Fill in Your Indiana Financial Form

Similar forms

The Indiana Financial Declaration Form is similar to the Financial Affidavit used in family law cases in many states. Both documents require parties to disclose their financial situation, including income, expenses, and assets. The purpose of a financial affidavit is to provide the court with a clear picture of each party's financial standing, which can impact decisions regarding child support, alimony, and property division. Just like the Indiana form, a financial affidavit typically includes sections on income sources, living expenses, and any relevant debts, ensuring transparency in the financial aspects of a divorce or custody case.

Another comparable document is the Child Support Worksheet, commonly used in various jurisdictions. This worksheet assists in calculating the appropriate child support obligations based on the financial information provided by both parents. Much like the Indiana Financial Declaration, the Child Support Worksheet requires detailed income disclosures and outlines necessary expenses related to the child's care. This ensures that the financial responsibilities are fairly assessed, taking into account both parents' financial capabilities and the needs of the child.

The Financial Disclosure Statement, often required in divorce proceedings, shares similarities with the Indiana form as well. This statement serves to outline both parties' financial circumstances, including assets, liabilities, and income. Similar to the Indiana Financial Declaration, it aims to provide the court with a comprehensive view of each party's financial health. Both documents emphasize the importance of full disclosure to facilitate fair negotiations and judicial decisions regarding financial matters in divorce cases.

The Statement of Net Worth is another document that aligns closely with the Indiana Financial Declaration. This statement provides a snapshot of an individual's financial position, listing assets and liabilities to determine net worth. Like the Indiana form, it requires individuals to disclose their income and expenses, ensuring that the court has a complete understanding of their financial situation. This information can be critical in divorce proceedings, particularly when dividing assets or determining support obligations.

The Income and Expense Declaration is a common form used in family law cases, mirroring the Indiana Financial Declaration in its purpose and structure. This document requires parties to report their income, expenses, and any dependents. Both forms aim to provide a clear financial picture to the court, which is essential for making informed decisions regarding support and custody arrangements. The Income and Expense Declaration is often used in conjunction with other financial documents to ensure comprehensive disclosure.

In navigating the complexities of personal property transactions, it is crucial to utilize a proper Bill of Sale form to prevent any misunderstandings. This document not only ensures a smooth transfer of ownership but also provides both parties with legal protection. For those in Arizona, you can find the necessary form at https://arizonapdfforms.com/bill-of-sale/, which outlines essential details, such as the item description and purchase price, essential for an effective transaction.

The Affidavit of Financial Status is another document that serves a similar function. It requires individuals to provide detailed information about their financial circumstances, including income, expenses, and assets. Much like the Indiana Financial Declaration, this affidavit is sworn under penalty of perjury, emphasizing the importance of honesty and accuracy in financial reporting. Courts rely on this information to assess each party's financial situation and make equitable decisions in family law matters.

Lastly, the Financial Statement for Divorce is a document utilized in many jurisdictions that closely resembles the Indiana Financial Declaration. This statement requires a thorough breakdown of an individual's financial details, including income, expenses, and assets. Both documents serve the same purpose: to provide the court with a clear and comprehensive view of each party's financial situation during divorce proceedings. The Financial Statement for Divorce helps ensure that all financial matters are addressed fairly and transparently, similar to the goals of the Indiana form.

FAQ

What is the purpose of the Indiana Financial Declaration Form?

The Indiana Financial Declaration Form is designed to provide a comprehensive overview of an individual's financial situation during legal proceedings, particularly in divorce cases. This form captures essential information about income, expenses, assets, and liabilities. It ensures that both parties involved in a case have a clear understanding of each other's financial standing, which is crucial for determining child support, alimony, and property division. By requiring detailed disclosures, the form promotes transparency and fairness in the legal process.

Who needs to complete the Indiana Financial Declaration Form?

What information is required on the form?

How does the completion of this form affect child support calculations?

Common mistakes

Completing the Indiana Financial Declaration Form can be a straightforward process, but many individuals make common mistakes that can lead to complications. One frequent error is failing to provide accurate personal information. It is essential to ensure that all names, addresses, and Social Security numbers are correct. Inaccuracies can delay processing or even result in a rejection of the form.

