Free Indiana Durable Power of Attorney Template

Similar forms

The Indiana Durable Power of Attorney (DPOA) is a crucial legal document that allows an individual, known as the principal, to designate another person, called the agent, to make decisions on their behalf. This document is particularly significant because it remains effective even if the principal becomes incapacitated. Similar to the DPOA, the Health Care Power of Attorney (HCPOA) specifically grants authority to an agent to make medical decisions for the principal. While the DPOA can cover a wide range of financial matters, the HCPOA focuses solely on health care choices, ensuring that the principal's medical preferences are honored when they cannot communicate them themselves.

A Living Will is another document that shares similarities with the DPOA. It allows individuals to express their wishes regarding medical treatment in situations where they are unable to communicate their desires. Unlike the DPOA, which appoints an agent to make decisions, a Living Will provides specific instructions about the types of medical interventions an individual does or does not want. Both documents work together to ensure that an individual’s health care preferences are respected, particularly in end-of-life situations.

The Revocable Trust, while primarily a financial tool, bears resemblance to the DPOA in that it allows for the management of assets. In a Revocable Trust, a person transfers ownership of their assets into a trust during their lifetime, which can be managed by a trustee. This arrangement can help avoid probate and ensure that the assets are distributed according to the individual’s wishes. The DPOA, on the other hand, allows an agent to manage the principal's assets directly, providing flexibility in decision-making during the principal's lifetime.

The Medical Power of Attorney (MPOA) is closely related to the Health Care Power of Attorney. Both documents empower an individual to make health care decisions for another person. However, the MPOA is often used in conjunction with other medical directives to provide a more comprehensive approach to health care decision-making. This ensures that the appointed agent has the authority to act in the best interest of the principal, similar to the way a DPOA allows for financial decisions.

For those looking to establish personal autonomy in their affairs, a reliable resource is the durable power of attorney template that guides you through the process of creating a binding document tailored to your needs.

The Guardianship is a legal arrangement where a court appoints an individual to make decisions for someone who is unable to do so. While the DPOA is a voluntary arrangement made by the principal, guardianship is typically established when there is a need for protection and the individual has not designated an agent. The DPOA allows individuals to retain control over their decision-making process, while guardianship can sometimes remove that autonomy, making the DPOA a preferred option for many.

The Advance Directive is a broader category that encompasses both the Living Will and the Health Care Power of Attorney. It allows individuals to outline their preferences for medical treatment and designate someone to make decisions on their behalf. While the DPOA focuses on financial and legal matters, the Advance Directive specifically addresses health care, ensuring that individuals have a voice in their medical treatment even when they cannot express it themselves.

The Will is a legal document that outlines how an individual’s assets will be distributed after their death. While it does not provide for decision-making during the individual’s lifetime, it is often discussed alongside the DPOA because both documents are essential for comprehensive estate planning. The DPOA ensures that decisions can be made while the individual is alive, while the Will addresses the distribution of assets after death.

Lastly, the Special Power of Attorney is a limited version of the DPOA. It grants authority to an agent to act on behalf of the principal for specific tasks or transactions. Unlike the DPOA, which can cover a wide array of decisions, the Special Power of Attorney is tailored to particular needs. This document can be useful in situations where the principal wants to delegate authority for a specific purpose without granting broad powers.

FAQ

What is a Durable Power of Attorney in Indiana?

A Durable Power of Attorney (DPOA) in Indiana is a legal document that allows you to appoint someone you trust to make decisions on your behalf if you become unable to do so yourself. This can include financial matters, healthcare decisions, and other important choices. The “durable” aspect means that the authority granted to your agent remains in effect even if you become incapacitated. This is crucial for ensuring that your wishes are respected when you cannot communicate them yourself.

Who can be appointed as my agent in a Durable Power of Attorney?

You can choose almost anyone to be your agent, as long as they are at least 18 years old and mentally competent. Many people select trusted family members, close friends, or professional advisors. It’s important to choose someone who understands your values and wishes, as they will have significant authority to act on your behalf. Additionally, consider discussing your decision with the person you wish to appoint to ensure they are willing to take on this responsibility.

How do I create a Durable Power of Attorney in Indiana?

Creating a Durable Power of Attorney in Indiana involves a few straightforward steps. First, you need to complete the DPOA form, which can be obtained online or through legal resources. Be sure to include specific details about the powers you wish to grant your agent. After filling out the form, you must sign it in the presence of a notary public. This notarization helps to verify your identity and the authenticity of the document. Finally, it’s wise to provide copies of the signed document to your agent and any relevant institutions, like banks or healthcare providers, to ensure they recognize your agent's authority.

