Fill in Your Indiana It 40 Form

Similar forms

The Indiana IT-40 form is similar to the Federal Form 1040, which is the standard individual income tax return used by U.S. taxpayers. Both forms require taxpayers to report their income, deductions, and credits. They share similar structures, such as sections for personal information, income calculations, and tax liabilities. However, the IT-40 focuses specifically on Indiana state taxes, while the 1040 addresses federal tax obligations. Taxpayers filing both forms must ensure that the information reported is consistent to avoid discrepancies.

Understanding the various tax forms is essential for anyone navigating Indiana's tax landscape. Among these, the North Carolina Motor Vehicle Bill of Sale serves as a vital document in vehicle transactions, ensuring clarity and legality in ownership transfer. For those interested in similar legal documentation, resources can be found at UsaLawDocs.com, which offers insights into various legal forms and their applications.

Another document that resembles the IT-40 is the Indiana IT-40PNR, or the Part-Year Resident Income Tax Return. This form is used by individuals who lived in Indiana for only part of the tax year. Like the IT-40, it requires reporting of income and deductions, but it also includes sections to determine the portion of income earned while residing in Indiana. This distinction is crucial for accurate tax calculations, making it essential for part-year residents to use the correct form.

The IT-40 form also has similarities with the Indiana IT-9, which is the Indiana Individual Income Tax Withholding Exemption Certificate. While the IT-9 is primarily used to claim exemptions from withholding, it impacts the overall tax calculations reported on the IT-40. Taxpayers may need to reference their IT-9 when completing the IT-40 to ensure that withholding amounts align with their tax obligations.

Additionally, the Indiana IT-40X is an amended tax return form that allows taxpayers to correct errors made on their original IT-40 submissions. This form is similar in structure to the IT-40, but it includes specific sections for detailing the changes being made. Taxpayers must provide a clear explanation for the amendments, which helps the Indiana Department of Revenue process the corrections accurately.

The Indiana IT-20 form, used for corporations, shares a similar purpose with the IT-40, as both forms are designed to calculate state tax liabilities. While the IT-20 is tailored for corporate entities, the underlying principles of reporting income, deductions, and credits are consistent. Both forms require detailed financial information, reflecting the taxpayer's overall financial situation to ensure accurate tax assessments.

Lastly, the Indiana IT-2210 form is relevant for those who may face penalties for underpayment of estimated taxes. This form allows taxpayers to calculate any penalties incurred and is often referenced when completing the IT-40. Understanding the implications of the IT-2210 can help taxpayers avoid unexpected charges on their final tax liability reported on the IT-40.

FAQ

What is the Indiana IT-40 form?

The Indiana IT-40 form is the state’s individual income tax return for full-year residents. It is used to report income, calculate taxes owed, and claim any applicable credits or deductions. This form is necessary for individuals who have lived in Indiana for the entire tax year and need to file their state income taxes.

When is the Indiana IT-40 form due?

The IT-40 form is typically due on April 15 of the year following the tax year being reported. For example, for the 2020 tax year, the form was due on April 15, 2021. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to file on time to avoid penalties and interest on any taxes owed.

Who needs to file the Indiana IT-40 form?

What information is required to complete the IT-40 form?

What happens if I file the IT-40 form late?

Common mistakes

Filling out the Indiana IT-40 form can be tricky. Many people make common mistakes that can lead to delays or issues with their tax returns. Here are nine mistakes to watch out for.

First, not including the correct Social Security number is a frequent error. This number is essential for identifying you and your spouse. Double-check that it’s accurate. A small typo can cause significant problems.

Another common mistake is failing to sign the form. Both you and your spouse must sign if you are filing jointly. An unsigned form is considered incomplete and will not be processed.

Many people also forget to enclose necessary schedules. If the form asks for additional schedules, like Schedule 1 or Schedule 3, make sure to include them. Not doing so can lead to delays in processing your return.

Inaccurate calculations are another issue. Some individuals miscalculate their adjusted gross income or tax amounts. Always double-check your math. It’s easy to make a mistake, especially with multiple lines to fill out.

Moreover, using outdated forms can create problems. Ensure you are using the latest version of the IT-40 form. Tax laws change, and using an old form might lead to errors.

People often neglect to check the filing status. Selecting the wrong status, such as “married filing separately” instead of “married filing jointly,” can affect your tax rate and potential deductions. Make sure you choose the correct option based on your situation.

Additionally, not entering county codes can be an oversight. These codes are crucial for calculating county taxes. Make sure you enter the correct codes for where you lived and worked.

