Fill in Your Indiana M400 Form

Similar forms

The Indiana M400 form is similar to the IRS Form 5500, which is used by employee benefit plans to report information about their financial condition, investments, and operations. Both forms require detailed information about the organization, including its structure and governance. Just like the M400, the Form 5500 mandates that organizations certify the accuracy of the information provided. This ensures transparency and accountability in how employee benefits are managed, making it essential for compliance with federal regulations.

For those interested in safeguarding their future, understanding the Durable Power of Attorney options is crucial. A well-prepared document can grant authority to a trusted individual to handle decisions in times of incapacity. You might find valuable resources, such as a "guide to crafting your Durable Power of Attorney," on this site: Durable Power of Attorney.

Another document that shares similarities with the M400 is the Department of Labor’s Form 990. This form is used by tax-exempt organizations to provide the IRS with information about their financial activities. Both forms require organizations to disclose their governance structures and financial health. Additionally, both forms necessitate a certification of truthfulness from an authorized individual, reinforcing the importance of accurate reporting in maintaining trust and compliance with regulatory standards.

The M400 also resembles the state-level application for a Certificate of Authority, which is required for entities looking to operate as insurance providers. Like the M400, this application demands comprehensive information about the organization, including its address, contact details, and the nature of its business activities. Both documents aim to ensure that the organizations meet specific legal requirements before they can offer benefits or insurance products to employees, thereby protecting consumers and maintaining market integrity.

Lastly, the Employee Retirement Income Security Act (ERISA) plan document is akin to the M400 in that it outlines the terms and conditions of employee benefit plans. Both documents require detailed information about the plan’s structure, governance, and financial status. They also emphasize the importance of compliance with applicable laws and regulations. By requiring organizations to provide this information, both documents help ensure that employees receive the benefits they are entitled to while maintaining the integrity of the employee benefit system.

FAQ

What is the Indiana M400 form?

The Indiana M400 form is a renewal application specifically designed for the registration of Multiple Employer Welfare Arrangements (MEWAs). A MEWA is an entity that provides employee benefit plans, such as accident and sickness or death benefits, for the employees of at least two employers, which may include self-employed individuals and their dependents. This form is essential for ensuring compliance with Indiana state regulations regarding employee benefits.

Who needs to fill out the M400 form?

Any organization that operates as a Multiple Employer Welfare Arrangement in Indiana must complete the M400 form. This includes groups of employers who come together to provide health benefits to their employees. If there have been changes to the MEWA's information or documentation since the last application, the organization must also provide updated details on this form.

What information is required on the M400 form?

The M400 form requires several pieces of information. Applicants must provide the full name of the MEWA, its statutory home address, and its mailing address. Additionally, the form asks for the contact person's details, including their title and telephone number. Other important questions address the association of employers, fiscal year changes, non-profit status, and whether there is a contract with a third-party administrator.

What certifications must be made on the M400 form?

Applicants must certify that there have been no changes to the application information submitted in the previous year. If changes have occurred, the applicant must attach the revised documentation. This certification ensures that the information provided is accurate and up-to-date, which is crucial for regulatory compliance.

What happens if there are changes to the MEWA's information?

If there have been changes to the MEWA's information since the last application, the applicant must indicate this on the form and provide the necessary revised documentation. It is important to keep the state informed of any changes to ensure that the MEWA remains in good standing and compliant with state laws.

Is there a fee associated with submitting the M400 form?

While the M400 form itself does not specify a fee, there may be associated costs for processing the application or for maintaining the MEWA's registration. It is advisable to check with the Indiana Department of Insurance for any applicable fees or additional requirements that may be in place.

How can I submit the M400 form?

The M400 form can typically be submitted through the Indiana Department of Insurance's website or by mail. Ensure that all required information is completed accurately, and attach any necessary documentation before submission. It is also recommended to keep a copy of the submitted form for your records.

