Fill in Your Indiana 43709 Form

Similar forms

The Indiana 43709 form, which serves as a statement of mortgage or contract indebtedness for deduction from assessed valuation, shares similarities with the Homestead Exemption Application. Both documents aim to provide financial relief to property owners by reducing the taxable value of their property. The Homestead Exemption Application allows homeowners to claim a deduction based on their primary residence, while the Indiana 43709 form focuses specifically on mortgage or contract indebtedness. Each form requires specific information about ownership and property details, and both must be filed within designated time frames to be effective for the upcoming tax year.

Another similar document is the Property Tax Abatement Application. This form is utilized by property owners seeking to reduce their tax burden through abatement programs offered by local governments. Like the Indiana 43709 form, the Property Tax Abatement Application requires detailed information about the property, including its assessed value and ownership status. Both forms seek to alleviate financial pressure on property owners, albeit through different mechanisms—one through deductions based on indebtedness and the other through temporary tax reductions.

The Indiana 44000 form, known as the Statement of Benefits for Tax Abatement, also bears resemblance to the Indiana 43709 form. This document is submitted by businesses seeking tax incentives for economic development projects. Similar to the Indiana 43709, it requires detailed financial information and outlines the benefits the applicant expects to receive. Both forms are designed to support applicants in navigating tax obligations, though they cater to different types of property ownership—residential versus commercial.

The Application for Veteran’s Property Tax Exemption is another document that aligns with the Indiana 43709 form. This application allows qualifying veterans to reduce their property tax liability, reflecting the state’s commitment to providing benefits to those who have served in the military. Both forms necessitate proof of eligibility and require applicants to provide personal and property-related information. They serve to ease the financial burden on specific groups of property owners, emphasizing the importance of community support for veterans and homeowners alike.

The Indiana 43999 form, which is a Statement of Agricultural Land Use, is also comparable to the Indiana 43709 form. This document is used by landowners to claim agricultural use status, which can lead to reduced property taxes. Similar to the Indiana 43709, it requires the owner to provide specific information about the property and its use. Both forms aim to recognize the unique circumstances of property ownership and provide financial relief based on the property’s classification.

For individuals seeking to complete a transaction involving personal property, a comprehensive Missouri bill of sale document is vital. This form ensures clarity in the exchange by detailing the specific items involved and the conditions of the sale. To create your own bill of sale, you can find a useful resource here.

The Application for Disabled Person's Property Tax Deduction is another related document. This form allows individuals with disabilities to apply for a property tax deduction, offering financial assistance to those who may face additional challenges. Like the Indiana 43709 form, it requires the applicant to provide personal information and details about the property. Both documents seek to provide equitable financial support, recognizing the varied needs of property owners in Indiana.

Finally, the Indiana 44001 form, which is a Business Personal Property Return, is similar in that it requires businesses to report their personal property for tax assessment. This form, like the Indiana 43709, focuses on providing information that will ultimately affect the tax liability of the applicant. Both forms require accurate reporting of property details and ownership status, underscoring the importance of transparency in tax matters.

FAQ

What is the Indiana 43709 form used for?

The Indiana 43709 form, also known as the Statement of Mortgage or Contract Indebtedness for Deduction from Assessed Valuation, is used by property owners or contract buyers in Indiana to apply for a deduction from their property’s assessed value. This deduction can help reduce property taxes by allowing eligible applicants to report their mortgage or contract indebtedness.

Who can file the Indiana 43709 form?

Only residents of Indiana who are the legal owners or contract buyers of the property can file this form. If you are applying as a contract buyer, you must submit a recorded copy of the contract or a recorded memorandum that includes a legal description of the property. Additionally, if the property is owned jointly, only one spouse's signature is needed if they are married and hold the property as tenants by the entireties.

When should I file the Indiana 43709 form?

The filing deadlines vary depending on the type of property. For real property, the form must be filed during the 12 months leading up to May 11 of the year in which the deduction is to take effect. For mobile homes assessed under IC 6-1.1-7, the filing period is between January 15 and March 2 of the year the deduction is intended to be effective.

What information do I need to provide on the form?

When completing the Indiana 43709 form, you will need to provide several key pieces of information. This includes the assessed value of the property, the unpaid mortgage or contract indebtedness as of March 1 of the current year, and details about the mortgagee or contract seller. If applicable, you must also disclose any other properties owned in Indiana and whether this deduction has been requested for the current year.

What happens after I submit the Indiana 43709 form?

Once you submit the form, the County Auditor will review your application. If approved, the deduction amount will be noted on the form. It is important to keep a copy of the receipt for your records. If there are no changes to your property status, you will not need to file again until there is a change that affects your eligibility for the deduction.

What is the maximum deduction I can receive?

The maximum deduction you can receive through the Indiana 43709 form is the lesser of $3,000, half of the assessed value of the property, or the remaining mortgage or contract indebtedness as of the assessment date. This deduction can significantly lower your property tax burden, making it essential to apply if you qualify.

