Fill in Your Indiana Financial Declaration Form

Similar forms

The Indiana Financial Declaration form shares similarities with the California Financial Disclosure form. Both documents aim to provide a comprehensive overview of an individual's financial situation, including income, expenses, and assets. Like the Indiana form, the California form requires detailed information about gross income from various sources, such as wages, pensions, and business income. Additionally, both forms include sections for disclosing monthly expenses and liabilities, ensuring that all financial obligations are transparent during divorce proceedings.

Another comparable document is the Texas Inventory and Appraisement form. This form is used in family law cases to outline the assets and liabilities of each party. Similar to the Indiana Financial Declaration, it requires parties to list their assets, including real estate and personal property, along with any associated debts. The goal of both forms is to facilitate a fair division of property by providing a clear picture of each party's financial standing.

For those looking to understand the specifics of a state-specific bill of sale, this document outlines the essential elements and requirements needed for effective ownership transfer. Utilizing the appropriate template can simplify the process and ensure that all necessary information is accurately recorded.

The Florida Family Law Financial Affidavit also bears resemblance to the Indiana Financial Declaration. Both documents require individuals to disclose their income, expenses, assets, and liabilities in a structured format. The Florida affidavit includes specific categories for income and expenses, mirroring the detailed breakdown found in the Indiana form. This similarity helps ensure that all relevant financial information is presented to the court, aiding in equitable decision-making.

In New York, the Statement of Net Worth serves a similar purpose. This document requires individuals to provide a detailed account of their financial situation, including income, expenses, and assets. Like the Indiana Financial Declaration, the New York Statement of Net Worth includes sections for both gross income and monthly expenses, making it easier for the court to assess each party's financial needs and capabilities.

The Illinois Financial Affidavit is another document that aligns closely with the Indiana Financial Declaration. Both forms require a thorough disclosure of financial information, including income sources, monthly expenses, and assets. The structure of the Illinois affidavit, with its focus on income and expenses, reflects the same intent as the Indiana form: to ensure transparency and fairness in financial matters during divorce proceedings.

Similarly, the Virginia Financial Disclosure form serves as a counterpart to the Indiana Financial Declaration. This document requires individuals to disclose their income, expenses, and assets in a detailed manner. Both forms emphasize the importance of providing accurate financial information to facilitate equitable distribution of marital property, making them essential tools in family law cases.

The Ohio Financial Disclosure Affidavit is also comparable. It requires parties to provide a detailed account of their financial situation, including income, expenses, and assets. The Ohio form, like the Indiana Financial Declaration, aims to ensure that all relevant financial information is available to the court, allowing for informed decisions regarding support and property division.

In Pennsylvania, the Financial Affidavit is another document that mirrors the Indiana Financial Declaration. Both forms require individuals to disclose their financial information in a structured format, including income, expenses, and assets. This similarity helps ensure that the court has a complete understanding of each party's financial circumstances, which is crucial for fair resolution of family law matters.

Finally, the Washington Financial Disclosure form is akin to the Indiana Financial Declaration. Both documents require a comprehensive overview of an individual's financial situation, detailing income, expenses, and assets. The Washington form, like its Indiana counterpart, is designed to promote transparency and fairness in divorce proceedings, ensuring that both parties' financial circumstances are fully considered by the court.

FAQ

What is the Indiana Financial Declaration form?

The Indiana Financial Declaration form is a document used in family law cases, particularly during divorce proceedings. It provides a comprehensive overview of an individual's financial situation, including income, expenses, assets, and liabilities. This form helps the court understand the financial circumstances of both parties involved, ensuring fair decisions regarding support and division of property.

Who needs to complete the Indiana Financial Declaration form?

Both parties in a divorce or legal separation are typically required to complete the Indiana Financial Declaration form. This includes the husband/father and the wife/mother. Each party must disclose their financial information to facilitate equitable decisions regarding child support, alimony, and asset distribution.

What information is required on the form?

