Fill in Your Indiana Land Contract Example Form

Similar forms

The Indiana Land Contract Example form shares similarities with a traditional purchase agreement. Both documents facilitate the transfer of property from a seller to a buyer. However, while a purchase agreement typically requires the buyer to secure financing upfront, a land contract allows for gradual payments over time. This structure can be particularly beneficial for buyers who may not qualify for conventional loans, as it offers them an opportunity to invest in property without immediate full payment.

Another document akin to the Indiana Land Contract is a lease-to-own agreement. This arrangement also allows a tenant to eventually purchase the property they are renting. In a lease-to-own contract, a portion of the rent may be credited toward the purchase price, much like the payments in a land contract. However, the lease-to-own agreement often includes a specified rental period, after which the tenant must decide whether to buy the property, whereas a land contract typically has a more flexible timeline for payments.

A mortgage agreement is yet another document that bears resemblance to the Indiana Land Contract. In both cases, the buyer agrees to make payments over time in exchange for ownership of the property. However, a mortgage involves a bank or financial institution as the lender, which holds the title until the loan is fully paid. In contrast, a land contract allows the seller to retain the title until the buyer completes all payments, providing a different level of security for the seller.

The warranty deed is also similar in that it is often executed at the conclusion of a land contract. This document serves to transfer ownership from the seller to the buyer, guaranteeing that the seller holds clear title to the property. While the land contract outlines the terms of payment and responsibilities, the warranty deed finalizes the transaction and provides legal assurance of ownership, ensuring that the buyer has the right to the property free from claims.

Another related document is the promissory note, which can accompany a land contract. This note serves as a formal promise by the buyer to repay the seller the agreed-upon amount. Like the land contract, it specifies the terms of repayment, including interest rates and payment schedules. The promissory note functions as a legal instrument that reinforces the buyer's obligation to fulfill their payment duties, thus providing additional protection for the seller.

In addition, the title insurance policy is a crucial document that often parallels the Indiana Land Contract. This policy protects the buyer against potential title disputes or claims that may arise after the purchase. In a land contract, the seller may provide title insurance to assure the buyer of their ownership rights, similar to how it is used in traditional real estate transactions. This safeguard is essential for buyers, as it helps mitigate the risks associated with property ownership.

Understanding the intricacies of land contracts is vital for both buyers and sellers, and referring to reliable resources can be beneficial. For instance, the New York Residential Lease Agreement form is a legal document that outlines the rights and obligations of both the landlord and the tenant in a residential rental arrangement in New York state. This agreement is crucial for defining the terms of the lease, including rent, duration, and conditions of the living space. It serves as a binding contract that ensures both parties understand their responsibilities and are protected under New York law, a topic discussed in detail at UsaLawDocs.com.

Lastly, an escrow agreement may also be similar to the Indiana Land Contract. In both scenarios, an impartial third party may hold funds or documents until certain conditions are met. An escrow agreement ensures that the buyer's payments are securely managed and that the seller fulfills their obligations before the property title is transferred. This arrangement helps build trust between the parties and provides a structured process for completing the transaction.

FAQ

What is an Indiana Land Contract?

An Indiana Land Contract is a legal agreement between a seller and a buyer regarding the purchase of real estate. It outlines the terms of the sale, including payment details, responsibilities of both parties, and conditions under which the contract can be forfeited or terminated. This type of contract allows the buyer to take possession of the property while making payments over time, rather than paying the full purchase price upfront.

Who are the parties involved in the contract?

The contract involves two main parties: the Seller and the Purchaser. The Seller is the individual or entity selling the property, while the Purchaser is the individual or entity buying the property. Each party's name and address are specified in the contract to ensure clarity and accountability.

What are the key terms of payment in the contract?

The contract specifies the total purchase price and outlines how payments will be made. Typically, the Purchaser pays a down payment upfront, followed by monthly installments that include interest. The contract also details the interest rates applicable during normal payment periods and in the event of a default. The entire balance must be paid within a specified timeframe, ensuring that both parties understand their financial commitments.

What responsibilities does the Purchaser have?

The Purchaser has several important responsibilities. They must maintain the property, comply with local regulations, and pay all taxes and insurance premiums associated with the property. The contract may also require the Purchaser to submit proof of these payments to the Seller. Additionally, the Purchaser must keep the property in good condition and cannot make significant changes without the Seller's consent.