Another mistake involves not fully disclosing income sources. People sometimes forget to include all forms of income, such as bonuses, commissions, or side jobs. Omitting any source of income can create issues down the line, especially if the other party questions the financial disclosures.

Some individuals neglect to list all dependents and their relevant details. This includes not only the names and ages of children but also their Social Security numbers. Failing to include this information can lead to misunderstandings regarding child support calculations.

When it comes to health insurance, many people make the mistake of not providing complete health insurance information. This includes failing to list all individuals covered under the plan or not indicating the costs accurately. Incomplete health insurance details can affect the overall financial picture presented in the form.

Another common issue is the miscalculation of income and deductions. Individuals often confuse gross income with net income or fail to calculate weekly amounts correctly. It’s crucial to follow the guidelines for converting monthly figures into weekly amounts to avoid discrepancies.

People sometimes overlook the importance of itemized deductions. Not detailing every deduction can lead to a misunderstanding of disposable income. Each deduction should be clearly listed to provide a complete financial overview.

Additionally, many individuals fail to prepare and attach the required Indiana Child Support Guideline Worksheet. This is a necessary step in cases involving child support. Not including this worksheet can cause delays or complications in the support determination process.

Another mistake is not updating the form with recent financial changes. If there have been changes in employment, income, or living expenses since the last filing, it is important to reflect those updates accurately. Failure to do so can misrepresent one’s current financial situation.

Lastly, many people do not seek assistance or clarification when needed. If there are uncertainties about how to fill out specific sections, it is wise to ask for help rather than risk submitting an incorrect form. Taking the time to ensure accuracy can save time and stress in the long run.