What are the consequences of providing false information on the form?

Providing false information on the Indiana 43709 form can lead to serious consequences, including being charged with perjury. If convicted, penalties can be imposed as provided by law. It is crucial to ensure that all information is accurate and truthful when completing the application to avoid any legal repercussions.

Common mistakes

When filling out the Indiana 43709 form, many applicants make common mistakes that can lead to delays or denials of their deductions. One frequent error is failing to file within the specified time frame. The form must be submitted during the 12 months leading up to May 11 for real property or between January 15 and March 2 for mobile homes. Missing these deadlines can disqualify applicants from receiving the deduction.

Another mistake involves incorrect or incomplete property descriptions. Applicants must provide accurate legal descriptions and key numbers for their properties. Inaccurate information can result in confusion and may require resubmission of the form. Additionally, some individuals neglect to indicate whether they own the property solely or jointly with others. This information is crucial for determining eligibility and must be clearly stated.

Many applicants also overlook the requirement to disclose if the name on the property records differs from the applicant's name. This discrepancy can raise red flags during the review process. Furthermore, failing to provide the correct address for the mortgagee or contract seller can complicate the verification process, leading to potential delays in approval.

Another common oversight is not answering the question regarding ownership of property in other counties. If applicants own property elsewhere in Indiana, they must disclose this information, as it may affect the deduction eligibility. Similarly, some individuals forget to indicate whether they have requested this deduction for the current year, which can also impact their application.

Completing the signature section incorrectly is another frequent issue. The form requires signatures from the owner or authorized person, and applicants must ensure that they sign in the appropriate places. Moreover, some applicants fail to certify their residency status or ownership of the property as of March 1, which is a critical requirement for the deduction.

Lastly, applicants often neglect to include necessary documentation, such as a recorded copy of the contract for contract buyers. This omission can lead to immediate rejection of the application. Each of these mistakes highlights the importance of careful review and attention to detail when completing the Indiana 43709 form.