The form requires detailed information about your income, including salaries, pensions, child support received, and other sources. Additionally, you must list your monthly expenses, such as taxes, housing costs, and medical expenses. You will also need to disclose your assets, including real estate, vehicles, and bank accounts, along with any debts associated with these assets.

How do I calculate my gross weekly income?

Your gross weekly income is the total amount you earn before any deductions. To calculate this, add together your salary, wages, commissions, and any other income sources. It’s important to attach your last three payroll stubs to provide proof of your earnings, as this helps establish a clear financial picture for the court.

What should I do if my financial situation changes after I submit the form?

If your financial circumstances change after submitting the Indiana Financial Declaration form, you have a duty to update the court. You should amend the form to reflect any new information prior to the trial. This ensures that the court has the most accurate and current information when making decisions.

Can I include my spouse's income on my Financial Declaration?

No, you should only include your own income and financial information on your Financial Declaration form. Each party must complete their own form independently. This separation helps the court assess each individual’s financial situation accurately.

What happens if I fail to complete the Financial Declaration form?

Failing to complete the Financial Declaration form can have serious consequences. The court may view this as a lack of cooperation or transparency, which could negatively impact your case. It’s essential to fill out the form accurately and submit it on time to avoid any potential penalties or unfavorable decisions.

Is there assistance available for filling out the form?

Yes, there are resources available to help you complete the Indiana Financial Declaration form. You can seek assistance from a family law attorney, legal aid organizations, or local court self-help centers. These resources can provide guidance on how to accurately report your financial information and ensure compliance with court requirements.

Where do I submit the Indiana Financial Declaration form?

You should submit the completed Indiana Financial Declaration form to the court where your divorce or legal separation case is filed. Make sure to keep copies of the form and any supporting documents for your records. Additionally, you may need to serve a copy of the form to the other party involved in the case.

What if I have questions about specific sections of the form?

If you have questions about specific sections of the Indiana Financial Declaration form, it’s advisable to consult with a legal professional. They can provide clarity on how to accurately complete each section based on your unique financial situation. Additionally, many court websites offer guides and FAQs that can help clarify common concerns.

Common mistakes

Filling out the Indiana Financial Declaration form is a crucial step in legal proceedings related to family law. However, many individuals make common mistakes that can lead to complications. Understanding these pitfalls can help ensure a smoother process.

One frequent error is incomplete information. Many people fail to provide all required details, such as income sources or household members. This omission can delay proceedings and necessitate additional filings. It is essential to carefully review each section and ensure that all requested information is included.

Another mistake involves incorrect calculations. Individuals often miscalculate their total gross weekly income or monthly expenses. This can happen due to simple arithmetic errors or misunderstandings about how to total various sources of income. Double-checking these figures can prevent discrepancies that may arise later.

Many also neglect to attach necessary documentation. The form requests supporting documents, such as payroll stubs and calculations for business income. Failing to include these attachments can lead to questions about the accuracy of the information provided, potentially undermining one's credibility.

In some cases, individuals mistakenly include non-relevant income sources. For instance, certain benefits like food stamps or general assistance should not be reported. Misrepresenting income can have serious legal consequences, so it is vital to understand what should and should not be included.

Another common issue is not updating the form when circumstances change. If financial situations evolve after the initial submission, individuals have a duty to amend their declarations. Ignoring this responsibility can lead to misunderstandings and complications during legal proceedings.

Finally, individuals may overlook the importance of accurately valuing assets. It is crucial to disclose all assets, even if their value is uncertain. Underestimating or omitting assets can affect the outcome of financial settlements. Providing a thorough and honest account of assets demonstrates good faith and transparency.

By being aware of these mistakes, individuals can better prepare their Indiana Financial Declaration forms. Taking the time to carefully complete the form can significantly impact the legal process and lead to more favorable outcomes.