Indiana Financial Preview

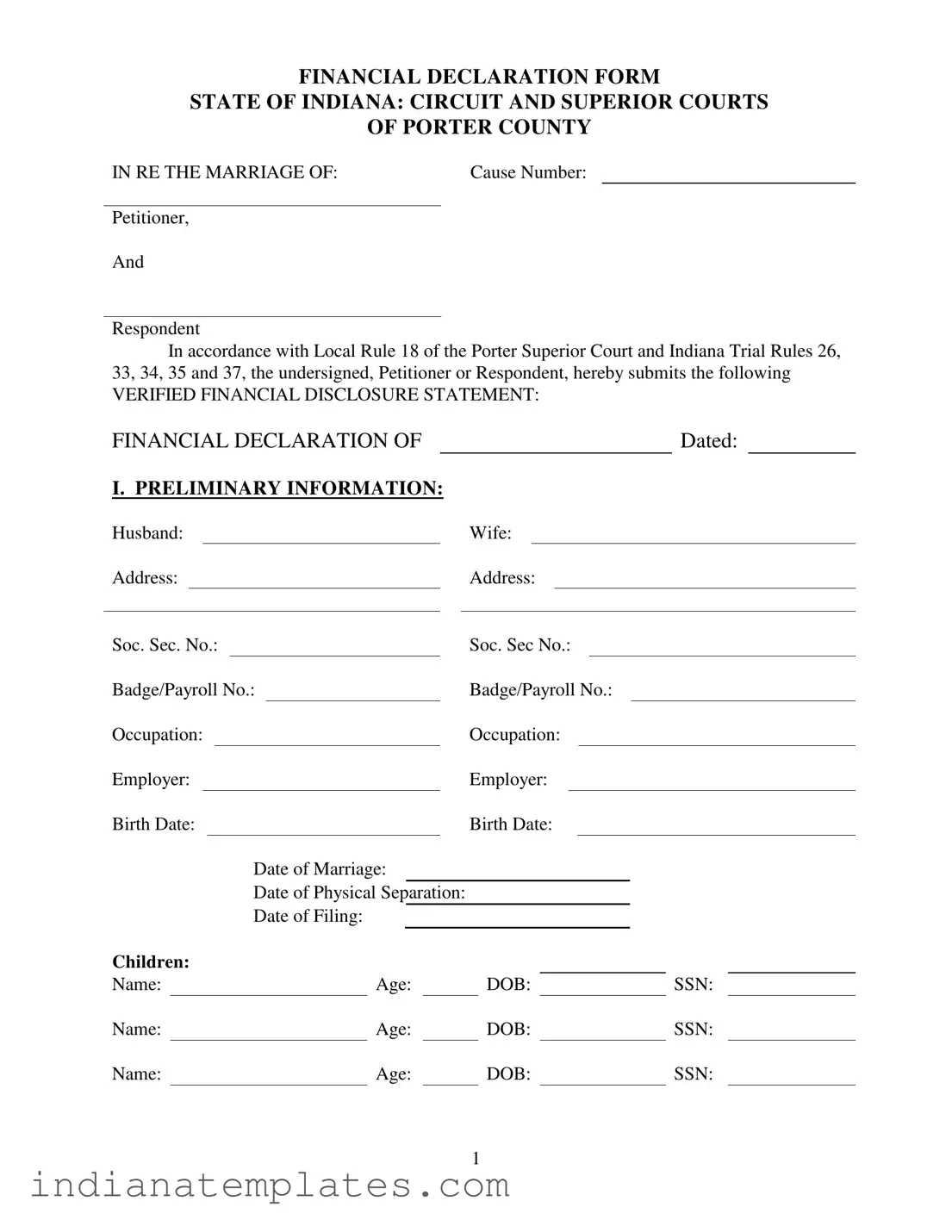

FINANCIAL DECLARATION FORM

STATE OF INDIANA: CIRCUIT AND SUPERIOR COURTS

OF PORTER COUNTY

IN RE THE MARRIAGE OF: |

Cause Number: |

Petitioner,

And

Respondent

In accordance with Local Rule 18 of the Porter Superior Court and Indiana Trial Rules 26, 33, 34, 35 and 37, the undersigned, Petitioner or Respondent, hereby submits the following

VERIFIED FINANCIAL DISCLOSURE STATEMENT:

FINANCIAL DECLARATION OF |

|

|

|

|

|

|

|

|

Dated: |

|

|||||||||

I. PRELIMINARY INFORMATION: |

|

|

|

|

|

|

|

|

|

||||||||||

Husband: |

|

|

Wife: |

|

|||||||||||||||

Address: |

|

|

Address: |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Soc. Sec. No.: |

|

|

Soc. Sec No.: |

|

|||||||||||||||

Badge/Payroll No.: |

|

|

Badge/Payroll No.: |

|

|||||||||||||||

Occupation: |

|

|

Occupation: |

|

|||||||||||||||

Employer: |

|

|

Employer: |

|

|||||||||||||||

Birth Date: |

|

|

Birth Date: |

|

|||||||||||||||

|

|

|

|

|

Date of Marriage: |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Date of Physical Separation: |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

Date of Filing: |

|

|

|

|

|

|

|

|

|

|

||||

Children: |

|

|

|

|

|

|

Name: |

|

Age: |

|

DOB: |

|

SSN: |

Name: |

|

Age: |

|

DOB: |

|

SSN: |

Name: |

|

Age: |

|

DOB: |

|

SSN: |

1

II. HEALTH INSURANCE INFORMATION:

Name and Address of health care insurance company:

Name all persons covered under plan(s):

Weekly cost of total health insurance premium:

Weekly cost of health insurance premium for children only:

Name of the children’s health care providers:

The names of the schools and grade level for each child are:

List any extraordinary health care concerns of any family member:

List any educational concerns of any family member:

III.INCOME INFORMATION:

A.EMPLOYMENT HISTORY:

Current Employer:

Address:

Telephone No.: |

|

|

|

|

Length of Employment: |

|

|

|

|||

Job Description: |

|

|

|

|

|

|

|

|

|

|

|

Gross Income: |

|

|

|

|

|

|

|

|

|

||

|

|

Per week |

|

|

|

Per month |

|

|

Yearly |

||

Net Income: |

|

|

|

|

|

|

|

|

|

||

|

|

Per week |

|

|

|

Per month |

|

|

Yearly |

||

2

B.EMPLOYMENT HISTORY FOR LAST 5 YEARS:

Employer |

|

Dates of Employment |

|

Compensation (per wk/mo/yr) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C.INCOME SUMMARY:

1.GROSS WEEKLY INCOME from: Salary and wages, including commissions, bonuses, allowances, and

Note: If paid monthly, determine weekly income by dividing monthly income by 4.3

Pensions & Retirement

Social Security

Disability and unemployment insurance

Public Assistance (welfare, AFDC payments, etc.)