Indiana 43709 Preview

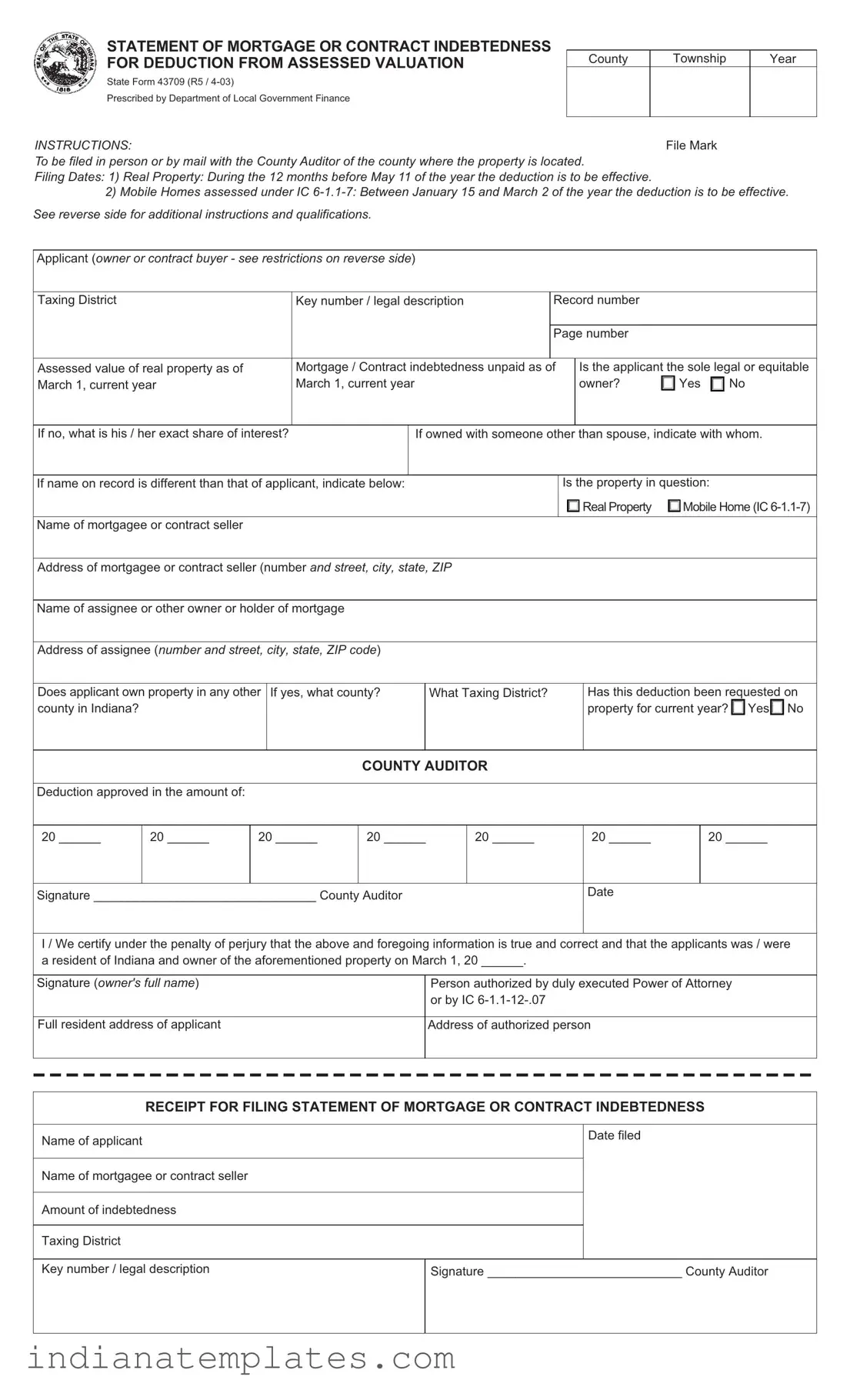

STATEMENT OF MORTGAGE OR CONTRACT INDEBTEDNESS FOR DEDUCTION FROM ASSESSED VALUATION

State Form 43709 (R5 /

Prescribed by Department of Local Government Finance

County

Township

Year

INSTRUCTIONS:

To be filed in person or by mail with the County Auditor of the county where the property is located.

Filing Dates: 1) Real Property: During the 12 months before May 11 of the year the deduction is to be effective.

2)Mobile Homes assessed under IC

Applicant (owner or contract buyer - see restrictions on reverse side)

Taxing District |

Key number / legal description |

Record number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page number |

|

|

|

|

|

|

|

|

|

|

|

||

Assessed value of real property as of |

Mortgage / Contract indebtedness unpaid as of |

Is the applicant the sole legal or equitable |

|||||

March 1, current year |

March 1, current year |

|

owner? |

|

Yes |

|

No |

|

|

|

|||||

|

|

|

|

|

|

|

|

If no, what is his / her exact share of interest?

If owned with someone other than spouse, indicate with whom.

If name on record is different than that of applicant, indicate below: |

Is the property in question: |

||||

|

|

|

Real Property |

|

Mobile Home (IC |

|

|

|

|

||

|

|

|

|

|

|

Name of mortgagee or contract seller |

|

|

|

|

|

Address of mortgagee or contract seller (number and street, city, state, ZIP

Name of assignee or other owner or holder of mortgage

Address of assignee (number and street, city, state, ZIP code)

Does applicant own property in any other county in Indiana?

If yes, what county?

What Taxing District?

Has this deduction been requested on property for current year?

Yes

Yes

No

No

COUNTY AUDITOR

Deduction approved in the amount of:

20 ______

20 ______

20 ______

20 ______

20 ______

20 ______

20 ______

Signature ________________________________ County Auditor

Date

I / We certify under the penalty of perjury that the above and foregoing information is true and correct and that the applicants was / were a resident of Indiana and owner of the aforementioned property on March 1, 20 ______.

Signature (owner's full name) |

Person authorized by duly executed Power of Attorney |

|

or by IC |

|

|

Full resident address of applicant |

Address of authorized person |

|

|

RECEIPT FOR FILING STATEMENT OF MORTGAGE OR CONTRACT INDEBTEDNESS

Name of applicant |

Date filed |

|

Name of mortgagee or contract seller

Amount of indebtedness

Taxing District

Key number / legal description |

Signature ____________________________ County Auditor |

|

|

Instructions and Qualifications

Applicants must be residents of the State of Indiana.

Applications must be filed during the periods specified. Once the application is in effect, no other filing is necessary unless there is a change in the status of the property of applicant that would affect the deduction.

This application may be filed in person or by mail. If mailed, the mailing must be postmarked before the last day for filing.

Any person who willfully makes a false statement of the facts in applying for this deduction is guilty of the crime of perjury and on the conviction thereof will be punished in the manner provided by law.

The deduction equals $3,000,

Authority for signing a deduction application may be delegated only by an executed power of attorney or by IC

Signature of only one spouse is required for filing, when owner is a husband and wife as tenants by the entireties.

An Indiana resident who was a member of the United States Armed Forces and who was away from the county of his residence as a result of military service during the time of filing must file a claim for deduction during the twelve months before May 11 of the year next succeeding the year of discharge.

A contract buyer must submit a recorded copy or recorded memorandum of the contract, which contains a legal description with the first statement filed for this deduction.

Different PDF Forms

Bob Evans 401k - The processing time may vary, so plan accordingly for your tax needs.

Indiana State Tax Return - Timeliness in application submission is important to maintain compliance with state requirements.

To ensure clarity and protection for both parties involved in a rental agreement, utilizing a reliable source for crafting a lease is essential. One such resource can be found at UsaLawDocs.com, which offers comprehensive guidance on the New York Residential Lease Agreement form, enabling landlords and tenants to navigate their rights and obligations effectively.

Hunter Orange Requirements Indiana - It is important to note any special conditions dictated by the landowner.