Common mistakes

Filling out the Indiana M400 form can be straightforward, but many applicants make common mistakes that can delay the process. One frequent error is failing to update information. If there have been changes to the application information or documentation since the last submission, it’s essential to check the box indicating those changes and attach the revised documentation. Neglecting to do this can lead to confusion and potential denial of the application.

Another mistake involves providing incorrect addresses. The form requires both the statutory home address and the mailing address of the Multiple Employer Welfare Arrangement (MEWA). Ensure that these addresses are accurate and complete, including street, city, state, and ZIP code. An incomplete address can cause important correspondence to be misdirected.

Many applicants overlook the requirement for a contact person. This individual should be designated clearly on the form, along with their title and telephone number. Not including this information can make it difficult for the reviewing authority to reach out for any necessary clarifications or additional information.

Some applicants also fail to address the questions about the association’s involvement and the MEWA’s status as a non-profit organization. These sections require clear answers. If the MEWA is not a non-profit, or if the association is not substantially involved in activities beyond sponsorship, these must be explained. Providing vague or incomplete answers can lead to misunderstandings.

Finally, applicants often forget to include the signature of the Chair of the Board and the date on the form. This step is crucial, as an unsigned application may be considered invalid. Always double-check that the signature and date are present before submitting the form.

Indiana M400 Preview

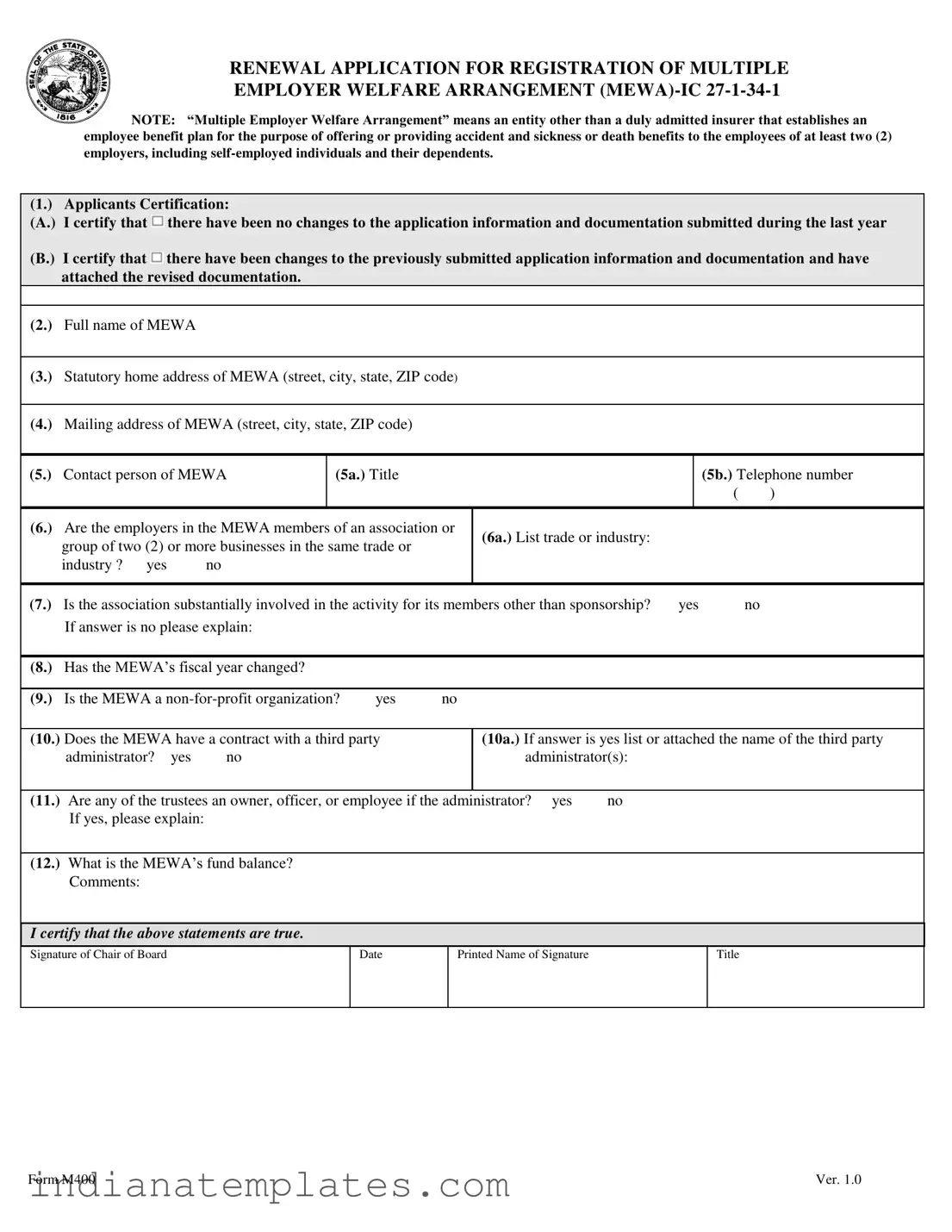

RENEWAL APPLICATION FOR REGISTRATION OF MULTIPLE

EMPLOYER WELFARE ARRANGEMENT

NOTE: “Multiple Employer Welfare Arrangement” means an entity other than a duly admitted insurer that establishes an employee benefit plan for the purpose of offering or providing accident and sickness or death benefits to the employees of at least two (2) employers, including

(1.) |

Applicants Certification: |

|

|

|

|

|

|

|

|

|

|

|||

(A.) |

I certify that |

there have been no changes to the application information and documentation submitted during the last year |

||||||||||||

|

|

|

|

|

|

|

|

|

||||||

(B.) |

I certify that |

there have been changes to the previously submitted application information and documentation and have |

||||||||||||

|

attached the revised documentation. |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(2.) |