Food Stamps

Child supports received for any child(ren) not both of the parties to this marriage

Dividends and Interest

Rents received

All other sources (specify)

TOTAL GROSS WEEKLY INCOME

2.ITEMIZED WEEKLY DEDUCTIONS: from gross income

State and Federal Income Taxes:

Social Security & Medicare Taxes:

Medical Insurance |

|

|

|

|

Coverage: |

Health |

( |

|

) |

|

Dental |

( |

|

) |

|

Eye Care |

( |

|

) |

|

Psychiatric |

( |

|

) |

3

Union or other dues:

Retirement:

Pension fund: Mandatory ( )Optional ( )

Profit sharing: Mandatory ( )Optional( )

401(K): Mandatory ( ) Optional ( )

SEP: Mandatory ( ) Optional ( )

ESOP: Mandatory ( ) Optional ( )

IRA: Mandatory ( ) Optional ( )

403 B: Mandatory ( ) Optional ( )

Child Support withheld from pay (not including this case)

Garnishments (itemize on separate sheet)

Credit Union debts

Direct Withdrawals Out of Paychecks:

Car Payments

Life Insurance

Disability Insurance

Thrift plans

Credit Union Savings

Bonds

Donations

Other (specify)

Other (specify)

TOTAL WEEKLY DEDUCTIONS:

3. WEEKLY DISPOSABLE INCOME:

(A minus B: Subtract Total Weekly Deduction from Total Weekly Gross Income)

IN ALL CASES INVOLVING CHILD SUPPORT: Prepare and attach an Indiana Child Support Guideline Worksheet (with documentation verifying your income); or, supplement with such a Worksheet within ten (10) days of the exchange of this Form.

IV. MONTHLY LIVING EXPENSES:

House

1.Rent (Mortgage)

2.2nd Mortgage

4

3.Line of Credit

4.Gas/Electric

5.Telephone

6.Water

7.Sewer

8.Sanitation (garbage)

9.Cable

10.Satellite

11.Internet

12.Taxes (real estate – if not included in mortgage payment

13.Insurance (house – if not included in mortgage payment)

14.Lawn Care/Snow Removal

Groceries

1.Food

2.Toiletries

3.Cleaning Products

4.Paper Products

Clothing

1.Clothes

2.Shoes

3.Uniforms

Health Care

1.Health Insurance not deducted from pay

2.Dental Insurance not deducted from pay

3.Doctor visits

4.Dental visits

5.Prescription Pharmaceutical

5

6.

7.Glass/contact lenses

8.Other

Car & Travel

1.Car Payment

2.Gasoline

3.Oil/Maintenance

4.Insurance (car)

5.Car Wash

6.Tolls

7.Train/Bus

8.Parking Lot Fees

9.License Plates

Beauty Care

1.Hair Dress/Barber

2.Cosmetics

School Needs

1.Lunches

2.Books

3.Tuition/Registration

4.Uniforms

5.School Supplies

6.

Infant Care

1.Diapers

2.Baby Food

6

Miscellaneous

1.Church Donations

2.Charitable Donations

3.Life Insurance

4.Babysitter

5.Newspapers & Magazines

6.Cigarettes

7.Dry Cleaning

8.Entertainment

9.Cell Phone

10.Dues/Subscriptions

11.Charge Cards

12.Other (specify)

Average Weekly Expenses (multiply monthly expenses by 12 and divide by 52)

V. PROVISIONAL ARREARAGE COMPUTATIONS:

If you allege the existence of a child support, maintenance, or other arrearage, attach all records or other exhibits regarding the payment history and complete the child support arrearage.