What happens if the Purchaser defaults on the contract?

If the Purchaser fails to meet their obligations, such as missing payments or not maintaining the property, the Seller has the right to declare the contract forfeited. This means the Seller can reclaim the property and keep any payments made by the Purchaser. The contract will specify how and when the Seller can exercise this right, ensuring that the Purchaser is aware of the potential consequences of default.

Can the Seller take out a mortgage on the property?

Yes, the Seller may encumber the property with a mortgage while the contract is in effect. However, this mortgage cannot exceed the unpaid balance of the contract. The Purchaser will be notified of any such mortgage, and they may be required to subordinate their rights to the mortgage, meaning the mortgage will take priority over the Purchaser's claims.

What is the significance of title insurance in this contract?

Title insurance is crucial as it protects the Purchaser against any future claims or issues related to the property's title. The Seller may provide a title insurance policy to the Purchaser, ensuring that the title is clear and marketable. This insurance serves as a safeguard, giving the Purchaser peace of mind regarding their investment.

How are disputes resolved under the contract?

Disputes related to the contract can be addressed through negotiation between the parties. If an agreement cannot be reached, legal action may be necessary. The contract may outline specific procedures for resolving disputes, including mediation or arbitration, to help both parties find a resolution without going to court.

Is the Indiana Land Contract legally binding?

Yes, the Indiana Land Contract is a legally binding document once both parties sign it. This means that both the Seller and the Purchaser are obligated to adhere to the terms outlined in the contract. It is essential for both parties to fully understand their rights and responsibilities before signing, as the contract will be enforceable in a court of law.

Common mistakes

Completing the Indiana Land Contract Example form can be a straightforward process, but several common mistakes can lead to complications later on. One frequent error occurs when individuals fail to provide complete and accurate information about the parties involved. The form requires the full names and addresses of both the Seller and the Purchaser. Omitting or incorrectly entering this information can create confusion and may hinder the enforceability of the contract.

Another mistake often made is neglecting to specify the property details adequately. The section for describing the premises must include specific information such as the county, state, and tax identification number. Incomplete or vague descriptions can lead to disputes over what property is actually being sold, which can complicate future transactions or legal proceedings.

Many people also overlook the importance of clearly outlining the payment terms. The contract requires the total consideration for the sale, along with the amount paid and the balance due. Failing to fill in these details accurately can result in misunderstandings regarding payment obligations. Additionally, not specifying the interest rates and monthly installment amounts can lead to financial disputes between the parties.

Lastly, individuals often forget to review the terms related to taxes and insurance. The contract stipulates that the Purchaser must keep the property insured and pay all relevant taxes. If these responsibilities are not clearly defined or if the estimated amounts are not included, it can lead to unexpected financial burdens for the Purchaser. Ensuring that these sections are completed accurately helps protect both parties' interests and clarifies their obligations under the contract.