Full name of MEWA |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||||

(3.) |

Statutory home address of MEWA (street, city, state, ZIP code) |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||

(4.) |

Mailing address of MEWA (street, city, state, ZIP code) |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

(5.) |

Contact person of MEWA |

(5a.) Title |

|

|

|

|

|

(5b.) Telephone number |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

(6.) |

Are the employers in the MEWA members of an association or |

(6a.) List trade or industry: |

|

|

|

|

||||||||

|

group of two (2) or more businesses in the same trade or |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

||||||

|

industry ? |

yes |

|

no |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

(7.) |

Is the association substantially involved in the activity for its members other than sponsorship? |

yes |

no |

|||||||||||

|

If answer is no please explain: |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

(8.) |

Has the MEWA’s fiscal year changed? |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||

(9.) |

Is the MEWA a |

yes |

no |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||||||

(10.) Does the MEWA have a contract with a third party |

|

|

(10a.) If answer is yes list or attached the name of the third party |

|||||||||||

|

administrator? |

yes |

no |

|

|

|

|

administrator(s): |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||||

(11.) |

Are any of the trustees an owner, officer, or employee if the administrator? yes |

no |

|

|

|

|

||||||||

|

If yes, please explain: |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

(12.) |

What is the MEWA’s fund balance? |

|

|

|

|

|

|

|

|

|

|

|||

|

Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

I certify that the above statements are true. |

|

|

|

|

|

|

|

|

|

|

||||

Signature of Chair of Board |

|

|

|

Date |

|

Printed Name of Signature |

|

|

|

Title |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form M400 |

Ver. 1.0 |

Different PDF Forms

Indiana Oversize Permits Online - The form emphasizes the importance of adhering to proper permit application procedures to avoid issues.

Contempt of Court Indiana - It’s important to consult legal advice if you’re unsure about next steps.

In addition to its essential role in documenting the vehicle transaction, the North Carolina Motor Vehicle Bill of Sale form can be easily obtained from resources such as UsaLawDocs.com, ensuring that both buyers and sellers have the necessary documentation to facilitate a smooth registration process.

Indiana Sales Tax Return - Keep a copy of the completed form for your records.