Can I revoke my Durable Power of Attorney once it is created?

Yes, you can revoke your Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation document stating your intent to cancel the DPOA. It's also advisable to inform your agent and any institutions that may have a copy of the original document. This ensures that everyone is aware that the previous authority has been revoked. Keeping your legal documents up to date is essential for reflecting your current wishes and ensuring your peace of mind.

Common mistakes

Filling out a Durable Power of Attorney form in Indiana can be a straightforward process, but many people make common mistakes that can lead to confusion or legal issues down the line. Understanding these pitfalls can help ensure that your wishes are honored when it matters most.

One frequent mistake is not specifying the powers granted to the agent. The form allows you to outline what your agent can do on your behalf, but many individuals leave this section vague. Without clear instructions, your agent may not have the authority to act in certain situations, which could create problems when decisions need to be made.

Another common error is failing to date the document. A Durable Power of Attorney must be dated to be valid. If you forget this simple step, it could raise questions about when the powers were intended to take effect. This can lead to disputes among family members or challenges to the authority of your agent.

Some people neglect to sign the form in the presence of a notary. In Indiana, notarization is a crucial step for the document to be legally binding. Skipping this can render the entire form ineffective, which defeats the purpose of having a Durable Power of Attorney in the first place.

Additionally, failing to discuss your decisions with your chosen agent is a significant oversight. It’s essential that your agent understands your wishes and is willing to accept the responsibility. Without this communication, your agent may be unprepared to make the decisions you would want them to make.

Another mistake involves not keeping copies of the completed form. After filling out the Durable Power of Attorney, it’s vital to distribute copies to your agent and any relevant institutions, such as banks or healthcare providers. If your agent doesn’t have a copy, they may face challenges when trying to act on your behalf.

Some individuals also forget to review and update their Durable Power of Attorney as their circumstances change. Life events, such as marriage, divorce, or the birth of a child, can affect your choices. Regularly revisiting the document ensures that it reflects your current wishes.

In some cases, people choose an agent who may not be the best fit for the role. It’s important to select someone you trust and who is capable of handling the responsibilities. Picking someone out of obligation rather than suitability can lead to issues when the time comes for them to act on your behalf.

Finally, a lack of understanding about the implications of granting power can lead to mistakes. It’s crucial to comprehend what it means to give someone else authority over your financial or healthcare decisions. Taking the time to educate yourself on these matters can prevent future regrets.

By being aware of these common mistakes, you can approach the Durable Power of Attorney process with confidence and clarity. This document is an important tool for ensuring your wishes are respected, so it’s worth the effort to get it right.

