entries as instructed on the form.

Ccdf Meaning - This application form is essential for accessing child care assistance.