Indiana Financial Declaration Preview

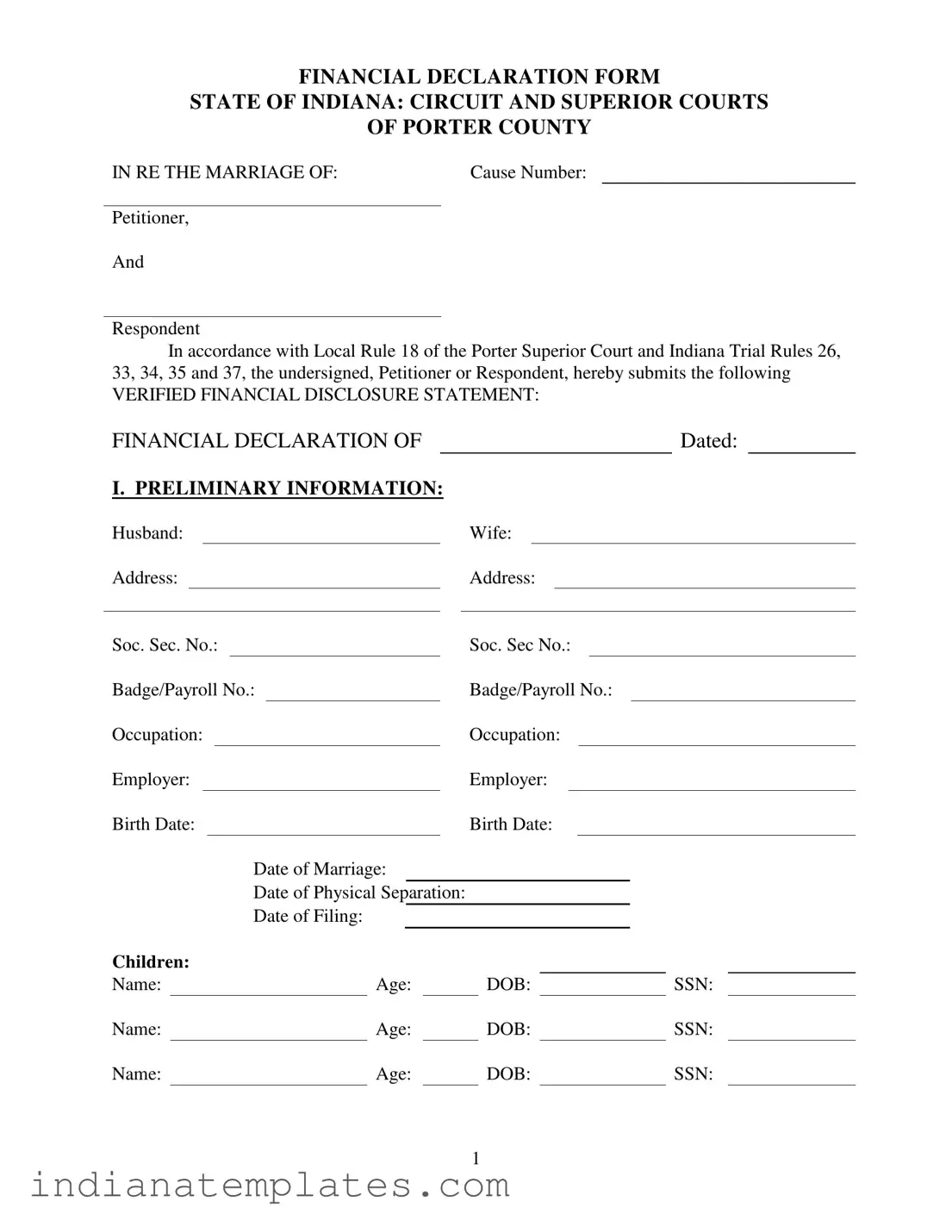

FINANCIAL DECLARATION FORM

STATE OF INDIANA: CIRCUIT AND SUPERIOR COURTS

OF PORTER COUNTY

IN RE THE MARRIAGE OF: |

Cause Number: |

Petitioner,

And

Respondent

In accordance with Local Rule 18 of the Porter Superior Court and Indiana Trial Rules 26, 33, 34, 35 and 37, the undersigned, Petitioner or Respondent, hereby submits the following

