Fill in Your Entity Annual Report Indiana Form

Similar forms

The Entity Annual Report Indiana form shares similarities with the IRS Form 990, which is used by tax-exempt organizations to provide the IRS with information about their financial activities. Both documents require organizations to disclose financial information, including revenue and expenditures. The IRS Form 990 also requires details about governance, similar to the Entity Annual Report's request for information about the organization's governing structure. Both forms aim to enhance transparency and accountability, ensuring that stakeholders have access to essential financial data.

Another comparable document is the Annual Report filed with the Secretary of State in many states. This report typically includes basic information about the organization, such as its legal name, address, and the names of its officers. Like the Entity Annual Report, it is used to maintain the organization’s good standing and ensure compliance with state regulations. Both documents serve as an official record of the organization’s existence and operational status, providing essential information to state authorities.

The Form 990-T, which is used by tax-exempt organizations to report unrelated business income, also shares common elements with the Entity Annual Report. Both forms require detailed financial reporting, although Form 990-T focuses specifically on income generated from activities not directly related to the organization's exempt purpose. Each document plays a role in ensuring compliance with tax regulations and provides a mechanism for reporting financial performance to relevant authorities.

The Federal Form 1023, which is the application for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code, is another document with similarities. While Form 1023 is used to apply for tax-exempt status, it requires detailed information about the organization’s purpose, governance, and financial projections. The Entity Annual Report also seeks information about the organization’s purpose and governance, thereby promoting transparency and accountability in both contexts.

State-specific annual financial reports, often required by state agencies for various types of organizations, also resemble the Entity Annual Report. These reports typically require similar financial disclosures, including income, expenditures, and funding sources. Both types of reports aim to ensure that organizations adhere to state laws and maintain transparency regarding their financial activities.

In the context of trailer ownership transfer, it is important to understand the legal requirements and documentation involved. For instance, the New York Trailer Bill of Sale form serves as an essential tool for buyers and sellers, as it provides a detailed account of the transaction to prevent any potential disputes. Familiarizing oneself with resources like UsaLawDocs.com can offer valuable insights and guidance on how to properly complete this form and fulfill legal obligations effectively.

Finally, the Audited Financial Statements serve a similar purpose by providing a comprehensive overview of an organization's financial status. While these statements are often more detailed and are prepared by independent auditors, they share the goal of presenting an accurate picture of the organization's finances. The Entity Annual Report and Audited Financial Statements both contribute to the accountability and transparency of organizations, ensuring that stakeholders can make informed decisions based on reliable financial data.

