Free Indiana General Power of Attorney Template

Similar forms

The Indiana General Power of Attorney (GPOA) form is similar to a Durable Power of Attorney. Both documents allow an individual, known as the principal, to appoint someone else, called an agent, to manage their affairs. The key difference lies in the durability of the powers granted. A Durable Power of Attorney remains effective even if the principal becomes incapacitated, whereas a standard GPOA may not. This distinction is crucial for those who wish to ensure their financial and medical matters are handled without interruption during periods of incapacity.

Another document similar to the Indiana GPOA is the Medical Power of Attorney. This form specifically grants an agent the authority to make healthcare decisions on behalf of the principal. While the GPOA can cover a broad range of financial and legal matters, the Medical Power of Attorney focuses solely on health-related issues. This ensures that the principal’s medical preferences are respected when they are unable to communicate their wishes directly.

The Limited Power of Attorney also shares similarities with the Indiana GPOA. In this case, the principal grants the agent authority to act on their behalf but only for specific tasks or a limited time frame. This contrasts with the GPOA, which typically provides broader powers. Individuals may choose a Limited Power of Attorney when they need someone to handle a particular transaction, such as selling a property, without relinquishing control over all their affairs.

A Revocable Living Trust is another document that parallels the GPOA. While a GPOA allows an agent to manage the principal's affairs during their lifetime, a Revocable Living Trust enables the principal to place assets into a trust for management and distribution according to their wishes. The trust can be altered or revoked by the principal at any time, providing flexibility and control over asset management, similar to how a GPOA allows for management of affairs.

The Advance Healthcare Directive is closely related to the Medical Power of Attorney but encompasses a broader scope. It combines the elements of a living will and a Medical Power of Attorney, allowing individuals to outline their healthcare preferences and appoint an agent. This document ensures that an individual's wishes regarding medical treatment are honored, similar to how the GPOA ensures that financial matters are managed according to the principal's instructions.

A Financial Power of Attorney is another document that aligns with the Indiana GPOA. It specifically grants authority to an agent to handle financial matters, such as banking, investments, and real estate transactions. While the GPOA can cover a wide range of responsibilities, the Financial Power of Attorney is focused solely on financial decisions. This allows individuals to designate someone to manage their finances without granting them authority over other areas of their life.

The North Carolina Motor Vehicle Bill of Sale form is not only essential for documenting the sale of a vehicle but also mirrors the purpose of several legal instruments like the Indiana GPOA, ensuring clarity and authority in transactions. For those interested in templates or guidance on creating such documents, resources such as UsaLawDocs.com can be invaluable in navigating the requirements and ensuring compliance with state laws.

Lastly, the Springing Power of Attorney is similar to the Indiana GPOA but with a specific condition. This type of document only becomes effective when a certain event occurs, typically the incapacitation of the principal. This contrasts with the GPOA, which is effective immediately upon signing. The Springing Power of Attorney can provide peace of mind for those who prefer to retain control over their affairs until a specific situation arises.

FAQ

What is a General Power of Attorney in Indiana?

A General Power of Attorney in Indiana is a legal document that allows one person, known as the principal, to appoint another person, called the agent or attorney-in-fact, to make decisions on their behalf. This authority can cover a wide range of financial and legal matters, such as managing bank accounts, paying bills, and handling real estate transactions. It is essential for individuals who may need assistance in managing their affairs due to health issues or other circumstances.

When should I consider creating a General Power of Attorney?

Creating a General Power of Attorney is a proactive step that can be beneficial in various situations. Individuals may consider it when they anticipate being unable to manage their affairs due to illness, travel, or other personal reasons. It’s also a good idea for those who want to ensure that their financial and legal matters are handled according to their wishes, even if they cannot do so themselves.

What powers can I grant to my agent through a General Power of Attorney?

In a General Power of Attorney, you can grant your agent broad powers to act on your behalf. This may include managing your bank accounts, paying bills, filing taxes, and making investment decisions. However, you can also limit the powers if desired. Clearly outlining the scope of authority in the document helps ensure that your agent acts in your best interest.