Another mistake is overlooking credits and deductions. Taxpayers sometimes miss out on valuable credits or deductions because they don’t fully understand what they qualify for. Take time to review all possible credits and deductions to ensure you maximize your return.

Finally, missing the filing deadline is a common error. The due date for the IT-40 form is typically April 15. Mark your calendar and file on time to avoid penalties.

By being aware of these mistakes, you can fill out your Indiana IT-40 form more accurately and efficiently. Take your time and review each section carefully to ensure a smooth filing process.

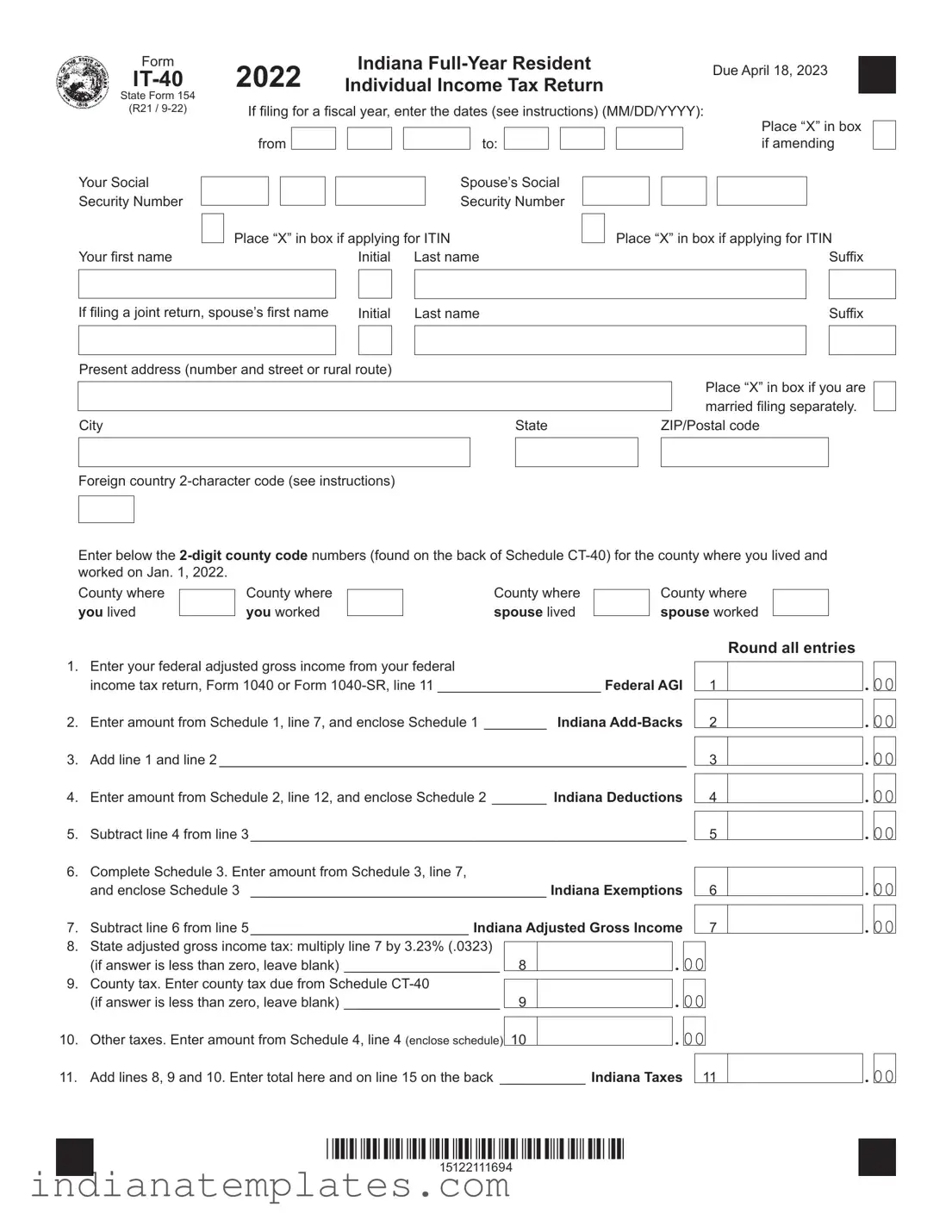

Indiana It 40 Preview

Form

State Form 154

(R21 /

Your Social Security Number

Your first name

2022 |

Indiana |

Due April 18, 2023 |

|

Individual Income Tax Return |

|

||

|

|

If filing for a fiscal year, enter the dates (see instructions) (MM/DD/YYYY):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Place “X” in box |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

from |

|

|

|

|

|

|

|

|

|

to: |

|

|

|

|

|

|

|

|

|

|

|

if amending |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s Social |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Number |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Place “X” in box if applying for ITIN |

|

|

|

Place “X” in box if applying for ITIN |

|||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

Initial |

|

|

Last name |

|

|

|

|

|

|

|

|

Suffix |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If filing a joint return, spouse’s first name |

