Free Indiana Articles of Incorporation Template

Similar forms

The Articles of Organization is a document used for forming a Limited Liability Company (LLC) in Indiana. Similar to the Articles of Incorporation, it establishes the existence of the LLC and outlines basic information such as the company name, address, and registered agent. Both documents serve as foundational filings with the state, providing legal recognition and protection for the business entity. While the Articles of Incorporation focuses on corporations, the Articles of Organization is specific to LLCs, catering to different business structures.

The Bylaws of a corporation detail the internal rules and procedures governing the management of the corporation. While the Articles of Incorporation serve to establish the corporation's existence, the Bylaws provide the framework for its operation. Both documents are essential for a corporation, but the Articles are filed with the state, whereas Bylaws are maintained internally. They work together to ensure that the corporation operates smoothly and in compliance with applicable laws.

For those making decisions about medical care, understanding key documents such as the Maryland Do Not Resuscitate (DNR) Order is essential. By utilizing resources like the DNR Document, individuals can clearly express their resuscitation preferences, ensuring that their end-of-life wishes are known and respected in medical emergencies.

The Operating Agreement is akin to the Bylaws but is specific to LLCs. It outlines the management structure, member responsibilities, and operational procedures of the LLC. Like the Articles of Organization, the Operating Agreement is not filed with the state but is crucial for defining the relationship among members. Both documents help clarify roles and expectations, ensuring that the LLC functions effectively.

The Certificate of Good Standing verifies that a business entity is legally registered and compliant with state requirements. Similar to the Articles of Incorporation, it confirms that the business exists and is authorized to operate. This certificate is often required for various business transactions, such as opening a bank account or applying for loans. While the Articles of Incorporation establish the business, the Certificate of Good Standing serves as proof of its active status.

The Statement of Information is a document that corporations and LLCs must file periodically to update the state on key information such as addresses and officers. Like the Articles of Incorporation, it helps maintain the business's good standing with the state. However, the Statement of Information is more focused on ongoing compliance, while the Articles serve as the initial establishment of the entity.

The Business License is a permit that allows a business to operate legally within a specific jurisdiction. While the Articles of Incorporation create the legal entity, the Business License ensures that the entity can conduct its activities in compliance with local regulations. Both documents are essential for legal operation, but they serve different purposes in the business lifecycle.

The Federal Employer Identification Number (EIN) is similar in that it identifies a business entity for tax purposes. While the Articles of Incorporation establish the corporation, the EIN is necessary for tax filings, opening bank accounts, and hiring employees. Both documents are vital for the legal and financial operations of a business, but they address different aspects of its existence and obligations.

FAQ

What are the Articles of Incorporation in Indiana?

The Articles of Incorporation is a legal document that establishes a corporation in the state of Indiana. It outlines basic information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document with the Indiana Secretary of State is the first step in creating a corporation.

Who needs to file Articles of Incorporation?

Any individual or group looking to form a corporation in Indiana must file Articles of Incorporation. This includes businesses of all types, whether they are for-profit or nonprofit organizations. If you plan to operate as a corporation, completing this form is essential.

What information is required on the Articles of Incorporation form?

The form requires several key pieces of information. This includes the name of the corporation, the purpose of the corporation, the address of the principal office, the name and address of the registered agent, and the number of shares the corporation is authorized to issue. Additional details may also be necessary depending on the specific type of corporation being formed.

How do I file the Articles of Incorporation in Indiana?

To file the Articles of Incorporation, you can complete the form online through the Indiana Secretary of State's website or submit a paper form by mail. If filing online, you will need to create an account. There is a filing fee associated with this process, which varies based on the type of corporation.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Indiana typically ranges from $90 to $100, depending on the type of corporation you are forming. Nonprofit corporations may have a lower fee. It is advisable to check the Indiana Secretary of State's website for the most current fee schedule.

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary. Generally, if you file online, the Articles of Incorporation may be processed within a few business days. Paper filings can take longer, sometimes up to two weeks or more. For urgent needs, expedited services may be available for an additional fee.

Can I amend the Articles of Incorporation after they are filed?

Yes, you can amend the Articles of Incorporation after they are filed. If changes are necessary, such as altering the corporation's name or the number of authorized shares, you must file an amendment with the Indiana Secretary of State. This process also includes a filing fee.

Do I need an attorney to file the Articles of Incorporation?

While it is not required to hire an attorney to file the Articles of Incorporation, it can be beneficial, especially for those unfamiliar with the process. An attorney can provide guidance on the specific requirements and help ensure that the form is completed correctly.

What happens after the Articles of Incorporation are approved?

Once the Articles of Incorporation are approved, the corporation is officially formed. You will receive a certificate of incorporation from the Indiana Secretary of State. After this, it is important to obtain any necessary business licenses and permits, as well as to comply with ongoing reporting requirements.

Common mistakes

Filing the Indiana Articles of Incorporation is a crucial step for anyone looking to establish a corporation in the state. However, many individuals make common mistakes that can lead to delays or complications. One frequent error is failing to provide a clear and complete business name. The name must be unique and not too similar to existing entities. Omitting this detail can result in rejection of the application.

Another mistake is not including the correct registered agent information. The registered agent serves as the official point of contact for legal documents. If this section is incomplete or inaccurate, it can lead to issues with communication and legal notifications.

Many people also neglect to specify the duration of the corporation. While most corporations are established to exist indefinitely, failing to indicate this can cause confusion and may require additional amendments later on.

Inaccurate or incomplete addresses are another common pitfall. The Articles of Incorporation require a physical address for the corporation's principal office. Using a P.O. Box instead of a physical address can lead to rejection of the filing.

Additionally, individuals often overlook the importance of the purpose clause. This section should clearly outline the business activities the corporation will engage in. A vague or overly broad description can raise red flags and prompt further inquiries from the state.