FAQ

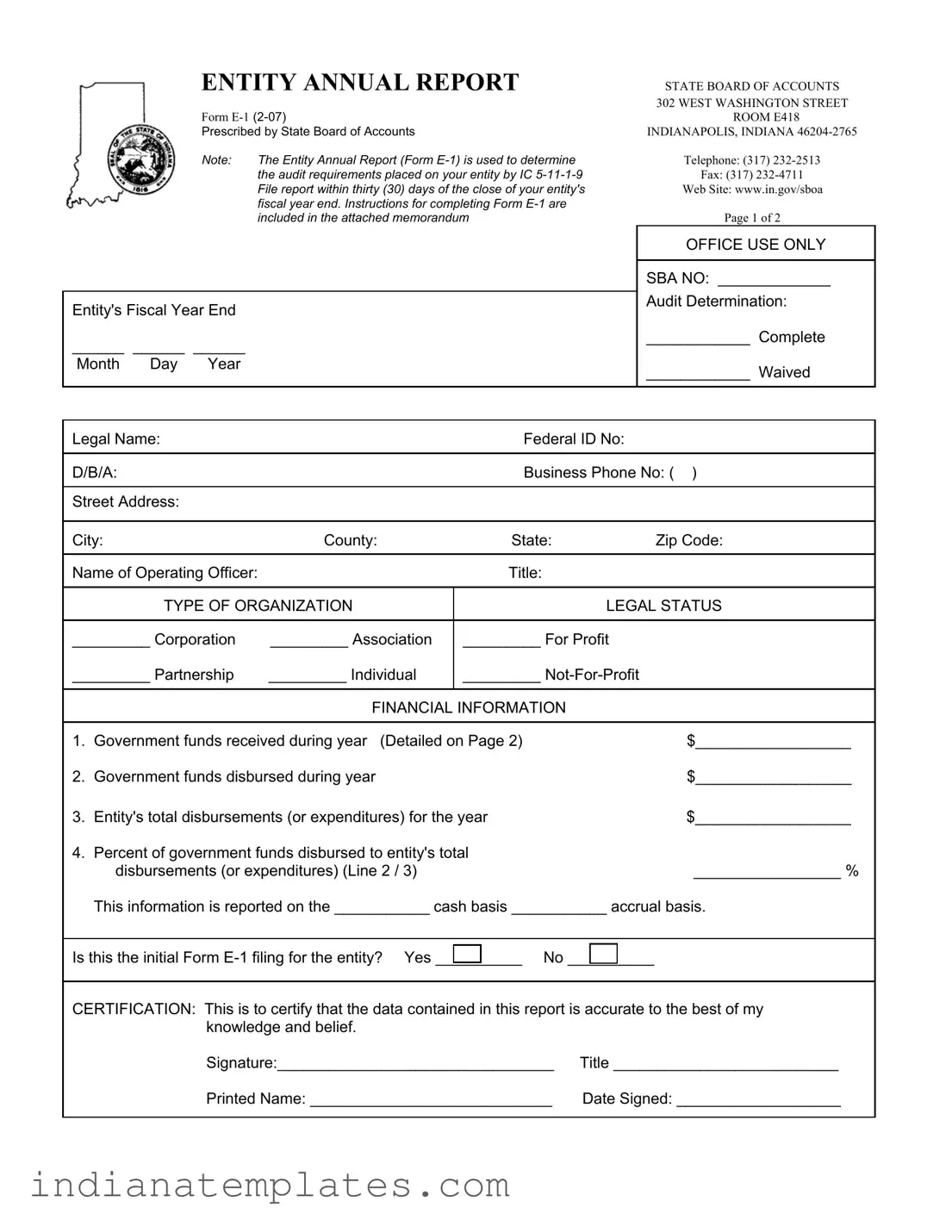

What is the Entity Annual Report Indiana form?

The Entity Annual Report, also known as Form E-1, is a document required by the State Board of Accounts in Indiana. It serves to determine the audit requirements for various entities based on their financial activities during the fiscal year. This form must be filed within thirty days after the end of the entity's fiscal year.

Who needs to file the Entity Annual Report?

All entities operating in Indiana that receive government funds or have specific financial activities are required to file the Entity Annual Report. This includes corporations, partnerships, associations, and not-for-profit organizations. The report helps assess the audit requirements applicable to each entity.

What information is required to complete the form?

The form requires basic information such as the legal name of the entity, its federal ID number, and contact details. Additionally, financial data must be provided, including government funds received and disbursed, total disbursements, and the basis of accounting used (cash or accrual). The entity must also certify the accuracy of the information reported.

What happens if the Entity Annual Report is not filed on time?

Failure to file the Entity Annual Report within the specified thirty-day period can lead to penalties or increased scrutiny from the State Board of Accounts. Timely submission is crucial to avoid potential legal or financial repercussions for the entity.

Can the form be amended after submission?

Yes, if an error is discovered after the form has been submitted, the entity can file an amended report. It is important to address any discrepancies as soon as possible to ensure that the information on record is accurate and up-to-date.