Indiana Land Contract Example Preview

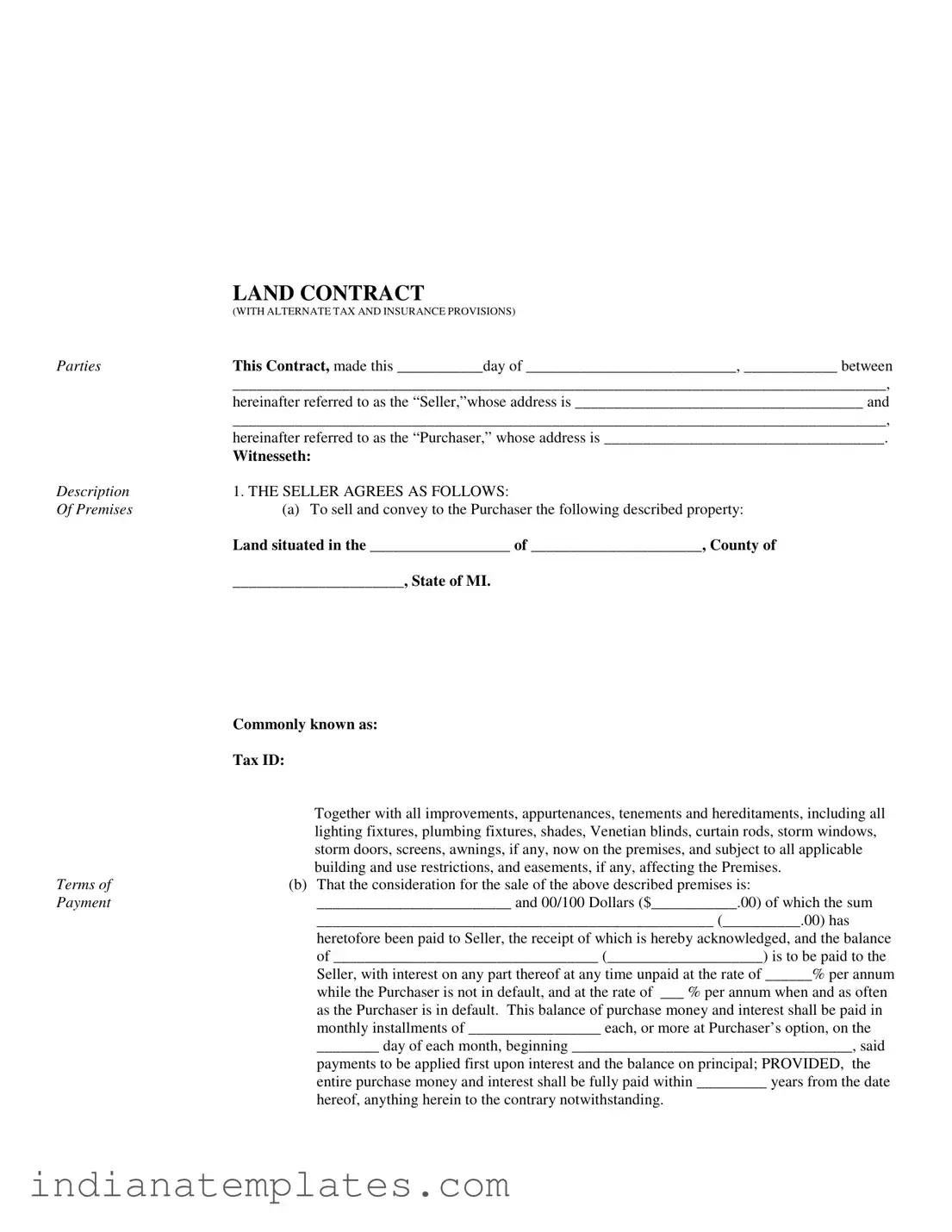

|

LAND CONTRACT |

|

(WITH ALTERNATE TAX AND INSURANCE PROVISIONS) |

Parties |

This Contract, made this ___________day of ___________________________, ____________ between |

|

____________________________________________________________________________________, |

|

hereinafter referred to as the “Seller,”whose address is _____________________________________ and |

|

____________________________________________________________________________________, |

|

hereinafter referred to as the “Purchaser,” whose address is ____________________________________. |

|

Witnesseth: |

Description |

1. THE SELLER AGREES AS FOLLOWS: |

Of Premises |

(a) To sell and convey to the Purchaser the following described property: |

|

Land situated in the __________________ of ______________________, County of |

|

______________________, State of MI. |

|

Commonly known as: |

|

Tax ID: |

|

Together with all improvements, appurtenances, tenements and hereditaments, including all |

|

lighting fixtures, plumbing fixtures, shades, Venetian blinds, curtain rods, storm windows, |

|

storm doors, screens, awnings, if any, now on the premises, and subject to all applicable |

|

building and use restrictions, and easements, if any, affecting the Premises. |

Terms of |

(b) That the consideration for the sale of the above described premises is: |

Payment |

_________________________ and 00/100 Dollars ($___________.00) of which the sum |

|

___________________________________________________ (__________.00) has |

|

heretofore been paid to Seller, the receipt of which is hereby acknowledged, and the balance |

|

of __________________________________ (____________________) is to be paid to the |

|

Seller, with interest on any part thereof at any time unpaid at the rate of ______% per annum |

|

while the Purchaser is not in default, and at the rate of ___ % per annum when and as often |

|

as the Purchaser is in default. This balance of purchase money and interest shall be paid in |

|

monthly installments of _________________ each, or more at Purchaser’s option, on the |

|

________ day of each month, beginning ____________________________________, said |

|

payments to be applied first upon interest and the balance on principal; PROVIDED, the |

|

entire purchase money and interest shall be fully paid within _________ years from the date |