You must attach a Child Support Guideline Worksheet to your Financial Declaration Form or one must be exchanged with the opposing party/counsel within 10 days of receipt of the other parties= Financial Declaration Form.

7

ASSETS

All property is to be listed regardless of whether it is titled in your name only or jointly of if the property you own is being held for you in the name of a third party.

VI. PROPERTY:

A. MARITAL RESIDENCE:

Description:

Location:

Date Acquired: |

|

Titled: |

|

||

Purchase Price: |

|

Down Payment: |

|

||

Source of down payment: |

|

|

|

|

|

Current Indebtedness: |

|

|

|

|

|

Monthly Payment: |

|

|

|

|

|

Current Market Value: |

|

|

|

|

|

B.OTHER REAL PROPERTY: (Complete B on a separate sheet of paper for each additional parcel of real estate owned etc.)

Description:

Location:

Date Acquired: |

|

Titled: |

|

||

Purchase Price: |

|

Down Payment: |

|

||

Source of down payment: |

|

|

|

|

|

Current Indebtedness: |

|

|

|

|

|

Monthly Payment: |

|

|

|

|

|

Current Market Value: |

|

|

|

|

|

8

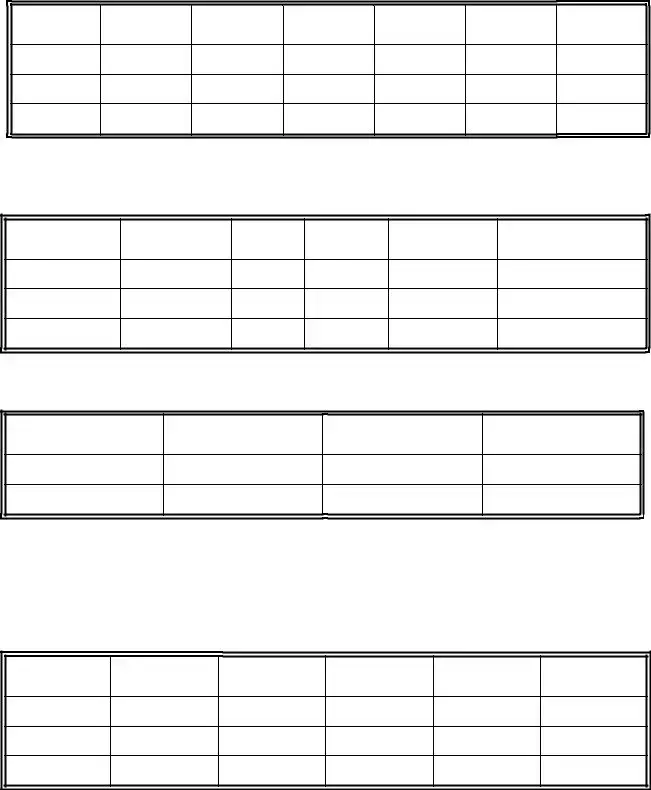

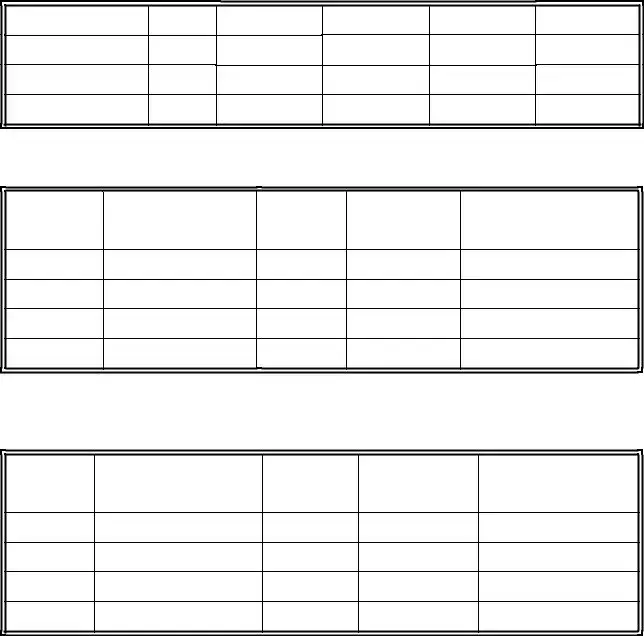

C.PERSONAL PROPERTY: (motor vehicles, boats, motorcycles, furnishings, household goods, jewelry, firearms, etc. Household furnishings and household goods such as pots and pans need not

be itemized).