VERIFIED FINANCIAL DISCLOSURE STATEMENT:

FINANCIAL DECLARATION OF |

|

|

|

|

|

|

|

|

Dated: |

|

|||||||||

I. PRELIMINARY INFORMATION: |

|

|

|

|

|

|

|

|

|

||||||||||

Husband: |

|

|

Wife: |

|

|||||||||||||||

Address: |

|

|

Address: |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Soc. Sec. No.: |

|

|

Soc. Sec No.: |

|

|||||||||||||||

Badge/Payroll No.: |

|

|

Badge/Payroll No.: |

|

|||||||||||||||

Occupation: |

|

|

Occupation: |

|

|||||||||||||||

Employer: |

|

|

Employer: |

|

|||||||||||||||

Birth Date: |

|

|

Birth Date: |

|

|||||||||||||||

|

|

|

|

|

Date of Marriage: |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Date of Physical Separation: |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

Date of Filing: |

|

|

|

|

|

|

|

|

|

|

||||

Children: |

|

|

|

|

|

|

Name: |

|

Age: |

|

DOB: |

|

SSN: |

Name: |

|

Age: |

|

DOB: |

|

SSN: |

Name: |

|

Age: |

|

DOB: |

|

SSN: |

1

II. HEALTH INSURANCE INFORMATION:

Name and Address of health care insurance company:

Name all persons covered under plan(s):

Weekly cost of total health insurance premium:

Weekly cost of health insurance premium for children only:

Name of the children’s health care providers:

The names of the schools and grade level for each child are:

List any extraordinary health care concerns of any family member:

List any educational concerns of any family member:

III.INCOME INFORMATION:

A.EMPLOYMENT HISTORY:

Current Employer:

Address:

Telephone No.: |

|

|

|

|

Length of Employment: |

|

|

|

|||

Job Description: |

|

|

|

|

|

|

|

|

|

|

|

Gross Income: |

|

|

|

|

|

|

|

|

|

||

|

|

Per week |

|

|

|

Per month |

|

|

Yearly |

||

Net Income: |

|

|

|

|

|

|

|

|

|

||

|

|

Per week |

|

|

|

Per month |

|

|

Yearly |

||

2

B.EMPLOYMENT HISTORY FOR LAST 5 YEARS:

Employer |

|

Dates of Employment |

|

Compensation (per wk/mo/yr) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C.INCOME SUMMARY:

1.GROSS WEEKLY INCOME from: Salary and wages, including commissions, bonuses, allowances, and

Note: If paid monthly, determine weekly income by dividing monthly income by 4.3

Pensions & Retirement

Social Security

Disability and unemployment insurance

Public Assistance (welfare, AFDC payments, etc.)

Food Stamps

Child supports received for any child(ren) not both of the parties to this marriage

Dividends and Interest

Rents received

All other sources (specify)

TOTAL GROSS WEEKLY INCOME

2.ITEMIZED WEEKLY DEDUCTIONS: from gross income

State and Federal Income Taxes:

Social Security & Medicare Taxes:

Medical Insurance |

|

|

|

|

Coverage: |

Health |

( |

|

) |

|

Dental |

( |

|

) |

|

Eye Care |

( |

|

) |

|

Psychiatric |

( |

|

) |

3

Union or other dues:

Retirement:

Pension fund: Mandatory ( )Optional ( )

Profit sharing: Mandatory ( )Optional( )

401(K): Mandatory ( ) Optional ( )

SEP: Mandatory ( ) Optional ( )

ESOP: Mandatory ( ) Optional ( )

IRA: Mandatory ( ) Optional ( )

403 B: Mandatory ( ) Optional ( )

Child Support withheld from pay (not including this case)