|

hereof, anything herein to the contrary notwithstanding. |

Seller’s Duty to Convey |

(c) |

Upon receiving payment in full of all sums owing herein, less the amount then due on any |

|

|

existing mortgage or mortgages, and the surrender of the duplicate of this contract, to execute |

|

|

and deliver to the Purchaser or the Purchaser’s assigns, a good and sufficient Warranty Deed |

|

|

conveying title to said land, subject to aforesaid restrictions and easements and free from all |

|

|

other encumbrances, except such as may be herein set forth, and such encumbrances as shall |

|

|

have accrued or attached since the date hereof through the acts or omissions of persons other |

|

|

then the Seller or his assigns. |

To Furnish Title |

(d) |

To deliver to the Purchaser as evidence of title, at the Seller’s option, a Policy of Title |

Evidence |

|

Insurance insuring Purchaser, the effective date of the policy to be approximately the date of |

|

|

this contract, and issued by Devon Title Agency, as agent for a title underwriter in good |

|

|

standing. |

Purchaser’s Duties

To Pay Taxes and Keep

Premises Insured

Alternate Payment

Method

Insert amount, if Advance Monthly Installment Method of Taxes and Insurance is to be Adopted

2.THE PURCHASER AGREES AS FOLLOWS:

(a)To purchase said land and pay the Seller the sum aforesaid, with the interest thereon as above provided.

(b)To use, maintain and occupy said premises in accordance with any and all restrictions thereon.

(c)To keep the premises in accordance with all police, sanitary and other regulations imposed by any governmental authority.

(d)To pay all taxes and assessments hereafter levied on said premises before any penalty for non- payment attaches thereto, and submit receipts to Seller upon request, as evidence of payment thereof; also at all times to keep the buildings now or hereafter on the premises insured against loss and damage, in a manner and to an amount approved by the Seller, and to deliver the policies as issued to the Seller with the premiums fully paid.

If the amount of the estimated monthly cost of taxes, assessments and insurance is inserted in the following Paragraph 2(e), then the method of the payment of these items as therein indicated shall be adopted. If this amount is not inserted, then Paragraph 2(e) shall be of no effect and the method of payment provided in the preceding Paragraph 2(d) shall be effective.

(e)To pay monthly in addition to the monthly payments herein before stipulated, the sum of

$____________________, which is an estimate of the monthly cost of the taxes, assessments and insurance premiums for said premises, which shall be credited by the Seller on the unpaid principal balance due on the contract. If the Purchaser is not in default under the terms of this contract, the Seller shall pay for the Purchaser’s account, the taxes, assessments and insurance premiums mentioned in Paragraph 2(d) above when due and before any penalty attaches, and submit receipts therefore to the Purchaser upon demand. The amounts so paid shall be added to the principal balance of this contract. The amount of the estimated monthly payment, under this paragraph, may be adjusted from time to time so that the amount received shall approximate the total sum required annually for taxes, assessments and insurance. This adjustment shall be made on demand of either of the parties and any deficiencies shall be paid by the Purchaser upon the Seller’s demand.

Acceptance of Title and |

(f) That he has examined a Title Commitment referenced above covering the above described |

Premises |

premises, and is satisfied with the marketability of the title shown thereby, and has examined |

|

the above described premises and is satisfied with the physical condition of any structures |

|

thereon. |

Maintenance of Premises |

(g) To keep and maintain the premises and the buildings thereon in as good condition as they are |

|

at the date hereof, reasonable wear and tear excepted, and not to commit waste, remove or |

|

demolish any improvements thereon, or otherwise diminish the value of the Seller’s security, |

|

without the written consent of the Seller. |

Mortgage by Seller |

3. THE SELLER AND PURCHASER MUTUALLY AGREE AS FOLLOWS: |

|

(a) That the Seller may, at any time during the continuance of this contract encumber said land by |

|

mortgage or mortgages to secure not more than the unpaid balance of this contract at the time |

|

such mortgage or mortgages are executed. Such mortgage or mortgages shall be payable in |

|

not less than three (3) years from the date of execution thereof and shall provide for payment |

|

of principal and interest in monthly installments which do not exceed such installments |

|

provided for in this contract; shall provide for a rate of interest on the unpaid balance of the |

|

mortgage debt which does not exceed the rate of interest provided in Paragraph 1 (b); or on |

|

such other items as may be agreed upon by the Seller and Purchaser, and shall be a first lien |