Description

Titled

Current Value

Indebtedness

Payment

Present User

VII. BANK ACCOUNTS:

Name

Type of Account

(Checking, Savings,

CD’s, etc.)

Owner

Account No.

Balance on Date of Filing

VIII.

Name

Type of Account

(Money Mkt, Stocks,

Bonds, Mutual Funds)

Owner

Account No.

Value on date of filing

9

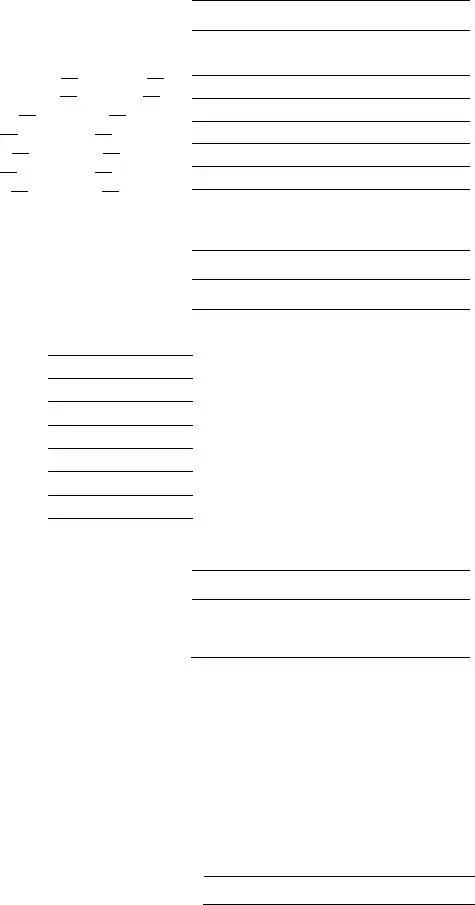

IX. LIFE INSURANCE POLICIES (whole life, variable life, annuities, term)

Company

Owner

Policy #.

Beneficiary

Face Value

Loan

Amount

Cash Value

X.RETIREMENT ACCOUNTS (Pension, Profit Sharing, 401(K), SEP, IRA, KEOGH, ESOP, etc.)

Company

Type of Plan

Owner

Account #

Vested (yes/no)

Value as of date of filing

XI. OTHER PROFESSIONAL OR BUSINESS INTERESTS:

Name of Business

Type (Corp., Part., Sole Owner

% Owned

Estimated Value

XII. MARITAL BILLS, DEBTS, AND OBLIGATIONS: (list every single bill, debt and obligation regardless of whether the bill is title in your name, your spouse=s name, or jointly. Please include all mortgages, 2nd mortgages, home equity loans, charge cards, other loans, credit union loans, car payments, and unpaid medical bills, etc. Do not include monthly expenses such as utilities that are paid in full every month).

Creditor

Description

Acct. #

Monthly

Payment

Balance as of

Date of Filing

Current

Balance

10

Different PDF Forms

It 40 - All returns must be signed and dated by you and your spouse, if filing jointly.

The New York Residential Lease Agreement form is a legal document that outlines the rights and obligations of both the landlord and the tenant in a residential rental arrangement in New York state. This agreement is crucial for defining the terms of the lease, including rent, duration, and conditions of the living space. For further information and to access a comprehensive template, visit UsaLawDocs.com, which provides valuable resources to ensure both parties understand their responsibilities and are protected under New York law.

Contempt of Court Indiana - This packet includes instructions on how to fill out the forms properly.