Initial |

|

Last name |

|

|

|

|

Suffix |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Present address (number and street or rural route) |

|

|

|

|

|

|

Place “X” in box if you are |

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

married filing separately. |

|

||

|

|

|

|

|

|

|

|

|

|

|||

City |

|

|

|

|

|

State |

|

ZIP/Postal code |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign country

Enter below the

County where you lived

County where you worked

County where spouse lived

County where spouse worked

Round all entries

1. |

Enter your federal adjusted gross income from your federal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

income tax return, Form 1040 or Form |

|

1 |

|||||

2. |

Enter amount from Schedule 1, line 7, and enclose Schedule 1 ________ |

|

2 |

|||||

Indiana |

|

|||||||

|

|

|

||||||

3. |

Add line 1 and line 2 ____________________________________________________________ |

|

3 |

|||||

|

|

|

||||||

4. |

Enter amount from Schedule 2, line 12, and enclose Schedule 2 _______ Indiana Deductions |

|

4 |

|||||

|

|

|

||||||

5. |

Subtract line 4 from line 3 ________________________________________________________ |

|

5 |

|||||

6. |

Complete Schedule 3. Enter amount from Schedule 3, line 7, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

and enclose Schedule 3 ______________________________________ Indiana Exemptions |

|

6 |

|||||

|

|

|

||||||

7. |

Subtract line 6 from line 5 ____________________________ Indiana Adjusted Gross Income |

|

7 |

|||||

8. |

State adjusted gross income tax: multiply line 7 by 3.23% (.0323) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(if answer is less than zero, leave blank) ____________________ |

8 |

|

|

.00 |

|

||

9. |

County tax. Enter county tax due from Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(if answer is less than zero, leave blank) ____________________ |

9 |

|

|

.00 |

|

||

|

|

|

|

|

|

|

|

|

.00

.00

.00

.00

.00

.00

.00

10. |

Other taxes. Enter amount from Schedule 4, line 4 (enclose schedule) |

|

|

|

|

|

|

|

10 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|

|

11. |

Add lines 8, 9 and 10. Enter total here and on line 15 on the back ___________ Indiana Taxes |

|

11 |

|||||

|

||||||||

.00

*15122111694*

15122111694

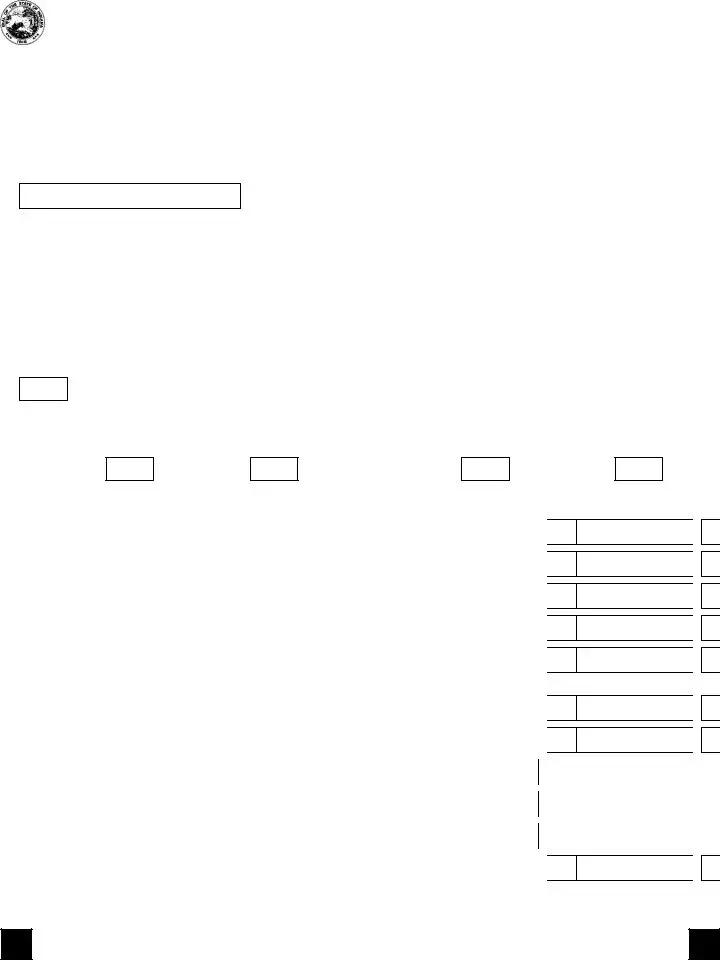

12. |

Enter credits from Schedule 5, line 12 (enclose schedule) ___ |

|

|

|

|

|

|

|

|

|

|

||

12 |

|

|

.00 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

Enter offset credits from Schedule 6, line 8 (enclose schedule) |

13 |

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Add lines 12 and 13 ______________________________________________ Indiana Credits |