Some filers mistakenly believe that they can submit the Articles of Incorporation without the necessary signatures. All incorporators must sign the document, and missing signatures will result in delays and potential rejections.

Another common error involves the payment of filing fees. Individuals sometimes forget to include the appropriate payment or submit an incorrect amount. This oversight can halt the processing of the application until the correct fees are received.

Finally, many people fail to review their documents thoroughly before submission. Simple typographical errors or omissions can lead to significant setbacks. Taking the time to double-check all information can save time and prevent complications in the future.

Indiana Articles of Incorporation Preview

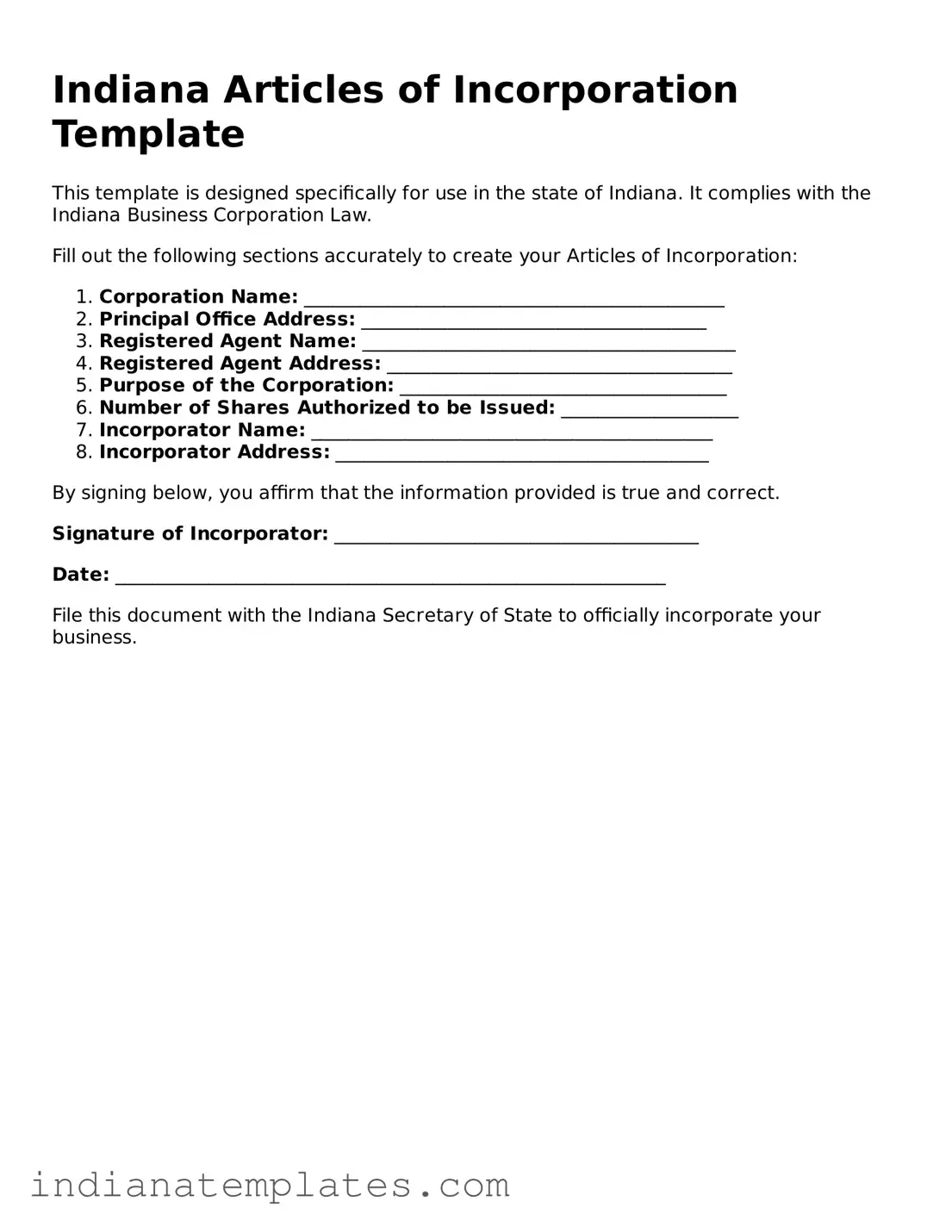

Indiana Articles of Incorporation Template

This template is designed specifically for use in the state of Indiana. It complies with the Indiana Business Corporation Law.

Fill out the following sections accurately to create your Articles of Incorporation:

- Corporation Name: _____________________________________________

- Principal Office Address: _____________________________________

- Registered Agent Name: ________________________________________

- Registered Agent Address: _____________________________________

- Purpose of the Corporation: ___________________________________

- Number of Shares Authorized to be Issued: ___________________

- Incorporator Name: ___________________________________________

- Incorporator Address: ________________________________________

By signing below, you affirm that the information provided is true and correct.

Signature of Incorporator: _______________________________________

Date: ___________________________________________________________

File this document with the Indiana Secretary of State to officially incorporate your business.

Other Popular Indiana Forms

Proof of Residency Indiana - This form can also assist in child custody disputes related to residency.

In order to create a strong foundation for your Limited Liability Company (LLC) and avoid potential disputes among members, it is vital to draft an Operating Agreement. This document not only clarifies ownership and member duties but also establishes the decision-making framework for the organization. For those interested in obtaining a well-structured template, you can visit UsaLawDocs.com for a reliable resource.

Indiana Lease Agreement Free - Describes allowable and prohibited activities on the leased property.

Indiana Durable Power of Attorney - The durable power of attorney can address both health care and finances, depending on your needs.