Can I revoke a General Power of Attorney in Indiana?

Yes, you can revoke a General Power of Attorney at any time, as long as you are mentally competent. To do so, you should create a written revocation document and notify your agent and any institutions that were relying on the original document. It’s important to ensure that the revocation is clear and that the agent understands their authority has ended.

Do I need to have my General Power of Attorney notarized?

In Indiana, a General Power of Attorney must be notarized to be legally valid. Notarization adds an extra layer of authenticity and helps prevent fraud. It’s advisable to consult with a notary public who can assist you in signing the document properly.

What happens if I become incapacitated and do not have a General Power of Attorney?

If you become incapacitated without having a General Power of Attorney in place, your loved ones may need to go through a legal process to obtain guardianship or conservatorship. This process can be time-consuming and costly, and it may not align with your wishes. Having a General Power of Attorney in advance can help avoid these complications.

Is a General Power of Attorney effective immediately?

A General Power of Attorney can be set up to take effect immediately or to become effective only upon a specific event, such as your incapacitation. This is known as a springing power of attorney. It’s important to clearly state your intentions in the document to ensure that your wishes are followed.

Can I use a General Power of Attorney for healthcare decisions?

No, a General Power of Attorney is primarily for financial and legal matters. If you want to designate someone to make healthcare decisions on your behalf, you will need a separate document known as a Healthcare Power of Attorney. This document specifically addresses medical decisions and can be tailored to reflect your healthcare preferences.

Common mistakes

Filling out a General Power of Attorney form in Indiana can be a straightforward process, but many individuals make common mistakes that can lead to confusion or even legal complications. One frequent error involves failing to clearly specify the powers granted to the agent. While it may seem obvious to the person creating the document, vague language can create ambiguity. This lack of clarity might lead to disputes or misinterpretations about what the agent is actually authorized to do.

Another common mistake occurs when individuals neglect to date the document. A General Power of Attorney should be dated to establish when it becomes effective. Without a date, it may be difficult to determine the validity of the powers granted, especially if there are changes in circumstances or if the document is challenged in the future. This simple oversight can create significant issues down the line.

Additionally, many people forget to have the document properly notarized. In Indiana, a General Power of Attorney must be signed in the presence of a notary public to be considered legally binding. Skipping this step can render the document invalid, leaving the agent without the authority to act on behalf of the principal. This can be particularly problematic in urgent situations where immediate action is required.

Lastly, individuals often overlook the importance of discussing the decision with the chosen agent before completing the form. It is crucial to ensure that the person selected is willing and able to take on the responsibilities that come with the role. By failing to have this conversation, the principal may inadvertently place an undue burden on someone who is not prepared or does not wish to serve in this capacity.