|

|

|

|

||||||||

14 |

|

.00 |

|||||||||||

15. |

Enter amount from line 11___________________________________________ Indiana Taxes |

|

|

|

|

||||||||

15 |

|

.00 |

|||||||||||

|

|

|

|

|

|

|

|

||||||

16. |

If line 14 is equal to or more than line 15, subtract line 15 from line 14 (if smaller, skip to line 23) |

16 |

|

.00 |

|||||||||

|

|

|

|

|

|

|

|

||||||

17. |

Enter donations from Schedule |

17 |

|

.00 |

|||||||||

18. |

Subtract line 17 from line 16 __________________________________________Overpayment |

|

|

|

|

||||||||

18 |

|

.00 |

|||||||||||

19. |

Amount from line 18 to be applied to your 2023 estimated tax account (see instructions). |

|

|

|

|

||||||||

|

Enter your county code |

|

county tax to be applied _ $ |

|

|

|

|

|

|

|

|

|

|

|

|

a |

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s county code |

|

county tax to be applied _ $ |

b |

|

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indiana adjusted gross income tax to be applied _________ $ |

c |

|

|

.00 |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

Total to be applied to your estimated tax account (a + b + c; cannot be more than line 18)_____ |

19d |

|

.00 |

|||||||||

20. |

Penalty for underpayment of estimated tax from Schedule |

|

|

|

|

||||||||

20 |

|

.00 |

|||||||||||

|

Refund: Line 18 minus lines 19d and 20. Note: If less than zero, see line 23 |

|

|

|

|

|

|||||||

21. |

___ Your Refund |

21 |

|

.00 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22.Direct Deposit (see instructions)

|

a. Routing Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b. Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

c. Type: |

|

Checking |

|

|

Savings |

|

|

Hoosier Works MC |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

d. Place an “X” in the box if refund will go to an account outside the United States |

|

|

|

|

|

|

|||||||||||||||||||||||

23. |

If line 15 is more than line 14, subtract line 14 from line 15. Add any amount to this on line 20 |

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||

|

(see instructions) _____________________________________________________________ |

23 |

|

.00 |

||||||||||||||||||||||||||

24. |

Penalty if filed after due date (see instructions) ______________________________________ |

|

|

|

|

|||||||||||||||||||||||||

24 |

|

.00 |

||||||||||||||||||||||||||||

25. |

Interest if filed after due date (see instructions) ______________________________________ |

|

|

|

|

|||||||||||||||||||||||||

25 |

|

.00 |

||||||||||||||||||||||||||||

|

Amount Due: Add lines 23, 24 and 25______________________________ Amount You Owe |

|

|

|

|

|||||||||||||||||||||||||

26. |

26 |

|

.00 |

|||||||||||||||||||||||||||

|

Do not send cash. Make your check or money order payable to: |

|

|

|

|

|||||||||||||||||||||||||

|

Indiana Department of Revenue. See instructions if paying with a credit card. |

|

|

|

|

|||||||||||||||||||||||||

Sign and date this return after reading the Authorization statement on Schedule 7. Remember to enclose Schedule 7.

_____________________________________________________ |

_________________________________________________ |

||

Signature |

Date |

Spouse’s Signature |

Date |

•Mail payments to: Indiana Department of Revenue, P.O. Box 7224, Indianapolis, IN

•Mail all other returns to: Indiana Department of Revenue, P.O. Box 40, Indianapolis, IN

*15122121694*

15122121694

Different PDF Forms

Financial Declaration Form Indiana - Information is collected from both spouses to ensure fairness.

Indiana Ged Transcript - Secure the necessary identification to ensure the request can be verified.

A Durable Power of Attorney form in Arizona is essential for anyone wishing to ensure their decisions are honored when they are unable to represent themselves. It designates a trusted individual to act on one's behalf, maintaining its validity even during periods of incapacity. For more information on this important legal tool, you can visit https://arizonapdfforms.com/durable-power-of-attorney/.

It6 - The form is a vital tool for managing corporate tax liabilities throughout the year.