Indiana Durable Power of Attorney Preview

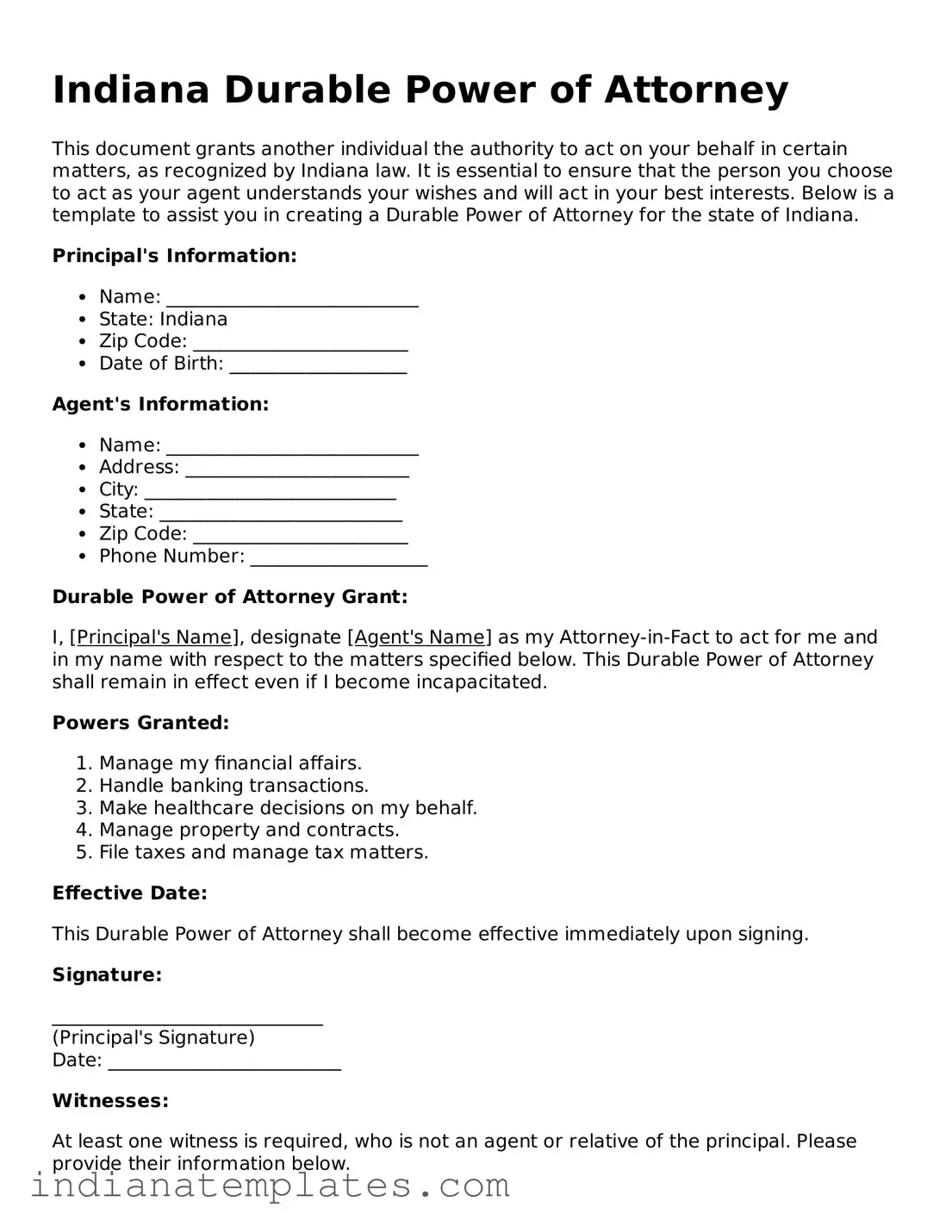

Indiana Durable Power of Attorney

This document grants another individual the authority to act on your behalf in certain matters, as recognized by Indiana law. It is essential to ensure that the person you choose to act as your agent understands your wishes and will act in your best interests. Below is a template to assist you in creating a Durable Power of Attorney for the state of Indiana.

Principal's Information:

- Name: ___________________________

- State: Indiana

- Zip Code: _______________________

- Date of Birth: ___________________

Agent's Information:

- Name: ___________________________

- Address: ________________________

- City: ___________________________

- State: __________________________

- Zip Code: _______________________

- Phone Number: ___________________

Durable Power of Attorney Grant:

I, [Principal's Name], designate [Agent's Name] as my Attorney-in-Fact to act for me and in my name with respect to the matters specified below. This Durable Power of Attorney shall remain in effect even if I become incapacitated.

Powers Granted:

- Manage my financial affairs.

- Handle banking transactions.

- Make healthcare decisions on my behalf.

- Manage property and contracts.

- File taxes and manage tax matters.

Effective Date:

This Durable Power of Attorney shall become effective immediately upon signing.

Signature:

_____________________________

(Principal's Signature)

Date: _________________________

Witnesses:

At least one witness is required, who is not an agent or relative of the principal. Please provide their information below.

- Witness Name: ________________________

- Witness Signature: ____________________

- Date: _________________________________

Notarization:

This power of attorney should be acknowledged before a notary public.

Notary Acknowledgment

State of Indiana, County of ________________

Subscribed and sworn before me on this _____ day of ______________, 20__.

______________________________

(Notary Public Signature)

My commission expires: _______________

Other Popular Indiana Forms

Indiana Non Compete Laws - This document can prevent an employee from working with direct rivals for a defined period.

When engaging in the sale or purchase of a vehicle in North Carolina, it's essential to utilize the proper documentation, such as the North Carolina Motor Vehicle Bill of Sale form. This form not only documents the essential details of the transaction but also aids in the transition of ownership. For more information on obtaining this form, you can visit UsaLawDocs.com, which provides the necessary resources to ensure a smooth process.

Vehicle Bill of Sale Indiana - Offering a Bill of Sale may give the buyer peace of mind regarding their purchase.

Real Estate Purchase Agreement Pdf - Real estate agents often assist in drafting and negotiating the agreement.