|

upon the land superior to the rights of Purchaser herein; provided notice of the execution of |

|

said mortgage or mortgages containing the name and address of the mortgagee or his agent, |

|

the amount of such mortgage or mortgages, the rate of interest and maturity of the principal |

|

and interest shall be sent to the Purchaser by registered mail promptly after execution thereof. |

|

Purchaser will, on demand, execute any instruments demanded by the Seller, necessary or |

|

requisite to subordinate the rights of the Purchaser hereunder to the lien of any such mortgage |

|

or mortgages. In event said Purchaser shall refuse to execute any instruments demanded by |

|

Seller and shall refuse to accept such registered mail hereinbefore provided, or said registered |

|

mail shall be returned unclaimed, then the Seller may post such notice in two conspicuous |

|

places on said premises, and upon making affidavit duly sworn to of such posting, this |

|

proceeding shall operate the same as if said Purchaser had consented to the execution of said |

|

mortgage or mortgages, and Purchaser’s rights shall be subordinate to said mortgage or |

|

mortgages as hereinbefore provided. The consent obtained, or subordination as otherwise |

|

herein provided, under or by virtue of the foregoing power, shall extend to any and all |

|

renewals or extensions or amendments of said mortgage or mortgages, after Seller has given |

|

notice to the Purchaser as above provided for giving notice of the execution of said mortgage |

|

or mortgages. |

Encumbrances on |

(b) That if the Seller’s interest be that of land contract, or now or hereafter be encumbered by |

Seller’s Title |

mortgage, the Seller shall meet the payments of principal and interest thereon as they mature |

|

and produce evidence thereof to the Purchaser on demand, and in default of the Seller said |

|

Purchaser may pay the same. Such payments by Purchaser shall be credited on the sums first |

|

maturing hereon, with interest at the rate provided in Paragraph 1 (b) on payments so made. |

|

If proceedings are commenced to recover possession or to enforce the payment of such |

|

contract or mortgage because of the Seller’s default, the Purchaser may at any time thereafter, |

|

while such proceeding are pending, encumber said land by mortgage securing such sum as |

|

can be obtained, upon such terms as may be required, and with the proceeds pay and |

|

discharge such mortgage, or purchase money lien. Any mortgage so given shall be a first lien |

|

upon the land superior to the rights of the Seller therein, and thereafter the Purchaser shall |

|

pay the principal and interest on such mortgage so given as they mature, which payments |

|

shall be credited on the sums of matured or first maturing hereon. When the sum owing |

|

hereon is reduced to the amount owing upon such contract or mortgage or owing on any |

|

mortgage executed under either of the powers in this contract a conveyance shall be made in |

|

the form above provided containing a covenant by the grantee to assume and agree to pay the |

|

same. |

(c) That if default is made by the Purchaser in the payment of any taxes, assessments or |

|

Insurance |

insurance premiums, or in the payment of the sums provided for in Paragraph 2(e), or in the |

|

delivery of any policy as herein before provided, the Seller may pay such taxes or premiums |

|

or procure such insurance and pay the premium or premiums thereon , and any sum or sums |

|

so paid shall be a further lien on the land and premises, payable by the Purchaser to Seller |

|

forthwith with interest at the rate as set forth in Paragraph 1(b) hereof. |

Assignment by Purchaser |

(d) No assignment or conveyance by the Purchaser shall create any liability whatsoever against |

|

the Seller until a duplicate thereof, duly witnessed and acknowledged, together with the |

|

residence address of such assignee, shall be delivered to the Seller. Purchaser’s liability |

|

hereunder shall not be released or affected in any way by delivery of such assignment, or by |

|

Seller’s endorsement of receipt and/or acceptance thereon. |

Possession |

(e) |

The Purchaser shall have the right to possession of the premises from and after the date |

|

|

hereof, unless otherwise herein provided, and be entitled to retain possession thereof only so |

|

|

long as there is no default on his part in carrying out the terms and conditions hereof. In the |

|

|

event the premises herein above described are vacant or unimproved, the Purchaser shall be |

|

|

deemed to be in constructive possession only, which possessory right shall cease and |

|

|

terminate after service of a notice of forfeiture of this contract. Erection of signs by |

|

|

Purchaser on vacant or unimproved property shall not constitute actual possession by him. |