Common mistakes

Filling out the Entity Annual Report for Indiana can be a straightforward process, but there are common mistakes that can lead to complications. One frequent error occurs when individuals forget to file the report within the required thirty days after the close of the entity's fiscal year. Missing this deadline can result in penalties and additional scrutiny, so it’s crucial to mark your calendar and adhere to the timeline.

Another common mistake is failing to provide accurate financial information. It’s essential to report the correct amounts for government funds received, disbursed, and total disbursements. If these figures are incorrect, it could affect the audit requirements for your entity. Double-checking these numbers can save you from potential issues down the road.

Many people also overlook the need to specify whether the financial information is reported on a cash or accrual basis. This distinction is important for auditors and can impact how your entity’s financial health is interpreted. Make sure to select the appropriate option to avoid confusion.

In addition, some filers neglect to include the legal name of the entity or its Federal ID number. These details are vital for proper identification and processing of the report. Omitting them can lead to delays or even rejection of the filing.

Another mistake is not providing a complete description of the organization’s purpose and governing structure. This information helps clarify the entity's operations and can be crucial for auditors. Take the time to articulate these aspects clearly to ensure your report is comprehensive.

People often forget to indicate whether this is the initial filing of Form E-1 for the entity. Marking "Yes" or "No" is a simple step that can prevent misunderstandings regarding your reporting history.

Many individuals also fail to sign the certification section of the report. This signature confirms that the information provided is accurate to the best of your knowledge. Without it, the report may be considered incomplete.

Another common oversight is not listing all government funds received during the year. It’s important to detail these funds by agency, address, program title, and amount received. If necessary, attach additional sheets to ensure that all information is captured.

Some filers may not be aware of the requirement to disclose whether they have ever been audited by an Independent Public Accountant (IPA). This information is relevant for the audit determination process. If applicable, provide details about the last fiscal year audited and the IPA’s contact information.

Lastly, individuals sometimes rush through the process without reviewing the completed report for accuracy. Taking a moment to review the entire form can help catch any mistakes or omissions before submission. This simple step can make a significant difference in ensuring a smooth filing experience.

Entity Annual Report Indiana Preview

ENTITY ANNUAL REPORT |

STATE BOARD OF ACCOUNTS |

|

|

|

302 WEST WASHINGTON STREET |

Form |

ROOM E418 |

|

Prescribed by State Board of Accounts |

INDIANAPOLIS, INDIANA |

|

Note: |

The Entity Annual Report (Form |

Telephone: (317) |

|

the audit requirements placed on your entity by IC |

Fax: (317) |

|

File report within thirty (30) days of the close of your entity's |

Web Site: www.in.gov/sboa |

|

fiscal year end. Instructions for completing Form |

|

|

included in the attached memorandum |

Page 1 of 2 |

Entity's Fiscal Year End

______ ______ ______

Month Day Year

OFFICE USE ONLY

SBA NO: _____________

Audit Determination:

____________ Complete

____________ Waived

Legal Name: |

|

Federal ID No: |

|

|

|

|

|

||

D/B/A: |

|

Business Phone No: ( ) |

||

|

|

|

|

|

Street Address: |

|

|

|

|

|

|

|

|

|

City: |

County: |

State: |

Zip Code: |

|

|

|

|

|

|

Name of Operating Officer: |

|

Title: |

|

|

|

|

|

||

|

TYPE OF ORGANIZATION |

LEGAL STATUS |

||

|

|

|

|

|

_________ Corporation |

_________ ASSOCIATION |

_________ For Profit |

|

|

_________ Partnership |

_________ INDIVIDUAL |

_________ |

|

|

|

|

|

|

|

|

|

FINANCIAL INFORMATION |

|

|

|

|

|

||

1. |

Government funds received during year (Detailed on Page 2) |

$__________________ |

||

2. |

Government funds disbursed during year |

|

$__________________ |

|

3. |

Entity's total disbursements (or expenditures) for the year |

$__________________ |

||

4. Percent of government funds disbursed to entity's total |

|

|

|

||

disbursements (or expenditures) (Line 2 / 3) |

_________________ % |

||||

This information is reported on the ___________ cash basis ___________ accrual basis. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Is this the initial Form |