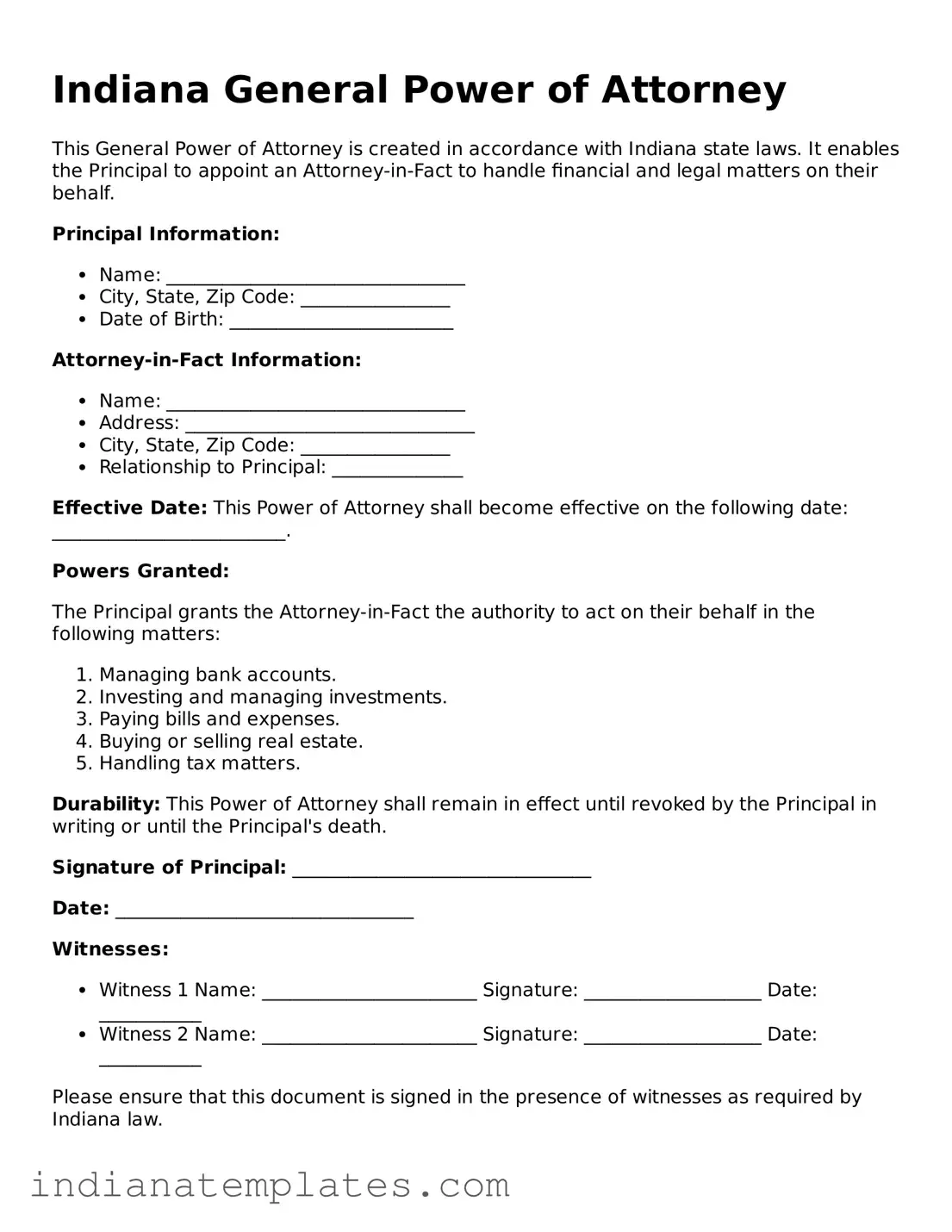

Indiana General Power of Attorney Preview

Indiana General Power of Attorney

This General Power of Attorney is created in accordance with Indiana state laws. It enables the Principal to appoint an Attorney-in-Fact to handle financial and legal matters on their behalf.

Principal Information:

- Name: ________________________________

- City, State, Zip Code: ________________

- Date of Birth: ________________________

Attorney-in-Fact Information:

- Name: ________________________________

- Address: _______________________________

- City, State, Zip Code: ________________

- Relationship to Principal: ______________

Effective Date: This Power of Attorney shall become effective on the following date: _________________________.

Powers Granted:

The Principal grants the Attorney-in-Fact the authority to act on their behalf in the following matters:

- Managing bank accounts.

- Investing and managing investments.

- Paying bills and expenses.

- Buying or selling real estate.

- Handling tax matters.

Durability: This Power of Attorney shall remain in effect until revoked by the Principal in writing or until the Principal's death.

Signature of Principal: ________________________________

Date: ________________________________

Witnesses:

- Witness 1 Name: _______________________ Signature: ___________________ Date: ___________

- Witness 2 Name: _______________________ Signature: ___________________ Date: ___________

Please ensure that this document is signed in the presence of witnesses as required by Indiana law.

Other Popular Indiana Forms

Indiana Durable Power of Attorney - Choosing a reliable agent is critical, as they will have significant control over your affairs.

Indiana Quit Claim Deed Form - A Quitclaim Deed is significant in finalizing property transfers that may arise during bankruptcy proceedings.

For those looking to enhance organizational clarity, the effective Employee Handbook guidelines offer a structured approach to defining workplace policies that facilitate better understanding among staff.

Indiana Bill of Sale - Reduces the risk of misunderstandings between parties.