Right to Forfeit |

(f) |

If the Purchaser shall fail to perform this contract or any part thereof, the Seller immediately |

|

|

after such default shall have the right to declare the same forfeited and void, and retain |

|

|

whatever may have been paid hereon, and all improvements that may have been made upon |

|

|

the premises, together with additions and accretions thereto, and consider and treat the |

|

|

Purchaser as his tenant holding over without permission and may take immediate possession |

|

|

of the premises and have the Purchaser and each and every other occupant removed and put |

|

|

out. In all cases where a notice of forfeiture is relied upon by the Seller to terminate rights |

|

|

hereunder, such notice shall specify all unpaid moneys and other breaches of this contract and |

|

|

shall declare forfeiture of this contract effective in the time period provided by statute or if no |

|

|

statutory provision applies then within 30 days after service unless such money is paid and |

|

|

any other breaches of this contract are cured within that time. |

Acceleration Clause |

(g) |

If default is made by the Purchaser and such default continues for a period of thirty (30) days |

|

|

or more, and the Seller desires to foreclose this contract in equity, then the Seller shall have at |

|

|

his option the right to declare the entire unpaid balance hereunder to be due and payable |

|

|

forthwith, notwithstanding anything herein contained to the contrary. |

Disposition of Insurance |

(h) |

That during the existence of this contract, any proceeds received from a hazard insurance |

Proceeds |

|

policy covering the land shall first be used to repair the damage and restore the property, with |

|

|

the balance of such proceeds, if any, being distributed to Seller and Purchaser, as their |

|

|

interests may appear. |

|

(i) |

Time shall be deemed to be of the essence of this contract. |

|

(j) |

The individual parties hereto represent themselves to be of full age, and the corporate parties |

|

|

hereto represent themselves to be valid existing corporations with their charters in full force |

|

|

and effect. |

Notice to Purchaser |

(k) |

Any declarations, notices or papers necessary or proper to terminate, accelerate or enforce this |

|

|

contract shall be presumed conclusively to have been served upon the Purchaser if such |

|

|

instrument is enclosed in an envelope with first class postage fully prepaid, if said envelope is |

|

|

addressed to the Purchaser at the address set forth in the heading of this contract or at the |

|

|

latest other address which may have been specified by the Purchaser and receipted for in |

|

|

writing by the Seller, and if said envelope is deposited in a United States Post Office Box. |

Additional Clauses |

|

|

The pronouns and relative words herein used are written in the masculine and singular only. If more than one joins in the execution hereof as Seller or Purchaser, or either be of the feminine sex or a corporation, such words shall be read as if written in plural, feminine or neuter, respectively. The covenants herein shall bind the heirs, devisees, legatees, assigns and successors of the respective parties.

In Witness Whereof, the parties hereto have executed this Contract in duplicate the day and year first above written.

Land Contract Seller(s) / Vendor(s)

|

______________________________________________ |

|

______________________________________________ |

|

Land Contract Purchaser(s) / Vendee(s) |

|

_______________________________________________ |

|

_______________________________________________ |

Use this |

STATE OF MICHIGAN |

Acknowledgement Form |

} S.S. |

for Individuals |

COUNTY OF ____________________ |

|

The foregoing instrument was acknowledged before me this _________day of _________________, |

|

__________ by _____________________________________________________________________ |

|

____________________________________________ |

|

Notary Public |

|

______________________________________County |

|

My commission expires: _______________________ |

Use this |

STATE OF MICHIGAN |

Acknowledgement Form |

} S.S. |

for Corporations |

COUNTY OF ____________________ |

|

The foregoing instrument was acknowledged before me this ____________day of ________________, |

|

________ by ________________________________________________________________________ |

|

__________________________________________ |

|

Notary Public |

|

____________________________________County |

|

My commission expires: _____________________ |

Drafted by: |

When recorded return to: |

Different PDF Forms

Indiana Entertainment Permit - Types of facilities include theaters, dance halls, and night clubs.

Completing an Arizona Bill of Sale form accurately is crucial for anyone looking to buy or sell personal property, as it helps outline the essential transaction details between the parties involved. Whether it's a vehicle, furniture, or any other item, having this document not only formalizes the exchange but also provides legal protection. For those unfamiliar with the process, resources are available to guide you through the necessary steps, such as visiting https://arizonapdfforms.com/bill-of-sale/ for further information.

Bob Evans 401k - Ensuring your request is complete helps expedite the processing time.