Garnishments (itemize on separate sheet)

Credit Union debts

Direct Withdrawals Out of Paychecks:

Car Payments

Life Insurance

Disability Insurance

Thrift plans

Credit Union Savings

Bonds

Donations

Other (specify)

Other (specify)

TOTAL WEEKLY DEDUCTIONS:

3. WEEKLY DISPOSABLE INCOME:

(A minus B: Subtract Total Weekly Deduction from Total Weekly Gross Income)

IN ALL CASES INVOLVING CHILD SUPPORT: Prepare and attach an Indiana Child Support Guideline Worksheet (with documentation verifying your income); or, supplement with such a Worksheet within ten (10) days of the exchange of this Form.

IV. MONTHLY LIVING EXPENSES:

House

1.Rent (Mortgage)

2.2nd Mortgage

4

3.Line of Credit

4.Gas/Electric

5.Telephone

6.Water

7.Sewer

8.Sanitation (garbage)

9.Cable

10.Satellite

11.Internet

12.Taxes (real estate – if not included in mortgage payment

13.Insurance (house – if not included in mortgage payment)

14.Lawn Care/Snow Removal

Groceries

1.Food

2.Toiletries

3.Cleaning Products

4.Paper Products

Clothing

1.Clothes

2.Shoes

3.Uniforms

Health Care

1.Health Insurance not deducted from pay

2.Dental Insurance not deducted from pay

3.Doctor visits

4.Dental visits

5.Prescription Pharmaceutical

5

6.

7.Glass/contact lenses

8.Other

Car & Travel

1.Car Payment

2.Gasoline

3.Oil/Maintenance

4.Insurance (car)

5.Car Wash

6.Tolls

7.Train/Bus

8.Parking Lot Fees

9.License Plates

Beauty Care

1.Hair Dress/Barber

2.Cosmetics

School Needs

1.Lunches

2.Books

3.Tuition/Registration

4.Uniforms

5.School Supplies

6.

Infant Care

1.Diapers

2.Baby Food

6

Miscellaneous

1.Church Donations

2.Charitable Donations

3.Life Insurance

4.Babysitter

5.Newspapers & Magazines

6.Cigarettes

7.Dry Cleaning

8.Entertainment

9.Cell Phone

10.Dues/Subscriptions

11.Charge Cards

12.Other (specify)

Average Weekly Expenses (multiply monthly expenses by 12 and divide by 52)

V. PROVISIONAL ARREARAGE COMPUTATIONS:

If you allege the existence of a child support, maintenance, or other arrearage, attach all records or other exhibits regarding the payment history and complete the child support arrearage.

You must attach a Child Support Guideline Worksheet to your Financial Declaration Form or one must be exchanged with the opposing party/counsel within 10 days of receipt of the other parties= Financial Declaration Form.

7

ASSETS

All property is to be listed regardless of whether it is titled in your name only or jointly of if the property you own is being held for you in the name of a third party.

VI. PROPERTY:

A. MARITAL RESIDENCE:

Description:

Location:

Date Acquired: |

|

Titled: |

|

||

Purchase Price: |

|

Down Payment: |

|

||

Source of down payment: |

|

|

|

|

|

Current Indebtedness: |

|

|

|

|

|

Monthly Payment: |

|

|

|

|

|

Current Market Value: |

|

|

|

|

|

B.OTHER REAL PROPERTY: (Complete B on a separate sheet of paper for each additional parcel of real estate owned etc.)