__________ No |

__________ |

|||

|

|

|

|

|

|

CERTIFICATION: This is to certify that the data contained in this report is accurate to the best of my |

|||||

knowledge and belief. |

|

|

|

||

Signature:________________________________ |

Title __________________________ |

||||

Printed Name: ____________________________ |

Date Signed: ___________________ |

||||

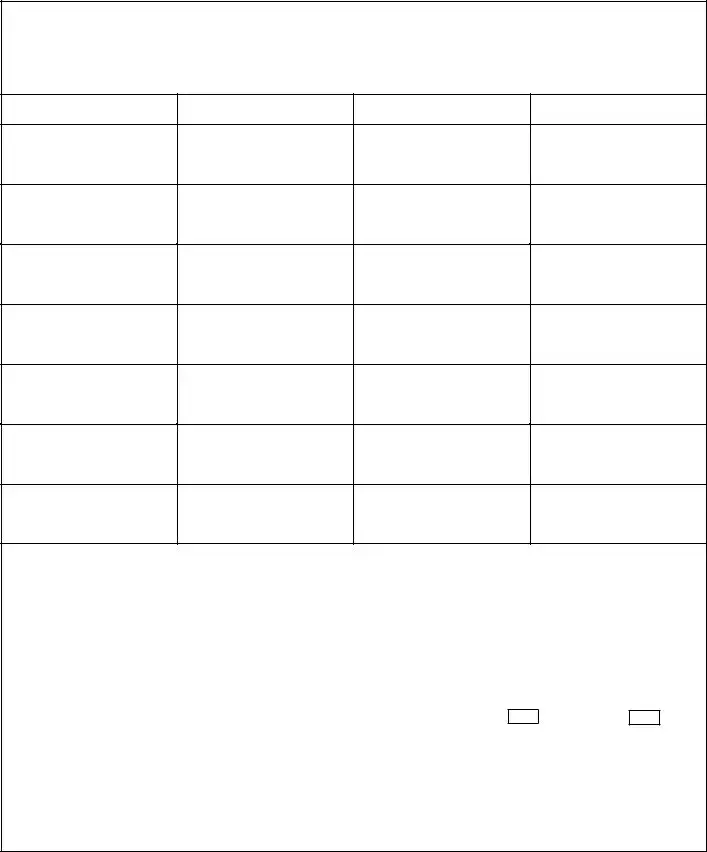

Page 2 of 2

DETAIL OF GOVERNMENT FUNDS RECEIVED

List the government funds received during the year by agency, address, program title and amount received. Attach additional sheets if necessary.

GOVERNMENT AGENCY

ADDRESS

PROGRAM TITLE

AMOUNT RECEIVED

Date organization was founded: _________________________________________________________________

Describe organization's purpose:_________________________________________________________________

___________________________________________________________________________________________

Describe organizational governing structure:________________________________________________________

___________________________________________________________________________________________

Have you ever been audited by an Independent Public Accountant (IPA)? Yes ___________ No ___________

If so, what was the last fiscal year audited? ________________________________________________________

Name and address of IPA that conducted audit: _____________________________________________________

___________________________________________________________________________________________

Different PDF Forms

Forgot to File Homestead Exemption Indiana - Deduction amounts are based on assessed property value or mortgage balance, whichever is lower.

For those looking to streamline their transaction process, our guide offers insights into the necessary documentation, including a vital complete Boat Bill of Sale template to ensure a smooth transfer of ownership.

When the Inspection Report Comes In, Which of the Following Should a Buyer's Agent Do? - Clarity in the response process helps avoid potential legal conflicts later.

Indiana Eviction Laws 2023 - The form specifies the necessity for both parties to bring relevant documents to the scheduled hearing.