Description:

Location:

Date Acquired: |

|

Titled: |

|

||

Purchase Price: |

|

Down Payment: |

|

||

Source of down payment: |

|

|

|

|

|

Current Indebtedness: |

|

|

|

|

|

Monthly Payment: |

|

|

|

|

|

Current Market Value: |

|

|

|

|

|

8

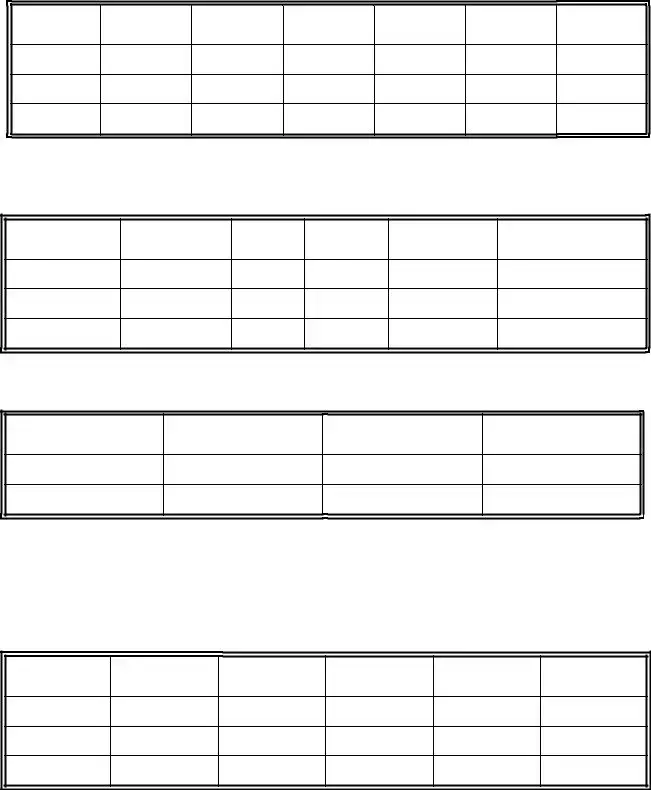

C.PERSONAL PROPERTY: (motor vehicles, boats, motorcycles, furnishings, household goods, jewelry, firearms, etc. Household furnishings and household goods such as pots and pans need not

be itemized).

Description

Titled

Current Value

Indebtedness

Payment

Present User

VII. BANK ACCOUNTS:

Name

Type of Account

(Checking, Savings,

CD’s, etc.)

Owner

Account No.

Balance on Date of Filing

VIII.

Name

Type of Account

(Money Mkt, Stocks,

Bonds, Mutual Funds)

Owner

Account No.

Value on date of filing

9

IX. LIFE INSURANCE POLICIES (whole life, variable life, annuities, term)

Company

Owner

Policy #.

Beneficiary

Face Value

Loan

Amount

Cash Value

X.RETIREMENT ACCOUNTS (Pension, Profit Sharing, 401(K), SEP, IRA, KEOGH, ESOP, etc.)

Company

Type of Plan

Owner

Account #

Vested (yes/no)

Value as of date of filing

XI. OTHER PROFESSIONAL OR BUSINESS INTERESTS:

Name of Business

Type (Corp., Part., Sole Owner

% Owned

Estimated Value

XII. MARITAL BILLS, DEBTS, AND OBLIGATIONS: (list every single bill, debt and obligation regardless of whether the bill is title in your name, your spouse=s name, or jointly. Please include all mortgages, 2nd mortgages, home equity loans, charge cards, other loans, credit union loans, car payments, and unpaid medical bills, etc. Do not include monthly expenses such as utilities that are paid in full every month).

Creditor

Description

Acct. #

Monthly

Payment

Balance as of

Date of Filing

Current

Balance

10

Different PDF Forms

Indiana Entertainment Permit - The date of signing must also be included in the application.

The New York Residential Lease Agreement form is a legal document that outlines the rights and obligations of both the landlord and the tenant in a residential rental arrangement in New York state. This agreement is crucial for defining the terms of the lease, including rent, duration, and conditions of the living space. For more information about obtaining this essential document, you can visit UsaLawDocs.com. It serves as a binding contract that ensures both parties understand their responsibilities and are protected under New York law.

Indiana Sales Tax Exemption Form - Local county identification is necessary for determining jurisdictional compliance.